Strength=Credibility

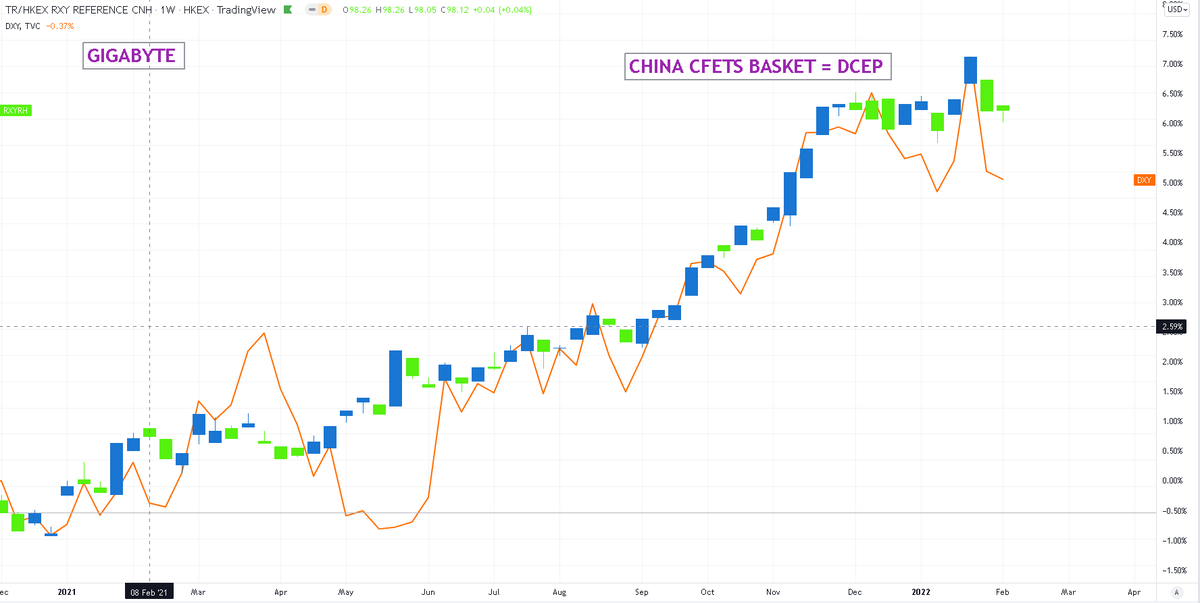

@jnordvig shows $CNY 8% TW rise since Covid confounding expectations. Why? $RMB Reserve FX status requires $CNY trades strong during domestic crises [Covid, Trade & Evergrande] as Strength = Credibility with #DCEP launch imminent, thus why #BTC strength will

@jnordvig shows $CNY 8% TW rise since Covid confounding expectations. Why? $RMB Reserve FX status requires $CNY trades strong during domestic crises [Covid, Trade & Evergrande] as Strength = Credibility with #DCEP launch imminent, thus why #BTC strength will

https://twitter.com/jnordvig/status/1440850557413982215

be resisted. As Jens highlights, China's FX reserves collapsed in 2015/16/17, falling 1.0 Trio USD. PBOC MU, the head of the digital lab told us at HK blockchain week in 2019 that the popularity of #bitcoin during this period lead the PBOC to fear for sovereignty of the Yuan. So

China decided to launch it's digital Yuan project as all the outflows were leaving the country. They broke the dollar peg in aug 2015, which crushed US stocks, and pivoted to tracking the CFETS basket a precursor to DCEP. China has changed its FX regime on avg every 5 years.

Winter olympics is bang in range of 5 year avg for DCEP launch. Look at the power of China's FX Manipulation. Instead of tracking the dollar only, they now targeted 15+ currencies. CNY TW dropped a whopping 10% making it competitive in anticipation of upcoming E-CNY launch.

in Aug 2015, China devlaued 3%. PBOC still wanted to weaken Yuan competively but also needed to cut off outflows. Targeting CFETS basket aloud them sell dollar's against basket component's. Euro, Yen, KRW Gold all contributed to Trade weighted (back door) delvaluation of 10%

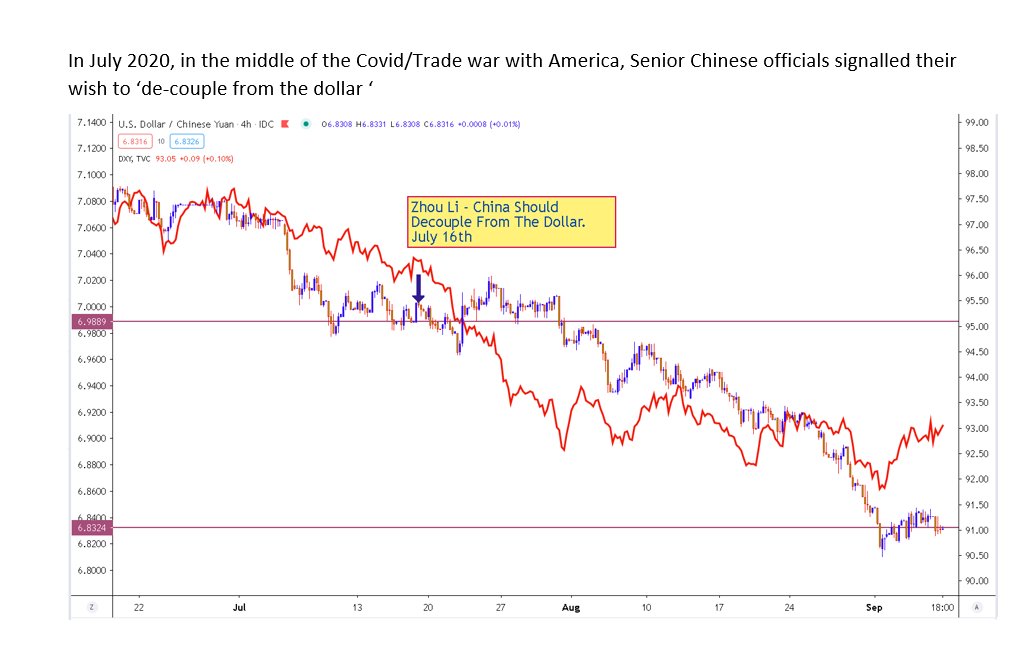

When Covid appeared, perhaps due to the drop in Chinese offshore tourism, but mindful of the imminent launch of its new digital reserve currency the chinese enouraged CNY strength(8%). in 2020 they 'decoupled' from the dollar. USDCNY dropped & #BTC rallied from 10k-40K

Jens highlighs China wants to ensure #Yuan is strong to earn Credibility. Inevitably this has consequences for the #dollar & #bitcoin, #gold too. In 2015 China sold dollars vs $Eur, $JPY, $XAU. In 2017 $KRW was added to the CFETS basket. Net effect : a big boost in competiveness

In 2020 they 'decoupled' from $DXY. #BTC rallied⬆️ 10 to 40k. In March 21, PBOC said Bitcoin was linked to money laundering. #BTC ⬇️ 55k to 29k. Bottom Line; If China can move $USD where it wants & BTC is a threat, they will avoid 2014/17 rerun where CNY & BTC weakened together

• • •

Missing some Tweet in this thread? You can try to

force a refresh