Here's my latest Tesla forecast. Several of you, after reading one of my 69-tweet threads, requested a "420" thread, so here it is:

🍀 The first tweet has 4 green charts

2⃣0⃣ tweets in total

The last 4 of 20 tweets contain previously unreleased detail on 2022-2023.

$TSLA

/1

🍀 The first tweet has 4 green charts

2⃣0⃣ tweets in total

The last 4 of 20 tweets contain previously unreleased detail on 2022-2023.

$TSLA

/1

This chart shows Tesla's actual revenue by quarter.

Please note that Q4 2021 has not happened yet. 👀

/2

Please note that Q4 2021 has not happened yet. 👀

/2

Here are the deliveries I'm forecasting for Tesla by site, by model, by quarter.

Rather than assuming GF4 will never build Model 3, I have just pushed it out 2 more years, which means I actually have an unannounced European model starting production before Model 3 now.

/3

Rather than assuming GF4 will never build Model 3, I have just pushed it out 2 more years, which means I actually have an unannounced European model starting production before Model 3 now.

/3

While the previous chart showed all models (including a couple of unannounced ones I expect), this S3XY chart shows only the 4 models Tesla makes today, including vehicles that will be produced in Texas and Germany.

/4

/4

This chart shows just Tesla's top 2 selling models.

For the next few years:

Model 3 will be made only in Fremont & Shanghai

Model Y will be made in Fremont, Shanghai, Texas, & Germany

...allowing it to become 🤞 the world's #1 selling vehicle (by revenue, then by units).

/5

For the next few years:

Model 3 will be made only in Fremont & Shanghai

Model Y will be made in Fremont, Shanghai, Texas, & Germany

...allowing it to become 🤞 the world's #1 selling vehicle (by revenue, then by units).

/5

This chart shows the expense related to Elon's 2018 CEO Performance Award (stock compensation plan), by quarter.

$1.974B of the $2.283B possible expense has already hit as all of the market cap work is done, so expect relatively low quarterly expense from now on.

/6

$1.974B of the $2.283B possible expense has already hit as all of the market cap work is done, so expect relatively low quarterly expense from now on.

/6

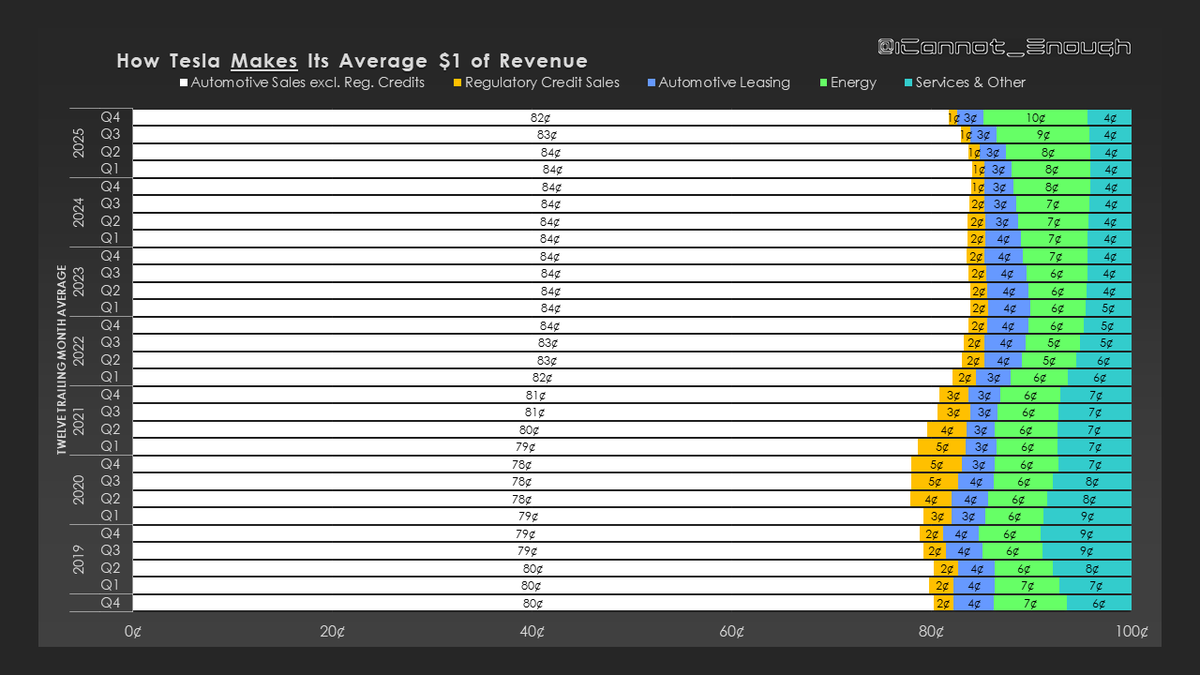

This chart shows the breakdown of Tesla's revenue by source, on an average dollar basis.

I expect regulatory credits (in orange) to become a smaller and smaller contributor on a percentage basis as time goes by.

Automotive revenue includes FSD sales, which I expect to grow.

/7

I expect regulatory credits (in orange) to become a smaller and smaller contributor on a percentage basis as time goes by.

Automotive revenue includes FSD sales, which I expect to grow.

/7

Similarly, this chart shows how Tesla spends its average dollar of revenue.

"Everything Else Excl. Stock Comp" includes taxes, which is why it decreases in Q4 2021 when I think Tesla will take a 1-time benefit from prior years' losses and then pay more taxes as profits grow.

/8

"Everything Else Excl. Stock Comp" includes taxes, which is why it decreases in Q4 2021 when I think Tesla will take a 1-time benefit from prior years' losses and then pay more taxes as profits grow.

/8

Here's a chart showing what I forecast for Non-GAAP Earnings per Delivery.

The $8,653 profit/delivery Tesla made in Q3 alone is actually much higher than the TTM average.

I boxed the quarters impacted favorably by that 1-time tax benefit from prior years' losses.

/9

The $8,653 profit/delivery Tesla made in Q3 alone is actually much higher than the TTM average.

I boxed the quarters impacted favorably by that 1-time tax benefit from prior years' losses.

/9

"But what about regulatory credits?"

The 🐻🐻🐻 have mostly given up on this popular 2020 criticism, probably for the reason illustrated on this chart:

Even if you just subtract the regulatory credits revenue from earnings (not valid accounting), there's still a profit.

/10

The 🐻🐻🐻 have mostly given up on this popular 2020 criticism, probably for the reason illustrated on this chart:

Even if you just subtract the regulatory credits revenue from earnings (not valid accounting), there's still a profit.

/10

Here's my forecast for quarterly adjusted EBITDA.

This assumes (among other things) successful ramping of the new factories, Tesla will be able to supply them all with cells, a few unannounced models, enough progress on FSD to increase its price steadily, etc.

/11

This assumes (among other things) successful ramping of the new factories, Tesla will be able to supply them all with cells, a few unannounced models, enough progress on FSD to increase its price steadily, etc.

/11

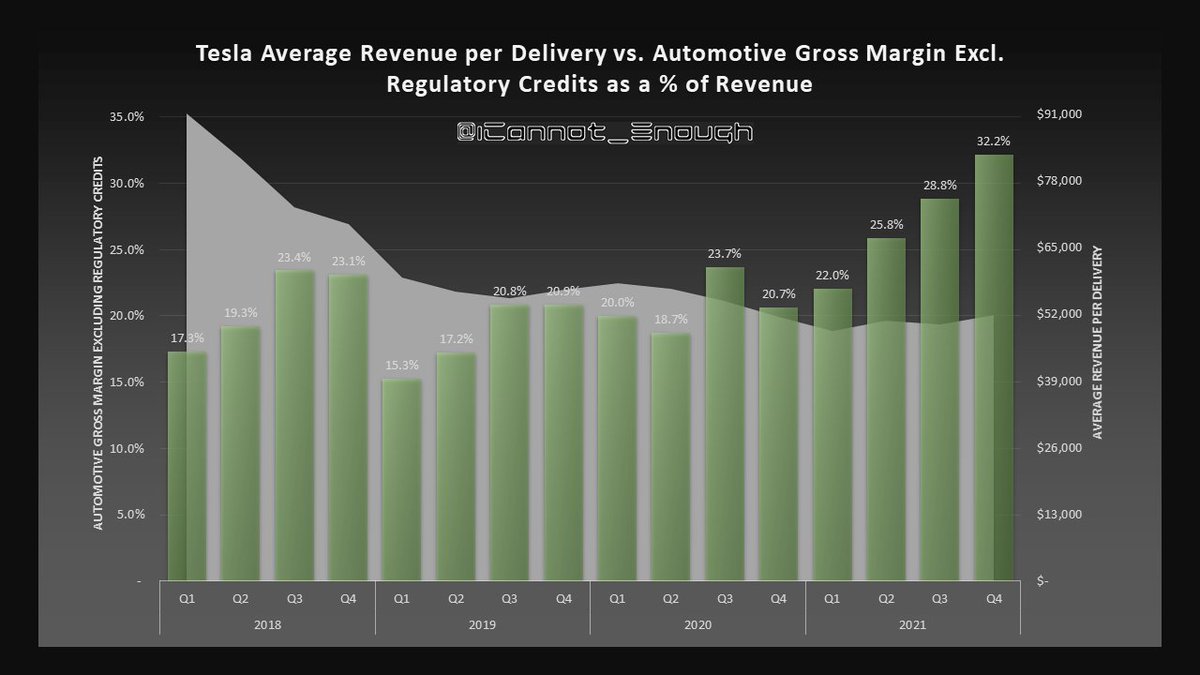

This chart shows a truly remarkable achievement on Tesla's part: improving gross margin percentages over the past 4 years even as revenue per delivery declined significantly.

/12

/12

Here's the slide I would typically show first. Everything but the last column are actuals now.

Any automaker would trade for the up-and-to-the-right trend Tesla has shown over the last 8 quarters, against severe headwinds.

/13

Any automaker would trade for the up-and-to-the-right trend Tesla has shown over the last 8 quarters, against severe headwinds.

/13

Here's the income statement I'm forecasting for Q4, alongside the last 4 years of actuals.

I realize that's not showing you very much of my forecast for coming years, so stay tuned...

/15

I realize that's not showing you very much of my forecast for coming years, so stay tuned...

/15

Here's some share count, COS %, Margin %, and delivery by site and model info.

I forecast 69 Model Y deliveries in Q4 from both Germany and Texas, and I expect those forecasts won't be off by more than about 69.

/16

I forecast 69 Model Y deliveries in Q4 from both Germany and Texas, and I expect those forecasts won't be off by more than about 69.

/16

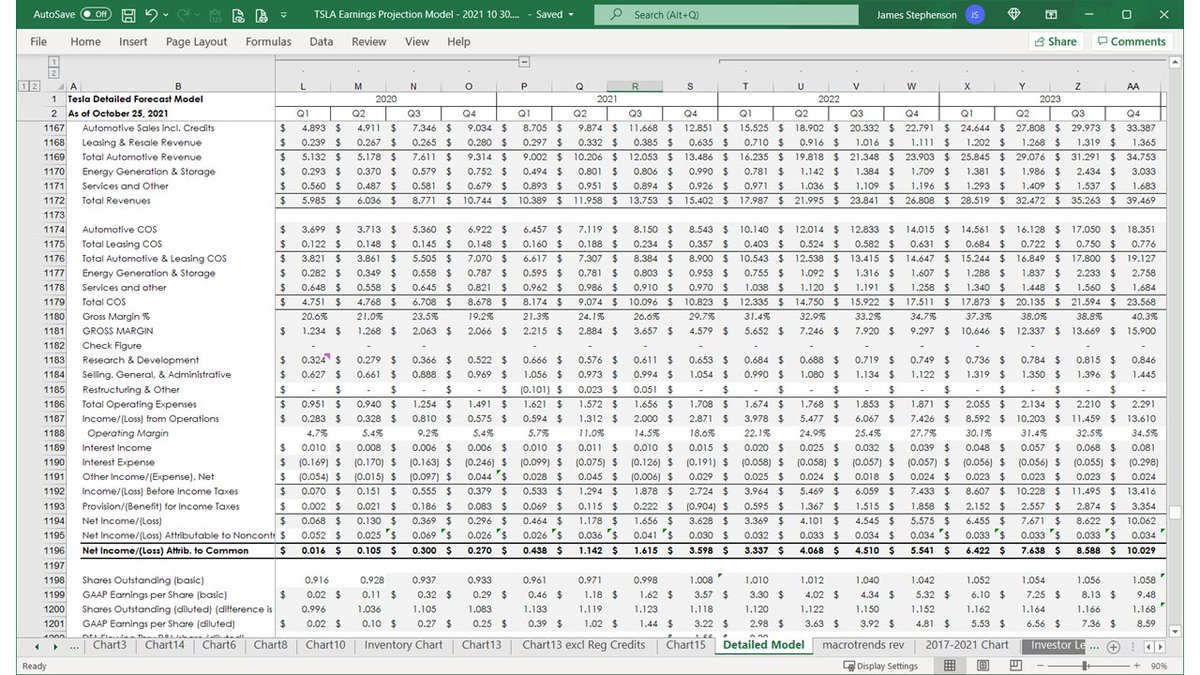

OK, here's the Income Statement I'm forecasting, including 2022-2023, by quarter, for the first time.

The growing order backlog bodes well for Tesla's ability to take additional pricing and introduce new models, as cell supply may permit.

/17

The growing order backlog bodes well for Tesla's ability to take additional pricing and introduce new models, as cell supply may permit.

/17

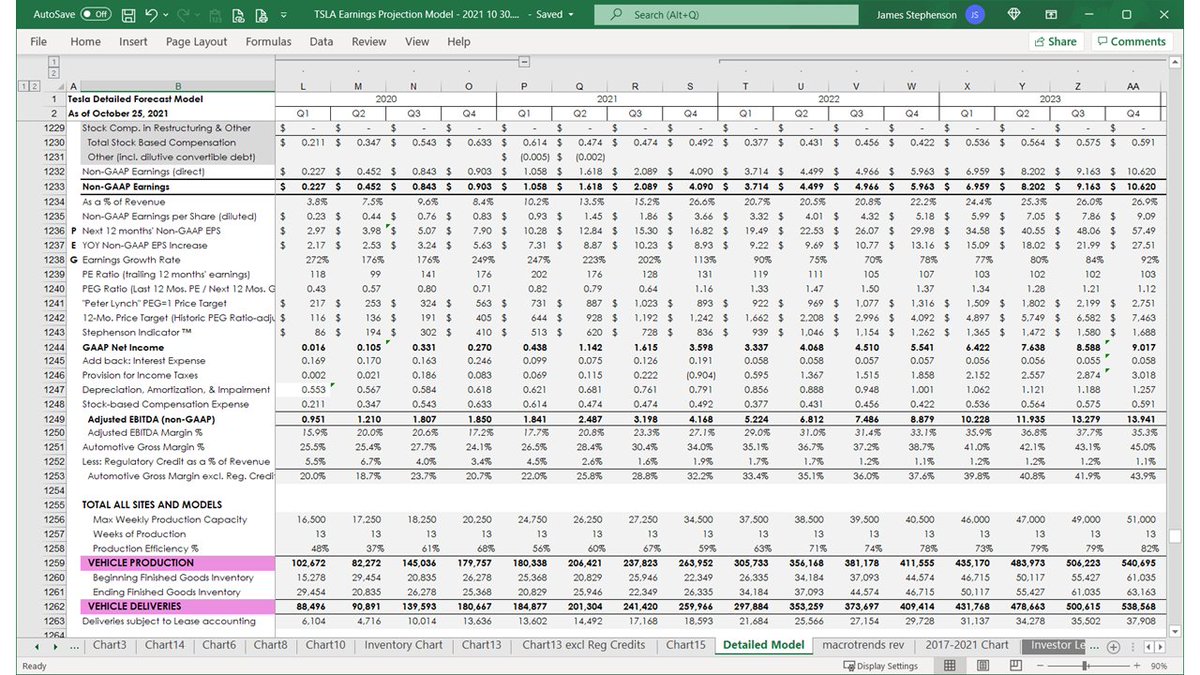

Here's a bunch of metrics I use to forecast the CEO Compensation plan expense, a breakdown of stock compensation by type, non-GAAP earnings and EPS, and other metrics that may be of interest.

/18

/18

This page shows metrics relating to P/E, PEG, a reconciliation of GAAP net income to Adjusted EBITDA (Non-GAAP), regulatory credits as a % of automotive revenue, automotive gross margin excluding regulatory credits, and total production, inventory, and deliveries.

/19

/19

And, finally, here are the deliveries I'm projecting by site and model, by quarter, through 2023.

You made it to the end of the 4 20 thread! 🥂🥳🎉🍾Enjoy your weekend.

/20

You made it to the end of the 4 20 thread! 🥂🥳🎉🍾Enjoy your weekend.

/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh