A Twitter story

Act I. I see this tweet👇 and DM old friend @ben_golub saying “yeah, that’s definitely not right, the seller would just invert Zillow’s signal, etc,, but I don’t want feel like a late night fight with a big account.” Ben’s like “I do.”

Act I. I see this tweet👇 and DM old friend @ben_golub saying “yeah, that’s definitely not right, the seller would just invert Zillow’s signal, etc,, but I don’t want feel like a late night fight with a big account.” Ben’s like “I do.”

https://twitter.com/quantian1/status/1456310111148859398

Act II. I go to sleep. Ben tweets.

https://twitter.com/ben_golub/status/1456456937667809280

Act II. Turns out that while OP’s original post implied seller’s 𝘦𝘴𝘵𝘪𝘮𝘢𝘵𝘦 𝘰𝘧 𝘷𝘢𝘭𝘶𝘦 was N(1,s) but instead solved as if seller’s 𝘳𝘦𝘴𝘦𝘳𝘷𝘢𝘵𝘪𝘰𝘯 𝘱𝘳𝘪𝘤𝘦 were N(1,s), per this tweet👇

Bayesian updating: when will they ever learn?

https://twitter.com/quantian1/status/1456461602757169153

Bayesian updating: when will they ever learn?

Act III. @Noahpinion and @ShengwuLi point out this is just Milgrom–Stokey 80. Of course, “this is pointless economist bullshit” because even though OP set up a model without e.g., noise traders and then solved it incorrectly, the real world is complicated so shut up nerds.

https://twitter.com/quantian1/status/1456463413731897345

ACT IV. Wake up. Check notifications. Tweet this.

Academics be like

[Figure 1 goes about here]

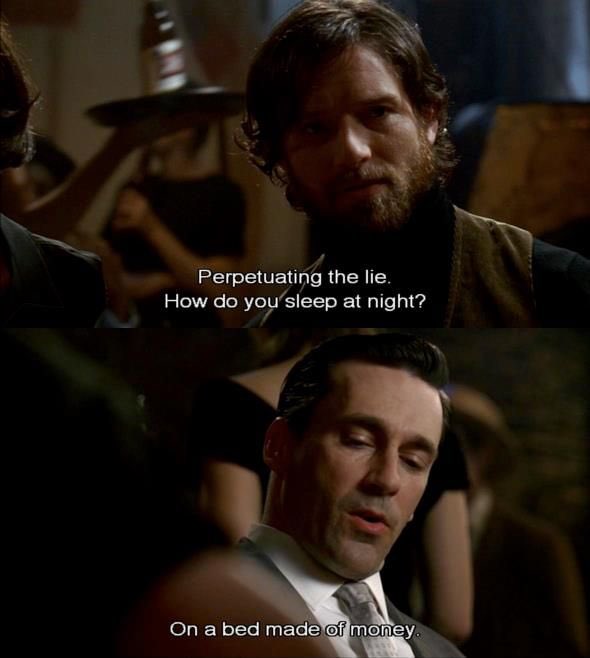

Practitioners be like

[Figure 2 goes about here]

Academics be like

[Figure 1 goes about here]

Practitioners be like

[Figure 2 goes about here]

• • •

Missing some Tweet in this thread? You can try to

force a refresh