Still doing work updating my $GBTC research primer. Complete destruction of GBTC's status as a leveraged bitcoin bet. Historically it almost always offered more extreme returns in either direction during moves. That has completely broken down with the current persistent discount.

If $GBTC is ever able to convert to an ETF and BTC price trend is positive during that time, it may act as a leverage play again as the discount closes. Who knows when/if that happens though. Still hasn't stopped $GBTC's trading dominance though. No other fund is remotely close.

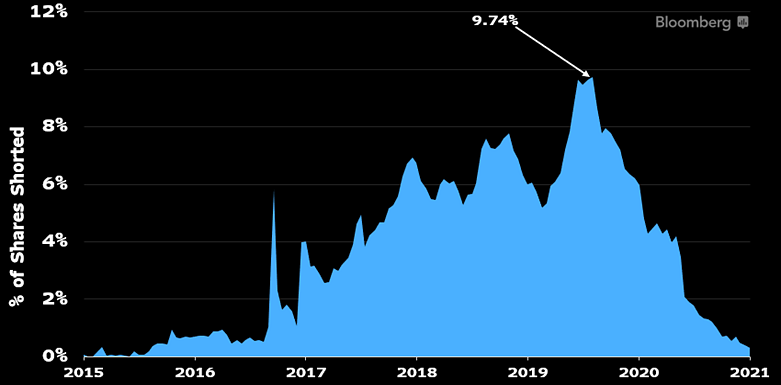

The collapse into a discount also caused a collapse in people betting against $GBTC. No one wants to be short this thing right now -- don't blame them. Current short interest as percent of shares is 0.3% of shares. Down from a peak of 9.74%.

If you've gotten this far and wanna see more charts and get some more detail. It can be found on the terminal at {GBTC US Equity BICO} or directly at the link below for clients. blinks.bloomberg.com/news/stories/R…

• • •

Missing some Tweet in this thread? You can try to

force a refresh