Think we’re definitely living in a simulation. It’s really hard to digest this otherwise.

How it started… How it’s going…

How it started… How it’s going…

#Bitcoin vs. shitcoin future

If it’s the government asking money, it’s called taxes.

If it’s you asking money, then it’s deemed a robbery.

If it’s the government printing money, it’s called financial policy.

If it’s you printing money, it’s called criminal offense.

If it’s you asking money, then it’s deemed a robbery.

If it’s the government printing money, it’s called financial policy.

If it’s you printing money, it’s called criminal offense.

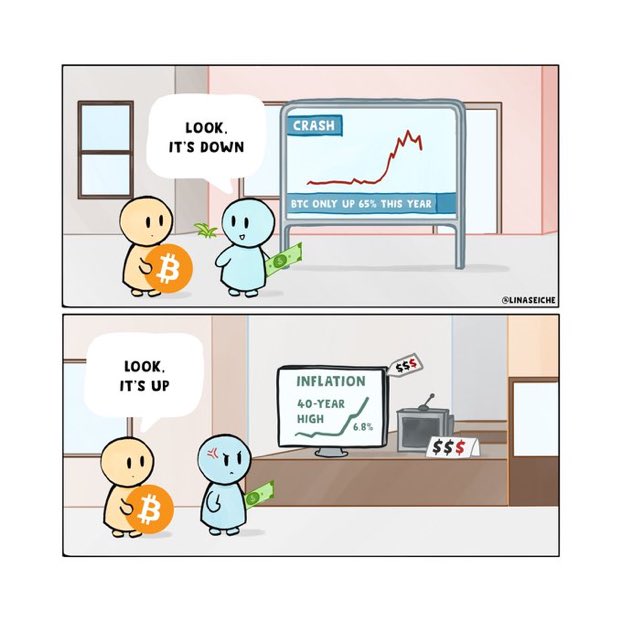

#Bitcoin does Bitcoin things, sometimes out of the blue. Time in the markets > Timing the markets.

#Bitcoin vs. Gold

(Trend shows Bitcoin stealing market share from gold)

Don't get me wrong... I love gold, but this is the truth as per recent trends and the way millennials & GenZ allocate their portfolios into the future.

Bitcoin is the Future, Gold is the Past

(Trend shows Bitcoin stealing market share from gold)

Don't get me wrong... I love gold, but this is the truth as per recent trends and the way millennials & GenZ allocate their portfolios into the future.

Bitcoin is the Future, Gold is the Past

Enter the Trojan Horse #Bitcoin through the walls of Troy 🤷♂️🤷♀️🤷

Robot nurses in the future anyone 🤷♂️

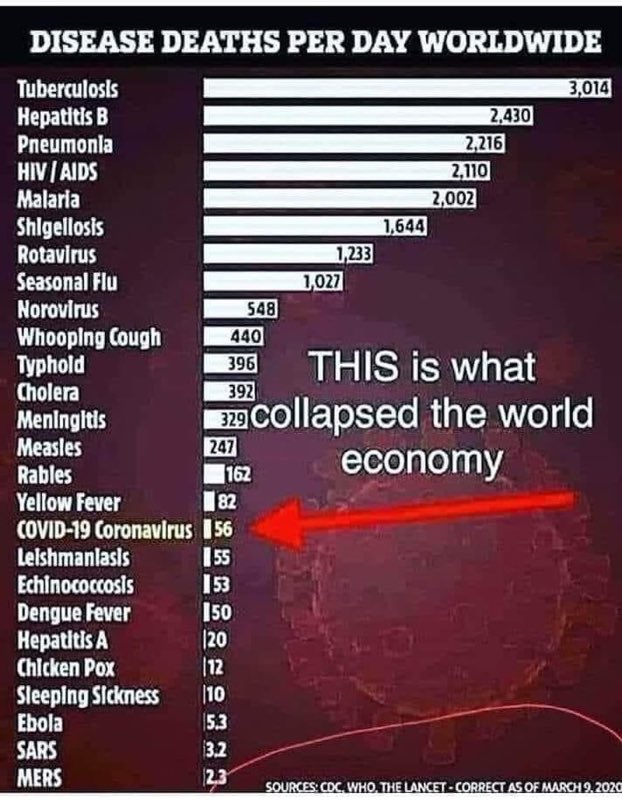

Food for thought — was it really necessary to completely shutdown the worlds economy, lock people down and close everything 🤷♂️🤷♀️🤷

#Bitcoin not only saves but increases your purchasing power tremendously. Start measuring your wealth in Satoshi’s not dollars.

#Bitcoin FOMO stacking Sats

The cost of living was so low in 1970 before the gold standard was removed, it’s stealth wealth theft first slowly then suddenly after 2008 crisis.

#Bitcoin let’s you opt out of theft.

#Bitcoin let’s you opt out of theft.

Make sure you don’t bring your #Bitcoin with you when you’re on a boat, you just might lose your wallets and keys. Hopefully you wouldn’t.

Who says Gold doesn’t have utility. Gold can be used in dental implants.

https://twitter.com/ratwell0x/status/1452070550201896962/video/1

If you understand #Bitcoin you wouldn’t look to trade it, every time there’s a 5% volatility move.

Goldmine, #Bitcoin mine, salt mine

#Bitcoin fixes money

@elonmusk kinda funds

Is this a #Bitcoin dip for ants 🐜

$SHIB token has zero fundamentals, zero adoption. It's all hype for being listed in Robinhood and other trading platforms. Don't fall for the hype and end up holding those heavy worthless bags later.

HODL your #Bitcoin

HODL your #Bitcoin

When can the FED & central banks print septillion dollars, keep the interest rates at near zero so we can all make it 🤷♂️🤷♀️🤷

Credit: @CarlBMenger

Nice one from @Breedlove22

Green: You people working hard

Red: Government, central banks, politicians & their military backing keeping you forcibly busy, while they print away your savings and future pushing you deeper into debt.

Red: Government, central banks, politicians & their military backing keeping you forcibly busy, while they print away your savings and future pushing you deeper into debt.

Governments want dummy taxpayers as citizens because they can feed any theories for them to believe in.

The way FED, ECB and worlds central banks are creating debt based money and inflating all assets people hold. One thing is definitely certain...

While most of the worlds assets keep up barely with inflation, for #Bitcoin and crypto inflation is rocket fuel.

While most of the worlds assets keep up barely with inflation, for #Bitcoin and crypto inflation is rocket fuel.

Holding Fiat vs. Holding #Bitcoin

The current global financial system

- Massive QE & Debt based money creation

- Massive Leverage plays from Wall Street & Banks

- ATH stocks, funds & securities

- Valuations and P/E ratios doesn't matter anymore

Opt out of this madness into #Bitcoin

- Massive QE & Debt based money creation

- Massive Leverage plays from Wall Street & Banks

- ATH stocks, funds & securities

- Valuations and P/E ratios doesn't matter anymore

Opt out of this madness into #Bitcoin

Opt out with #Bitcoin

You can buy a fraction of a #Bitcoin

#Bitcoin fixes this

Don’t be fooled by Metaverse. There are lots of implications for child social development and mental health issues when people are hooked into these 🤷♂️

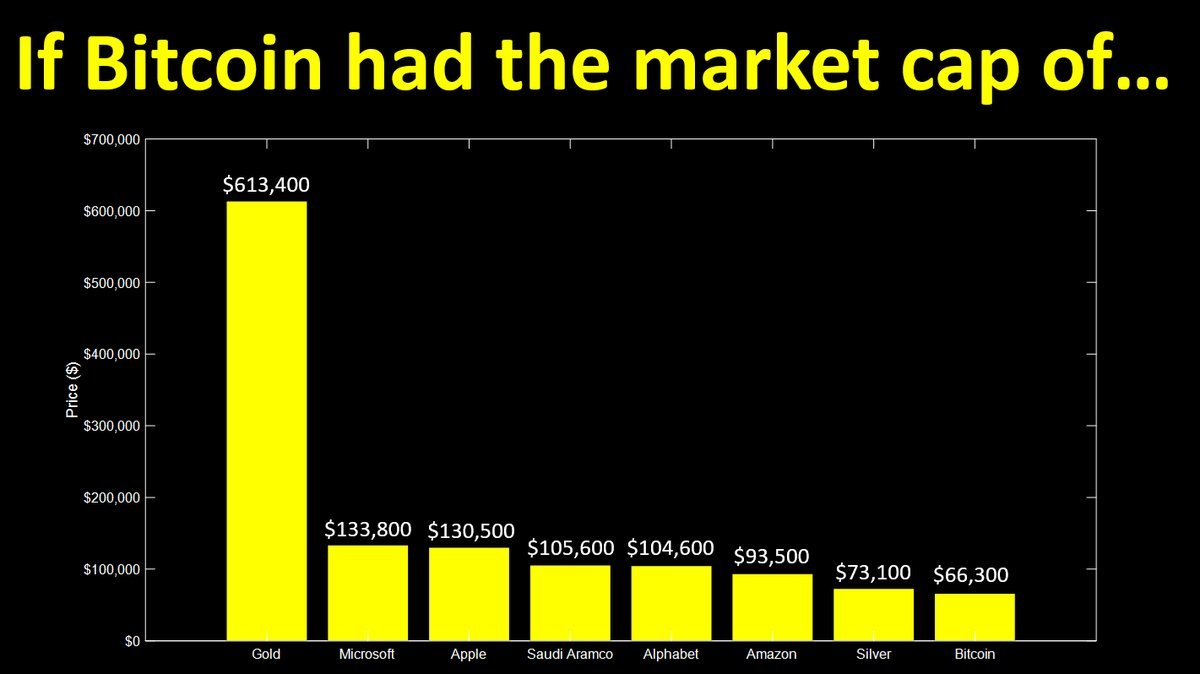

#Bitcoin market cap if it reaches these valuations

Are these genuinely happening despite Covid vaccines 💉 🤷♂️🤷♀️🤷

CC: @invest_answers

#Bitcoin is inevitable 🤷♂️🤷🤷♀️

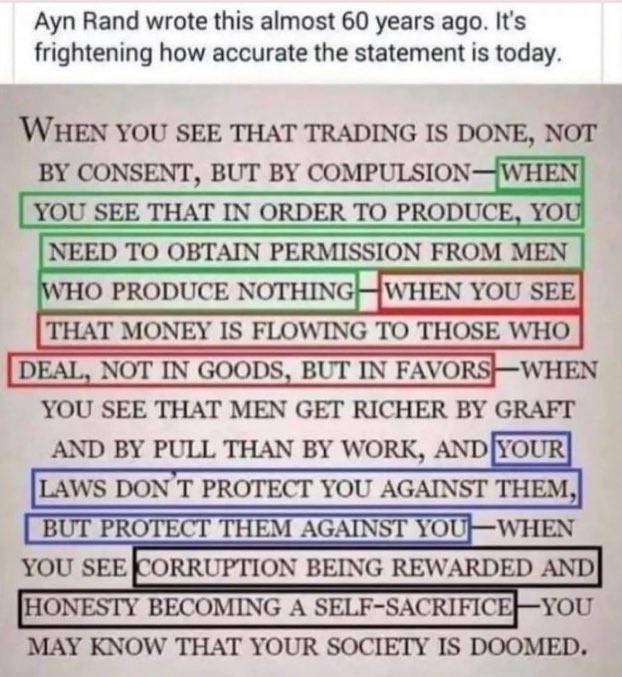

CC: @BNicholsLiberty

#Bitcoin is an oasis in a fiat desert

#Bitcoin fixes this

#Bitcoin to the moon 🚀🚀

#Bitcoin checkmates Fiat money

#Bitcoin checkmates Inflation

#Bitcoin checkmates corruption

#Bitcoin checkmates governments

#Bitcoin checkmates central banks

#Bitcoin checkmates negative yield

#Bitcoin checkmates Inflation

#Bitcoin checkmates corruption

#Bitcoin checkmates governments

#Bitcoin checkmates central banks

#Bitcoin checkmates negative yield

Suits vs. Shadowy Super Coders

(Suits won, better luck next time hoodies)

Ken Griffin (CEO of Citadel) won the Constitution

@ConstitutionDAO

(Suits won, better luck next time hoodies)

Ken Griffin (CEO of Citadel) won the Constitution

@ConstitutionDAO

Politicians on #Bitcoin

CC: @csuwildcat

#Bitcoin vs. Shitcoin

Hey @POTUS you’re doing great 🤷♂️

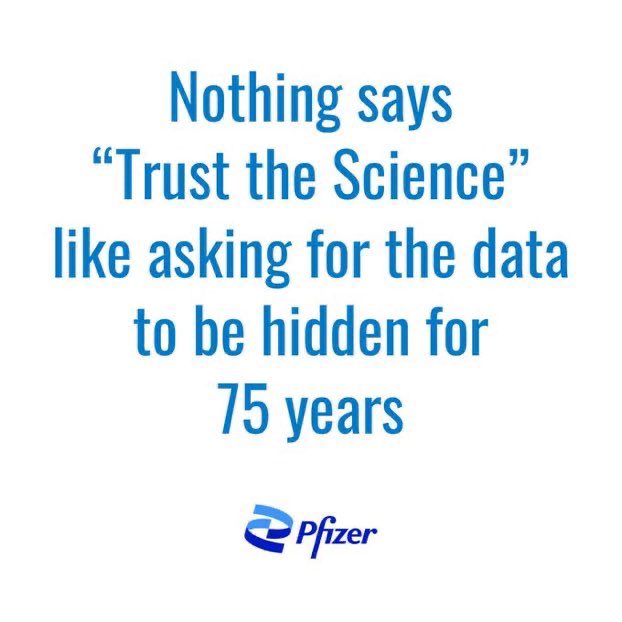

#VaccinationMyth

Just because you got vaccinated doesn't mean you don't get COVID, it's impact is minimized possibly.

Just because you got vaccinated doesn't mean you don't spread COVID, you still act as a COVID carrier.

Just because you got vaccinated doesn't mean you don't get COVID, it's impact is minimized possibly.

Just because you got vaccinated doesn't mean you don't spread COVID, you still act as a COVID carrier.

Metaverse:-

How it started… How it’s going…

If kids started out like this then I’m sorry to say humanity isn’t going to make it, we’re all doomed 🤷♂️

How it started… How it’s going…

If kids started out like this then I’m sorry to say humanity isn’t going to make it, we’re all doomed 🤷♂️

cc: @CHAIRFORCE_BTC

Happy Thanksgiving @elonmusk

Don’t spend your #Bitcoin on drugs

Faster the FED prints debt based money, the faster USD sinks and loses its world reserve currency status.

#Bitcoin holders know this and they chose to opt out of this sinking ship.

#Bitcoin holders know this and they chose to opt out of this sinking ship.

#Bitcoin this👇

#Bitcoin dips

100% Truth, when governments start threatening you with lockdowns, travel restrictions & unemployment — most people have no choice but to comply

All these CEOs stepped down ever since Jeffrey Epstein trial started. Is this a pure coincidence or something deeper is brewing behind the scenes.

Governments banning #Bitcoin

Complying with forced government mandates is prison. Forced vaccine mandates is prison. Slowly they’re getting y’all used to being in prison with your compliance

Student loans are business

Private prisons are business

Vaccine mandates are business

Y’all are inmates 🤷♂️

Student loans are business

Private prisons are business

Vaccine mandates are business

Y’all are inmates 🤷♂️

cc: @SenLummis

Just because some college dropout started a multi trillion dollar software business, doesn’t mean he’s a physician, virologist, scientist or a doctor. Stop taking dumb advices from wealthy phonies 🤷♂️🤷♀️🤷

Jerome Powell explaining the Inflation is Transitory narrative as well as why FED is the root cause of all wealth divide in the world

If you want to save your wealth or build wealth over time you can with #Bitcoin or else you can follow Jim

Day trading #Bitcoin and crypto is equivalent to a whale feeding frenzy. Crypto whales will chew you up.

If first booster didn’t work

If second booster didn’t work

If third booster didn’t work

If fourth booster didn’t work

…

If seventh booster didn’t work

If eighth booster didn’t work

What makes you think the ninth booster will work 🤷♂️🤷♀️🤷

If second booster didn’t work

If third booster didn’t work

If fourth booster didn’t work

…

If seventh booster didn’t work

If eighth booster didn’t work

What makes you think the ninth booster will work 🤷♂️🤷♀️🤷

I know it’s hard to live in prisons, but libertarians & #Bitcoin holders think this way for sure 🤷♂️🤷♀️🤷

If USA 🇺🇸 military consumes a million barrels of oil everyday, it’s almost comical they try controlling other countries green house emissions. Their actions contradict their words on #Bitcoin energy usage as well.

• • •

Missing some Tweet in this thread? You can try to

force a refresh