Tottenham Hotspur’s 2020/21 accounts cover a season when they finished 7th in the Premier League, were beaten in the final of the EFL Cup and reached the last 16 of the Europa League. Financials significantly impacted by COVID-19. Some thoughts in the following thread #THFC

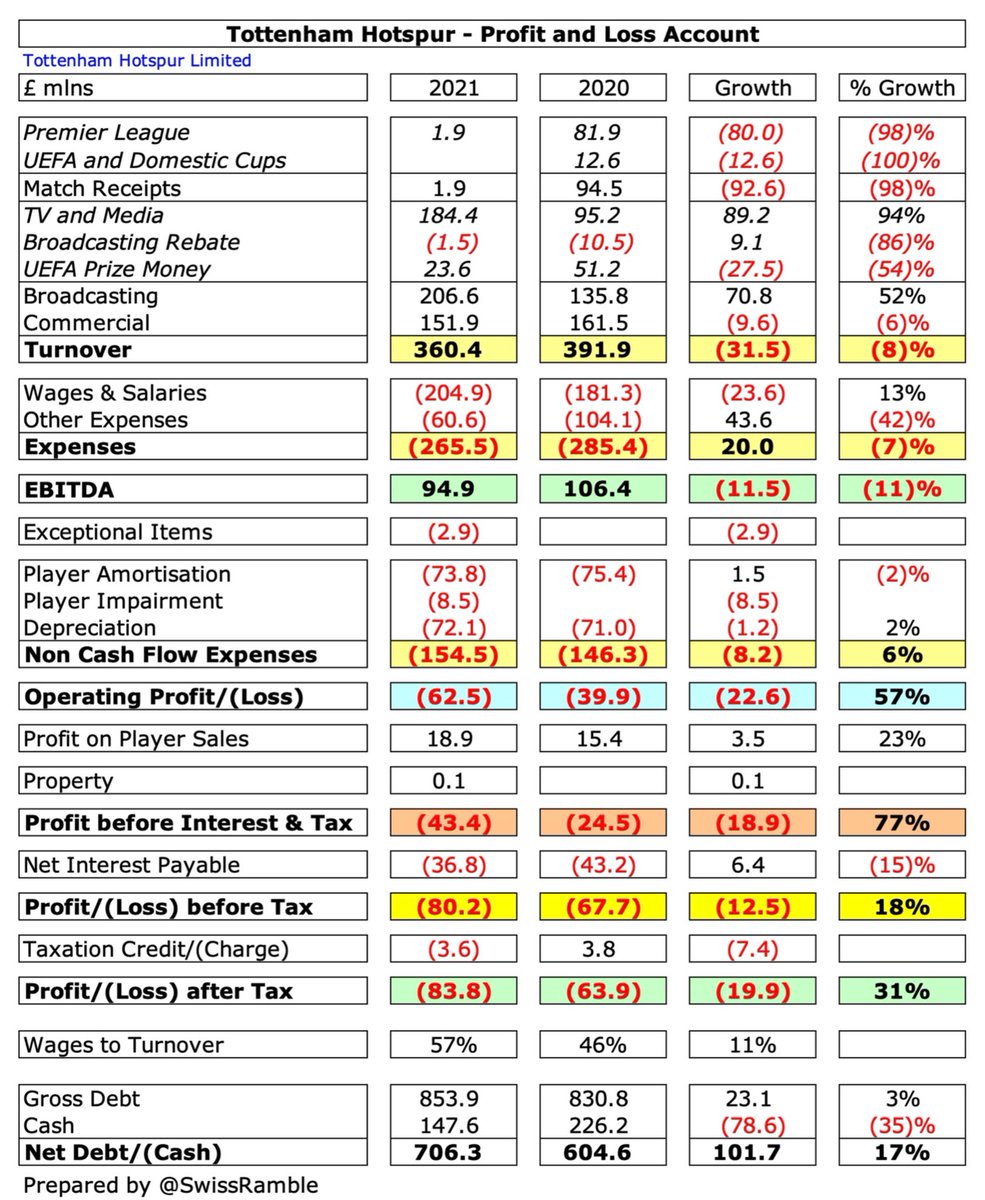

#THFC pre-tax loss widened from £68m to £80m (£84m after tax), as revenue dropped £32m (8%) from £392m to £360m, though profit on player sales rose £4m to £19m. Partly offset by a £9m (2%) decrease in operating expenses, while net interest payable was cut £6m (15%) to £37m.

The main reason that #THFC revenue only fell 8% was £71m (52%) increase in broadcasting from £136m to £207m, mainly due to deferred revenue from 2019/20, which compensated for COVID driven reductions in match day, down £93m (98%) to £2m, and commercial, down £10m (6%) to £152m.

Despite the revenue decrease, #THFC wages rose £24m (13%) from £181m to £205m, though player amortisation fell £2m (2%) to £74m (plus £9m impairment). Reduced business activity, due to COVID closures, meant £44m (42%) reduction in other expenses to £61m.

The only other Premier League club that has published 2020/21 accounts to date is #MUFC, whose £24m loss is much smaller than #THFC £80m. However, there were plenty of large losses already in 2019/20 and clubs’ figures will be worse with a full year of the pandemic reflected.

Clearly, #THFC revenue was significantly impacted by COVID. I have estimated the revenue loss as £133m in 2020/21 (mainly match day £122m and commercial £10m). Added to 2019/20 £35m shortfall, that gives a total of £168m lost in the last 2 years (probably under-stated).

As Daniel Levy noted, “The financial results reflect the challenging period of the pandemic and the incredibly damaging timing of COVID-19, coinciding, as it did, with the opening of our stadium in April 2019.”

Of course, all football clubs have been significantly hit by the effects of the pandemic, so #THFC £84m loss after tax is by no means the largest in Europe. In fact, it is much lower than Inter £215m, Juventus £184m, Roma £163m and especially Barcelona £422m.

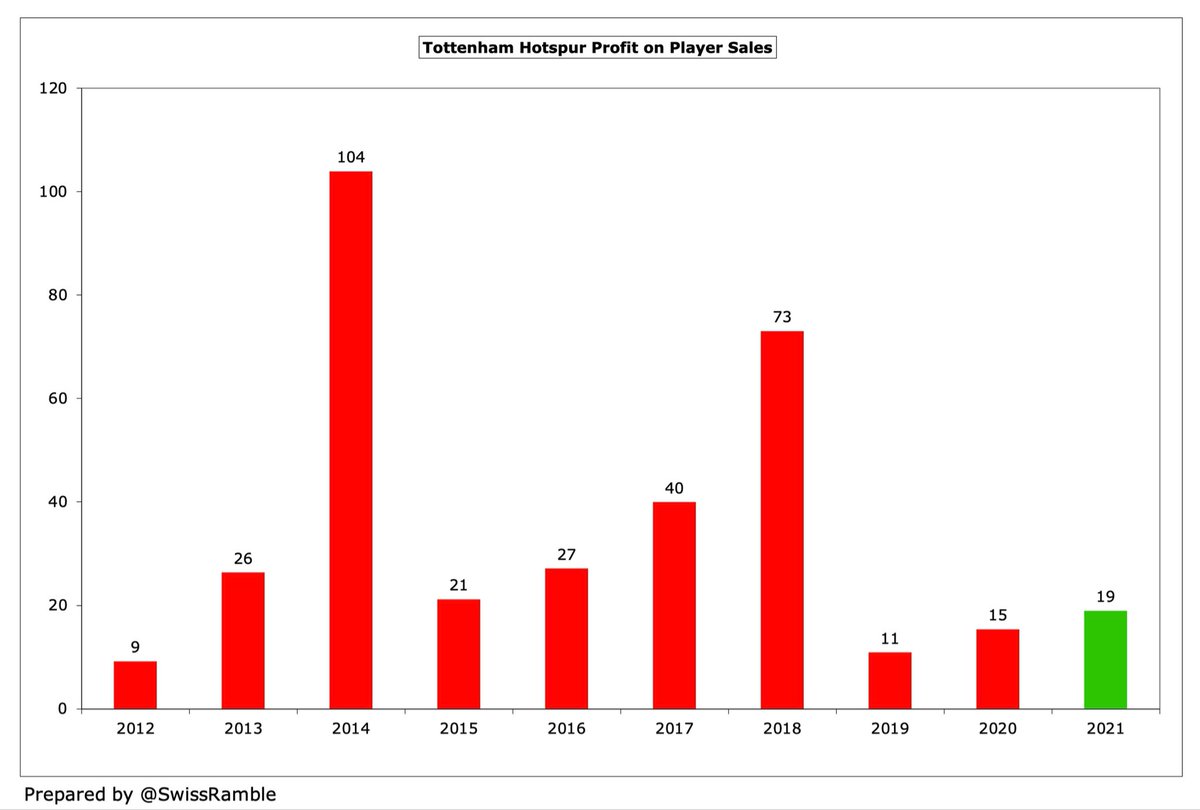

The #THFC bottom line only benefited from £19m profit on player sales, albeit up from prior year £15m, mainly Kyle Walker-Peters to Southampton. This was much lower than many other clubs in 2019/20, e.g. #CFC £143m, though transfer market has been depressed due to COVID.

The pandemic has resulted in #THFC posting pre-tax losses of nearly £150m in the last two seasons, compared to seven profitable years in a row before that, which generated an impressive £412m surplus. In 2018 and 2019 alone Spurs delivered a hefty £226m profit.

Player sales have had a big impact on #THFC figures in some years, e.g. in 2014 they made £104m, largely from the lucrative sale of Gareth Bale to Real Madrid. However, they have made relatively small profits from this activity in the last 3 years, averaging only £15m.

To reinforce this point, #THFC profit from player sales of £166m in the 5 years up to 2020 was only better than #MUFC in the Big Six and was a fair way behind #CFC £434m and #LFC £276m.

#THFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, as it strips out player sales and exceptionals, fell from £106m to a still respectable £95m. Second best in the Premier League, though down from £168m peak.

In 2020 #THFC reported an operating loss for the first time in 5 years and this further widened from £40m to £60m last season. In fairness, hardly any Premier League clubs post operating profits, while some made huge losses in 2019/20, e.g. #MCFC £160m, #EFC £144m & #LCFC £122m.

Due to COVID and not qualifying for the Champions League, #THFC revenue has fallen by £101m (22%) in the past two years from the £461m peak to £360m, which is the lowest since 2017. Most of the reduction (£80m) is in match day, down to £2m as games played behind closed doors

Despite the fall, #THFC have enjoyed the highest percentage revenue growth of the Big Six since 2016, while in absolute terms Spurs’ £151m growth has only been surpassed by #LFC. Furthermore, Spurs have eliminated a £141m deficit against their North London rivals #AFC.

#THFC £360m revenue is now fifth highest in England, ahead of #AFC £343m, even before the Gunners publish their 2020/21 results (with a full year of the pandemic). That said, Spurs are still a fair way behind the other leading clubs, e.g. #MUFC are still £130m higher.

Based on 2019/20 figures, #THFC dropped one place from 8th to 9th in the Deloitte Money League, which ranks clubs globally by revenue, having been overtaken by #CFC, though they remain ahead of Juventus.

Nevertheless, #THFC fans will be delighted that their club reman ahead of their great rivals #AFC in terms of revenue. In fact, in 2019/20 Spurs outpaced Arsenal in all three revenue streams: match day, broadcasting and commercial.

#THFC broadcasting revenue shot up £71m (52%) from £136m to £207m, mainly due to revenue deferred from 2019/20 for games played after end-June accounting close and prior year broadcasters’ rebate, offset by playing in the Europa League compared to Champions League.

#THFC broadcasting revenue of £207m is the club’s second highest ever, partly due to the money deferred from the 2019/20 accounts, though is below #MUFC £255m in 2020/21 and is likely to be overtaken when other clubs (in Champions League) publish their accounts.

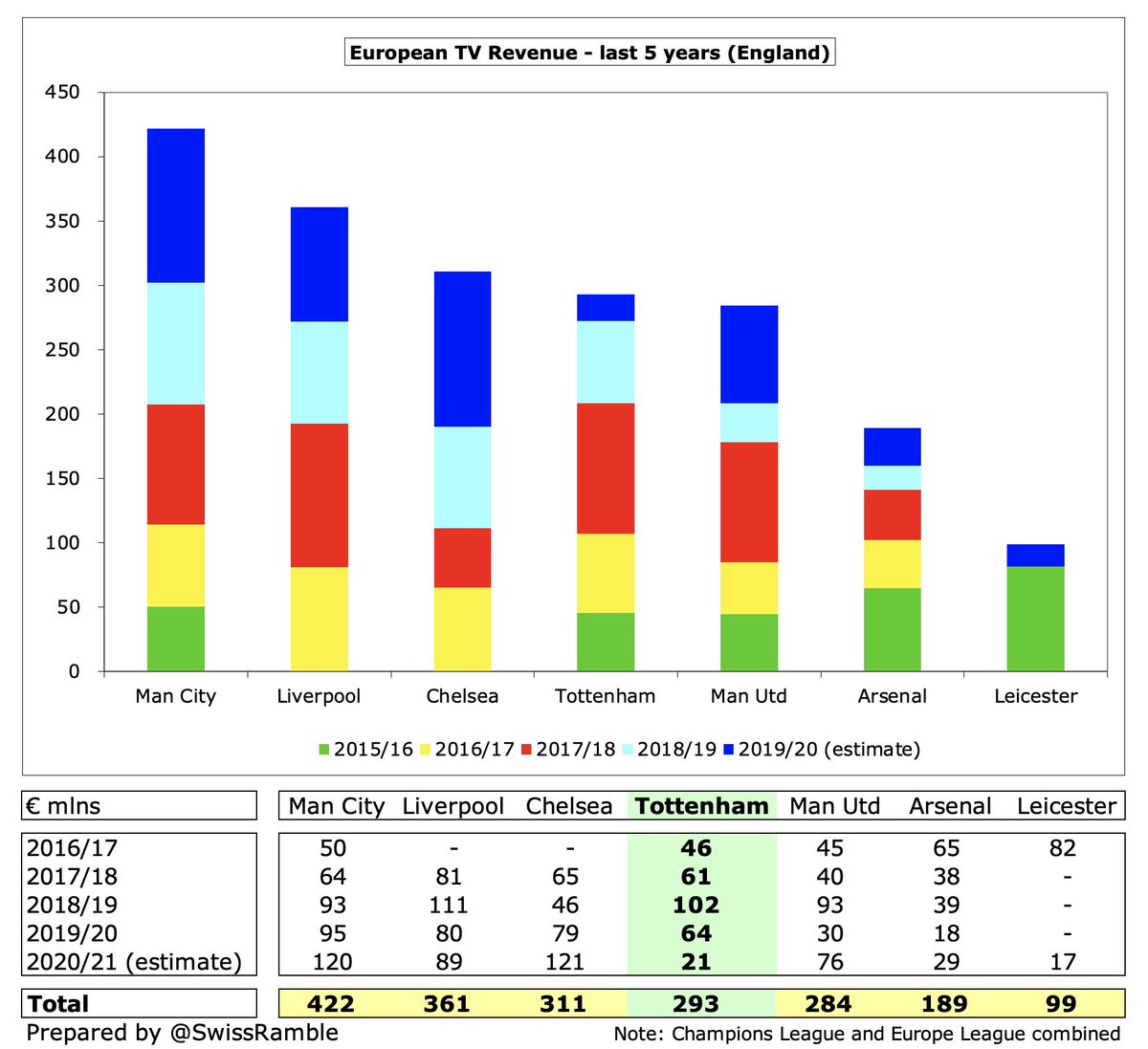

#THFC earned €23m for reaching the Europa League last 16, much less than prior season’s 64m for reaching the same stage in the Champions League. Difference highlighted by #CFC and #MCFC receiving around €120m. Spurs only qualified for the Europa Conference League in 2021/22.

The importance of the Champions League to #THFC revenue growth is clearly evident, especially in the three years between 2018 and 2020 (including reaching the final in 2019). They have earned €293m in last 5 years, though surpassed by #MCFC €422m, #LFC €361m and #CFC €311m.

#THFC match day income slumped £93m (98%) to just £2m, as all home games were played behind closed doors (except two with restricted capacity). Before the pandemic struck, the move to the new stadium had more than doubled revenue from £45m to £95m.

#THFC will be happy that the new stadium returned to full capacity at the start of 2021/22 season, as they should generate more match day revenue than any other English club. I estimate they will earn around £122m, which is higher than the £112m record established by #MUFC:

For games played with fans in 2019/20, #THFC average attendance of 59,385 was the third highest in England, only below #MUFC 72,726 and #WHUFC 59,925, but just ahead of North London neighbours #AFC 59,254.

#THFC splendid new stadium has a 62,850 capacity, though there were lengthy delays and the total cost was £1.2 bln. Nevertheless, it will drive significant revenue growth (NFL, boxing, rugby, concerts, conferences, etc), while the club is pushing for a naming rights deal

#THFC commercial income fell £10m (6%) from £162m to £152m, mainly due to no pre-season tour and inability to host events due to COVID. Nevertheless, this revenue stream has shot up from £59m in 2016 with the highest growth rate of Big Six (albeit from a low base).

Despite the decrease, #THFC £152m commercial revenue is still £10m higher than #AFC £142m. Way behind #MCFC £246m, #MUFC £232m and #LFC £217m, though new stadium should help close the gap. 10-year NFL deal allows Spurs to keep catering income, though not gate receipts.

#THFC two major commercial deals increased in last 3 years: (a) AIA shirt sponsorship extended to 2027, up from £35m to £40m; (b) Nike replaced Under Armour in 2018, doubling money from £15m to £30m, running to 2033. However, these long-term deals run the risk of being overtaken.

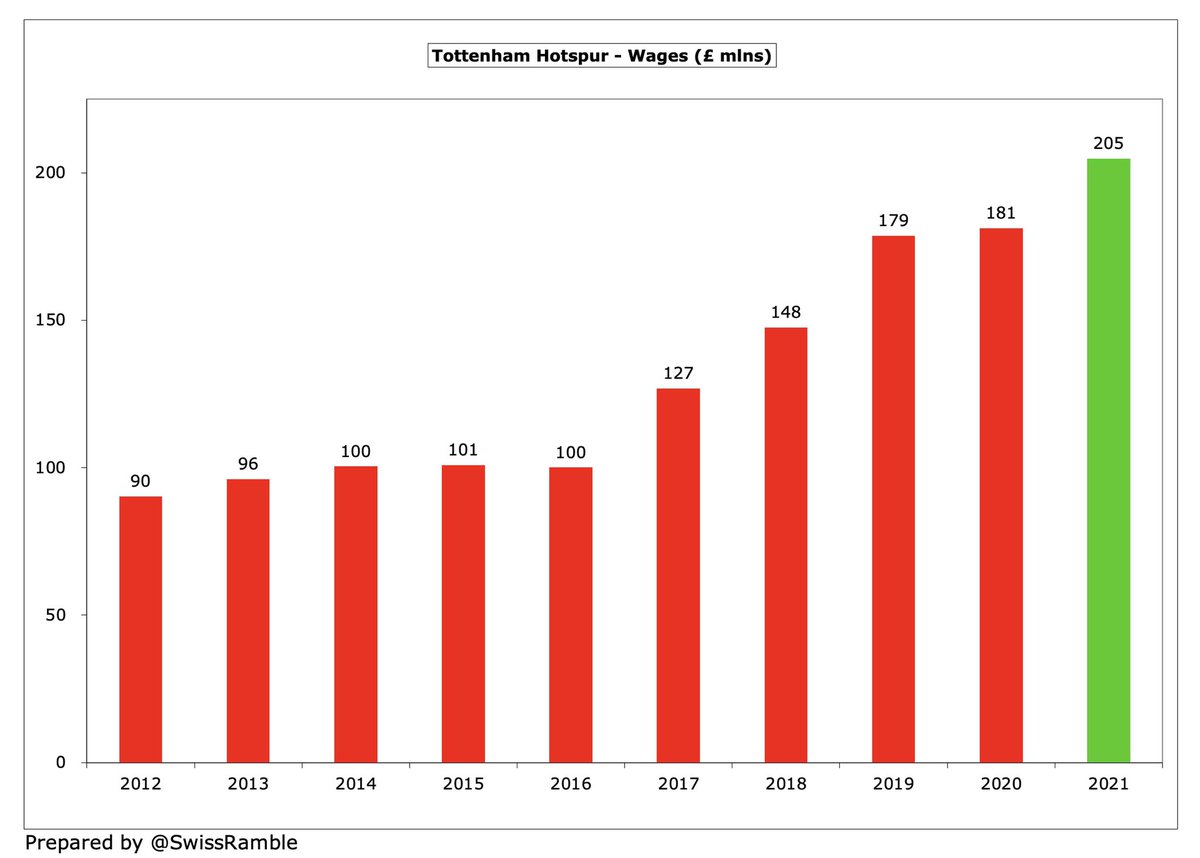

Despite the revenue decrease, #THFC wage bill rose £24m (13%) from £181m to £205m, which means that wages have doubled in the 5 years since 2016. This is the highest percentage growth in the Big Six, though in absolute terms Spurs have been beaten by #MCFC and #LFC.

Even after growth in recent years, #THFC £205m wage bill is still more than £100m below the top three (#MCFC £351m, #LFC £326m and #MUFC £323m). On the other hand, they are a fair way ahead of other clubs, e.g. next highest are #EFC £165m and #LCFC £157m.

#THFC wages to turnover ratio increased from 46% to 57%, their highest (worst) since 2013. However, this is still among the lowest (best) in the Premier League, 8% better than #MUFC 65% in 2020/21.

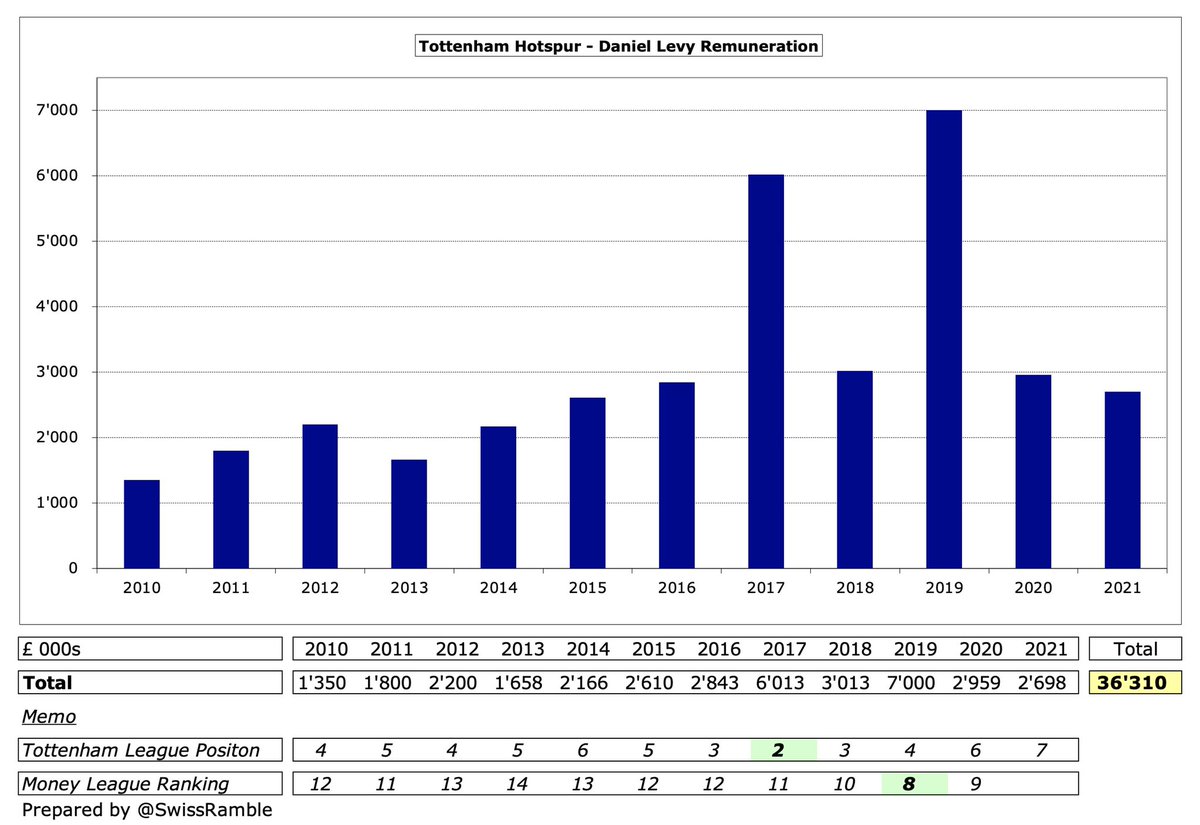

#THFC chairman Daniel Levy remuneration fell 9% from £3.0m to £2.7m, though remains the 2nd second highest in the Premier League, only behind Ed Woodward at #MUFC. He has trousered a cool £36m in last 12 years. League position deteriorated, but Money League ranking improved.

#THFC depreciation slightly increased to £72m, which is by far the highest charge in the Premier League, due to the investment in new stadium. This is over £55m more than #AFC £17m and #MUFC £15m, though worth noting that it is a non cash flow expense.

#THFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell 2% to £74m. Has more than doubled from £31m in 2016, though below #EFC £99m and #LCFC £78m, reflecting relatively low transfer spend. Booked £9m impairment charge.

#THFC did spend £110m on player purchases in 2020/21, including Lo Celso from Real Betis, Reguilon from Real Madrid, Doherty from #WWFC, Höjberg from Southampton and Rodon from Swansea City. Around the same level as #MUFC £116m last season.

#THFC have ramped up transfer spend with a £458m outlay in the past 5 years being significantly more than £273m in the preceding 5-year period. Swung from £11m net sales to £265m net spend. Since these accounts closed, Spurs have spent net £46m to bring in Gil, Royal and Sarr.

#THFC £172m net transfer spend in the preceding 5 years (up to 2019/20) was only 12th highest in the Premier League, behind clubs like #WWFC, #AVFC, #BHAFC and #LCFC. Slightly better with gross spend, though still only 9th highest in the top flight.

#THFC gross debt rose £23m from £831m to £854m, mainly to finance the new stadium. Short-term debt, including the £175m loan from the government COVID facility, was refinanced through a bond issue. Repayment terms extended to 2051 (average 22 years) at 2.7% interest rate.

#THFC £854m gross debt is by far the highest in the Premier League, well ahead of #MUFC £530m, and is also the highest in Europe. As cash balance decreased from £226m to £148m, net debt increased by £101m from £605m to £706m.

#THFC transfer debt also increased from £140m to £170m, up from just £26m in 2015. This is actually the highest in the Premier League, ahead of #AFC £154m and #MUFC £136m. Spurs are owed £19m by other clubs, so net payables are £151m.

In 2019/20 #THFC had the highest total debt in Europe of £1.2 bln, ahead of Barcelona £1.0 bln. This included £831m financial debt, £140m transfer debt and £207m other debt. Not as big an issue as Barca, because not so much is short-term (even before 2021 refinancing).

After adding back £154m non-cash items, offset by £94m working capital movements, #THFC had £9m negative operating cash flow, but then spent £55m on players (purchases £79m, sales £24m), capex £28m and interest £18m, partly offset by tax credit £10m and £22m external loans.

As a result, #THFC had net cash outflow of £79m, which reduced cash balance from £226m to £148m, which is one of the highest in the Premier League, only below #LFC £149m, but above #MUFC £111m and #AFC £110m.

In the last decade #THFC generated £1.0 bln cash from own operations, but also needed to raise £767m from loans. A hefty £1.4 bln has been invested in the new stadium and training centre, leaving just £122m on players (net), £102m interest and £47m tax. Cash balance up £127m.

#THFC interest payments (as opposed to the accountants’ interest payable in the P&L) rose from £14m to £18m, even after the debt refinancing, though down from £26m peak in 2109. Still second highest in the Premier League, behind #MUFC £21m, but ahead of #AFC £11m.

All of #THFC financing is external with nothing from the owners in the 10 years up to 2020 (loans and capital). In stark contrast, other owners have been more generous, e.g. #MCFC £837m, #CFC £559m, #AVFC £434m, #EFC £348m, #BHAFC £319m and #LCFC £310m.

Despite the huge loss, Levy was upbeat, “Our strategy is clear: to drive and generate revenues to invest in all our football activities.” With the new stadium finally delivering on its potential, there is cause for optimism, but Antonio Conte needs to drive progress on the pitch.

• • •

Missing some Tweet in this thread? You can try to

force a refresh