What’s your Convexity Profile?

What do you make if right & IORB Hikes won’t blast the economy coz of Private Sector De-Leveraging.. & what’s your downside at ZIRP if wrong?

$XLF #Reflation

What do you make if right & IORB Hikes won’t blast the economy coz of Private Sector De-Leveraging.. & what’s your downside at ZIRP if wrong?

$XLF #Reflation

https://twitter.com/gamesblazer06/status/1455592979905712129

Let’s say PermaBears are right & we have ZIRP forever… Banks have the highest Capital levels in 30+ Years… & can easily payout 100% of earnings at 13% CET1…

Worse case ATM payout machines w 10% All In Yields… Sure beats buying a Massive 10 Year Govt Bubble at 70x P/E imho.

Worse case ATM payout machines w 10% All In Yields… Sure beats buying a Massive 10 Year Govt Bubble at 70x P/E imho.

30% Divy… & 70% Buyback Ratios….in 5 Years…amount of Tangible Book Value Reduction… in a PermaBear ZIRP forever world…+ low credit costs…can easily get u to high Teen ROTCEs… & if we do get Inflation & Rate Hikes don’t Invert the Curve..ROTCEs are gonna Rip w TBVs👆 $XLF

& if we get Taper Vol… Buyback power is even greater as $XLF stocks trade down….Jacking up secular ROTCE Expansion. Sheet Efficiency can be even stronger imho w Central Clearing etc.

Any programatic buybacks reduce equity charges in any Residual Income model… & make the $XLF franchise value even stronger.. as PV of residual earnings is worth more… the concept of Residual Income is the bedrock that underpins the Price/Tangible Book Value Multiple concept.

Ultimate Worse Case… Bunker Boys are dead right…IORB hikes invert 10Y3M (probability < 9.5%)….Then u know ur downside at 15% Unemployment… which is Buybacks frozen Dividends retained & takes < 2 Quarters 2get to Peak 2-4% 2008 GFC Reserves.. Probability Wtd ur Outcomes.

$XLF

$XLF

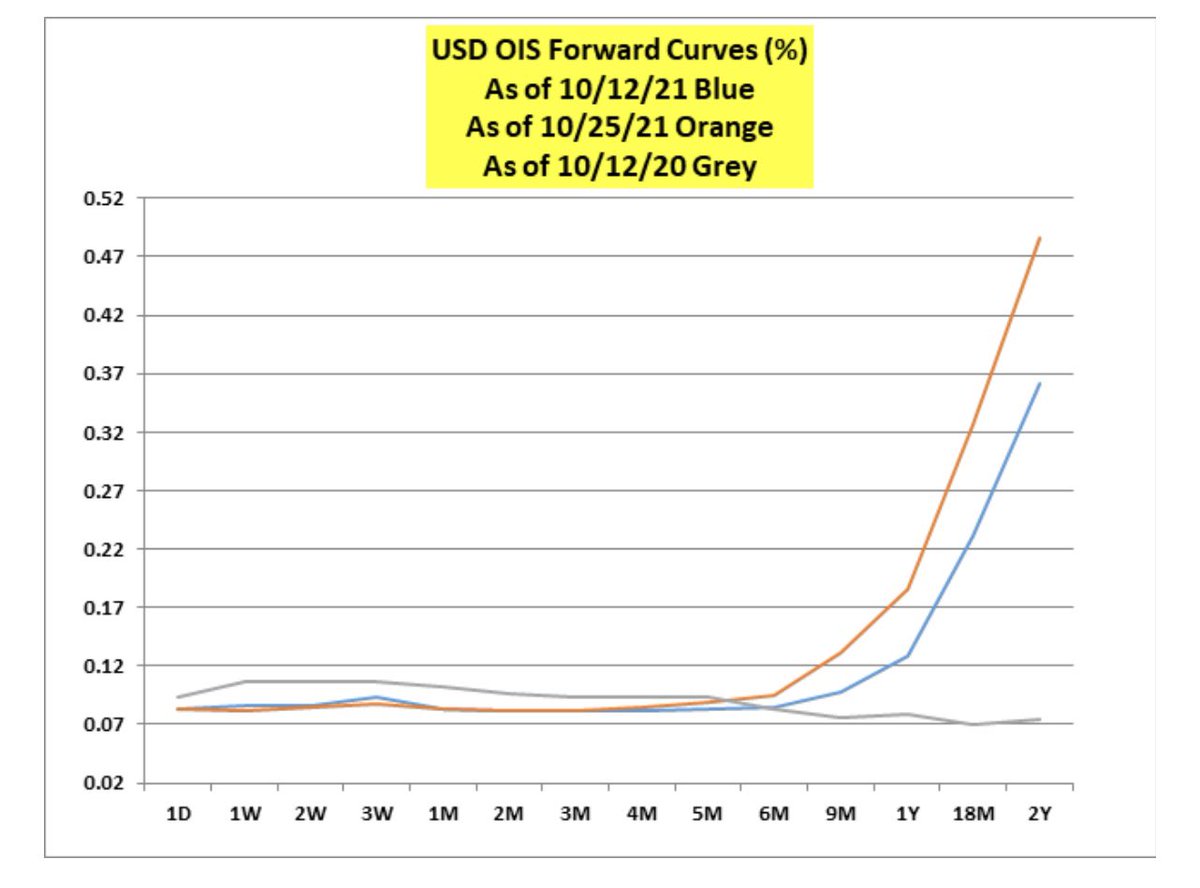

Or one can buy #Bitcoin proxy $SQ which trades at 260x EBITDA or get taken out in a stretcher by the Front End of the Curve these last few weeks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh