#Copper thread

1/ Everywhere on Twitter 'I Told You So' copper bulls are running

I get it- a technical setup where the 200d is defended & old highs are retested

And yes, I'm short duration & know the correlation w/ copper/gold

(ed note: do copper bulls short gold or bonds? :)

1/ Everywhere on Twitter 'I Told You So' copper bulls are running

I get it- a technical setup where the 200d is defended & old highs are retested

And yes, I'm short duration & know the correlation w/ copper/gold

(ed note: do copper bulls short gold or bonds? :)

2/ Unfortunately, the only tangible news behind this copper squeeze are a #CCP PBOC official talking about 'Rule of Law' principles resolving Evergrande.

Are you kidding me?

nypost.com/2021/10/15/eve…

Are you kidding me?

nypost.com/2021/10/15/eve…

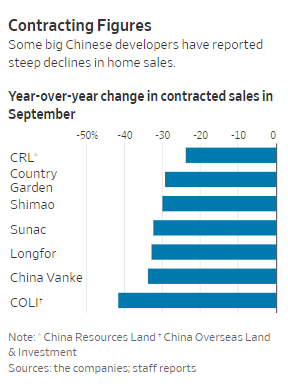

4/ Its not just volumes, its prices too

We'll see how Xi like his "homes are for living in" quotation as Lao Baixing savings are shredded

I believe the #CCP will soon begin restricting sales to try to stop the bleeding

wsj.com/articles/chine…

We'll see how Xi like his "homes are for living in" quotation as Lao Baixing savings are shredded

I believe the #CCP will soon begin restricting sales to try to stop the bleeding

wsj.com/articles/chine…

5/ Here are the raw fundamentals of the Copper market. Its a pure China story on demand

And here is a little math: China is consuming about 20lbs per person vs the US at 13

A reduction to a developed market norm would remove almost 20% of net #copper demand (e.g. not a crash)

And here is a little math: China is consuming about 20lbs per person vs the US at 13

A reduction to a developed market norm would remove almost 20% of net #copper demand (e.g. not a crash)

6/ The common bullish refrain is simply - won't electric vehicles and the US grid rebuild fill in the gap?

No, not even if Slidin' Biden could pass his infrastructure fantasy

If we lose 3-4m tons of Chinese demand in the next year, it will take a lot more EVs

No, not even if Slidin' Biden could pass his infrastructure fantasy

If we lose 3-4m tons of Chinese demand in the next year, it will take a lot more EVs

7/ Trees grow to the sky for Copper analysts on China. You can find all kinds of crazy 2050 projections like the below

All of the sudden we get a sudden stop in the Chinese housing market (the key to copper demand) and no one cares?

All of the sudden we get a sudden stop in the Chinese housing market (the key to copper demand) and no one cares?

8/ The biggest concession I can give the bulls is a long term one

Chile/Peru are governed by socialists now, & at 34% of supply, its a risk that isn't totally quantifiable if big mines are shut down suddenly

Chile/Peru are governed by socialists now, & at 34% of supply, its a risk that isn't totally quantifiable if big mines are shut down suddenly

9/ Thus, we own some long tail assets like Filo FIL.CN against being broadly negative on spot #Copper in the short to medium term

The #CCP has to prove they can maintain a bubble they should have burst 10 yrs ago, when people first visited the ghost cities

The #CCP has to prove they can maintain a bubble they should have burst 10 yrs ago, when people first visited the ghost cities

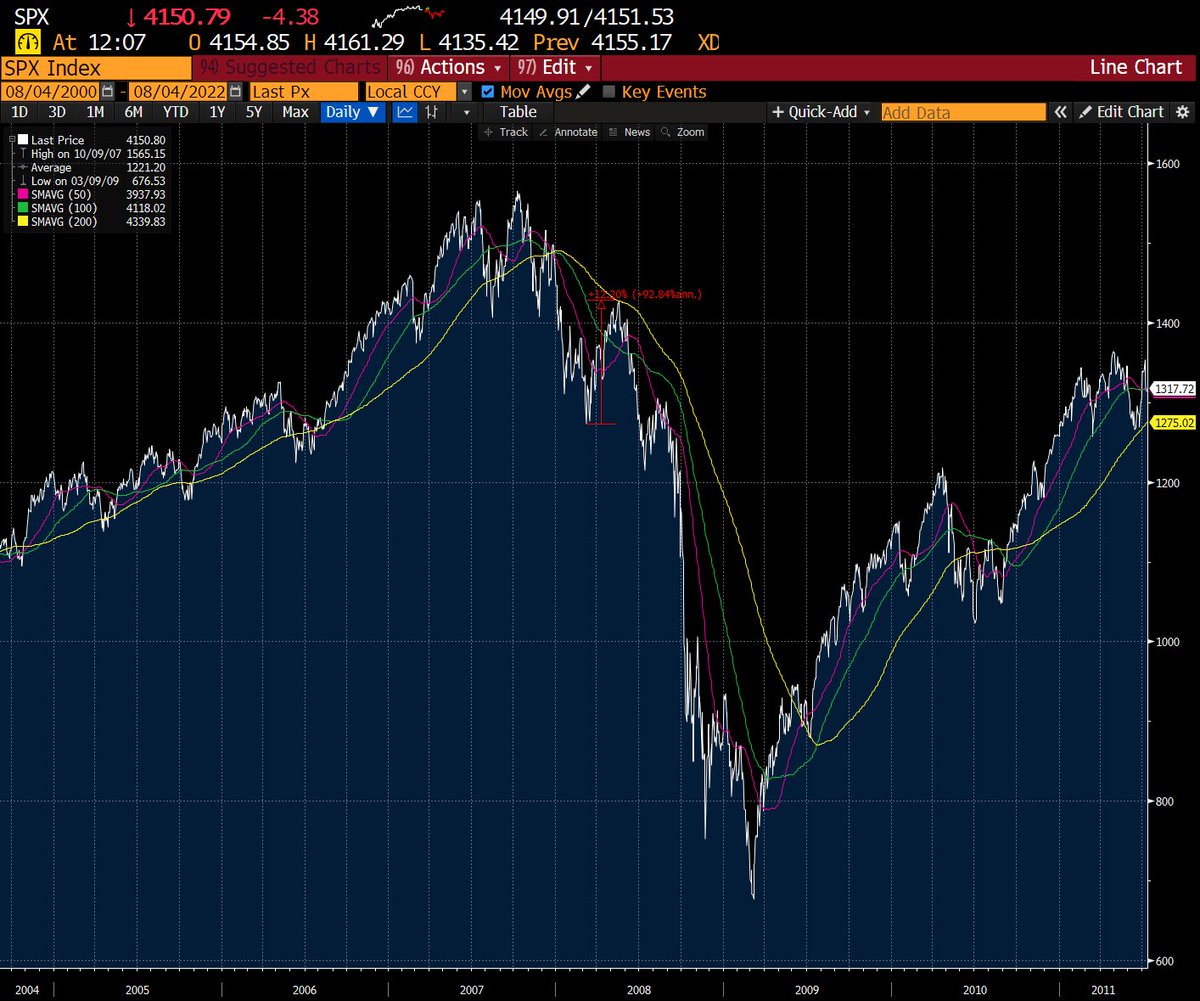

10/ Finally, and maybe most importantly, #IronOre has crashed and stayed down

The chart below is Dalian iron ore futures

China consumer more iron ore than copper, but only slightly (75% vs 52% of demand)

The chart below is Dalian iron ore futures

China consumer more iron ore than copper, but only slightly (75% vs 52% of demand)

11/ How could a break like this develop between iron ore/copper?

Maybe its passive, factor baskets, or some combination of people who don't read the news

Maybe the Chinese stopped buying iron ore to punish Australia, as they're forced to buy coal

Regardless, it matters /END

Maybe its passive, factor baskets, or some combination of people who don't read the news

Maybe the Chinese stopped buying iron ore to punish Australia, as they're forced to buy coal

Regardless, it matters /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh