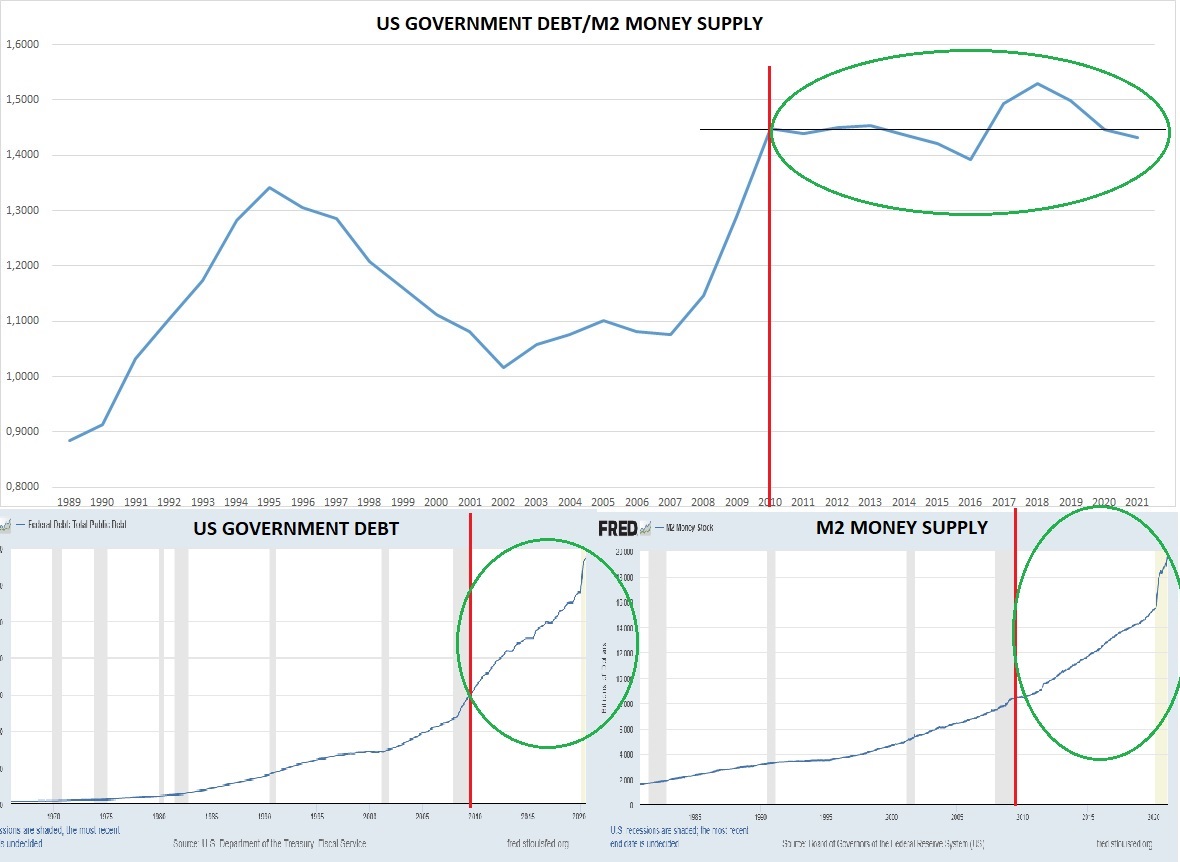

Estamos lejos aun de ver sesgos de hiper como en el 89 pero los graficos muestran aceleracion. Aca pongo una proyeccion para 2023 y dejo graf para q comparen 88/91 con 2017/2021 (ambos graficos analizan inicio devaluacion desde 17 Aus. vs 17$)

@UnrollHelper unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh