1/ $ETSY bear concerns

One of my followers recently mentioned to me a bear case for Etsy and asked me to take a look at 2020 10-k.

Let me first briefly mention his bear case and then share my thoughts.

One of my followers recently mentioned to me a bear case for Etsy and asked me to take a look at 2020 10-k.

Let me first briefly mention his bear case and then share my thoughts.

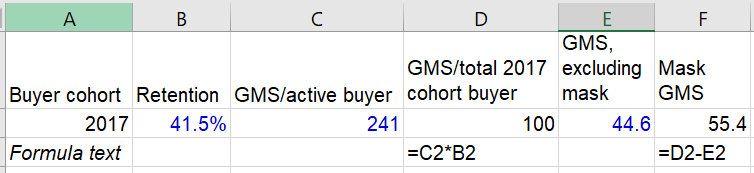

2/ The crux of the bear case lies on the noticeable drop in year 2 of 2017 buyer cohort.

Unlike the cohorts in 2013-16 when buyer retention was hovering around 40-45%, 2017 cohort had ~35% retention.

Unlike the cohorts in 2013-16 when buyer retention was hovering around 40-45%, 2017 cohort had ~35% retention.

3/ Let me first acknowledge that I didn't notice this before the follower mentioned it to me.

Why?

When I wrote my deep dive, I had 2019 10-k in hand, so the cohort data I saw had until 2016 buyer cohorts. While I scrolled 2020 10-k before, I didn't notice this drop.

Why?

When I wrote my deep dive, I had 2019 10-k in hand, so the cohort data I saw had until 2016 buyer cohorts. While I scrolled 2020 10-k before, I didn't notice this drop.

4/ Bears argue the churn on 2017 cohort is indication that Etsy was saved by the pandemic. What lined up with their argument is this chart in the very next page in the 10-k in which Etsy showed GMS, excluding masks per buyer by cohort.

5/ You'll notice although there was significant drop off in 2017 cohort in Yr 2, by yr 4 2017's retention came better than any other cohort.

Let's put it together what this means.

Let's put it together what this means.

6/ So because of the pandemic, people needed to buy mask without which 2017 buyer cohort wouldn't shop at Etsy. The improvement that we saw in retention would never materialize without Covid-19.

7/ Given this evidence, post-Covid, buyer retention will be difficult for Etsy.

Not a bad short thesis. If 2018 or 2019 buyer cohort exhibit similar retention in yr 2 as 2017 did, I would indeed be worried.

Etsy discloses this annually, so need to keep an eye out for next 10-k

Not a bad short thesis. If 2018 or 2019 buyer cohort exhibit similar retention in yr 2 as 2017 did, I would indeed be worried.

Etsy discloses this annually, so need to keep an eye out for next 10-k

8/ Here are some additional context that I have been wondering about 2017 buyer cohort.

Etsy was a total mess in 2017. Josh Silverman joined as CEO in May 02, 2017. The day before, Etsy fired 8% of the employees. Uncertainties about the company ran amok at that time.

Etsy was a total mess in 2017. Josh Silverman joined as CEO in May 02, 2017. The day before, Etsy fired 8% of the employees. Uncertainties about the company ran amok at that time.

9/ So I wonder whether that particular cohort is somewhat strange and weaker than other buyer cohorts.

What the bears may have been underestimating is the dynamism that's inherent in a two-sided marketplace. It gets better as it grows bigger.

What the bears may have been underestimating is the dynamism that's inherent in a two-sided marketplace. It gets better as it grows bigger.

10/ The cohort in 2018-19 had more compelling reasons to come back to Etsy since # of sellers increased from 2.12 mn in 2018 to 4.37 in 2020 and these sellers are selling diverse things.

The search experience is much better on the website. The shipping time improved.

The search experience is much better on the website. The shipping time improved.

End/ So I'd imagine the latter cohorts 2018-19 should fare much better than 2017 did.

If not, I'm probably wrong about the strength of Etsy. That is, of course, always a possibility.

If not, I'm probably wrong about the strength of Etsy. That is, of course, always a possibility.

• • •

Missing some Tweet in this thread? You can try to

force a refresh