This is an ongoing thread about the global energy crisis. As the crisis unfolds, we will update here.

Today, a Financial Times @FT article reports on China's electricity crisis further disrupting the global supply chain h/t @JKempEnergy ft.com/content/5174e5…

And Switzerland warns "big" firms they may need to cut their electricity usage @chigrl bloomberg.com/news/articles/…

And a member of the @JoeBiden administration and former @McKinsey consultant @PeteButtigieg says supply chain disruptions will continue "because the president has successfully guided the economy"

https://twitter.com/ElectionWiz/status/1449726699172765699?t=juYCOygLQMDrQKFTBPJbfw&s=19

And @Forbes addressed the impact of global supply chain gridlock, including energy markets forbes.com/sites/davidbla…

Potential unseasonably cold weather coming in eastern Asia could exacerbate the energy crisis situation there. H/t @pineconemacro

https://twitter.com/ScottDuncanWX/status/1449802017254395906?t=eHGTNKBZAaY_a_BQIdGFpg&s=19

Chinese companies are now bidding for long term US natural gas supplies, offering a 115% premium to the main benchmark Henry Hub price

https://twitter.com/vanckzhu/status/1449751004883324928?t=P5XaZ-RAiyYEXD67rotNgQ&s=19

And Indian coal inventories are at very low levels cnbc.com/2021/10/12/coa…

Low copper inventories in China could require energy intensive re-stocking and further strain tight energy markets

https://twitter.com/BurggrabenH/status/1449867374086217735?t=5sL-UFuTGRNGRfEgNEjOQg&s=19

Policy makers including @ecb's @Lagarde and @MikeBloomberg misidentifying the reason to keep coal mines open while ignoring the ongoing energy crisis: energy reliability and availability, particularly for the poorest in the world.

https://twitter.com/RudyHavenstein/status/1404644129187930113?t=qendn7qgkA4RqsIFEbeJ8w&s=19

Chinese thermal coal limit up h/t @pineconemacro

https://twitter.com/Sino_Market/status/1449930022177828864?t=AqJYUUmJLSnIfWMJuaEgcw&s=19

Japan urging oil producers to produce more reuters.com/article/japan-…

LNG prices hit fresh highs as Europe imports additional shipments. $34 implies over $200/barrel of oil equivalent

https://twitter.com/ClydeCommods/status/1449962777062166531?t=4-k1_0e-QJQp1l1uFSMrhA&s=19

European natural gas prices up 18% after Russia announced it will be limiting it's natural gas supply next month

https://twitter.com/BloombergNRG/status/1450051400143081473?t=GR0gMKupl-j0iceoU4LCPw&s=19

Early freeze exacerbates the energy crisis in China

https://twitter.com/chigrl/status/1450026615635943441?t=vms29Dy6kBTLJfnaf-pyXA&s=19

Behind the Energy Crisis: Fossil Fuel Investment Drops, and Renewables Aren’t Ready.

The transition to cleaner energy sources isn’t far enough along to meet a surge in demand. WSJ

wsj.com/articles/energ…

The transition to cleaner energy sources isn’t far enough along to meet a surge in demand. WSJ

wsj.com/articles/energ…

Energy crisis returning the world to coal

https://twitter.com/zerohedge/status/1450023926424342530?t=pO0NJBv2cLWSQ0Fq6r8eGA&s=19

"Revenge of the old economy" - Goldman

https://twitter.com/TheStalwart/status/1450056573687001089?t=l473wtgYCFW0jkAWxY8tMw&s=19

And now our coverage of the global energy crisis overlaps with our OPEC+ spare capacity thesis

https://twitter.com/Amena__Bakr/status/1450088058779484162?t=XUHOmEFhwvSnyai4nU5vjA&s=19

"Extremely tough" climate talks forthcoming. More fuel for the energy crisis?

https://twitter.com/annmarie/status/1450237696740319239?t=IzrOoB68B3FOV_prf3iz0g&s=19

Chinese coal prices rise even more. High power prices are hurting China's economy.

reuters.com/business/energ…

reuters.com/business/energ…

China pauses fertilizer exports

https://twitter.com/JavierBlas/status/1450417268731617281?t=zRO9MFMlBmEY7pM6STxa0A&s=19

Now LNG tanker rates are spiking

https://twitter.com/chigrl/status/1450425772540370944?t=_BnVRlw1ZUtYnB30bJYx7w&s=19

IHS: Propane Armageddon coming this winter #propane @IHSMarkit

https://twitter.com/zerohedge/status/1450478630367285258?t=Y7FHY2vNYPygkdEfIGohWA&s=19

Petrobas seeing "atypical" demand for oil products that exceeds their production capacity h/t @chigrl

https://twitter.com/GoldTelegraph_/status/1450468495481872385?t=n0XZwtYxn2Yo_jV0bGdD_A&s=19

Russia openly makes incremental gas supply contingent on approval of Nordstream 2

https://twitter.com/business/status/1450427500312551428?t=qBFBoj1LNR-E_yLJ3hiczQ&s=19

China evaluating intervening in their coal market

https://twitter.com/SStapczynski/status/1450460225086107654?t=1Y2pPBYkO_aLn4hPYsL7Nw&s=19

China furthering connection between energy crisis and potential future food shortage bloomberg.com/news/articles/…

World oil inventories plunging

https://twitter.com/antoine_halff/status/1450567174226067457?t=F-jpSGOuAVNGt-qvGjVv9w&s=19

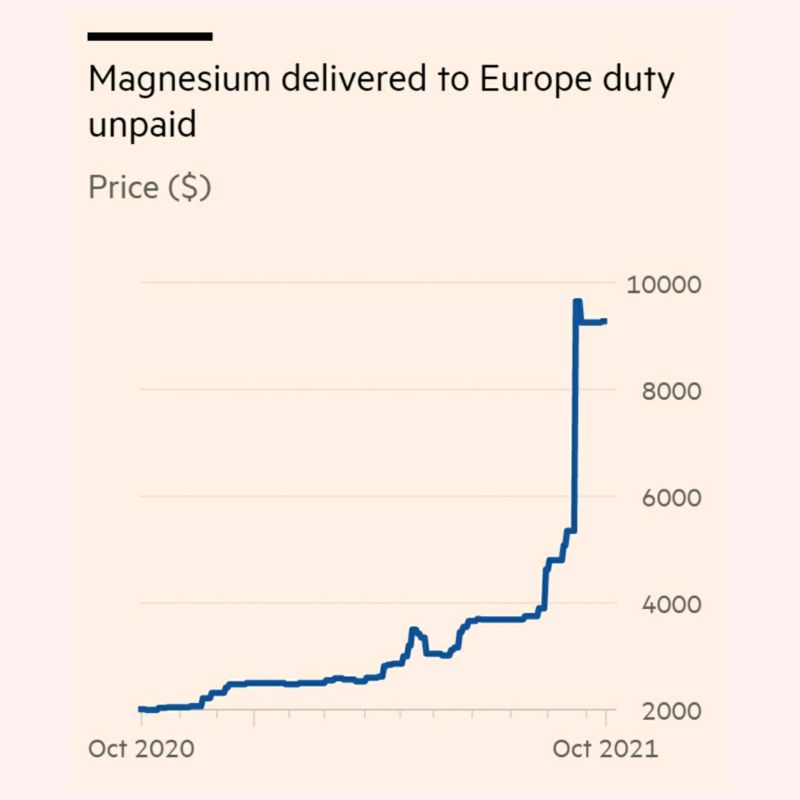

Magnesium price spikes as #china's power crisis reduces exports of this key component of #aluminum and #car manufacturing

UK may ration energy to homes

https://twitter.com/chigrl/status/1450794801952174092?t=7h3MqF6BuFBz7hCeCfP5KQ&s=19

China to double #lng imports from the US

https://twitter.com/Sino_Market/status/1450746794065858571?t=Nfm08gcMoFwUiACuHC3VKA&s=19

India asking for 50 LNG shipments retroactively

https://twitter.com/SStapczynski/status/1450806160697737225?t=re8CKR54bKjOE5k34jCPuA&s=19

Supermarkets running out of food with hoarding activity taking place, as global energy crisis spills into other segments like food

https://twitter.com/zerohedge/status/1450829244028887040?t=gsXHPy9scH6opJMSZvuY1A&s=19

Coal prices near historical highs despite China market intervention

https://twitter.com/dyer440/status/1450660250416201728?t=n6UncZ0q2trlquYF0Wf1Og&s=19

India seeking fixed price contracts for oil amidst the global energy crisis

https://twitter.com/staunovo/status/1450872151935004678?t=rGikUyoqcOUogw2nFSINCw&s=19

Power squeeze in China continues even as spot coal prices fall

https://twitter.com/pretentiouswhat/status/1451119044023635972?t=sxFAKh_jJNStHjqL9R4FtA&s=19

Ironic for an energy crisis to be propelled partially by a legacy of corruption

https://twitter.com/eyemightbewrong/status/1451175607983874053?t=BseC6eGpnEsZYVYp1l0vrA&s=19

Does "stay calm" about energy the signal mean to ...? Indication the energy crisis in Germany is intensifying.

https://twitter.com/Sino_Market/status/1451154704688418816?t=zs5JJNUW4OTXsNWJFZC07g&s=19

Thoughts on alternative energy, food vs fuel, and energy crisis

https://twitter.com/ShellenbergerMD/status/1451155441334079494?t=sCXiPFWbIvUyc2l82XpOxQ&s=19

Energy crisis and supply chain issues affecting energy transition in China. From Goldman Sachs

https://twitter.com/chigrl/status/1451262894113529857?t=L0WOmPxAd5XG627-VKo9BQ&s=19

The energy crisis is continuing in Germany, with record high one year forward electricity prices

https://twitter.com/Schuldensuehner/status/1451089928809558020?t=9Y1pVuYoSoFAP1QK-8qnyw&s=19

Hedgeye on China energy crisis and coal @Hedgeye @KeithMcCullough #china #coal

https://twitter.com/KeithMcCullough/status/1451252407309152257?t=_Su_KUcI9K7Gpm-5i3HrMg&s=19

Jordan Peterson weighing in on the energy crisis @jordanbpeterson

https://twitter.com/jordanbpeterson/status/1451296614992257033?t=ZnY6K80MWVc0Jn5WyRdU7g&s=19

France is subsidizing higher energy costs with a direct stimulus. Coming soon worldwide? Is this the next step towards hyper-inflation? #inflation #energy #crisis #france #projectzimbabwe @hkuppy

https://twitter.com/JavierBlas/status/1451303471567757312?t=uxnkqIlecvffMhjTkO_rlg&s=19

The above link isn't working for some. The source is: lemonde.fr/politique/arti… and an image of the headline is included as well

China navigating the energy crisis

https://twitter.com/SStapczynski/status/1451367918307057664?t=DWWW-j1vzth_zGJZp4NO4w&s=19

Nigirian rural gas users are switching back to cooking with firewood due to price increases

https://twitter.com/chigrl/status/1451480180543852549?t=tvPyM2cBmLs0m8SsoKL6dQ&s=19

Funny things happening in the Chinese coal market

https://twitter.com/Sino_Market/status/1451532211006677022?t=asctK6FsE5dEiPNseMvA3Q&s=19

Japan is prepared for winter with high levels of natural gas in storage. No energy crisis here, yet.

https://twitter.com/staunovo/status/1451417674404220961?t=s7UpXiECTz9vXHjdcW2H0A&s=19

Magnesium "going berserk" amid "energy crunch"

https://twitter.com/JavierBlas/status/1451551357735944208?t=S6IWfJLqGClSesfobycEFg&s=19

"Double inflationary" Chinese energy "crunch"

https://twitter.com/JavierBlas/status/1451556876999606288?t=CiIOH24hDD64dP7K0No97A&s=19

Energy crisis leading to food crisis as fertilizer prices skyrocket

https://twitter.com/BloombergNRG/status/1451412267111682048?t=PimBg5V_z-R_LrNX6iS8_Q&s=19

More commodity inflation commentary

https://twitter.com/JavierBlas/status/1451575901746081798?t=TEyxUxfwOFRpNI4kKBW1yw&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh