1. 🧵from Women's Budget Group re Autumn Budget 2021

#COP26

#COP26Glasgow

#Pensions

#HappyHalloween2021

👇👇👇

wbg.org.uk/analysis/autum…

#COP26

#COP26Glasgow

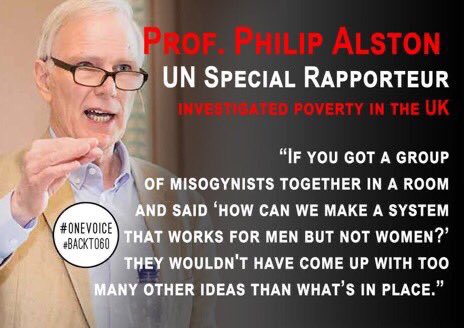

#Pensions

#HappyHalloween2021

👇👇👇

wbg.org.uk/analysis/autum…

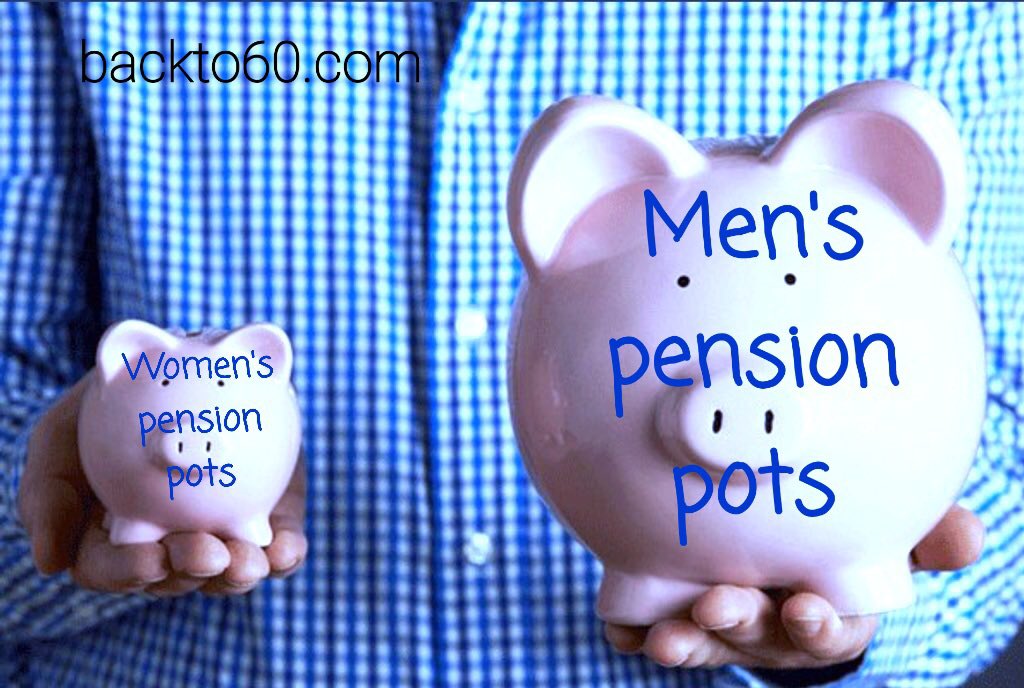

2. Public expenditure on State Pensions in the UK is among the lowest in the OECD; this reflects the fact that the main state pension for current pensioners is nearly £40 per week less than the government’s own poverty threshold (the means-tested minimum guarantee Pension Credit)

3. The new Single Tier Pension is just above the single rate of Pension Credit but due to transitional rules, it will be decades before women generally receive as much state pension as men.

#COP26

#StatePension

#50sWomen

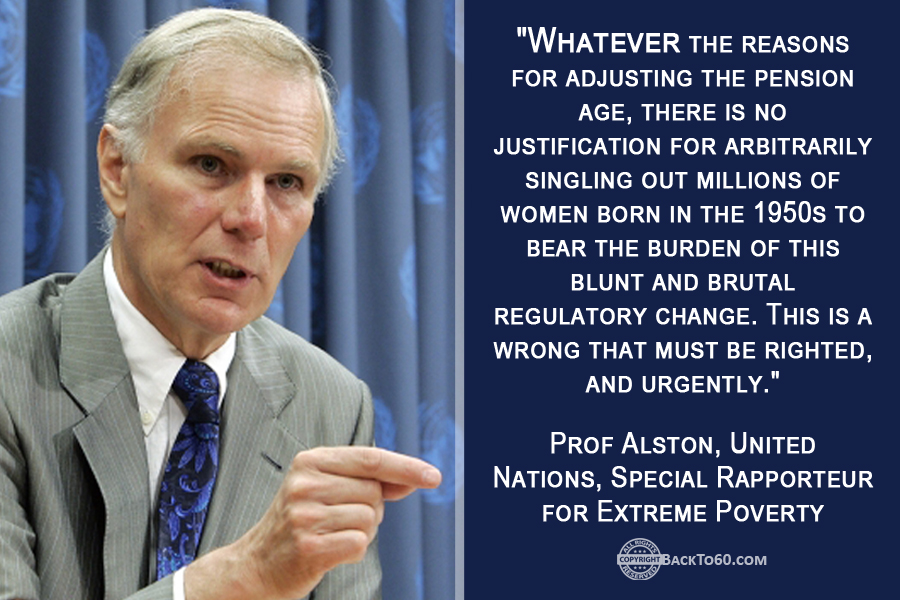

#COP26

#StatePension

#50sWomen

4. Private pension schemes, promoted and subsidised by UK governments, are the main reason for the gender gap in pensions, placing women at a disadvantage due to their domestic roles and lower pay.

#COP26

#COP26Glasgow

#Pensions

#inequality

#COP26

#COP26Glasgow

#Pensions

#inequality

5. Among 65–74 yr olds, median private pension wealth is £182,400 for men & £25,000 for women (meaning these women have just 1/7 of the private pension wealth of men)

Among the population as a whole women’s median pension wealth is £6,000, barely 1/4 of the £22,600 held by men

Among the population as a whole women’s median pension wealth is £6,000, barely 1/4 of the £22,600 held by men

6. Auto-enrolled private pensions, while including all employers, exclude low-paid employees and like other private pensions, make no allowance for periods of caring, hence perpetuating the gender gap in pensions.

#GenderPayGap

#GenderPensionGap

#COP26

#COP26Glasgow

#Pensions

#GenderPayGap

#GenderPensionGap

#COP26

#COP26Glasgow

#Pensions

7. Modelling has shown that a Family Carer Top-up in auto-enrolled pension schemes would substantially boost women’s private pension wealth.

#CEDAWinLAW

#COP26

#COP26Glasgow

#CEDAWinLAW

#COP26

#COP26Glasgow

8. We conclude that a Voluntary Earnings related State Pension Addition (VESPA) – an auto-enrolled option that is fully portable and allows carer credits – would be simpler and would better meet women’s need for extra pension saving.

#COP26

#COP26Glasgow

#CEDAWinLAW

#COP26

#COP26Glasgow

#CEDAWinLAW

9. Both state and private pensions were designed by men to fit a ‘masculine’ life course

#misogyny

#Pensions

#StatePension

#CEDAWinLAW

#Equality

#misogyny

#Pensions

#StatePension

#CEDAWinLAW

#Equality

10. For those who retired before April 2016, the full amount of the Basic State Pension (BSP) remains nearly £40 per week below the level of means-tested (single rate) Pension Credit.

#StatePension

#Inequality

#Injustice

#COP26

#G20

#50sWomen

#StatePension

#Inequality

#Injustice

#COP26

#G20

#50sWomen

11. Older retired women, in particular, are less likely than men to receive the full amount because of legacy rules that treated married women as dependent on their husbands

#StatePension

#50sWomen

#Injustice

#COP26

#COP26Glasow

#StatePension

#50sWomen

#Injustice

#COP26

#COP26Glasow

12. Women’s domestic roles are crucial to their pension disadvantage

Women’s lesser chance of being in employment, especially full time, has been their key handicap in accumulating private pensions and is strongly associated with marriage and motherhood

#StatePension

#COP26

Women’s lesser chance of being in employment, especially full time, has been their key handicap in accumulating private pensions and is strongly associated with marriage and motherhood

#StatePension

#COP26

13. The gender differential in private pension wealth is substantial among those aged over age 65 (see Tables 1 and 2). Among 65–74 year olds median private pension wealth is £182,400 for men and £25,000 for women (just 1/7 of the private pension wealth of men)

#Pensions

#COP26

#Pensions

#COP26

14. Among those with private pension wealth:

Median pension: Men £79,200; Women £47,200

Women % of Men = 60%

Among 65–74 year olds: Men £261,000; Women £131,000

Women % M = 50.2%

#Inequality

#COP26

Median pension: Men £79,200; Women £47,200

Women % of Men = 60%

Among 65–74 year olds: Men £261,000; Women £131,000

Women % M = 50.2%

#Inequality

#COP26

15. Among women aged 55-59, total personal income is 2/3 the income of men in the same age bracket

Women had little more than 1/4 (26.5%) of the median pension wealth of men with women having £6,000 and men £22,600

#GenderPayGap

#GenderPensionGap

#Pensions

#COP26

Women had little more than 1/4 (26.5%) of the median pension wealth of men with women having £6,000 and men £22,600

#GenderPayGap

#GenderPensionGap

#Pensions

#COP26

16. The Basic State Pension (BSP) fell relative to average earnings, from around 25% in

1979 to 16% by 2001, due to inadequate annual uprating, while the State Earnings Related Pension was substantially cut

#COP26

#StatePension

wbg.org.uk/analysis/autum…

1979 to 16% by 2001, due to inadequate annual uprating, while the State Earnings Related Pension was substantially cut

#COP26

#StatePension

wbg.org.uk/analysis/autum…

17. This was particularly damaging for women

already in retirement since they typically derive a higher proportion of their income than men from the State Pension and other state benefits – as remains the case today (61% for women and 51% for men)

#COP26

wbg.org.uk/analysis/autum…

already in retirement since they typically derive a higher proportion of their income than men from the State Pension and other state benefits – as remains the case today (61% for women and 51% for men)

#COP26

wbg.org.uk/analysis/autum…

18. The gains for women were offset by the Coalition government’s acceleration of the raising of the State Pension Age (SPA), reaching 66 in October 2020 – nearly six years earlier than originally planned – and set to reach 67 by 2028

#StatePension

#COP26

#StatePension

#COP26

19. The rise in SPA was particularly rapid for women born in the 1950s, leaving them insufficient time to adjust their retirement plans. The government accepted the recommendation of the Cridland Review to bring forward the rise in SPA to 68 to 2037-9 instead of 2044-6

#Pensions

#Pensions

20. This will bear hardest on the poorest women, those who have to leave employment before SPA due to caring commitments or disability

#StatePension

#Inequality

#COP26Glasgow

#COP26

#StatePension

#Inequality

#COP26Glasgow

#COP26

21. PLEASE CONTINUE TO READ THIS REVEALING REPORT HERE: 👉👉wbg.org.uk/wp-content/upl…

#StatePension

#inequality

#COP26Glasgow

#COP26

wbg.org.uk/analysis/autum…

#StatePension

#inequality

#COP26Glasgow

#COP26

wbg.org.uk/analysis/autum…

22. 💥ALSO:

🙏PLEASE follow Lord Prem Sikka @premnsikka and David Hencke @davidhencke for LATEST news re #StatePension #TripleLock #50sWomen

PLEASE retweet to "Tell Everyone" - Thank you👍

#COP26Glasgow

#COP26

🙏PLEASE follow Lord Prem Sikka @premnsikka and David Hencke @davidhencke for LATEST news re #StatePension #TripleLock #50sWomen

PLEASE retweet to "Tell Everyone" - Thank you👍

#COP26Glasgow

#COP26

• • •

Missing some Tweet in this thread? You can try to

force a refresh