I draw on info from @stablecoinindex, and a recently released report from @blockchain

Here is the thread!👇🏼

Some crypto use cases

-Fiat onramp

-Store of Value inbetween trades

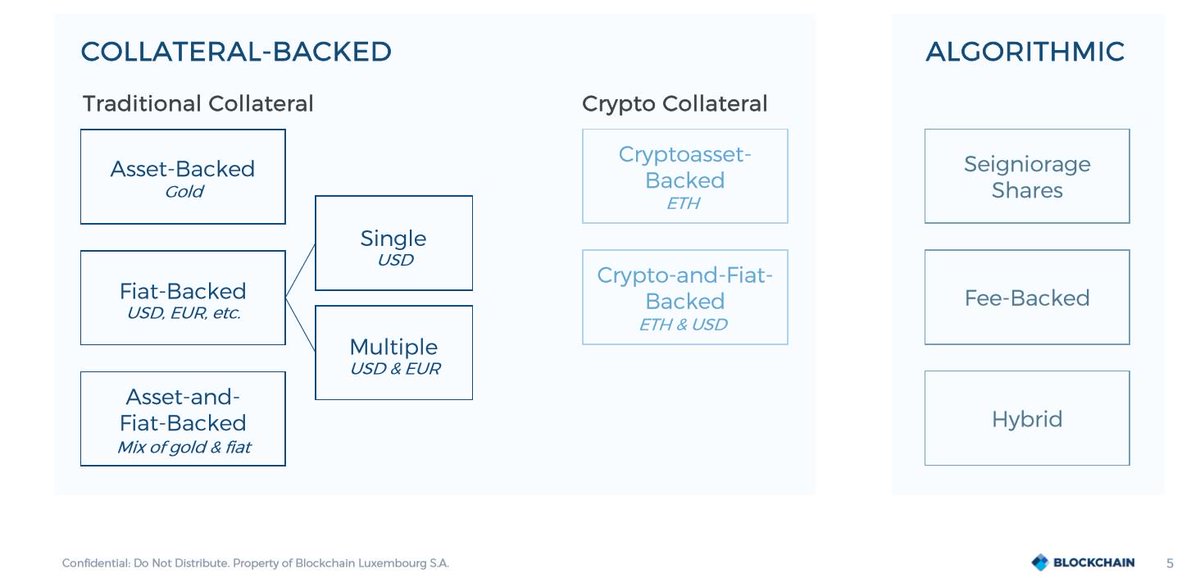

1)Traditional backed (USDC,GUSD)

2)Crypto backed (@MakerDAO)

3)Algorithmic (@basisprotocol)

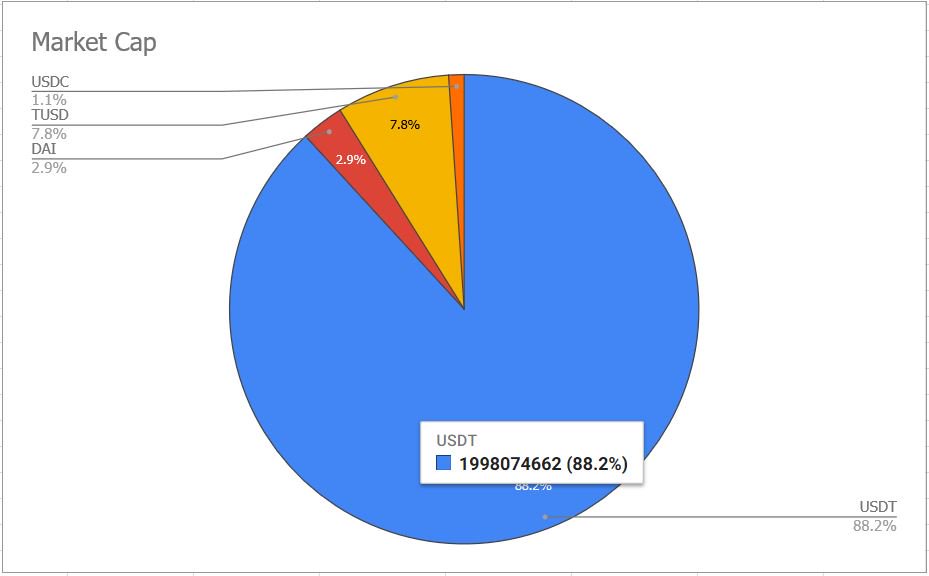

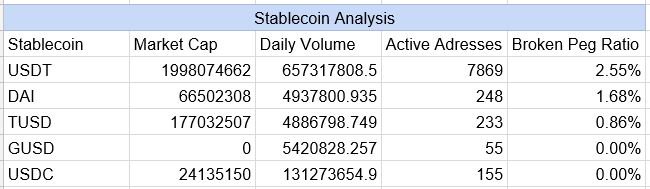

Here is a breakdown by market cap comparing @Tether_to , @MakerDAO and more.

This could be a sign that times are changing in stablecoin land.

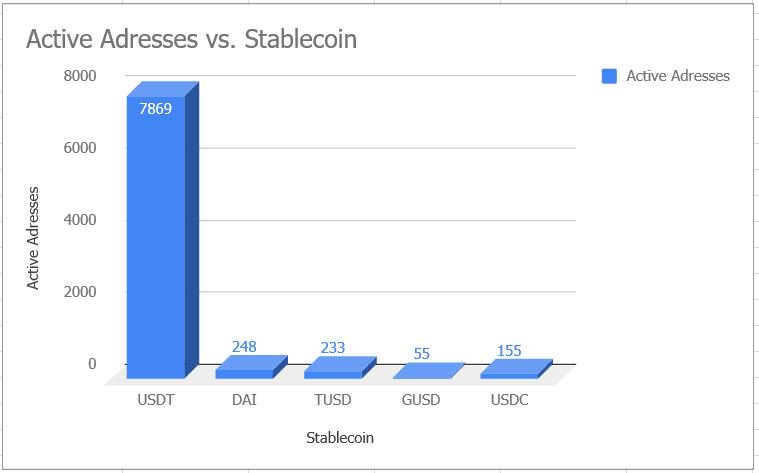

All stablecoins can be tracked here: stablecoinindex.com @stablecoinindex

You can also dive into my spreadsheet here: docs.google.com/spreadsheets/d…