So billion prices project is now Pricestats and they have an index with state street if anyone wants to pull that. the creator is an economist and has some interesting stuff.

from a paper in Sep, here are changes in online prices across countries through May.

from a paper in Sep, here are changes in online prices across countries through May.

here is a reweighting of the CPI by a more relevant covid consumption basket, also broken down by low and high incomes

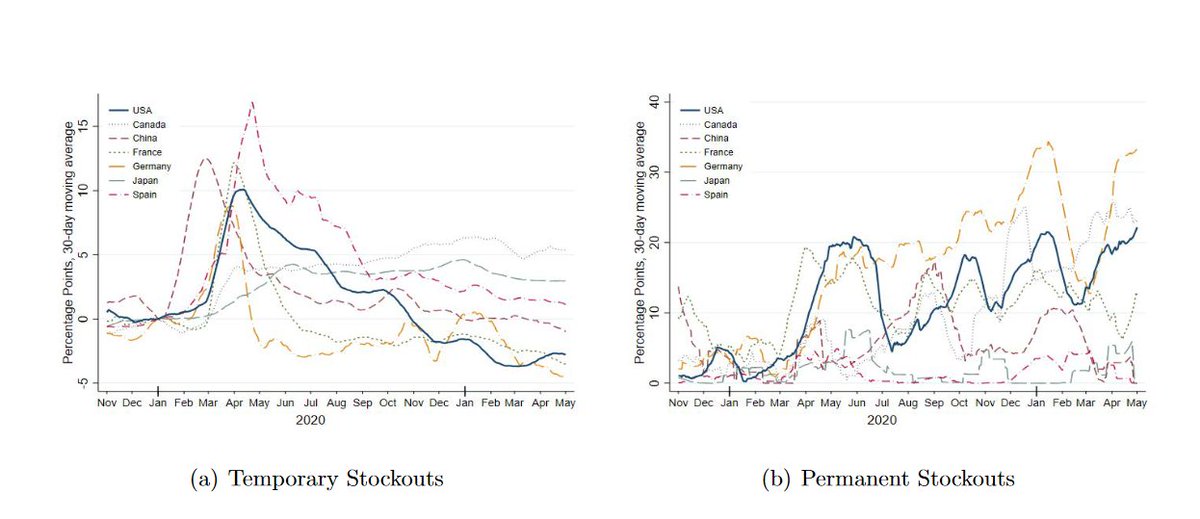

And his not surprising finding on stockouts is they are a meaningful driver of price inflation, but also have transitory impact

one more on online prices, the m/m change in US vs 10 year average. Can see the major deviation early this year that will be flowing through the y/y until next spring

also on twitter @albertocavallo and his website of interesting work is here hbs.edu/faculty/Pages/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh