1) As the DEX sector has matured, $SUSHI and $UNI have begun to differentiate in a big way.

Uniswap has become solely focused on spot trading on ETH and L2’s, while Sushi is moving towards a defi suite of products across multiple chains and L2’s.

Thread 👇

Uniswap has become solely focused on spot trading on ETH and L2’s, while Sushi is moving towards a defi suite of products across multiple chains and L2’s.

Thread 👇

2)The two largest DEX’s differ in more than just the products; they have massively different user bases as well. To explain, let's look at how each has performed since the mid-May drawdown.

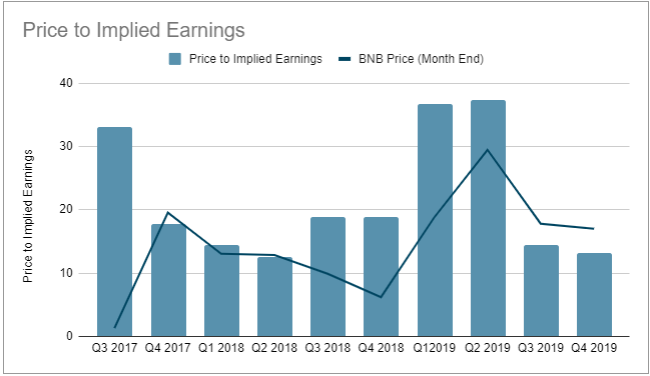

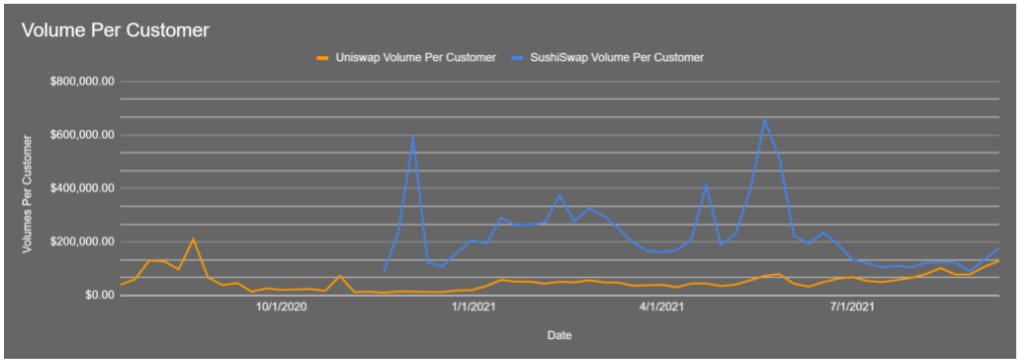

3) As prices declined in May / June, DeFi usage temporarily fell off a cliff and this is where the differentiation began. From peak to trough, $SUSHI weekly volumes fell -85% while $UNI volumes fell just -68%, a relatively large underperformance from Sushi.

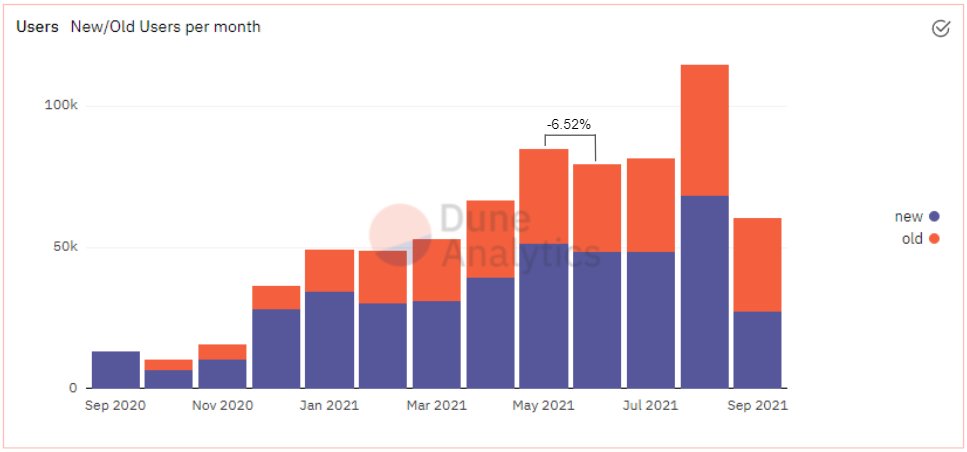

4) But that doesn’t tell the full story. In that same time period, $SUSHI transactions were only down small double digits and users down only single digits.

H/T: @dqniellew for the @DuneAnalytics dashboard

H/T: @dqniellew for the @DuneAnalytics dashboard

5) These dynamics lead us to believe that during the price drawdown, $SUSHI users were yield farming and consistently selling tokens that they earned rather than trading. That makes sense with transactions staying high but not translating into high trading volumes.

6) $Sushi users also differ from $UNI in terms of trading size. Sushi’s average volume per user is significantly higher than Uniswap’s. Combined with the point above means Sushi’s user base is predominantly #DeFi power users rather than a larger retail user base.

H/T: @hagaetc

H/T: @hagaetc

7) But just as the exchanges differentiated during the downturn, they have differentiated during the market recovery in July & August. From bottom to current market conditions, $SUSHI volumes have grown 169% while $UNI volumes have grown 97%. Massive outperformance from Sushi.

8) $SUSHI weekly traders have actually grown +40% from the May trading volume high while $UNI user base is down -72%. Again massive outperformance for Sushi.

9)This can again be attributed to the differentiated user base. Since $SUSHI user base was still actively participating in the market, they were quicker to move back to trading. $UNI retail user base has been slower-moving to get off the sidelines.

10) What about Sushi's #DeFi suite of products beyond the DEX? With products like MISO not collecting revenues, and others not taking off compared to stand-alone counterparts, why are these additional products valuable?

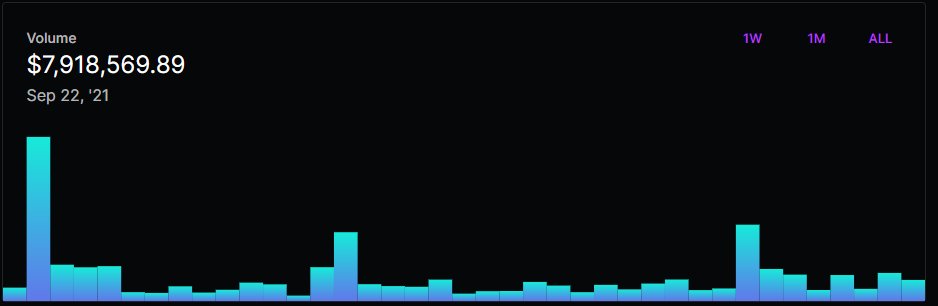

11) Simple. They offer new ways to interact with the $SUSHI platform, driving revenues and increasing customer stickiness. Using the Bit DAO sale on Miso, the sale has generated more than $250mm in volumes on Sushiswap, which drives more CF’s to xSushi holders.

12) But even more importantly, $SUSHI saw weekly unique traders grow 27% the week following the Bit DAO sale. A large portion of this is likely due to the sale.

However, this will likely pale in comparison to the number of new users @SHOYU_NFT has the ability to onboard.

However, this will likely pale in comparison to the number of new users @SHOYU_NFT has the ability to onboard.

13) To date 3 sectors have found PMF in digital assets, #DEFI, #NFT, & Gaming. But all three have very different user bases

Introducing Shoyu allows $SUSHI to cross-sell products to its new users (i.e. introduce NFT users to defi with lending, fractionalization, & cap-raising)

Introducing Shoyu allows $SUSHI to cross-sell products to its new users (i.e. introduce NFT users to defi with lending, fractionalization, & cap-raising)

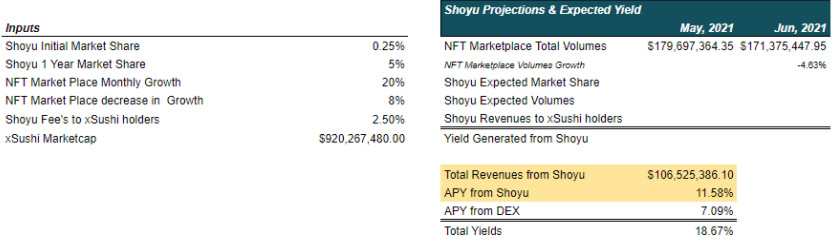

14) Shoyu also has the opportunity to drive significant CF’s to xSushi. If Shoyu grows to just 5% of the market share, Shoyu would drive more than $100m to xSushi holders more than doubling current APY’s. (see marketplace growth assumptions)

15)This doesn’t even begin to take into account the $SUSHI metaverse. The optionality of partnerships, product lines, and #NFT based games is huge. Finding ways to bring those users into the rest of the Sushi ecosystem is how Sushi continues to grow as a DEX and community.

16) Even though correlations remain high, the DEX sector is continuing to differentiate both in product offerings and more importantly by user base. We continue to be bullish on projects that are highly focused on customer acquisition and the cross-selling of products. $SUSHI

17) Disclosure: @Arca is long $SUSHI

• • •

Missing some Tweet in this thread? You can try to

force a refresh