Lots of papers ask what happens when firms get cash windfalls. Paper uses SBA-provided Small Business Innovation Research Grants (~$2.2B/yr). #FRA20

- $150K for proof-of-concept

- ≤$1M followup

Applying takes 1–2 months of FTE work, and program officials rank applications.

Data: 270 competitions; 4,300 applications; 800 winners. (~3 of 16 win each competition). Link to IRS W2 and LBD. #FRA20

✔︎ 1. Financial constraints (implicit contract to pay below-market wages until constraint relaxed)

✘ 2. Productivity growth

✘ 3. Bargaining

✘ 4. Incentive contracting (e.g., win bonus)

✘ 5. Agency issues

✘ 6–8. [Other] #FRA20

Winning firms

- Incease wages

- Basically only for incumbent employees (i.e., at firm pre-grant)

- Roughly equal for higher- and lower-paid employees

#FRA20

- Is this really a cash windfall?

- (Strong) incentive to apply for Phase II if successful in Phase I?

- Magnitudes? (Looks like $150K grant raises winners’ employees’ wages ~3% 🤷♂️)

- More detail on apparent implicit back-loading contracts? #FRA20

paulhdecaire.com

Do managers pad their discount rates? YES

Is it a big deal? NOT CLEAR

Cost of capital = Rf + 𝛽×MRP + stuff?

#FRA20

1. NPV (⇒ bounds on R depending whether project done or not)

2. Idiosyncratic risk #FRA20

1. Firms inflate discount rates ~7.9% (not percentage points; 12% → 13%)

2. Firms that “pad” are worse

3. Stronger for firms where it’s hard to raise money

4. Padding is related to idiosyncratic risk (though JW asks whether measure could be capturing skewness) #FRA20

#FRA20

Excited to see this presented; I learned that “My relevance condition is your exclusion restrictino violation.” #FRA20

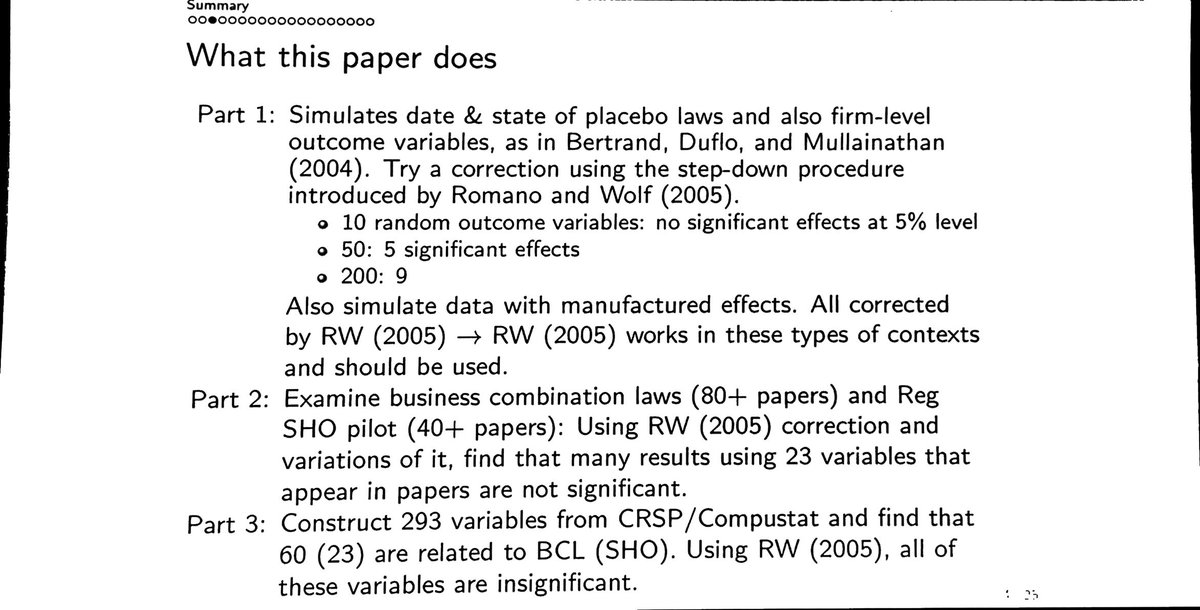

Considers

- RW (2005) random ordering, and then refinements where

- Outcomes are ordered by publication date or by

- Variables’ apparent causal chain #FRA20

1. Verify relevance and exclusion restrictions of main effects before examining higher order effects

2. Caution on reuse of natural experiments

3. Conduct multiple-comparison corrections using earlier papers in literature #FRA20

- Goal is *not* replication existing papers (uses standardized data); goal is methodological

- Appropriate corrections differ for reuse across different outcomes in same data set vs. same experiment but different contexts

- [Some methodological suggestions]

#FRA20

@ctrzcinka: “You guys *should* start a fight. The first, fundamental rule of financial econometrics is that everyone is wrong.” 🥊 #FRA20

Note Jun is a pre-market Econ PhD student at Berkeley, with (another paper) solo-authored R&R at JET. sites.google.com/site/junaoyagi…

#FRA20

How do speed bumps affect bid-ask spreads when HFT speed is endogenous? #FRA20

➕ Increases probability of successfully sniping

➖ Increases bid-ask spread, which reduces profit from sniping

➖ Has an (exogenous)

Solving the model...

⇒ Optimal speed is INCREASING in speed bump #FRA20

Model gives strategic complementarity.

Unlike benchmark model, longer speed bump widens spread. #FRA20

Introduces strategic substitution (similar to existing models) depending on parameters. #FRA20

1. Implications. Welfare (liquidity traders vs. mkt makers vs. snipers)?

2. *Baseline* model: Speed bumps are irrelevent in equilibrium (speed, Pr[sniping], etc)! Per envelope theorem

3. BUT in competitive model, speed bumps DO matter (eg increased spreads) #FRA20

Mmntum seems to predict 𝛽. We can model link between 𝛽s and chars in conditional factor model (as in authors’ earlier IPCA work) #FRA20

[Andrei notes that “Factor 3” from authors’ IPCA paper is ~0.5 correlated with momentum.] #FRA20

Glass half empty: We learned that arbitrageurs know about momentum so it is not a near-arbitrage opportunity.

Glass half full: We learned why momentum did not (and likely will not) disappear despite arbitrageurs knowing about it. #FRA20

Is this labor demand, or an “insurance”-like option? #FRA20

❶×❷ UberX staggered rollout across 163 CBSAs

❸ Car owners vs. non-owners

Isaac suggests complementarity with approach/results from Emilie Jackson’s JMP web.stanford.edu/~emilyj91/ #FRA20

#NotQuite2020Yet #FRA20

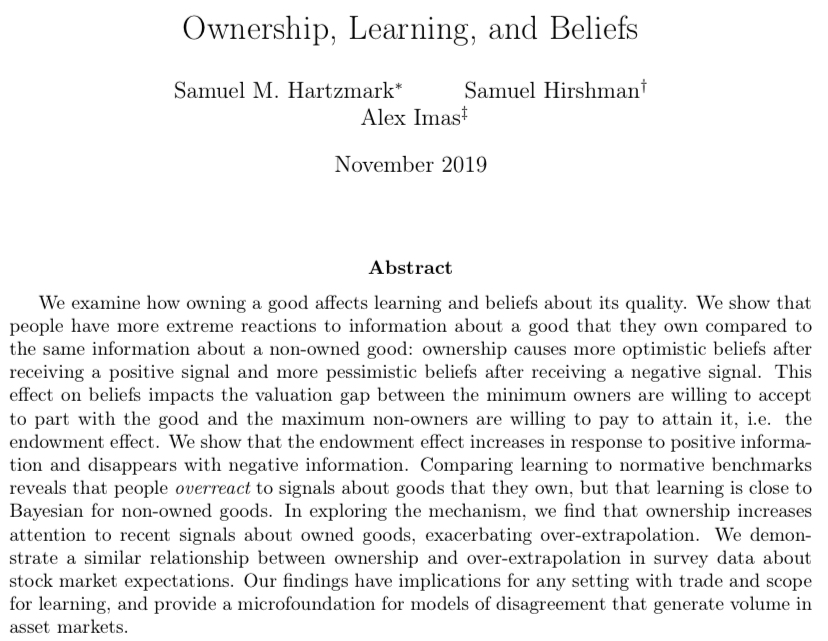

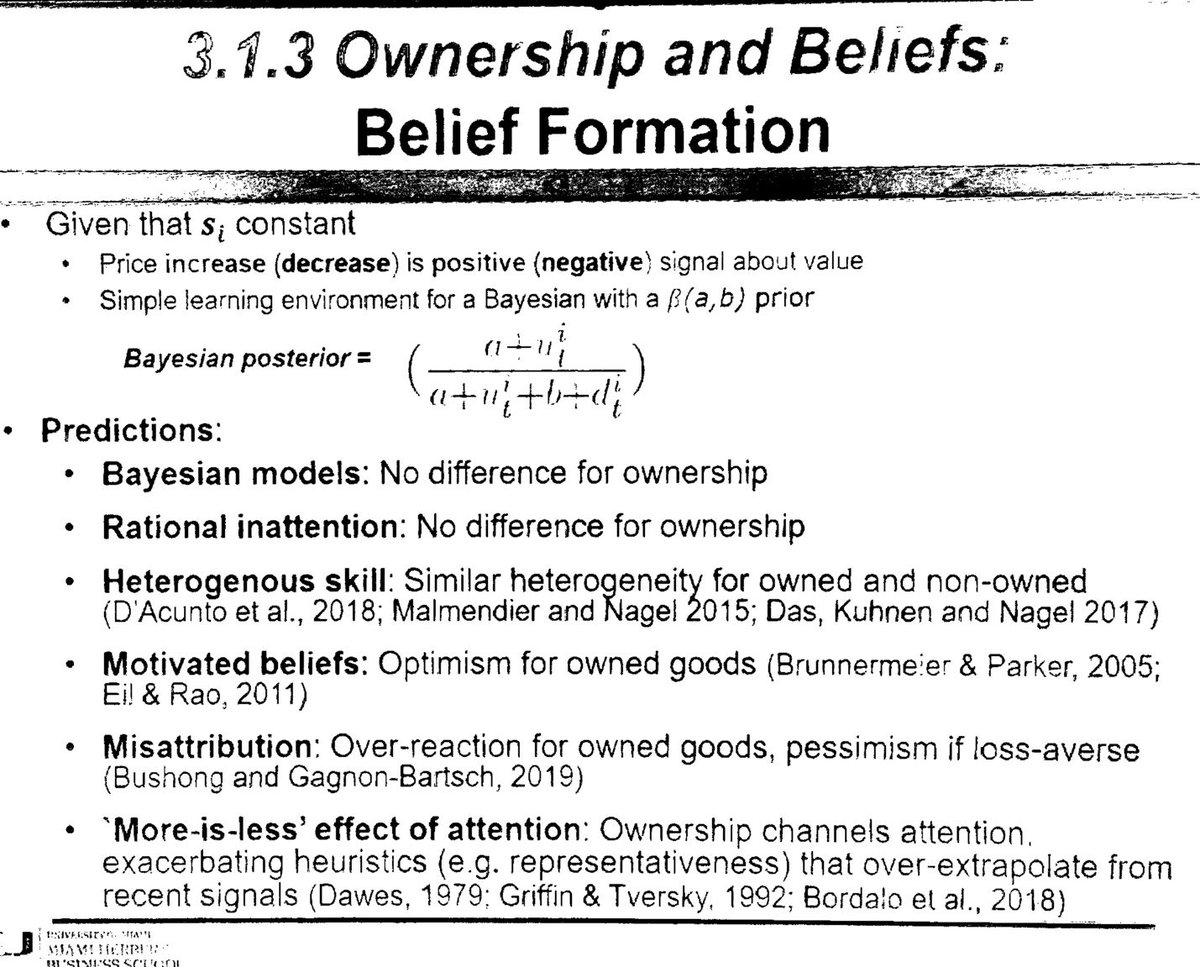

SH did a nice thread on this a few months ago: #FRA20

Difficult to address without experiments (how to separate preferences from beliefs?)

GB characterizes as “first paper to look at endowment effect’s dynamics and cleanly tie EE to beliefs”👍 #FRA20

- Ownership leads to overreaction to informational signals (first paper looking at EE’s dynamics)

- Learning is close to Bayesian for non-owners

- Driven by attention: “Attention + Incorrect Mental Model = BAD”

- Survey evidence consistent with experiments and theory #FRA20

Participants pick three of six goods, and then we see how beliefs evolve as function of (1) random realizations and (2) ownership. #FRA20

Elicit WTP/WTA as (actual) Amazon ratings revealed. 🤯 #FRA20

• Best discussant: James Weston

• Best poker player in finance: Todd Gormley

• Worst poker player in finance: Paul Décaire

• Best paper: Paul Décaire (a PhD student for the first time ever!!)

#FRA20