JPOW, JUST PRINT MORE MONEY!!

“Money printer go brrrrr” sounds amazing!

But as the printer continues to RAGE, what does this mean for interest rates?

For your stock portfolio?

Time for a thread 👇

“Money printer go brrrrr” sounds amazing!

But as the printer continues to RAGE, what does this mean for interest rates?

For your stock portfolio?

Time for a thread 👇

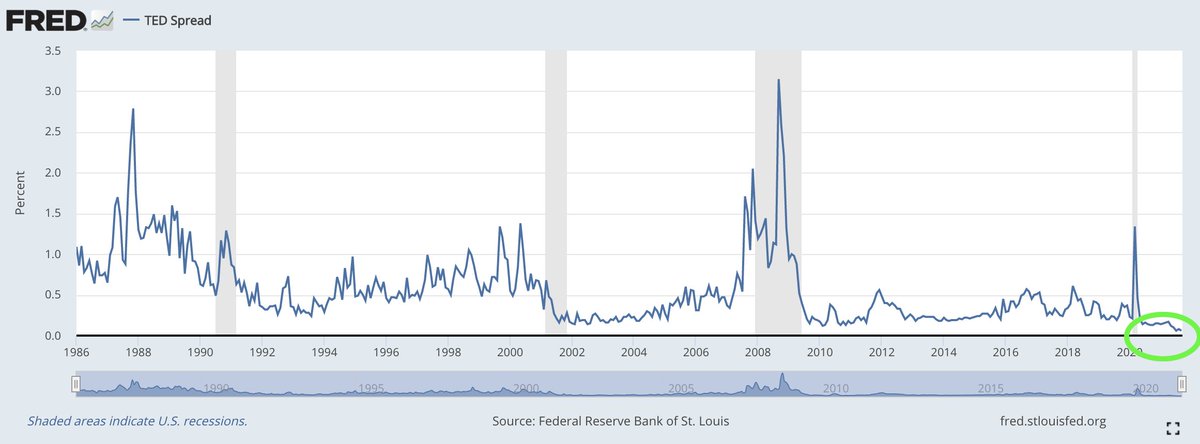

1. While watching CNBC, FOX or any stock market commentary, you may notice discussion of interest rates and its effects.

But what does it mean?

Simply put, an interest rate is the cost of using someone else’s money.

But what does it mean?

Simply put, an interest rate is the cost of using someone else’s money.

2. But what most market pundits refer to is the rate set by the federal open market committee.

➡️ This is the rate that banks borrow money and lend money at!

This economic activity has effects on both the stock and bond markets.

➡️ This is the rate that banks borrow money and lend money at!

This economic activity has effects on both the stock and bond markets.

3. Why does the FED change interest rates?

➡️ To control economic activity & inflation

Meaning that in order to decrease the money supply, the FED will increase rates.

➡️ To control economic activity & inflation

Meaning that in order to decrease the money supply, the FED will increase rates.

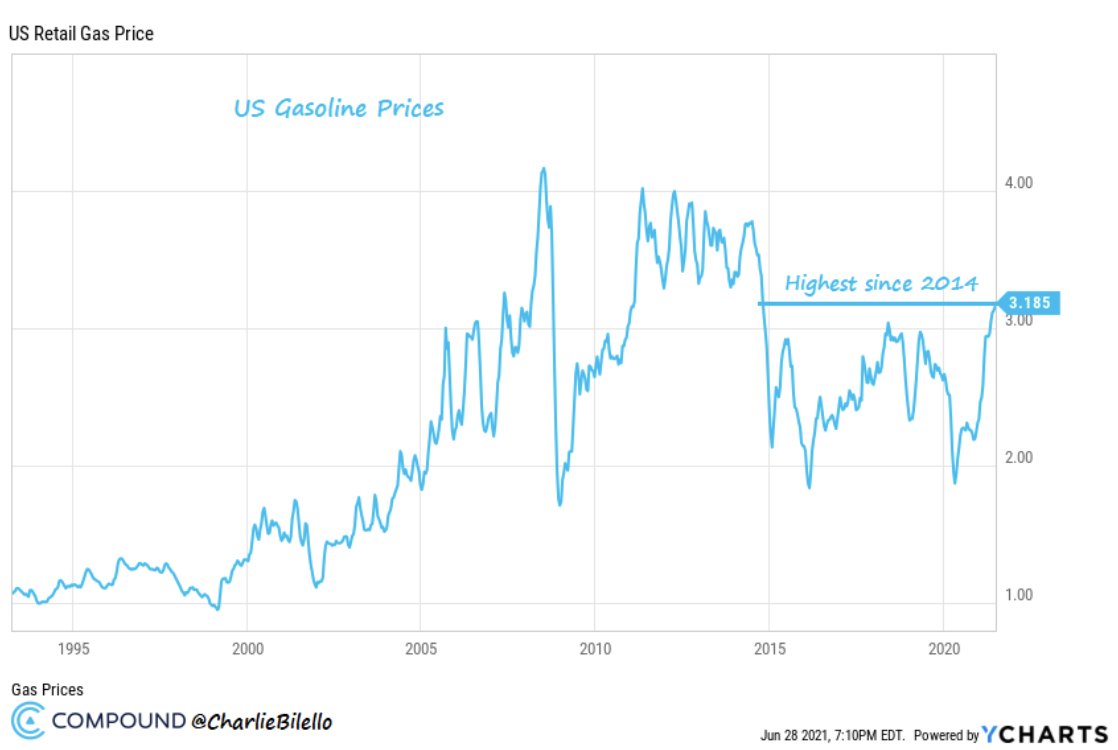

4. As we’ve seen over the past year with the pandemic, the FED has continued to print ungodly amounts of money.

📊 40% of the total money supply has been printed during this time!

📊 40% of the total money supply has been printed during this time!

5. At some point, the FED will need to raise rates in order to decrease the so-called “transitory inflation.” This means:

📉 To decrease the money supply… 📈 the Fed will increase rates

📉 To decrease the money supply… 📈 the Fed will increase rates

6. So, how does this affect our markets?

➡️ Typically with a rate hike, you see the stock market take a hit can negatively affect earnings and stock valuations.

➡️ Investors are forced to think more prudently about the higher risk assets.

investopedia.com/investing/how-…

➡️ Typically with a rate hike, you see the stock market take a hit can negatively affect earnings and stock valuations.

➡️ Investors are forced to think more prudently about the higher risk assets.

investopedia.com/investing/how-…

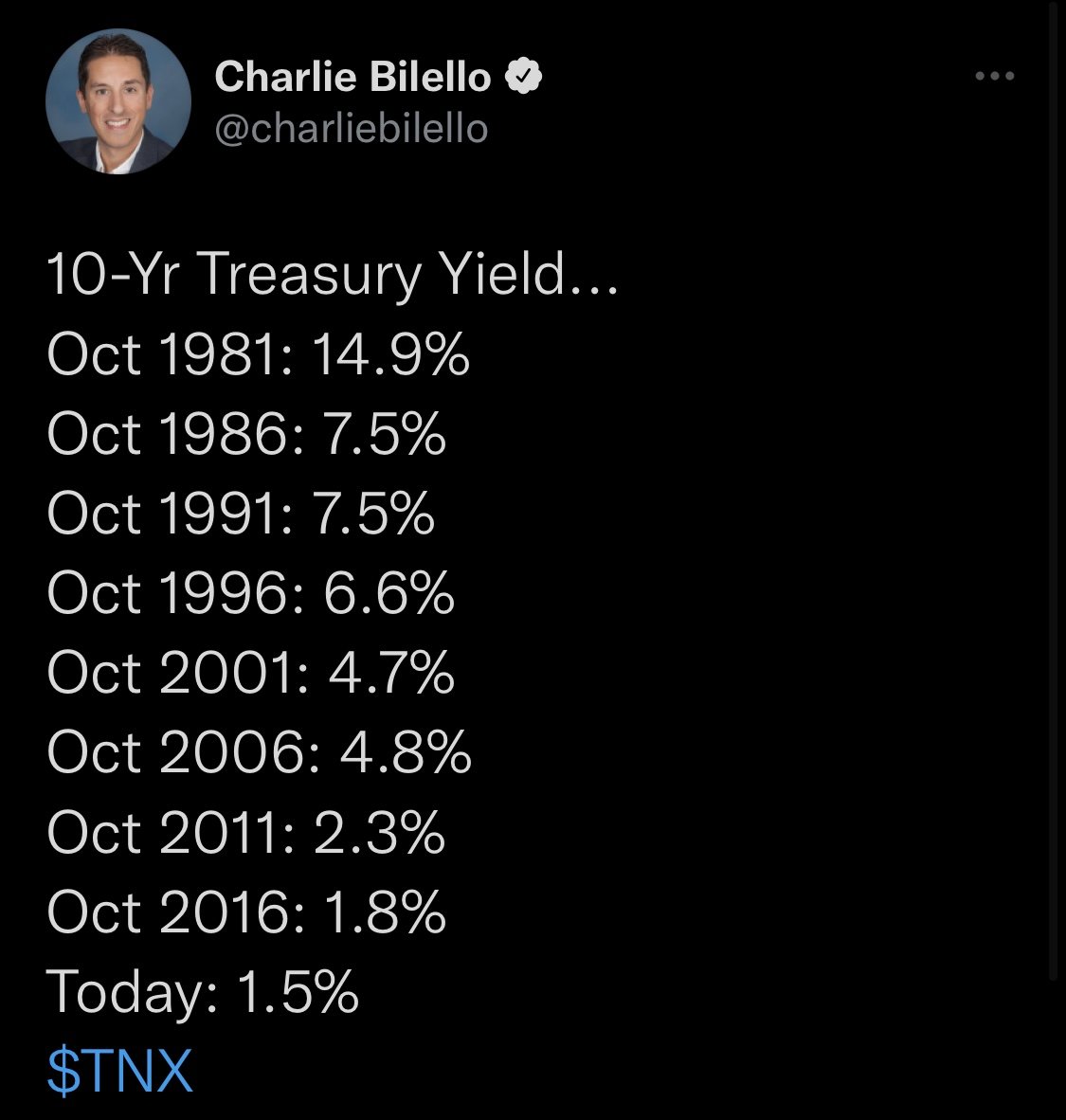

7. Over the last 10 years, we’ve enjoyed incredibly low rates & this has been a key driver for the blazing stock markets.

Capital has been incredibly cheap to allocate!

Companies can borrow cheaply, grow their earnings, pay dividends and buy back their shares!

Capital has been incredibly cheap to allocate!

Companies can borrow cheaply, grow their earnings, pay dividends and buy back their shares!

8. On the other hand, bonds have struggled over the past 10 years due to these low rates. Why?

➡️ Bonds have an inverse relationship with rates. Falling interest interest rates make bond prices rise BUT bond yields fall.

➡️ Bonds have an inverse relationship with rates. Falling interest interest rates make bond prices rise BUT bond yields fall.

10. So what are investors doing now?

➡️ Many investors are playing the waiting game (this is why the stock market is see-sawing) to see how high and how fast rates will rise.

reuters.com/business/finan…

➡️ Many investors are playing the waiting game (this is why the stock market is see-sawing) to see how high and how fast rates will rise.

reuters.com/business/finan…

11. So, when will the FED finally raise rates?

JPow & @alifarhat79 seem to always have a trick up their sleeves...

JPow & @alifarhat79 seem to always have a trick up their sleeves...

12. GRIT TAKE:

Keep a close eye on the 10 year yield. It’s the benchmark that guides other interest rates.

It’s NOW close to a 6 month high.

Will this cause the Fed to hike rates before 2022?

Keep a close eye on the 10 year yield. It’s the benchmark that guides other interest rates.

It’s NOW close to a 6 month high.

Will this cause the Fed to hike rates before 2022?

13. GRIT TAKE CONT:

In a rising rate environment these types of stocks tend to do well (ones I own):

➡️ Financials ($JPM, $MS)

➡️ Consumer Discretionary & Services ($AMZN, $DIS)

➡️ Growth Stocks ($SQ, $NOW)

In a rising rate environment these types of stocks tend to do well (ones I own):

➡️ Financials ($JPM, $MS)

➡️ Consumer Discretionary & Services ($AMZN, $DIS)

➡️ Growth Stocks ($SQ, $NOW)

14. Want to read more great business & financial insights?

📫 Check out our newsletter.

It's the #1 FREE FINANCE newsletter on Substack!

gritcapital.substack.com

📫 Check out our newsletter.

It's the #1 FREE FINANCE newsletter on Substack!

gritcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh