Today, I came across the post: "An analysis of Citadel's Pink Sheet Stocks" - by u/skifunkster

reddit.com/r/Superstonk/c…

1. It was an interesting read.

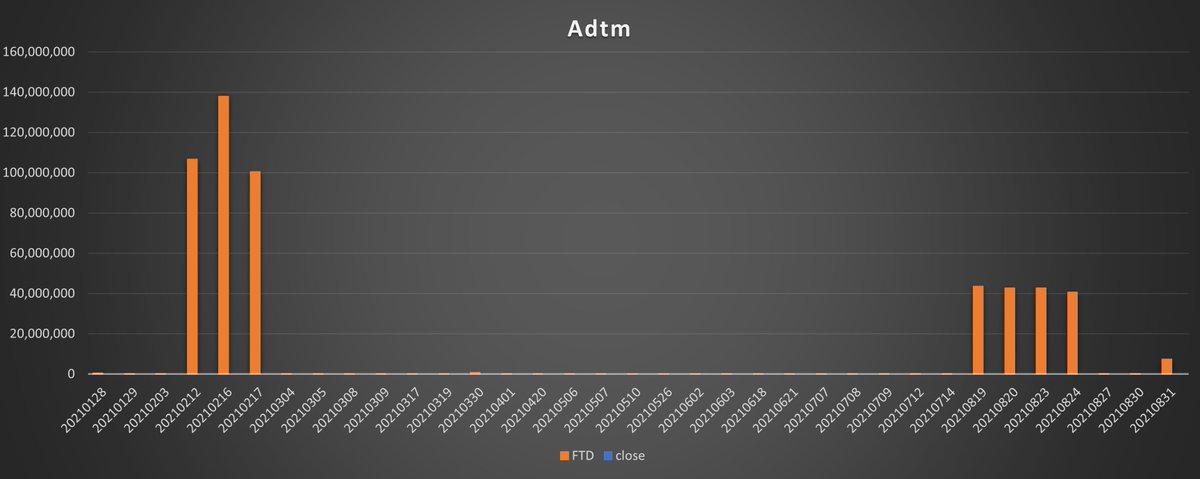

2. I got the idea to take a flook at the FTDs of the Pink Sheets Citadels is trading. 😎

Check ADTM (1) Value: 0,00010 USD

1/4

reddit.com/r/Superstonk/c…

1. It was an interesting read.

2. I got the idea to take a flook at the FTDs of the Pink Sheets Citadels is trading. 😎

Check ADTM (1) Value: 0,00010 USD

1/4

Foy Johnston Ord Shs FOYJ

0,00010 USD

CNXS

0.00000 No idea what value

BSSP

0.0003-0.0002 (-40.00%)

3/4

0,00010 USD

CNXS

0.00000 No idea what value

BSSP

0.0003-0.0002 (-40.00%)

3/4

AGDO $0.0003

@rensole

@__ZionLion__

@trey53881765

@K_R_Hamblin

@MlleNadjie

@trey53881765

@ConwayYen

@Taylor72350938

@ZammyymmaZ

@ham604

4/4

@rensole

@__ZionLion__

@trey53881765

@K_R_Hamblin

@MlleNadjie

@trey53881765

@ConwayYen

@Taylor72350938

@ZammyymmaZ

@ham604

4/4

Add: 5/4

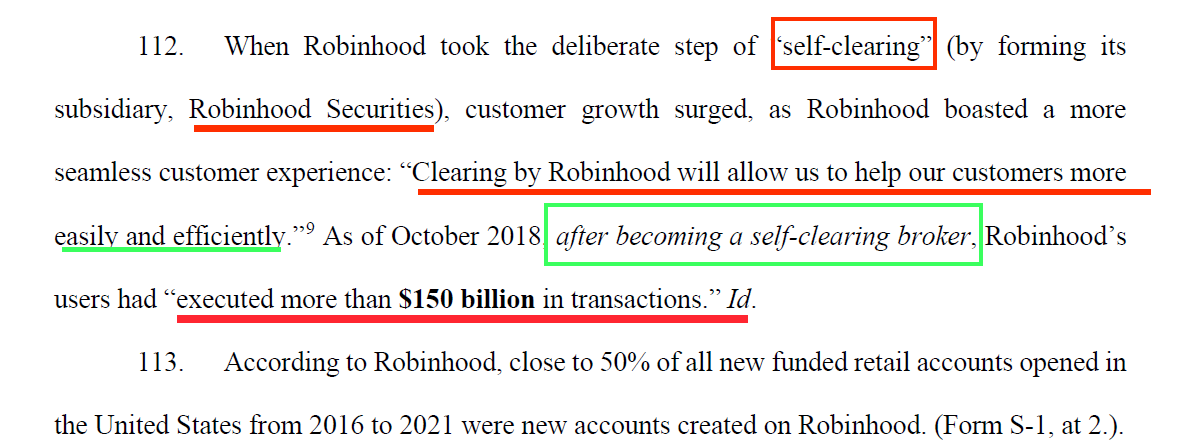

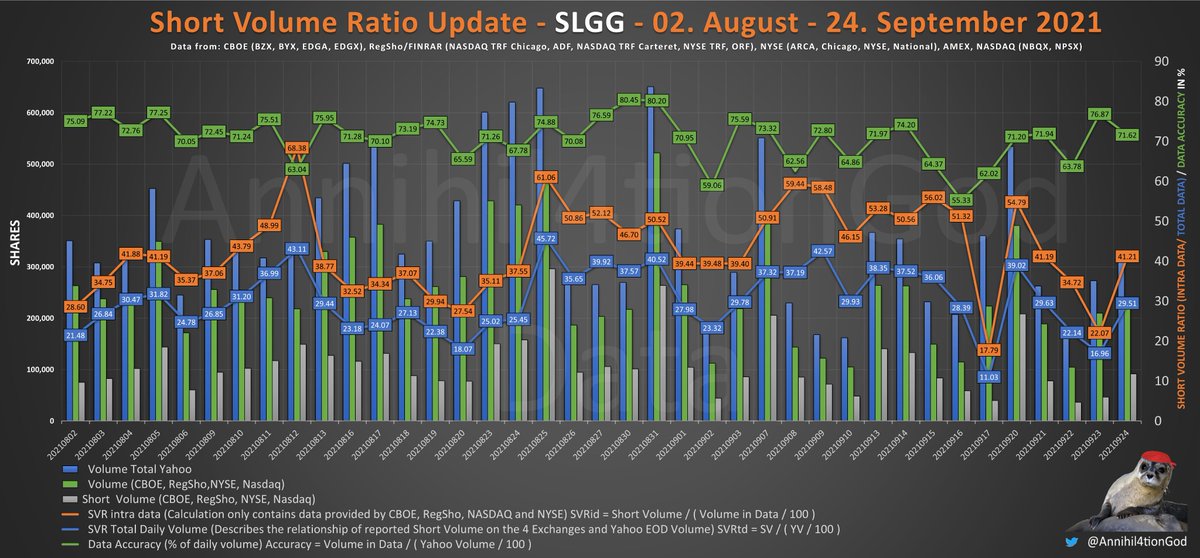

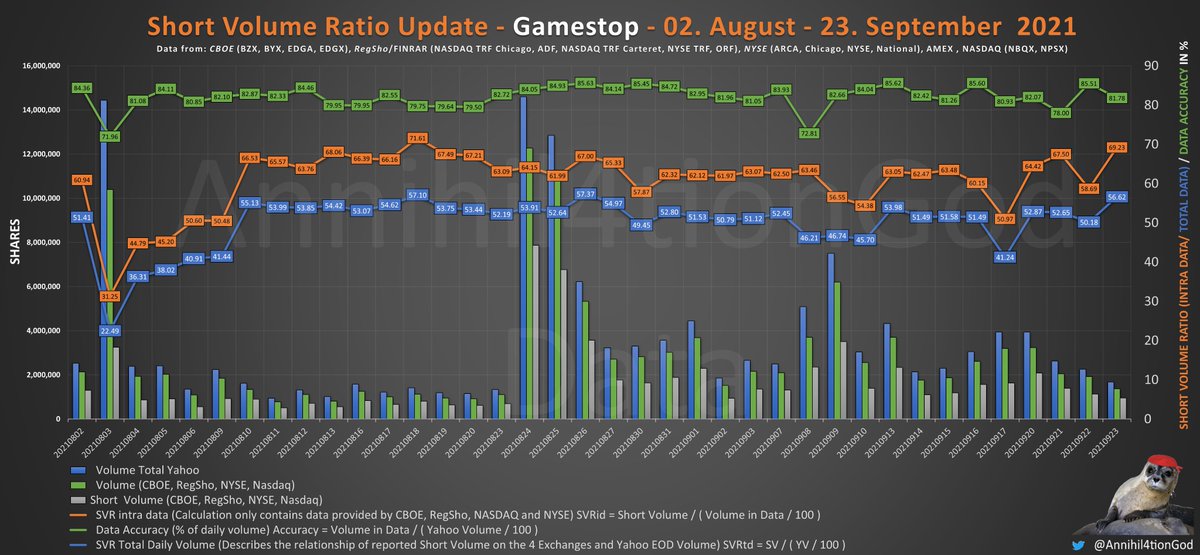

Chart 1: Blue Price - Rest Data i Will show you

Chart 2: Close Price and FTDs Full

Chart 3: Close Price and FTD zoomed in

Chart 4: Close and Short

Chart 1: Blue Price - Rest Data i Will show you

Chart 2: Close Price and FTDs Full

Chart 3: Close Price and FTD zoomed in

Chart 4: Close and Short

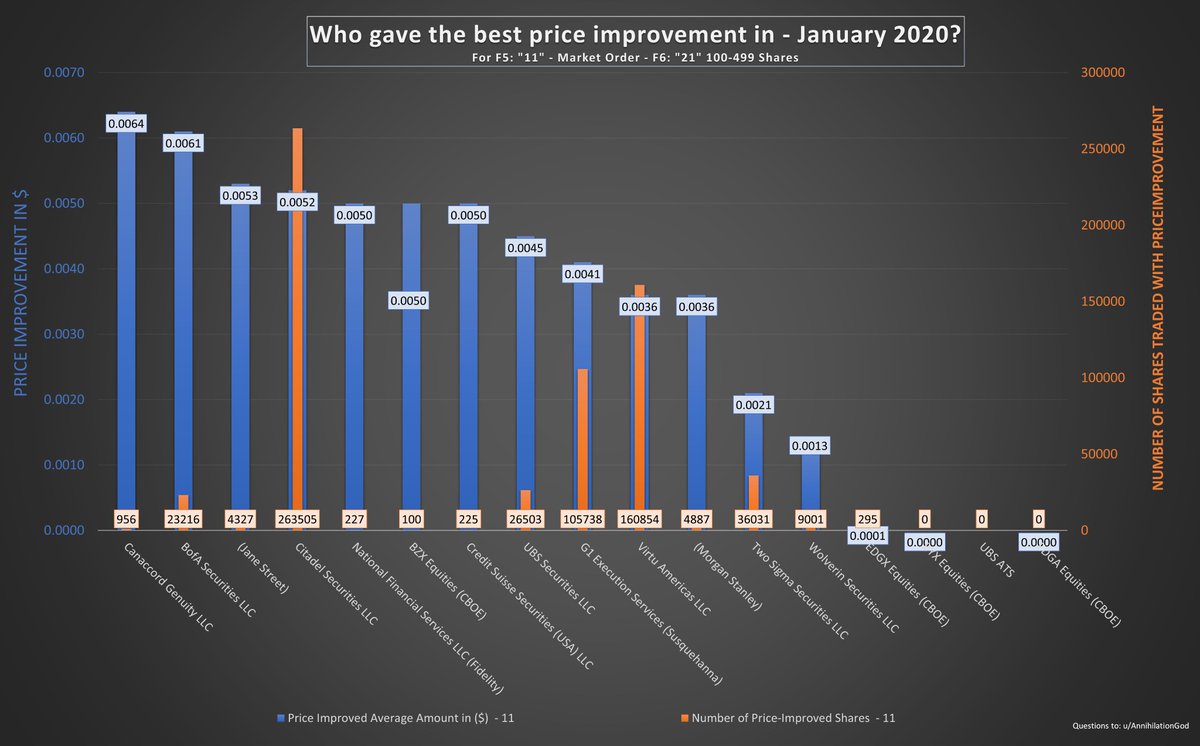

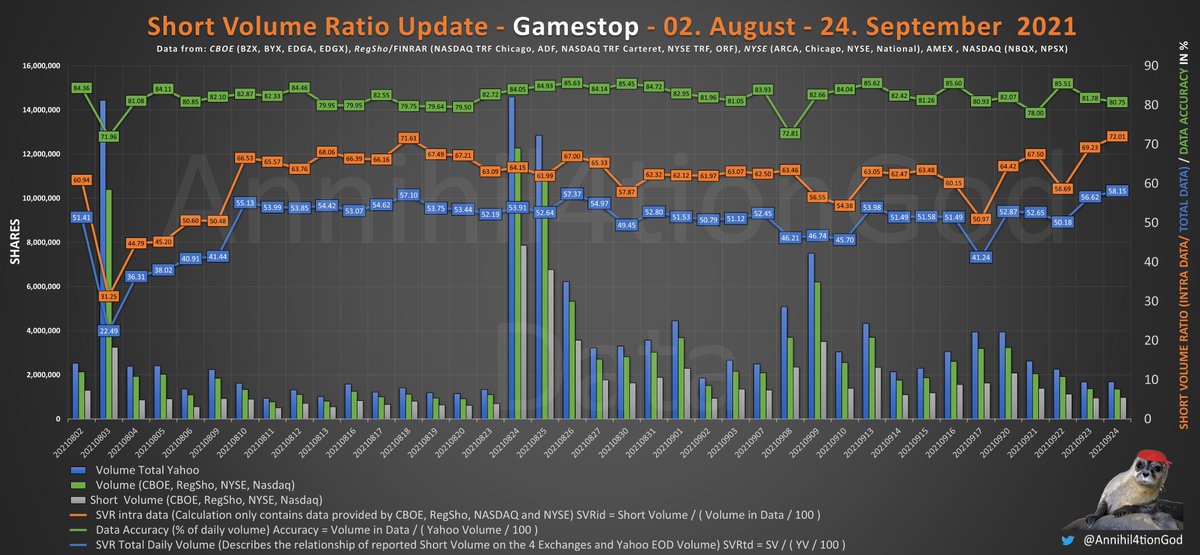

C1 ALOT Shorts

C2 On 80 Days + The SVR was 100% while the price was low on this time.

Close and Short Volume Ratio.

6/4

C2 On 80 Days + The SVR was 100% while the price was low on this time.

Close and Short Volume Ratio.

6/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh