Yes, but "was it good?"

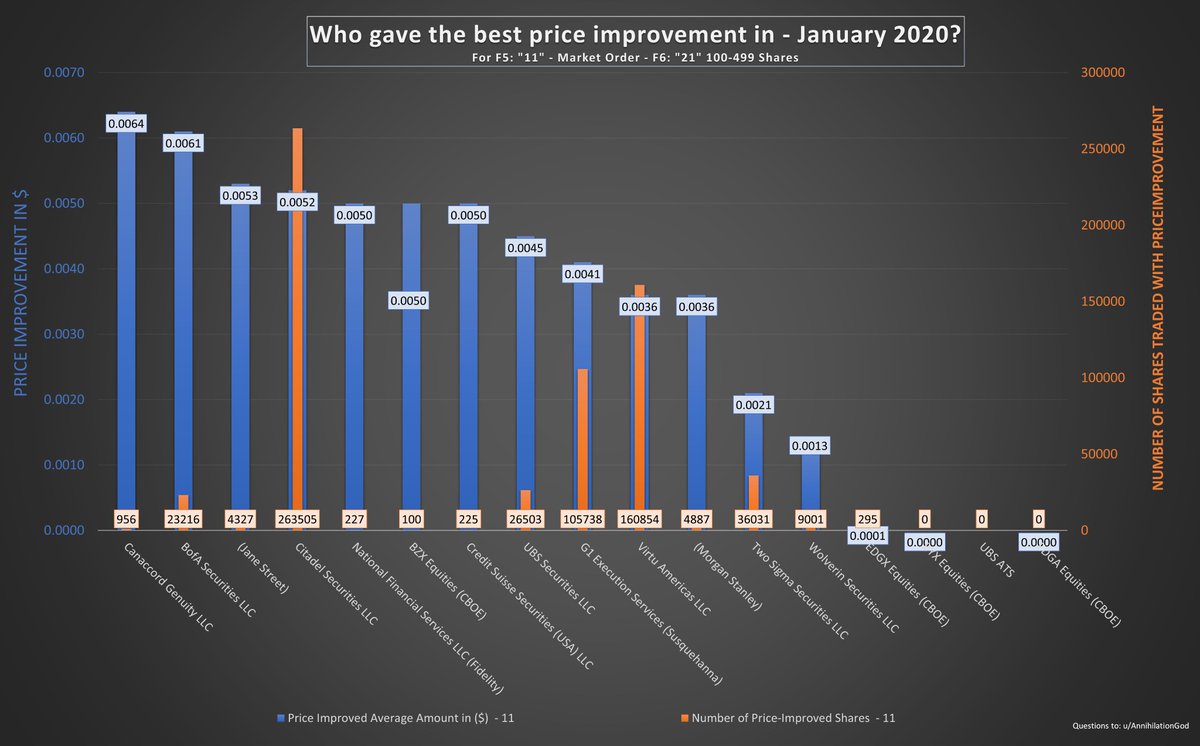

Some charts I started to do 4(?) months ago based on Rule 605 Data provided by Citadel and other market participants. Check the monthly Charts starting at 3/12 Jan 2020 to Feb 2021 and make up your own mind regarding

2/12- Overview.

1/12

Some charts I started to do 4(?) months ago based on Rule 605 Data provided by Citadel and other market participants. Check the monthly Charts starting at 3/12 Jan 2020 to Feb 2021 and make up your own mind regarding

2/12- Overview.

1/12

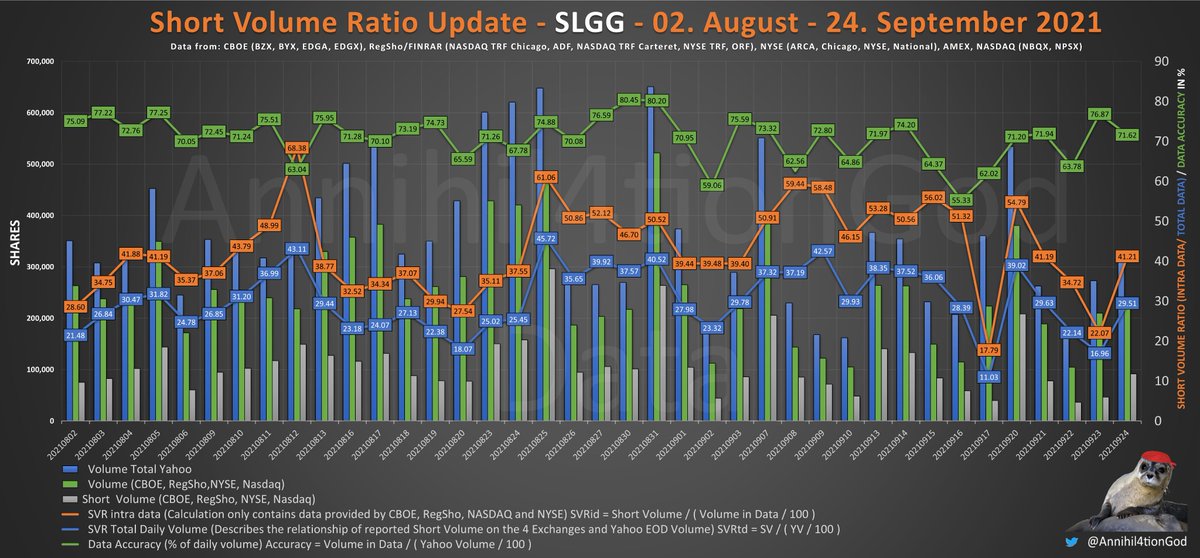

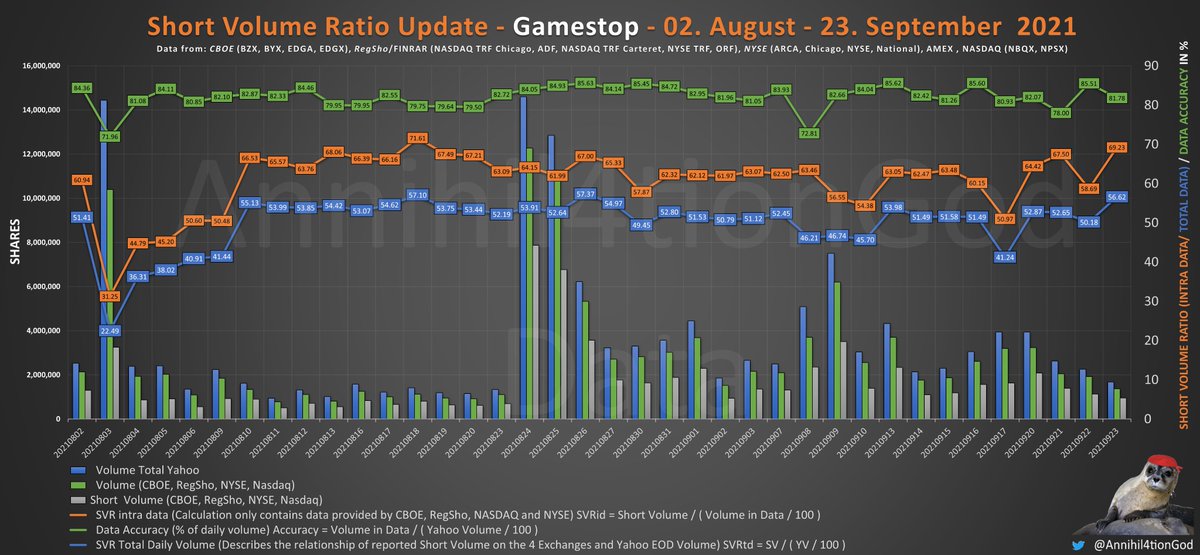

https://twitter.com/citsecurities/status/1442629359655919618

Starting at 3/13:

Monthly charts Timeframe 2020-2021 Feb regarding order execution quality aka. price improvement.

Starting at 10/12:

Comparison of Rule 605 Data provided by Citadel for order execution of #FB #GME and #AMD shares, Jan to June 2021.

2/12

Monthly charts Timeframe 2020-2021 Feb regarding order execution quality aka. price improvement.

Starting at 10/12:

Comparison of Rule 605 Data provided by Citadel for order execution of #FB #GME and #AMD shares, Jan to June 2021.

2/12

The Following Monthly chart will display the reported information regarding order routing (Rule 605) by Citadel and others.

Charts contain 2 months per tweet with.

1. Marketable Limit Order Price Improvement

2. Market Order

for the smalles category report - 100-499 Shares.

3/12

Charts contain 2 months per tweet with.

1. Marketable Limit Order Price Improvement

2. Market Order

for the smalles category report - 100-499 Shares.

3/12

March & April 2020

While Citadel was routing most of the trades in the researched timeframe, Citadel is not the top company regarding price improvement - looks like the price improvement by other institutions was way better.

4/12

While Citadel was routing most of the trades in the researched timeframe, Citadel is not the top company regarding price improvement - looks like the price improvement by other institutions was way better.

4/12

Still asking myself what a negative average realized spread means?!

Notice Chart 4: Quality of trades outside the quote.

(Smaller>Larger)

10/12

Notice Chart 4: Quality of trades outside the quote.

(Smaller>Larger)

10/12

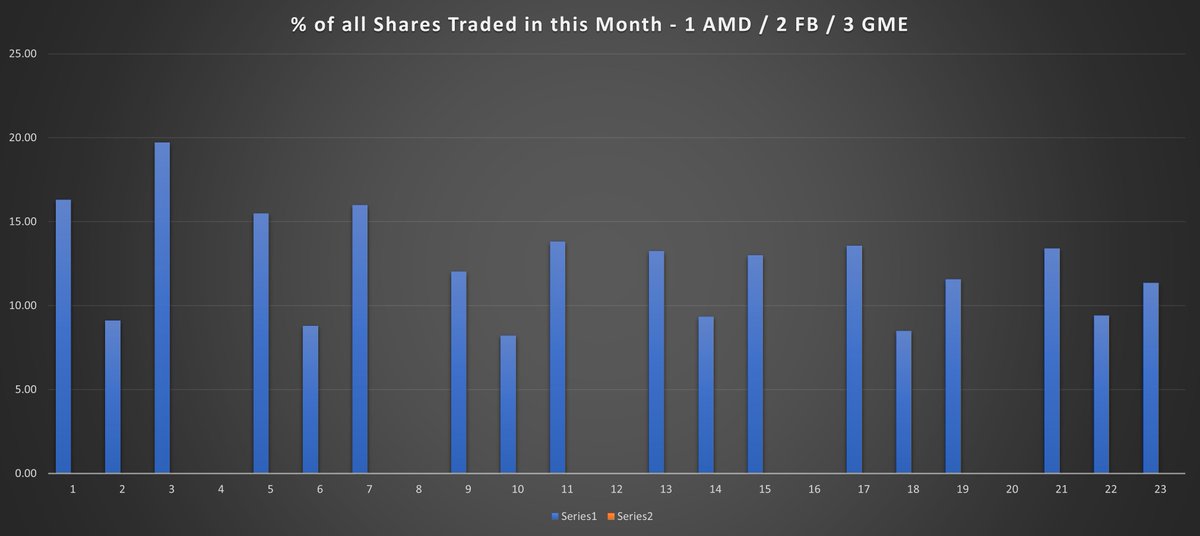

C1: Time to execution for trades outside the quote.

C2: % or Shares executed with price improvement, at the quote and outside the quote.

C3: After Feb, the % of shares traded OTQ for GME increased!

C4: Trades in Report as % of monthly vol acc to yahoo.

11/12

C2: % or Shares executed with price improvement, at the quote and outside the quote.

C3: After Feb, the % of shares traded OTQ for GME increased!

C4: Trades in Report as % of monthly vol acc to yahoo.

11/12

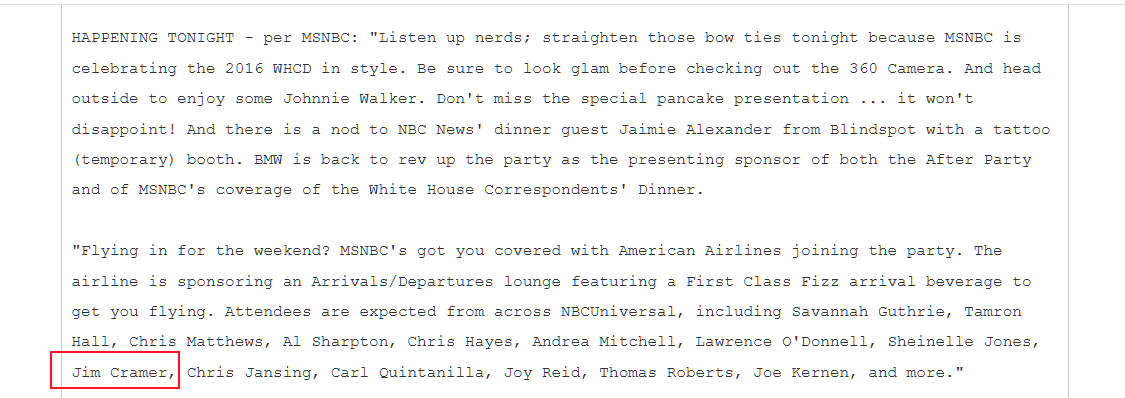

@rensole @__ZionLion__ @trey53881765 @K_R_Hamblin @MlleNadjie @trey53881765 @ConwayYen @Taylor72350938 @ZammyymmaZ @Taylor72350938 @ham604 @cvpayne @xmindthiefx @pwnwtfbbq @unusual_whales @JackPosobiec @DeeStonk @StocksBigPlays @radio2saturn @GMEshortsqueeze

12/12

12/12

• • •

Missing some Tweet in this thread? You can try to

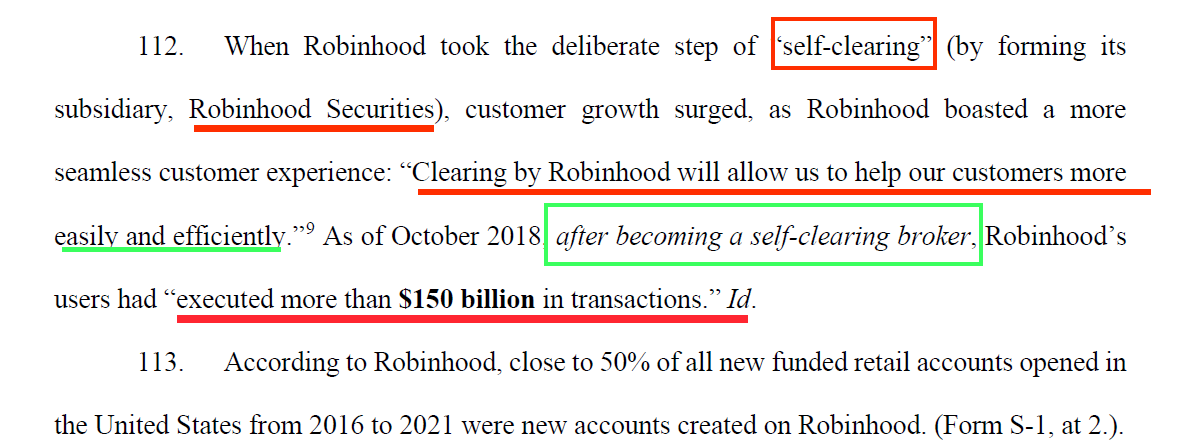

force a refresh