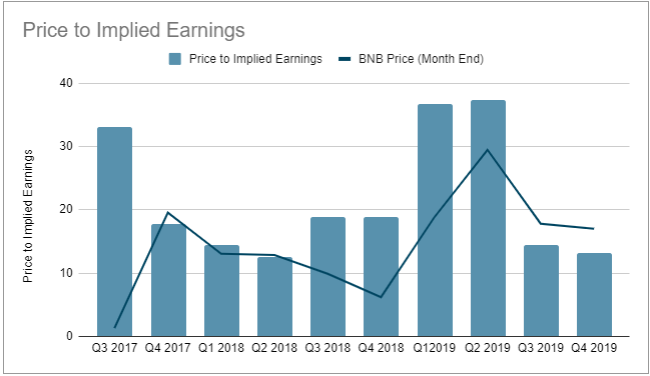

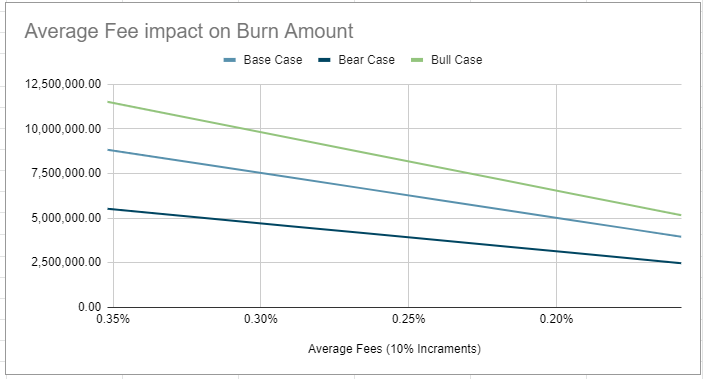

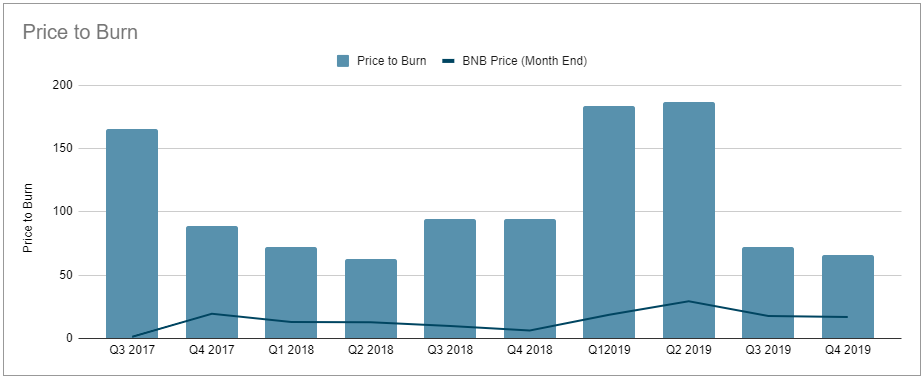

This pushes back against the critique of buyback and burn models not burning supply at quick rates

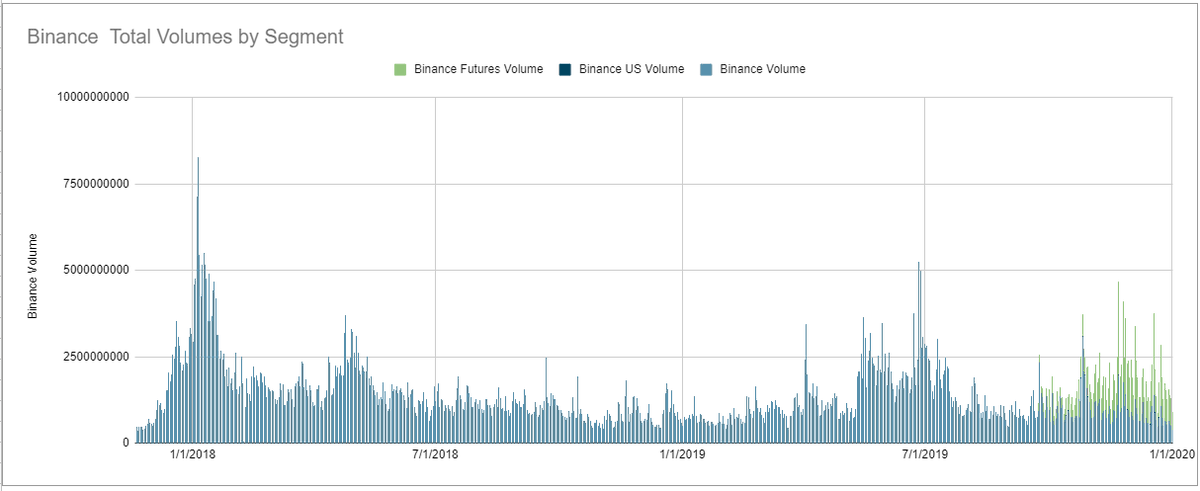

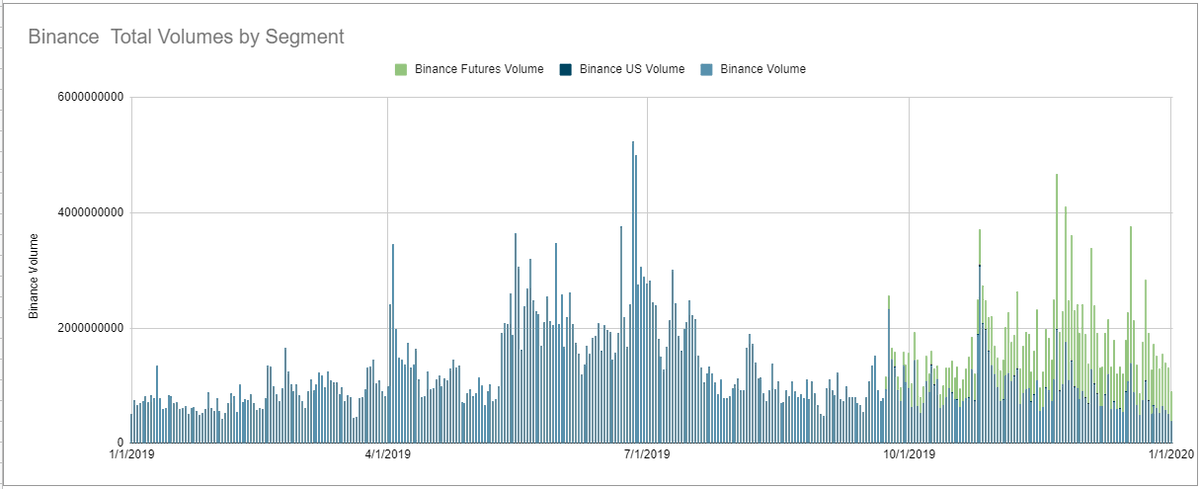

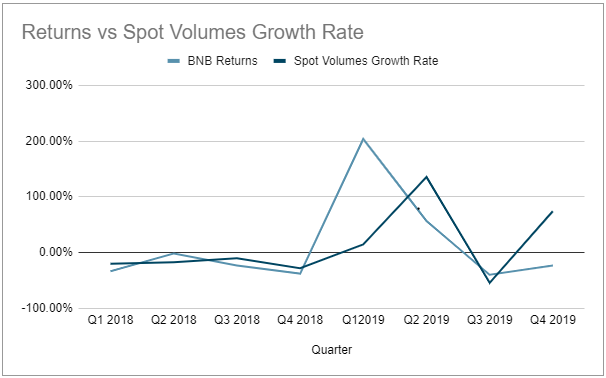

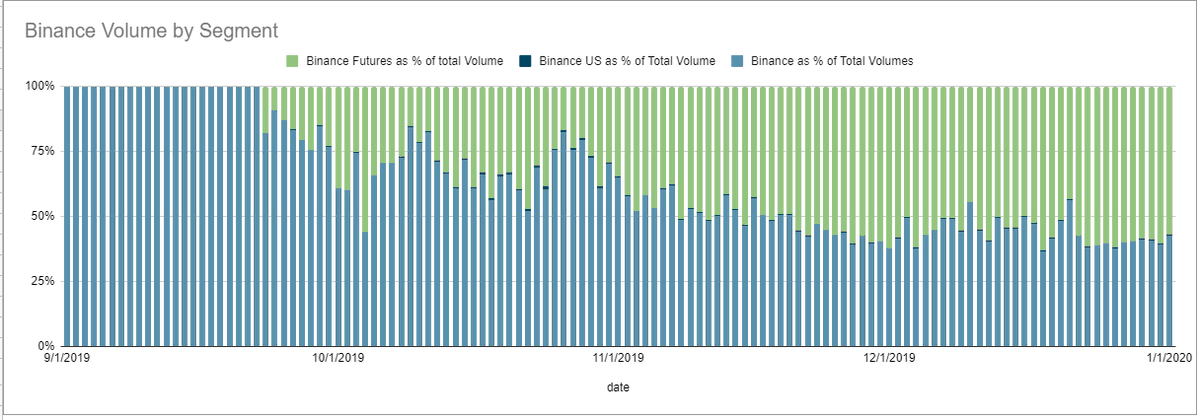

Side note: Though @BinanceAmerica volumes so early initial growth (due to no trading fees promotion) they did not have the same impact as futures.

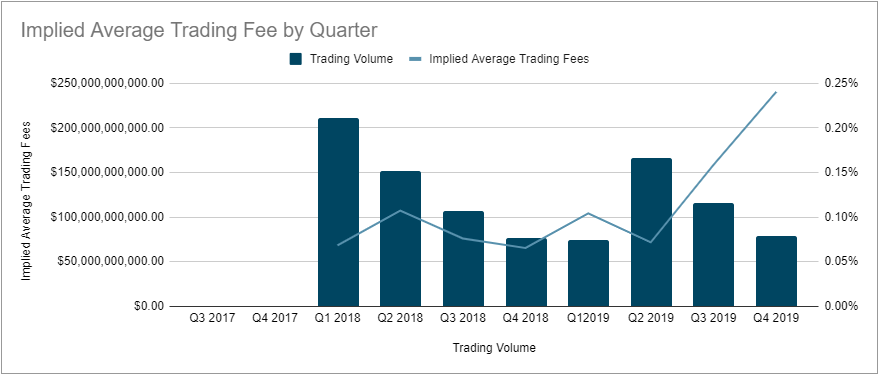

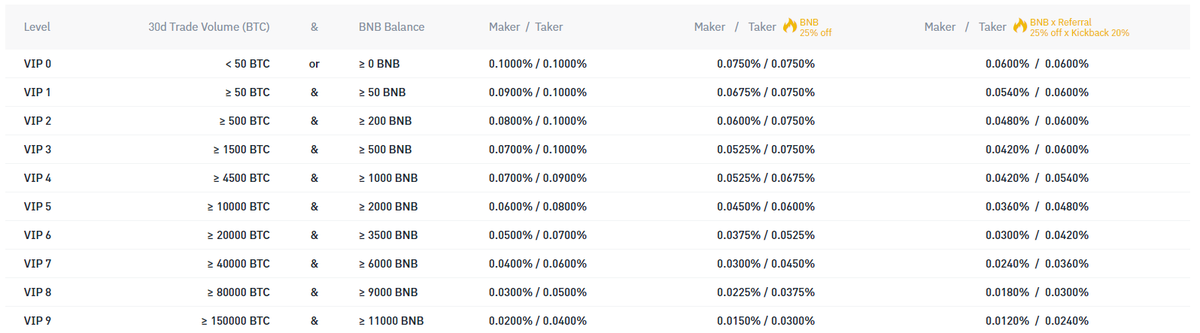

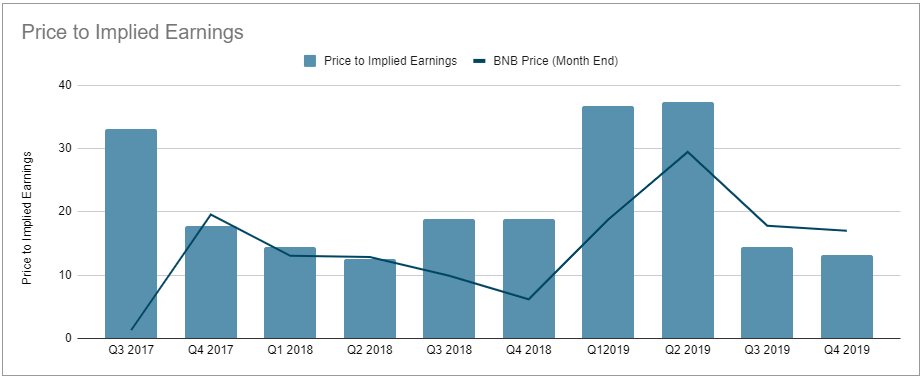

As we can see the implied avg trading fee has increased the last 2 quarters