🚨🚨 The Argument for a Bank Crisis (9/22/21) 👇👇

If contagion in the property sector spreads, and the sector continues its rapid contraction, a Chinese banking crisis is *IMO* is a significant risk if not a probability.

If contagion in the property sector spreads, and the sector continues its rapid contraction, a Chinese banking crisis is *IMO* is a significant risk if not a probability.

2. The belief that banks are not at risk ignores both huge direct and indirect property exposure as well as the direct warnings of Chinese regulators. Its rooted in the belief of power and desires of central intervention; the same faith that incorrectly assumed an EG bailout.

3. Setting the backdrop, on 12/31/20 Chinese regulators directed domestic banks to limit their property exposure to 40% of their total loan book in order to head off systemic risk, and provided them four years to comply. spglobal.com/marketintellig…

4. Clearly regulators are concerned about systemic risk of banks property exposure. Not only that, but the 40% (!) limit, and 4 year compliance timeline, suggests that many banks have well in excess of 40% of their loan book concentrated in property.

5. While not specified, its likely this percentage only considers direct property lending, and excludes indirect but correlated exposures, like construction supply chains, LGFV/SOEs that rely on land sales repay debts, and the impact to all loans due to an economic slowdown

6. Even the best capitalized, transparent, and conservative banking system would be under stress if it had >40% of its loan exposure in a sector caught in a spiral like Chinese property is in today. Chinese banks, unfortunately, are none of these things.

7. Non-performing loans (“NPLs”) are a recognized problem in China. Making matters worse, these NPLs are often hidden from regulators using various off B/S arrangements. Estimated true NPLs are 2x – 4x higher than reported as of 2019 (@BenCharoenwong)

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

8. Below is the reported Total Equity of Minsheng Bank

and Equity/Asset ratio (blue). Then, it is adjusted based for the midpoint of estimated hidden NPLs (orange). As reported, Minsheng can withstand a 8.3% decline in asset value. Adjusted, it can only withstand a 2% drop.

and Equity/Asset ratio (blue). Then, it is adjusted based for the midpoint of estimated hidden NPLs (orange). As reported, Minsheng can withstand a 8.3% decline in asset value. Adjusted, it can only withstand a 2% drop.

9. This adjustment isn’t scientific – but the market agrees. Below is the same chart but with the market implied equity values in GREEN, as well as Minsheng’s share price since 2010. I'm using Minsheng as an example given its stress but the general story applies broadly.

10. The hidden NPLs begin to appear at the end of Beijing’s significant de-leveraging campaign from 2013 to 2015. Notably, the significant increase in hidden NPLs since 2015 corresponds with ballooning inventories of property developers noted last week.

https://twitter.com/TheLastBearSta1/status/1438171722033901571?s=20

11. While prior deleveraging cycles did not cause a banking crisis, the true loan losses associated with them were never digested, leaving true capital buffers incredibly thin as a starting point to the current downturn. Even a minor impairment to their assets wipes their equity.

12. What does Evergrande suggest about recovery rates? EG's only assets are unfinished / unsold apts, that cannot be monetized, and whose former prices expectations hinged on banks writing mortgages to people to buy them.

13. Its not just loans. Tradable securities also make up a significant portion of bank's assets – China’s onshore bond market is $17.5 trillion. The majority of these bonds are not central government securities (safe) but local government and corporate debt (reliant on property).

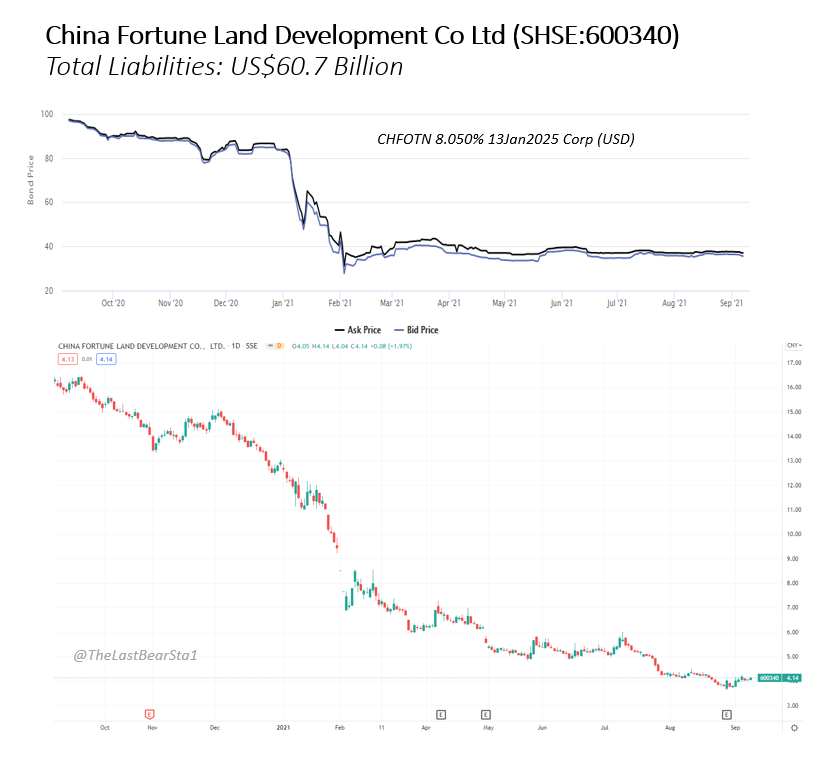

14. These tradable securities are subject rapid market contagion that has already been seen not only distressed property developers, but systemically important state financial institutions – Huarong.

15. Even state sponsored banks can see rapid devaluation of the price and collateral value of their bonds. The collateral value of Huarong bonds dropped from 91% to 40% from April to May. In June BBG reported there was zero liquidity in Huarong bonds. bloomberg.com/news/articles/…

16. The idea that Beijing can pick up the phone and force lenders to help a struggling bank, is contradicted by the Huarong bailout, which took 4 months to pull together just $8bn, not even enough to bring its capital ratio up to regulated minimums.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

17. Further, the idea interbank funding markets are “state controlled” and therefore not subject to disruption is contrary to history and market structure. PBOC liquidity injections only go to the large banks who must choose to lend on to smaller banks, where biggest concerns lie

18. The closest scare happened on June 20th 2013, when interbank lending froze. There was adequate bank liquidity in aggregate, but it was hoarded by larger banks, not provided to the banks who needed it. Self preservation is motivating if your neck may literally be on the line.

19. If that date sounds familiar, June 19th 2013 is the day Bernanke unexpectedly announced the QE taper, leading to the "taper tantrum". (To be clear, this is *not* a prediction of the future, just a historical fact)

20. Further Beijing does not control the shadow banking system, which we know to be a key financial conduit despite it sitting outside regulatory purview. Disruptions here could have significant impact and clearly are much harder for authorities to mitigate.

21. The timing of a potential banking crisis impossible predict and may not happen immediately. However, *IMO*, unless there is a material turnaround in the property sector it is not only a material risk, but a likely outcome. Recent liquidity injections may indicate stress today

22. This does not mean that *all* banks will fail. But even the failure of one, and the fear of contagion is enough to substantially disrupt markets globally. History again shows this point.

23. Finally – this is just one person’s analysis and conclusions. *I don't claim to be an expert*. Consider it along with any and all other opinions and data available to you, and take it as you will.

• • •

Missing some Tweet in this thread? You can try to

force a refresh