Thread warning; mute if boring.

uky.edu/financeconfere… #KentuckyFin2019

1. (Low-frequency) consumption growth covaries with profit margins

2. There are more price wars when growth is low

3. Growth predicts profit margins particularly for low-innovation capacity industries

#KentuckyFin2019

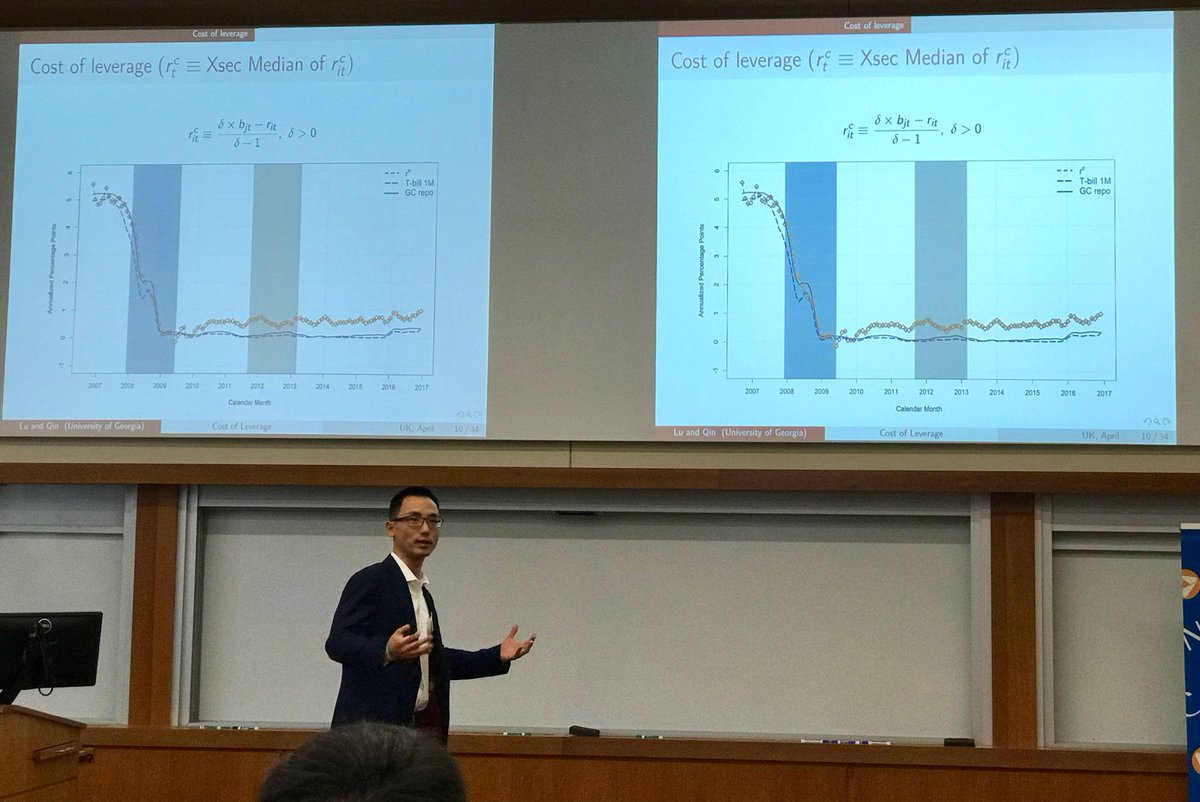

Marginal investor has to pay borrowing rate > risk-free rate to take on leverage. Old story, but analyze with new, good data. #KentuckyFin2019

VERY COOL: Estimate leverage cost by regressing fund returns on benchmark returns. #KentuckyFin2019

- Role of frames in decision making

- [In]stability of choice under uncertainty

#KentuckyFin2019

[See you after lunch] #KentuckyFin2019

Really excited to instead learn from @steve_kempton about the investment properties of thoroughbreds 🐎📈 kemptonbloodstock.com #KentuckyFin2019

Very different cash flow patterns and risks for males vs female horses.

#KentuckyFin2019

Intermediation: Consigner (cf investment bank) takes 5% of sale price—sometimes negotiated. Track takes ~18% of money gambled. #KentuckyFin2019

Asks: Do peers learn from rivals' disclosures, and are copycats naive or sophisticated? #KentuckyFin2019

#KentuckyFin2019

Asks how removing price discrim affects credit supply (using govt disaster loans) #KentuckyFin2019

Find: Fixed-price SBA loans particularly likely to be denied in locations with high minority share, subprime share, or income inequality. But ex post defaults give NO evidence for taste-based discrimination. #KentuckyFin2019

“Price discrimination without prices leads to discrimination” #KentuckyFin2019

Asks: What is the incidence of UI and what are its corporate finance effects? #KentuckyFin2019

-Employment

-Wages

-Value

particularly of risky firms. Also, entrepreneurship! #KentuckyFin2019

- Incidence of unemployment insurance

- Fixed income returns

- Banking crises*

- Wealth and houshold debt

- Financial inclusion*

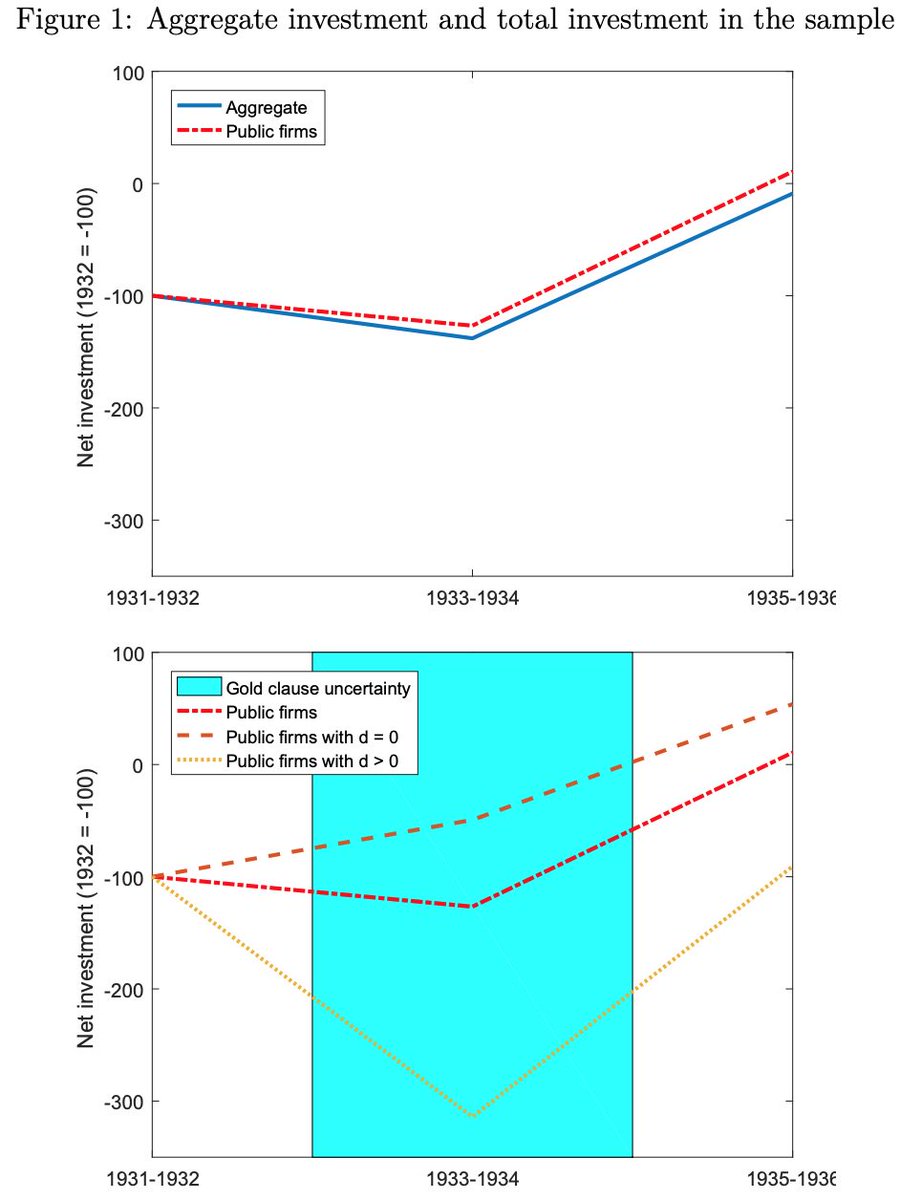

- Gold and corporate bonds*

*Historical questions/data

Some bonds don't trade for weeks, but mutual funds still have to provide liquidity. Wind up with lots of 0% returns. #KentuckyFin2019

- Treasury on the run (i.e., newly issued)

- Treasury off the run

- Investment-grade corporate

- NonIG corporate

- Distressed

- Municipal

How do you quote prices? #KentuckyFin2019

Evidence consistent with investors exploiting stale pricing (flow-underpricing sensitivity higher for high-ZRD funds); loads can mitigate this somewhat

Increased risk of fund runs #KentuckyFin2019

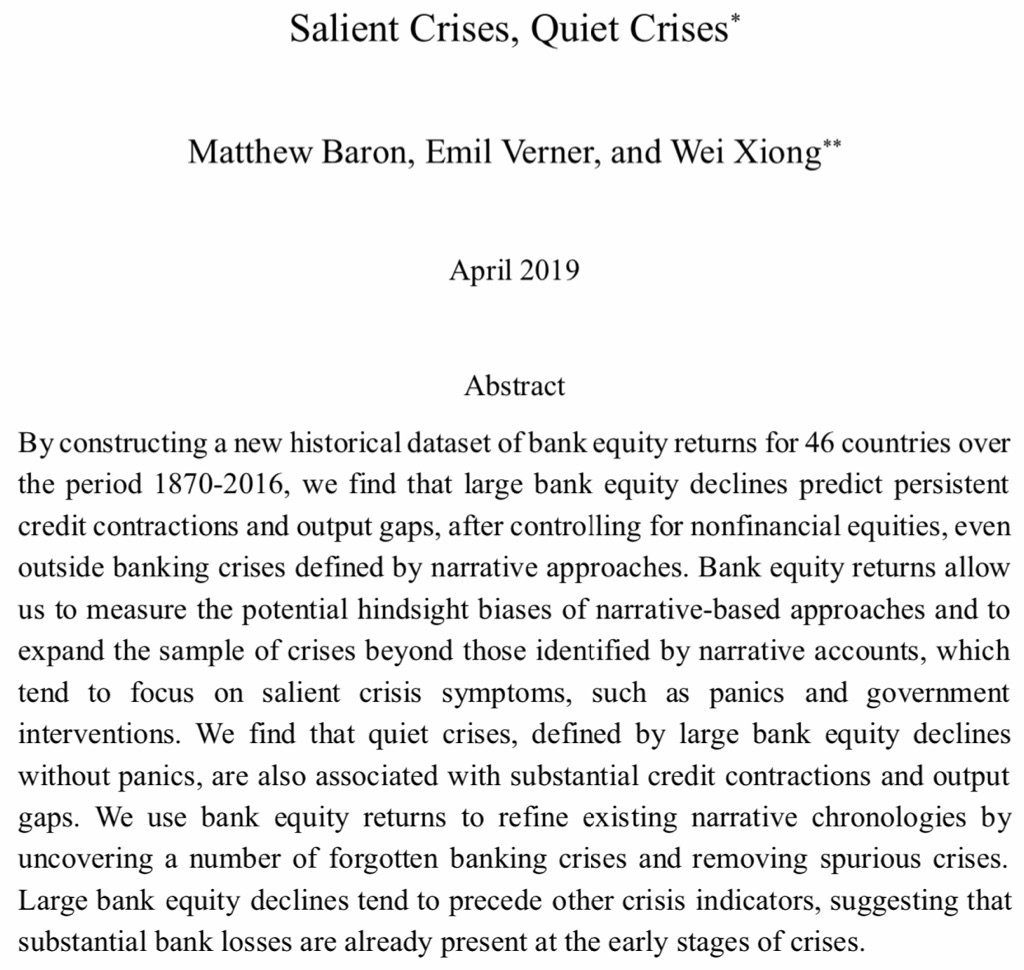

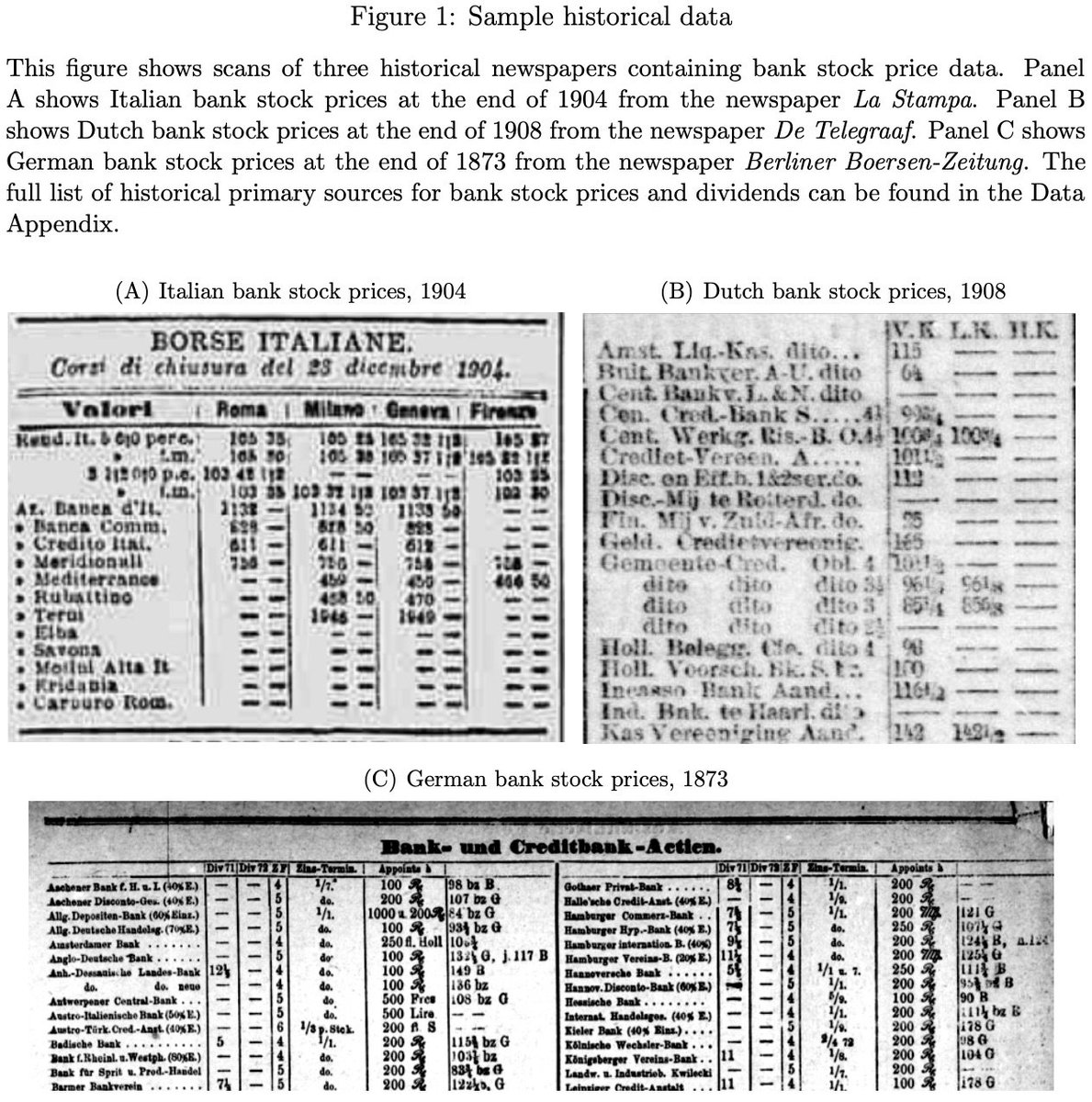

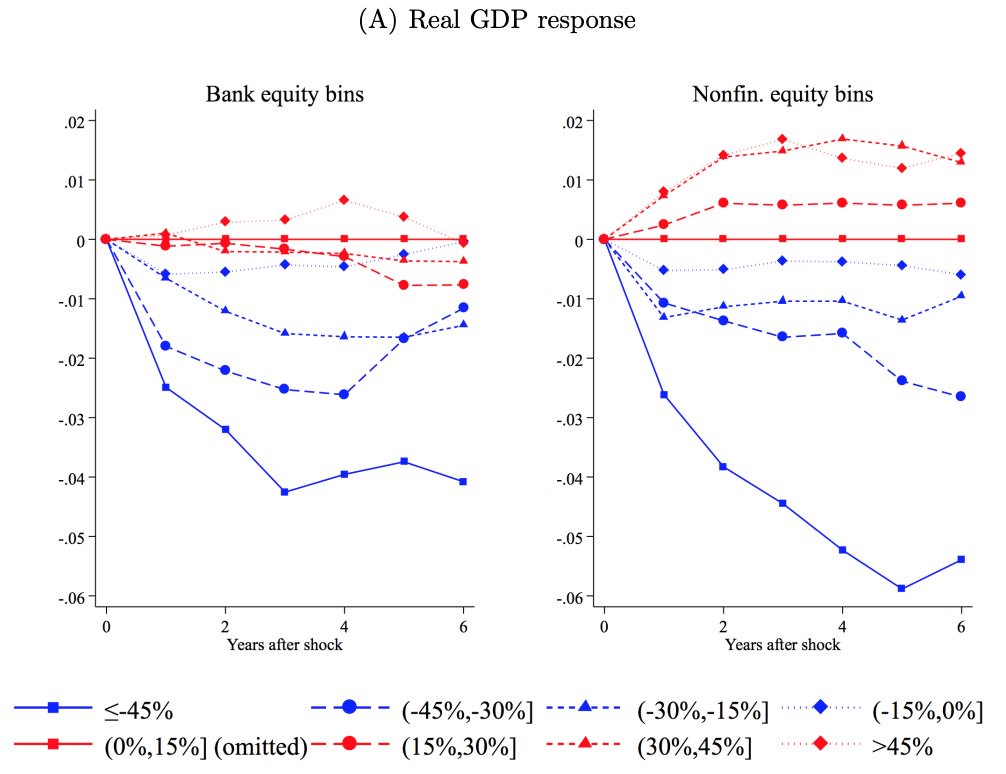

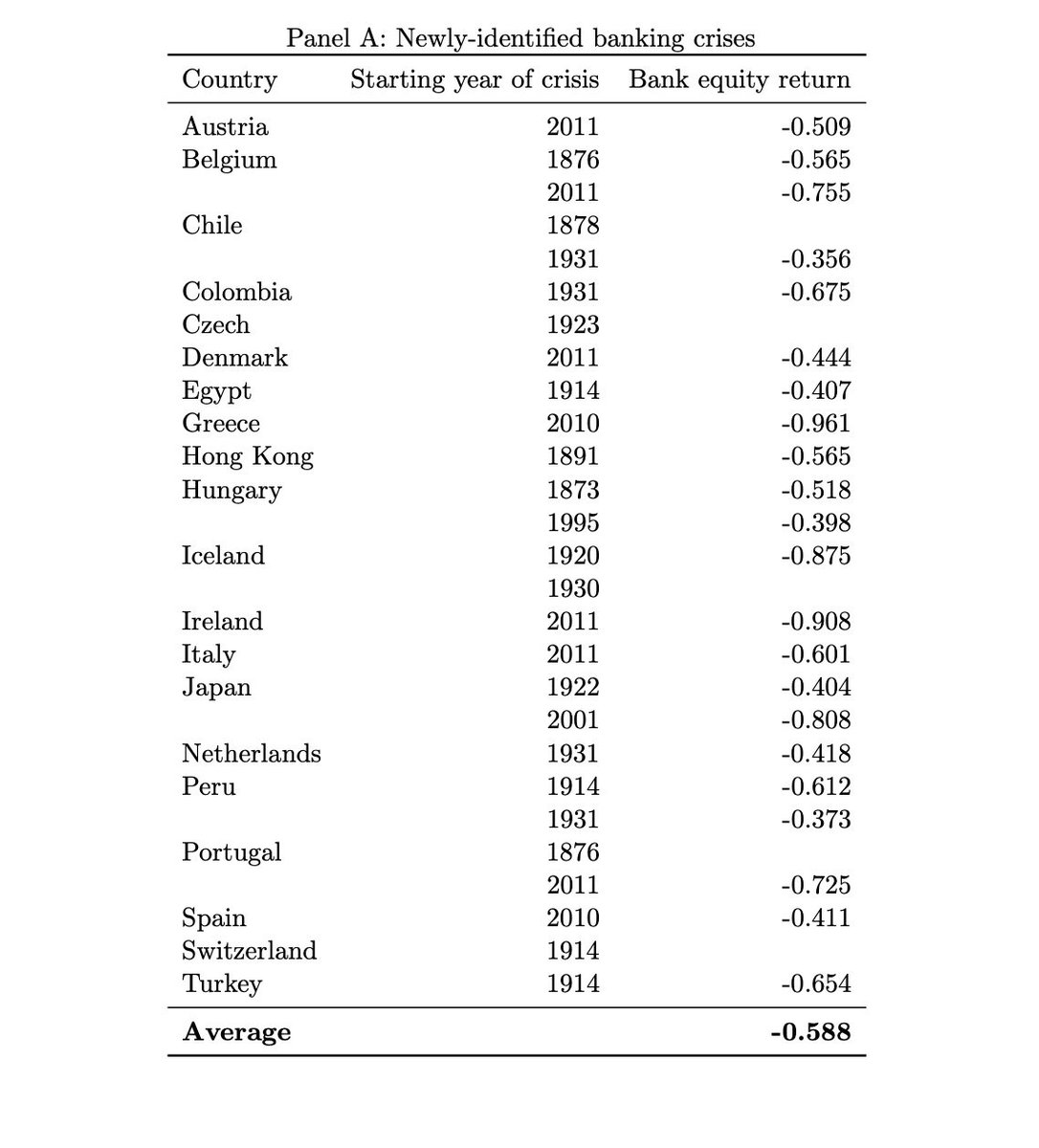

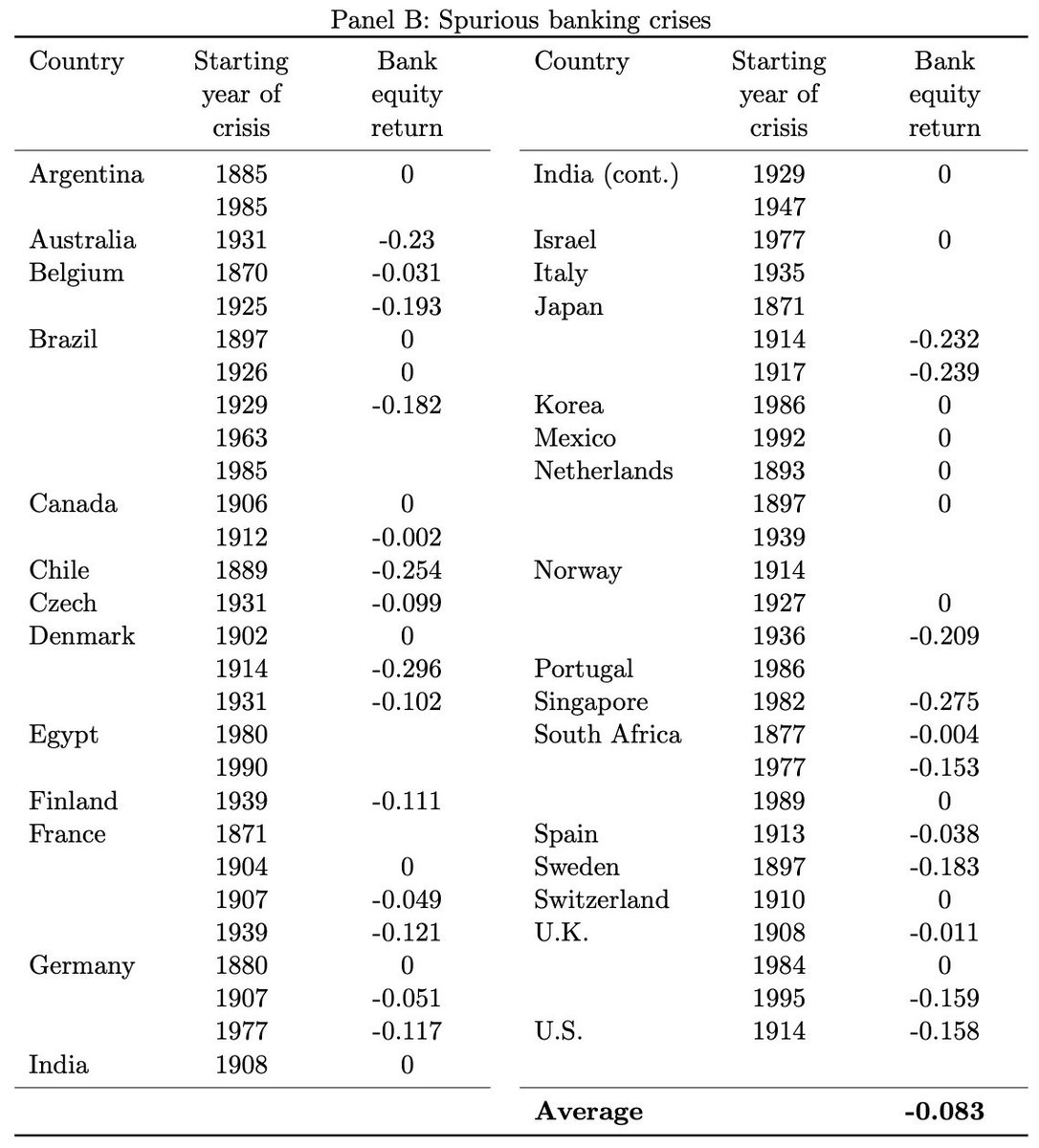

Uses large bank equity declines to identify crises in 46 countries 1870-2016

- Prospective not retrospective

- Objective

- Quantitative

#KentuckyFin2019

Bank equity declines precede nonfinancial equity declines and large credit spread increases later, but in older crises, more nonfinancial declines came first. #KentuckyFin2019

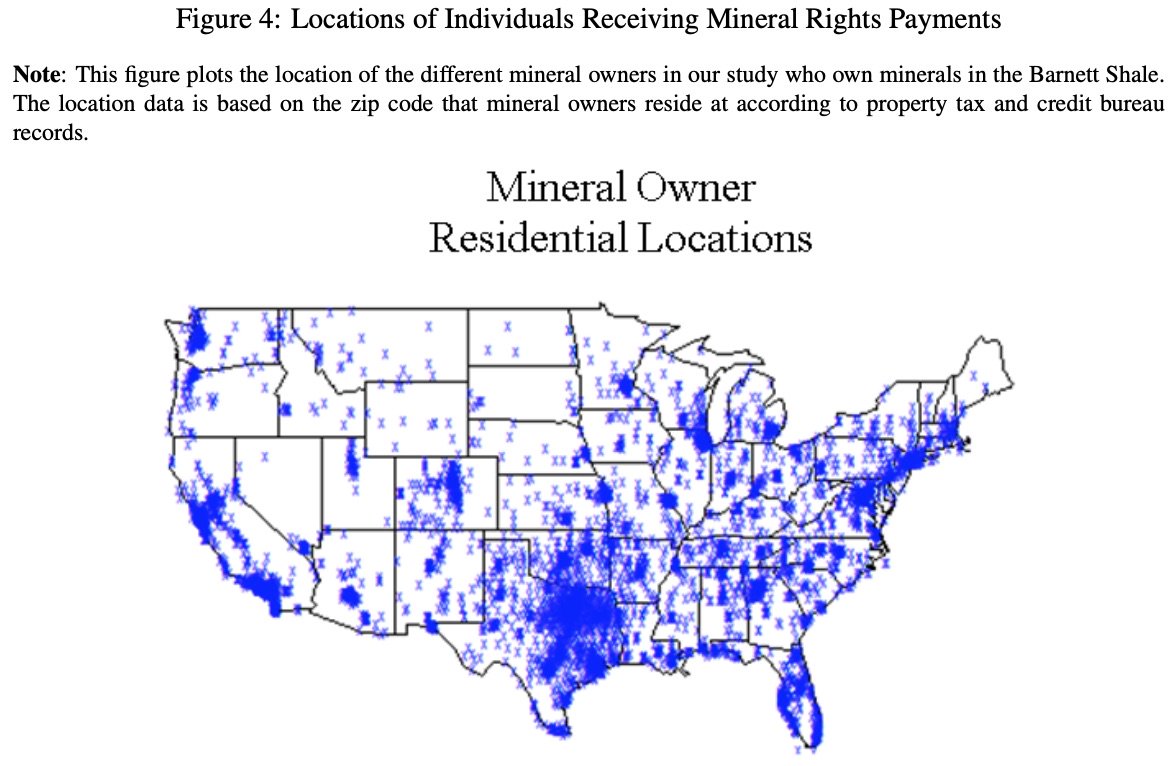

How does wealth affect debt? Experian credit profiles matched to 400k HH receiving $15B in oil/gas royalties. #KentuckyFin2019

DiD effects of wealth shock vary with credit score

- Subprime: ↓ revolving and mortgage balances

- Prime: ↑ revolving, auto, and mortgage balances

Effects level off at ~$50K wealth shock #KentuckyFin2019

ssrn.com/abstract=33029…

Excited for discussion from Jordan Nickerson @BCCarrollSchool #KentuckyFin2019

Considers a channel for gold standard→corporate investment during Great Depresn recovery #KentuckyFin2019

Implications for interplay between exchange rate uncertainty, nominal debt, and deflation risk #KentuckyFin2019

Thanks so much to our @UKGattonCollege hosts! #KentuckyFin2019