Long track record of covering India and @narendramodi eh ? Let's look at the past 4 Climate Transparency Reports since Paris 2016, to confirm your tracking capability:

2017: climate-transparency.org/wp-content/upl…

India and US blurbs:

1/

2017: climate-transparency.org/wp-content/upl…

India and US blurbs:

1/

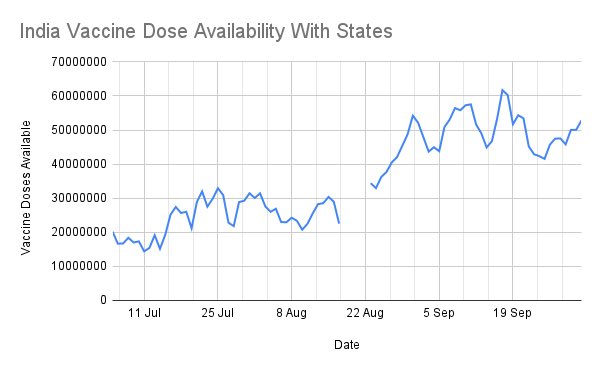

2020: climate-transparency.org/wp-content/upl…

Table of G20 members and their alignment with Paris NDCs:

4/

Table of G20 members and their alignment with Paris NDCs:

4/

Not looking good for your reporting skills. @business is American. The US lists as critically insufficient.

Business mags are read by businessmen. They depend on accurate data being presented. Failing that, the magazine has no value beyond tabloid journalism.

5/

Business mags are read by businessmen. They depend on accurate data being presented. Failing that, the magazine has no value beyond tabloid journalism.

5/

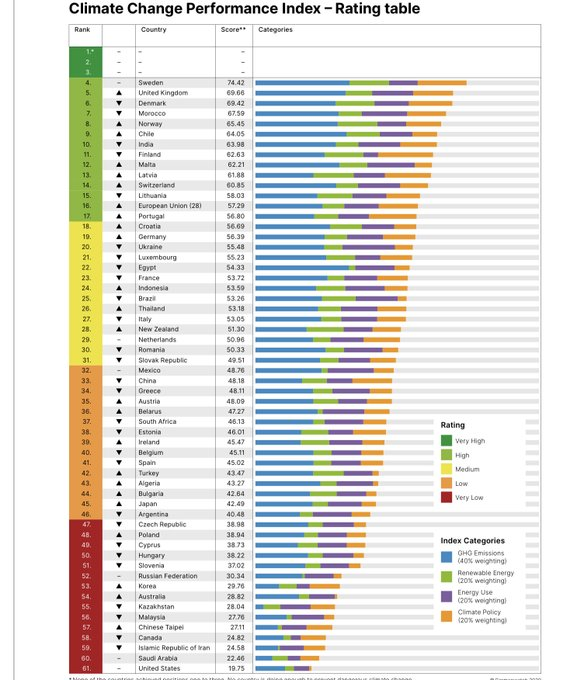

@business You're simply a reporter. You do not define the metrics here. Metrics are in the CTRs, or in CCPI 2021: germanwatch.org/en/19552

6/

6/

What you're doing is point to your prior article as evidence. All that proves is that you agree with yourself.

You're a reporter - report the data - CTR, CCPI. Links are right up here.

Writing alarmist puff pieces and then saying you agree with yourself is silly.

7/7

You're a reporter - report the data - CTR, CCPI. Links are right up here.

Writing alarmist puff pieces and then saying you agree with yourself is silly.

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh