GRIT has hired its first AMBASSADOR!

Welcome @perfiliev who left his Quantitative Analyst position at Goldman Sachs to join us!

...there was a bit of time in between but you get it ;)

How long until Wall Street realizes their talent is burning suits to join GRIT?

Time for 🧵

Welcome @perfiliev who left his Quantitative Analyst position at Goldman Sachs to join us!

...there was a bit of time in between but you get it ;)

How long until Wall Street realizes their talent is burning suits to join GRIT?

Time for 🧵

2/ In one corner: Goldman Sachs.

An old, stodgy investment bank with conflicts of interest, literal printers, and stuffy suits who still thinks the 60/40 is the perfect portfolio.

An old, stodgy investment bank with conflicts of interest, literal printers, and stuffy suits who still thinks the 60/40 is the perfect portfolio.

3/In the other corner: GRIT CAPITAL

A cutting-edge financial media company helping the masses make money in stocks with zero offices, no paper, no suits, the 80/20 portfolio, and *diamond hands*

Who would you choose?

A cutting-edge financial media company helping the masses make money in stocks with zero offices, no paper, no suits, the 80/20 portfolio, and *diamond hands*

Who would you choose?

4/ Sergei chose GRIT!

He comes to us most recently from Goldman Sachs where he was a quant analyst

He has 10+ years of experience in roles across Equity, FX and Commodity markets and is constantly putting out amazing content!

He comes to us most recently from Goldman Sachs where he was a quant analyst

He has 10+ years of experience in roles across Equity, FX and Commodity markets and is constantly putting out amazing content!

https://twitter.com/perfiliev/status/1395067525084364800

5/ Sergei will write a Tuesday newsletter for GRIT.

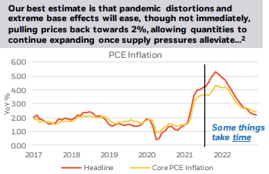

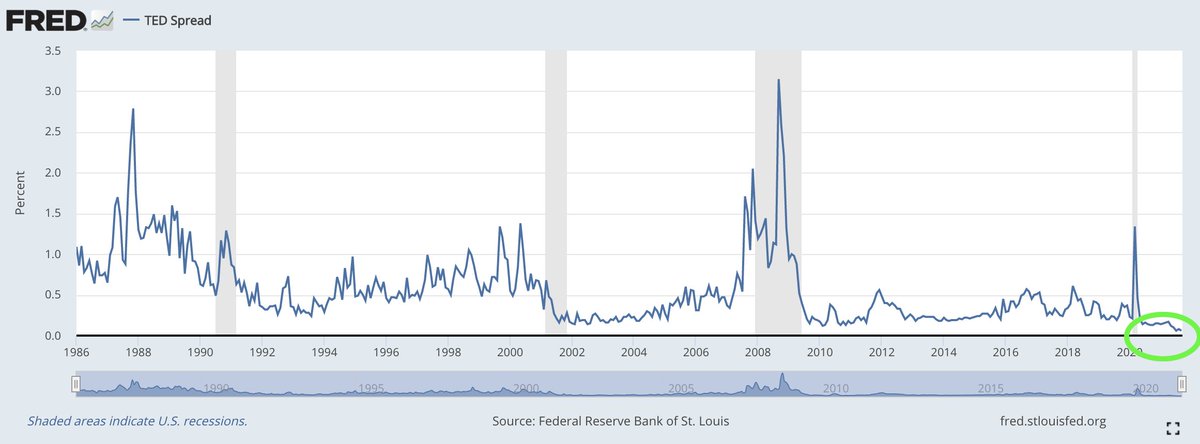

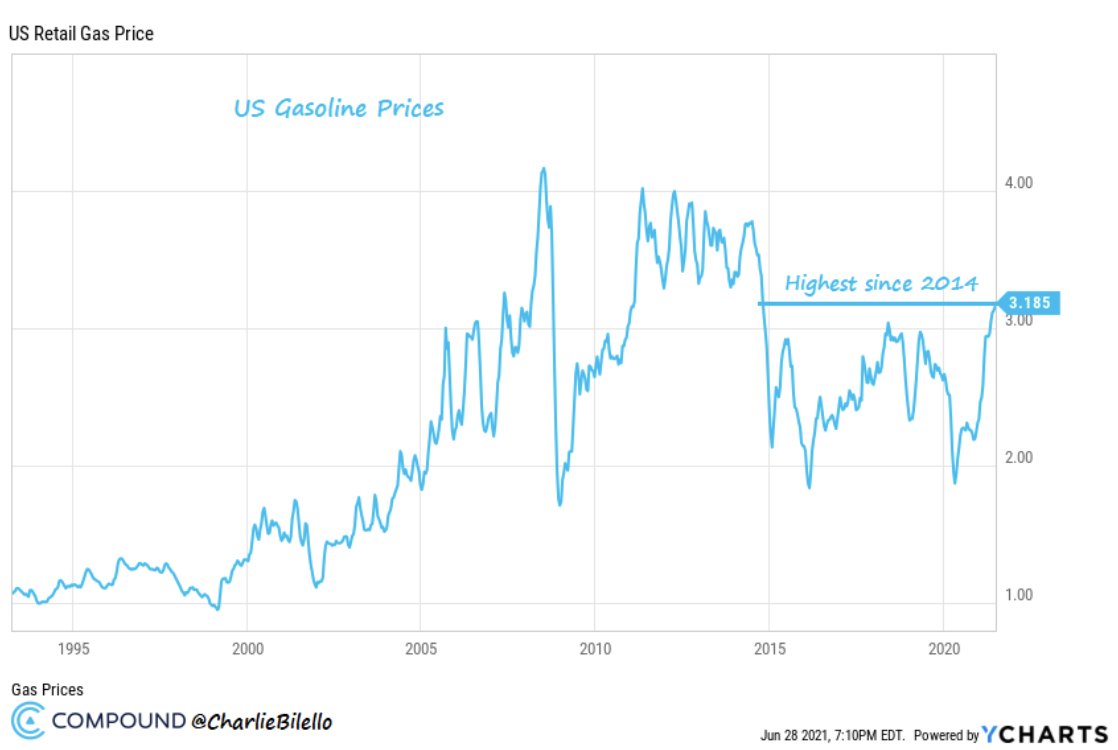

Using his expertise in quant and options he will reveal what Wall Street doesn't want us to know is brewing beneath the surface.

A fresh take that GRIT subscribers will LOVE!

Subscribe NOW 👇

[gritcapital.substack.com]

Using his expertise in quant and options he will reveal what Wall Street doesn't want us to know is brewing beneath the surface.

A fresh take that GRIT subscribers will LOVE!

Subscribe NOW 👇

[gritcapital.substack.com]

• • •

Missing some Tweet in this thread? You can try to

force a refresh