The past few months I've seen a deluge of IRL and digital frens look to get into crypto & DeFi professionally.

With talent in this space continuing to swell, thought I'd open-source some of the tips I've picked up over these past years.

A thread🧵

With talent in this space continuing to swell, thought I'd open-source some of the tips I've picked up over these past years.

A thread🧵

#1: Find your tribe(s)

This is by far the most important tip I'd have for someone new.

Find a group of friends that you can trust with anything, that will criticize your views, that will support you through thick and thin.

Find your tribe. Find your squad.

This is by far the most important tip I'd have for someone new.

Find a group of friends that you can trust with anything, that will criticize your views, that will support you through thick and thin.

Find your tribe. Find your squad.

#1 (cont)

The above applies to all of life but in crypto, I think it's especially potent due to the psyops, tumult, mental strain this space puts u through.

Winning together ("Mutually Ensured Success") is powerful.

Reading on this (h/t @Daryllautk):

otherinter.net/research/squad…

The above applies to all of life but in crypto, I think it's especially potent due to the psyops, tumult, mental strain this space puts u through.

Winning together ("Mutually Ensured Success") is powerful.

Reading on this (h/t @Daryllautk):

otherinter.net/research/squad…

#2: No one is inaccessible

So how do you find your tribe? One way is to reach out to anyone (even 'popular' ppl) by adding insight, sharing opposing views, or asking Qs.

I've found that (almost) everyone in this space will respond to you eventually. Take advantage of that!

So how do you find your tribe? One way is to reach out to anyone (even 'popular' ppl) by adding insight, sharing opposing views, or asking Qs.

I've found that (almost) everyone in this space will respond to you eventually. Take advantage of that!

#3: Ask dumb questions

Related to the above, feel free to ask dumb questions.

No one in this space knows everything. Early DeFi adopters you recognize today may not have known how impermanent loss worked or how sUSD is collateralized.

Don't be afraid to ask for help.

Related to the above, feel free to ask dumb questions.

No one in this space knows everything. Early DeFi adopters you recognize today may not have known how impermanent loss worked or how sUSD is collateralized.

Don't be afraid to ask for help.

#4: Know your worth

Even despite the influx, good talent in this space *is* extremely scarce and will continue to be scarce moving forward. This applies whether you're a developer, investor, designer, etc.

If you know your stuff, make sure you're getting compensated well.

Even despite the influx, good talent in this space *is* extremely scarce and will continue to be scarce moving forward. This applies whether you're a developer, investor, designer, etc.

If you know your stuff, make sure you're getting compensated well.

#5: Know you won't catch everything

It's basically impossible to catch every move in DeFi, NFTs, and crypto. This was the case last year, and in 2017, and even before that.

It's worth stomaching sooner rather than later you won't catch everything but do your damn best to!

It's basically impossible to catch every move in DeFi, NFTs, and crypto. This was the case last year, and in 2017, and even before that.

It's worth stomaching sooner rather than later you won't catch everything but do your damn best to!

#6: Become a user

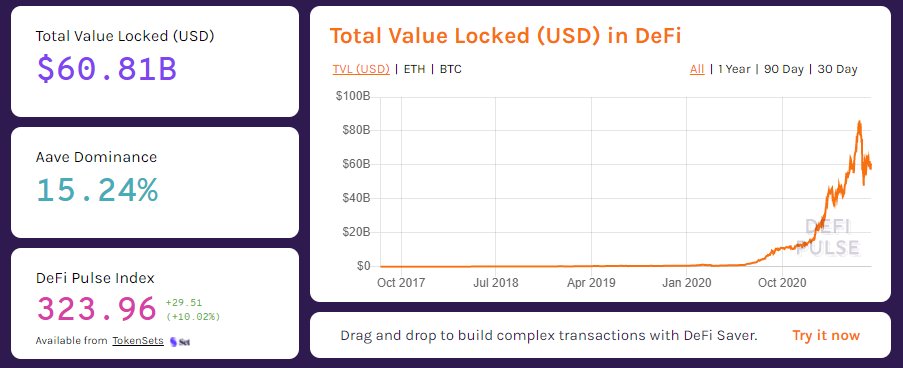

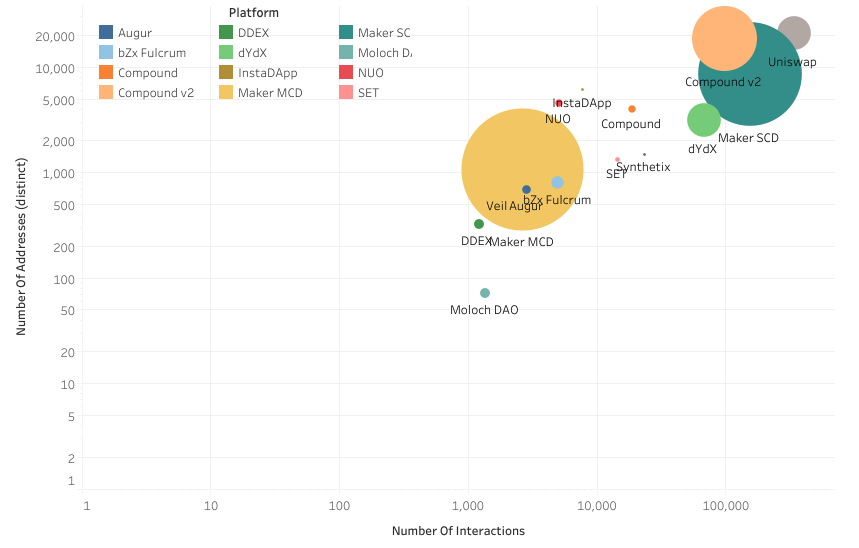

It pays to be a user in DeFi. Early adopters of Uniswap, Curve, and other protocols were rewarded generously for being power users early on.

If you can, load up a wallet with $x000s, then do all u can to earn yield, trade, etc.

It pays to be a user in DeFi. Early adopters of Uniswap, Curve, and other protocols were rewarded generously for being power users early on.

If you can, load up a wallet with $x000s, then do all u can to earn yield, trade, etc.

https://twitter.com/Darrenlautf/status/1442836788939083777

Also, wanted to supplement this thread with resources that may be helpful for those looking to get into DeFi.

Quick list of some resources I use on the regular.

Quick list of some resources I use on the regular.

Podcasts:

Uncommon Core by @hasufl and @zhusu

Delphi Podcast by @Shaughnessy119

Bankless by @TrustlessState and @RyanSAdams

Talking Crypto by @gabrielhaines

Data:

@nansen_ai

@etherscan

@uniwhalesio

@DuneAnalytics

Uncommon Core by @hasufl and @zhusu

Delphi Podcast by @Shaughnessy119

Bankless by @TrustlessState and @RyanSAdams

Talking Crypto by @gabrielhaines

Data:

@nansen_ai

@etherscan

@uniwhalesio

@DuneAnalytics

Overall, just get involved on Twitter, Telegram, and Discord.

Again, feel free to ask dumb questions. No one is impossible to reach. Make frens and find a tribe.

Again, feel free to ask dumb questions. No one is impossible to reach. Make frens and find a tribe.

Special h/t to @Darrenlautf, who runs The Daily Ape (check his bio), by far the best aggregator of pertinent information in DeFi, NFTs, and crypto more broadly.

Also, he did a really good skill tree here. Don't miss this.

Also, he did a really good skill tree here. Don't miss this.

https://twitter.com/Darrenlautf/status/1434877372700901384

A lot of these things I explained in audio format in this podcast with @gabrielhaines. Tune in on your next lindy walk if you're interested.

(My first podcast, so pardon the scuff pls and ty <3)

(My first podcast, so pardon the scuff pls and ty <3)

Fwiw, these are tips and resources that I personally have found useful in my crypto "career."

I don't think I have it all figured out yet—I'd be scared if I did.

Everyone approaches this space differently but hopefully what I discussed can be helpful.

I don't think I have it all figured out yet—I'd be scared if I did.

Everyone approaches this space differently but hopefully what I discussed can be helpful.

As always, my DMs are open if you have any specific questions or want to chat with me further about anything I discussed in this thread.

I'll do my best to get back to you as soon as possible if you do want to reach out.

WAGMI frens.

I'll do my best to get back to you as soon as possible if you do want to reach out.

WAGMI frens.

Soz, it's late, so forgot a few things (and probs forgot some others):

@theBlockcrunch by the ever-venerable @mrjasonchoi (my first crypto podcast listen actually)

Arthur Hayes' blog and Deribit Insights are solid reads.

@theBlockcrunch by the ever-venerable @mrjasonchoi (my first crypto podcast listen actually)

Arthur Hayes' blog and Deribit Insights are solid reads.

• • •

Missing some Tweet in this thread? You can try to

force a refresh