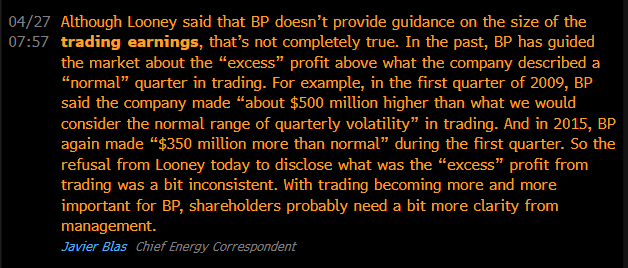

DO WE NEED TO INVEST IN OIL? Each year, the @IEA offers some answers. I'm going to focus on the first 10 years, as beyond 2030 the uncertainties are so large there's little point. The IEA tries to answer the question with 3 scenarios (no forecasts)🧵 1/6 #OOTT

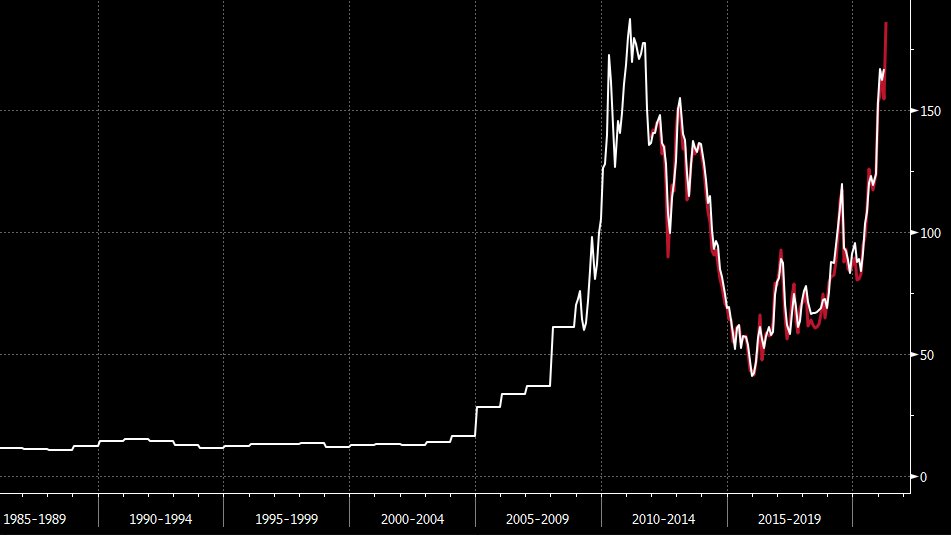

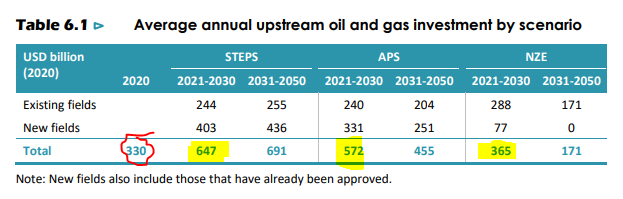

Under two of its three scenarios (see below), @IEA sees a need for a huge oil and gas investment surge for the next 10 years (from the 2020 investment level). Even using the 2018-19 baseline, before the impact of low prices on capex, the investment increase is pretty large 2/6

Under IEA middle-ground scenario (APS, which includes current policy and stated net-zero pledges), oil and gas investment needs to increase >70% from $330bn in 2020 to ~$572bn from 2021-2030. That's a scenario in which oil demand has already peaked, and starts to fall 3/6

If oil demand doesn't fall (and the IEA short-term forecast points to oil demand surging to a record by 2022), then the volume of investment reflected in APS won't be enough and sadly we will need something closer to the big numbers of the STEPS scenario 4/6

Policymakers may push the world into the NZE scenario (one can only hope we get serious about climate change...), but even on that scenario we need investment to increase from 2020 level by about 10%, over the next 10 years. It's only after 2030 when investment can truly drop 5/6

The difficulty for policymakers and businesspeople is what of those scenarios will happen, because require huge different $$$ capex. Get it wrong, and you can lock-in fossil fuel supply for longer, exacerbating climate change, or you under invest, hurting the global economy. 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh