What they don't tell you about microcap/smallcap investing.

(a thread) 👇

(a thread) 👇

1/ It is extremely lonely.

For a large part of your investing cycle, you will be holding some tiny companies and you know that even if you talk about it, you will either be wrong 80% of the time, or people will just trash it.

For a large part of your investing cycle, you will be holding some tiny companies and you know that even if you talk about it, you will either be wrong 80% of the time, or people will just trash it.

2/ You're wrong more often than you're right.

People who seem to be picking amazing smallcaps/microcaps all the time aren't telling you about their failures. Or they haven't even invested and just trying to give you FOMO for personal gain (attention, followers, services).

People who seem to be picking amazing smallcaps/microcaps all the time aren't telling you about their failures. Or they haven't even invested and just trying to give you FOMO for personal gain (attention, followers, services).

3/ Accept uncertainty and build a process around it

In smallcaps/microcaps, certainty is an illusion. Anyone claiming otherwise is fooling you or themselves or both. No matter how certain a bet seems, listen to that voice over your shoulder.

In smallcaps/microcaps, certainty is an illusion. Anyone claiming otherwise is fooling you or themselves or both. No matter how certain a bet seems, listen to that voice over your shoulder.

4/ Margin of safety lies in valuation, and nothing else.

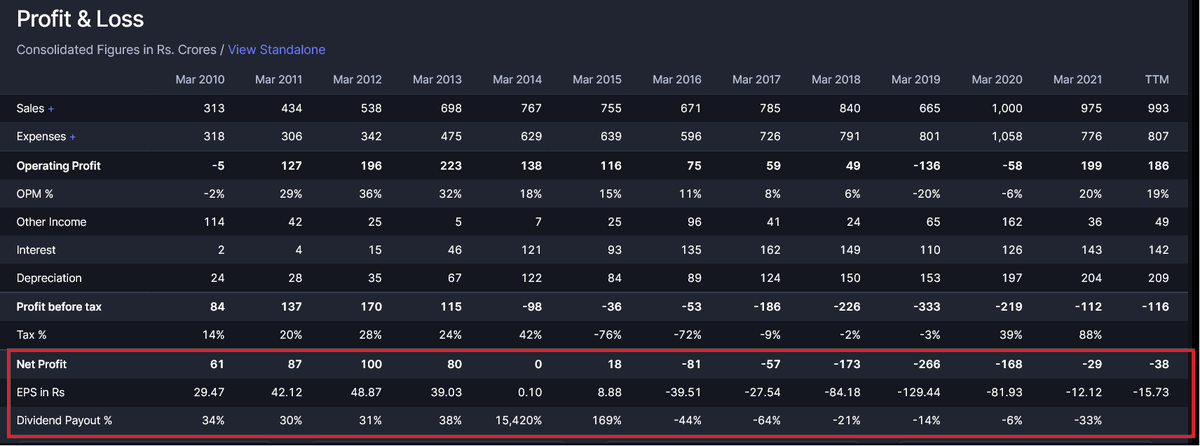

Always value the business for the worst case - no growth happens, all assumptions go wrong, business earns only enough to survive. Check historical data - past period of outperformance (if any), reasons, etc.

Always value the business for the worst case - no growth happens, all assumptions go wrong, business earns only enough to survive. Check historical data - past period of outperformance (if any), reasons, etc.

5/ Learn the basics of supply and demand in illiquid companies

In this space, a hundred buyers and an influencer can put a stock on upper or lower circuits for days. People constantly judge small companies based on how many circuits they've had. It means nothing.

In this space, a hundred buyers and an influencer can put a stock on upper or lower circuits for days. People constantly judge small companies based on how many circuits they've had. It means nothing.

6/ If they're discussing on social media, the margin of safety is likely gone

Self explanatory - either you were holding before everyone got excited, or you should be wait for the inevitable reversion to mean when expectations are missed.

Self explanatory - either you were holding before everyone got excited, or you should be wait for the inevitable reversion to mean when expectations are missed.

7/ You will encounter many false starts

A false start is when there is a temporary rise in earnings, which you pick up as a positive sign. Experience is knowing probable causes for temporary outperformance. Many companies had several false starts before they really took off.

A false start is when there is a temporary rise in earnings, which you pick up as a positive sign. Experience is knowing probable causes for temporary outperformance. Many companies had several false starts before they really took off.

8/ Low PE is not a bargain- it is a default

Smallcaps and microcaps deserve to trade at low PEs. Don't compare these companies with the index and fancied stocks of the day.

Smallcaps and microcaps deserve to trade at low PEs. Don't compare these companies with the index and fancied stocks of the day.

9/ Bet on honest, experienced management and favourable macro conditions for the industry

You are not looking for visionary management, you're just looking for people and companies well placed grab an opportunity and come out stronger once it plays out.

You are not looking for visionary management, you're just looking for people and companies well placed grab an opportunity and come out stronger once it plays out.

10/ Tiny companies usually don't have strong balance sheets

At small scale of operations, there is a lot of inefficiency. Eg. working capital is usually a big cost, and plant & machinery generally tend to be old and obsolete.

It isn't about how it IS, but how it COULD BE.

At small scale of operations, there is a lot of inefficiency. Eg. working capital is usually a big cost, and plant & machinery generally tend to be old and obsolete.

It isn't about how it IS, but how it COULD BE.

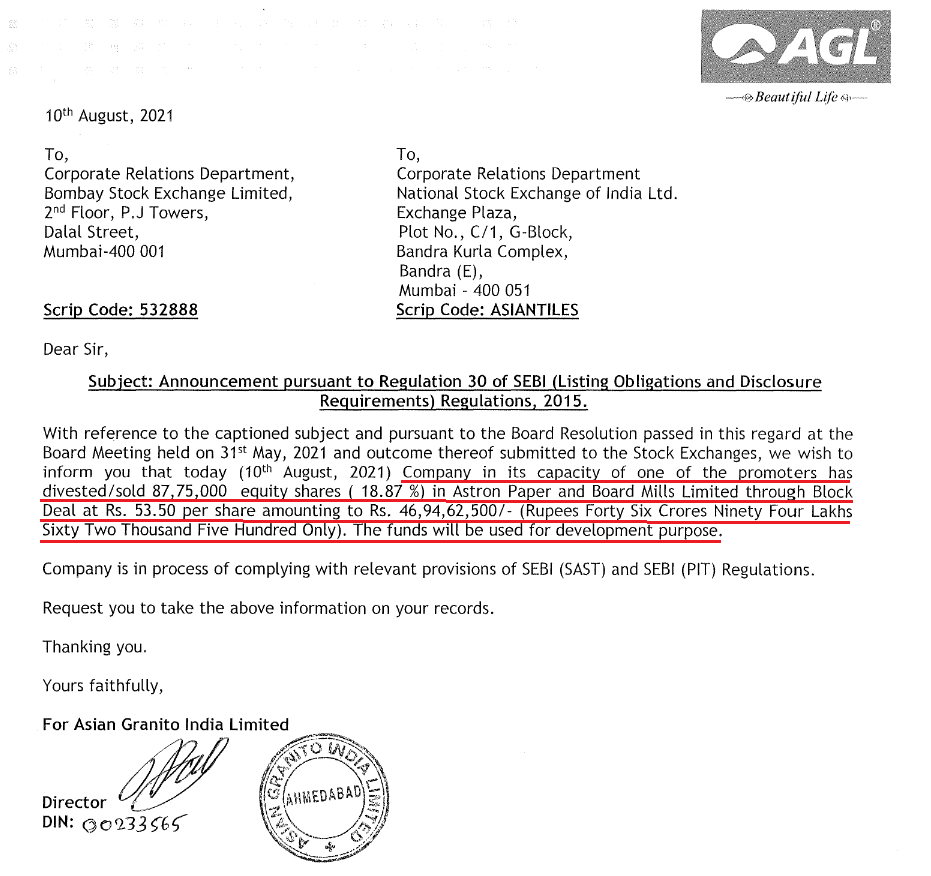

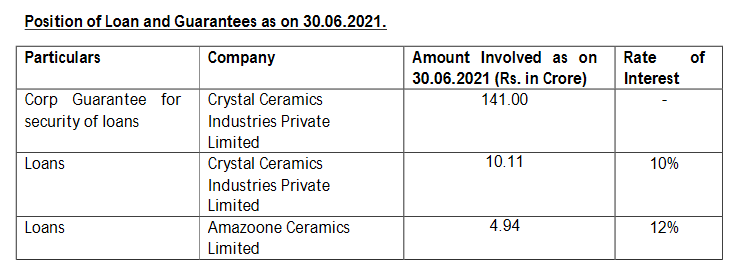

11/ Governance analysis is very nuanced

Small cos need promoter support, hence share warrants, unsecured loans and related party transactions are common. Often, these improve as the company grows. Conflict of interest and compliance lapses are the main red flag I look for.

Small cos need promoter support, hence share warrants, unsecured loans and related party transactions are common. Often, these improve as the company grows. Conflict of interest and compliance lapses are the main red flag I look for.

12/ Scaling operations is not a linear exercise, it's more start and stop

In tiny companies, growth consumes precious cash not just for capex but also manpower and increased working capital. As an organization, it has to be adjust to being larger. This doesn't happen overnight.

In tiny companies, growth consumes precious cash not just for capex but also manpower and increased working capital. As an organization, it has to be adjust to being larger. This doesn't happen overnight.

13/ How well do you sleep at night?

Separates the wheat from the chaff. If price movements keep you up at night, you don't have the temperament or your gut knows you effed up. Strong emotions on change in price are a good indicator of the underlying basis for the decision.

Separates the wheat from the chaff. If price movements keep you up at night, you don't have the temperament or your gut knows you effed up. Strong emotions on change in price are a good indicator of the underlying basis for the decision.

14/ Watch only business performance and have a stomach for volatility

30-40% drops can be stomach churning, it will either force you out of the space, or you will adapt and learn. Even then, broader market trends result in significant price erosion for no discernible reason.

30-40% drops can be stomach churning, it will either force you out of the space, or you will adapt and learn. Even then, broader market trends result in significant price erosion for no discernible reason.

15/ Volatility is actually your friend

Volatility means companies experience sharp movements in prices due to broader trends or non-specific reasons. Smallcaps/microcaps rise and also fall the fastest. Other people's fear and euphoria is your opportunity (selectively).

Volatility means companies experience sharp movements in prices due to broader trends or non-specific reasons. Smallcaps/microcaps rise and also fall the fastest. Other people's fear and euphoria is your opportunity (selectively).

16/ Watching and understanding is more useful than jumping in and out

Microcap stories play out over elongated time frames, with stops and starts. Watch for long periods and understand the industries. The more you track, the more you learn about the space.

Microcap stories play out over elongated time frames, with stops and starts. Watch for long periods and understand the industries. The more you track, the more you learn about the space.

17/ Use primary sources to generate ideas

Read exchange announcements and annual reports, and to a lesser extent investor presentations, to get the information you need. Screeners are fine but account for cyclicality. Avoid ideas on SM unless from trusted sources.

Read exchange announcements and annual reports, and to a lesser extent investor presentations, to get the information you need. Screeners are fine but account for cyclicality. Avoid ideas on SM unless from trusted sources.

18/ Understand business and industry cycles.

In the long run, your objective is to understand structures and economics for various industries and sectors so you can better understand events of change taking place in small and tiny companies. This is compounded knowledge.

In the long run, your objective is to understand structures and economics for various industries and sectors so you can better understand events of change taking place in small and tiny companies. This is compounded knowledge.

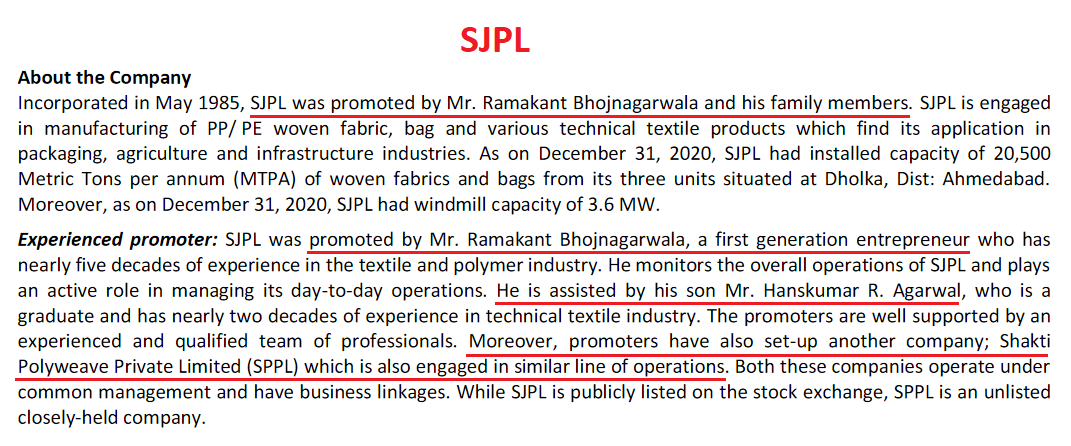

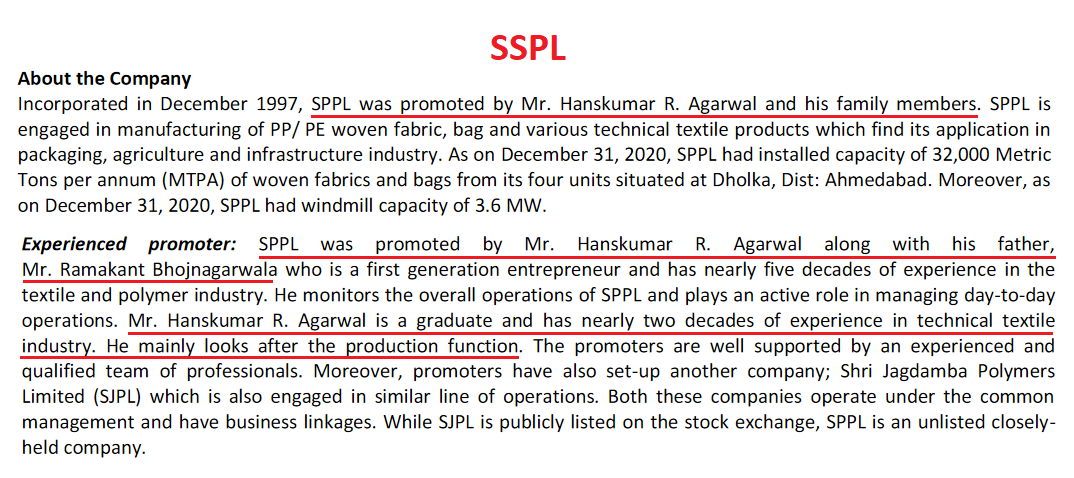

19/ Use credit rating reports

Lot of tiny companies have credit ratings for loans oustanding or in the past. These can have information you won't find in the absence of any presentations or concalls. Credit reports will often be the only third party info source available to you.

Lot of tiny companies have credit ratings for loans oustanding or in the past. These can have information you won't find in the absence of any presentations or concalls. Credit reports will often be the only third party info source available to you.

/Finito

Note: there is no specific order to the Tweets, just kept typing as they popped up in my head. There will always be exceptions to the general concepts discussed above, nothing is ever absolute.

RT the first Tweet if you like the thread.

Note: there is no specific order to the Tweets, just kept typing as they popped up in my head. There will always be exceptions to the general concepts discussed above, nothing is ever absolute.

RT the first Tweet if you like the thread.

/Postscript-1

Practice safe allocation, spread your bets and try not to exit while business is till performing and has a runway. Also, don't be in a hurry to exit something you know well - you can afford to wait if cost of acquisition is low.

Practice safe allocation, spread your bets and try not to exit while business is till performing and has a runway. Also, don't be in a hurry to exit something you know well - you can afford to wait if cost of acquisition is low.

Postscript-2

Perhaps the most important - don't be afraid to average up if the business performs as expected. As business grows larger, the prospects could be better and bigger than you thought in the first place. Don't get anchored but still practice risk management.

Perhaps the most important - don't be afraid to average up if the business performs as expected. As business grows larger, the prospects could be better and bigger than you thought in the first place. Don't get anchored but still practice risk management.

Postscript-3

Avoid trimming positions solely because they've grown too large through appreciation. Have strong reasons or a definite strategy. Don't break compounding unless you absolutely have to. Speaking from experience.

Avoid trimming positions solely because they've grown too large through appreciation. Have strong reasons or a definite strategy. Don't break compounding unless you absolutely have to. Speaking from experience.

Postscript-4

Don't be afraid to email or call companies. For most promoters, company is like their child. They may not be very good at what they do, but they still like to talk about themselves, as all humans do.

Success rate will be low but you might just get information.

Don't be afraid to email or call companies. For most promoters, company is like their child. They may not be very good at what they do, but they still like to talk about themselves, as all humans do.

Success rate will be low but you might just get information.

• • •

Missing some Tweet in this thread? You can try to

force a refresh