Central Clearing helps not hurts Banks.

It’s gonna help get back > 20%

ROTCEs…blunting GSIB Score requirements, giving path to further Buybacks within context of getting off the ZIRP Floor (NII 👆) while Inflation Rises. $XLF #Reflation

It all starts w tons of XS Capital.

It’s gonna help get back > 20%

ROTCEs…blunting GSIB Score requirements, giving path to further Buybacks within context of getting off the ZIRP Floor (NII 👆) while Inflation Rises. $XLF #Reflation

It all starts w tons of XS Capital.

Banks love $TLT Central Clearing & moving Volume from Triparty to Sponsored FICC that Nets.

$XLF #Reflation

$XLF #Reflation

In simple DuPont terms:

ROTCE = Net Income/Revenues x Revenues/Tangible Assets x Tangible Assets/Tangible Equity

Net Margin x Asset Turnover x Financial Leverage Force Multiplier

Last turn is a Turbo Charger (Now think Central Clearing of $TLT )

$XLF #Reflation

ROTCE = Net Income/Revenues x Revenues/Tangible Assets x Tangible Assets/Tangible Equity

Net Margin x Asset Turnover x Financial Leverage Force Multiplier

Last turn is a Turbo Charger (Now think Central Clearing of $TLT )

$XLF #Reflation

The next few years $XLF Buybacks are gonna be insane…

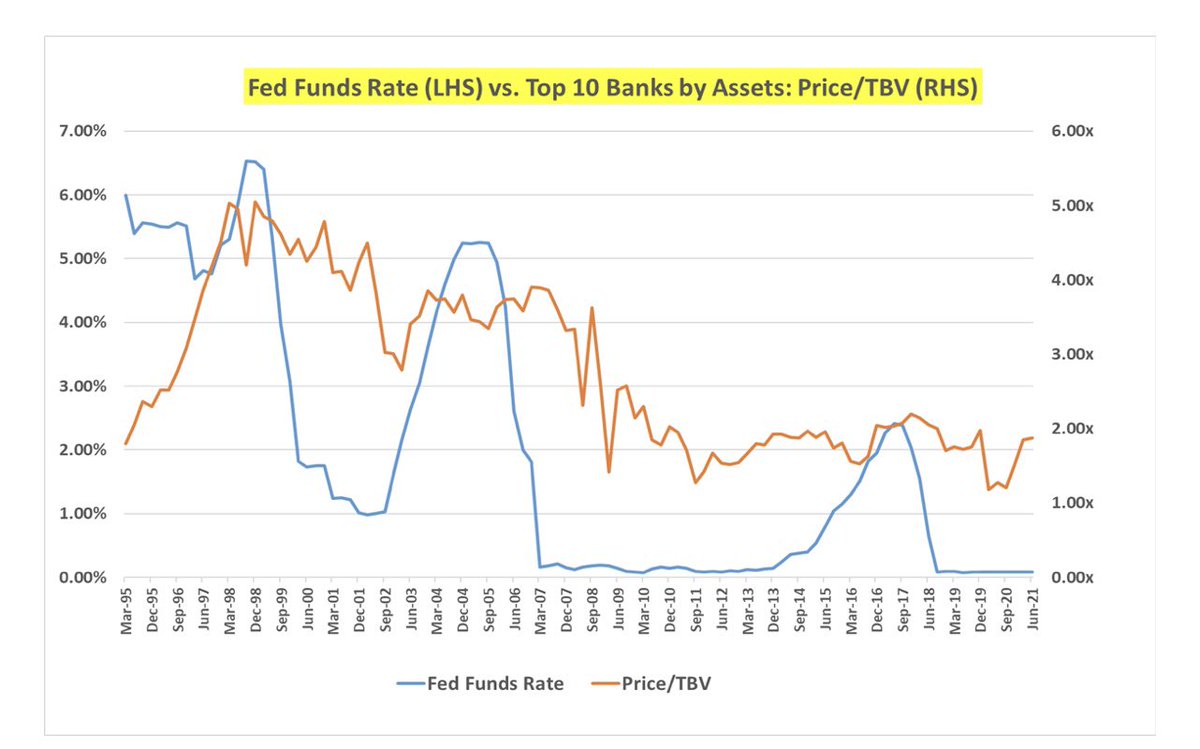

They tell me that $XLF at 1.8x Year 2/ Early Cycle TBV is Super Rich…..

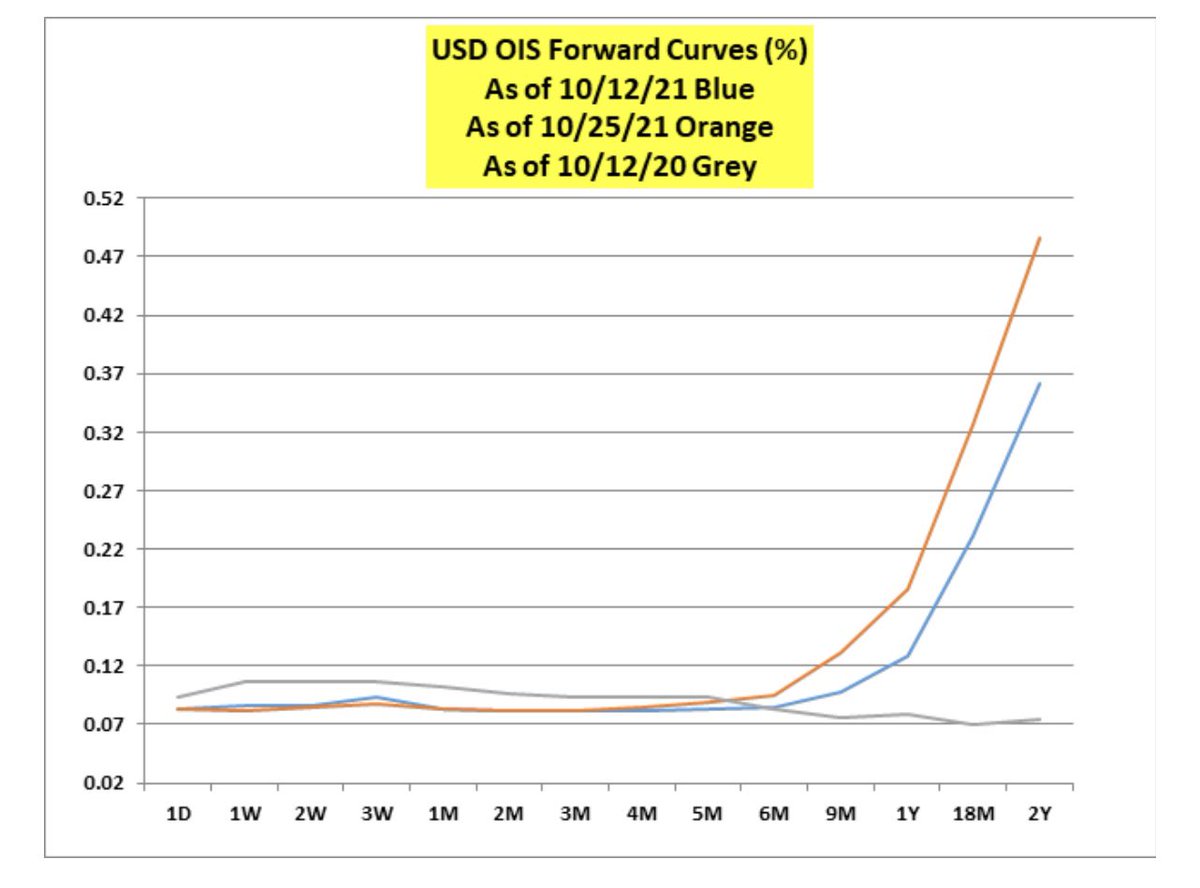

We are getting off ZIRP w Inflation….

Are we sure about that? 👇

$XLF #Reflation

We are getting off ZIRP w Inflation….

Are we sure about that? 👇

$XLF #Reflation

• • •

Missing some Tweet in this thread? You can try to

force a refresh