BITO – a Bitcoin ETF that was launched in the US – has over $1B in AUM.

But over the course of a month, it underperformed Bitcoin by about 2%!

Why is it failing to keep up with the cryptocurrency that it's supposed to track?

Let's find out! 👇

But over the course of a month, it underperformed Bitcoin by about 2%!

Why is it failing to keep up with the cryptocurrency that it's supposed to track?

Let's find out! 👇

2/ Bitcoin has been around for a while and more people are giving into their FOMO and deciding to invest in BTC.

The US SEC regulator seems to suggest that the best way to do that is via ETFs.

Last month, ProShares launched the first Bitcoin ETF in the US, with more to follow.

The US SEC regulator seems to suggest that the best way to do that is via ETFs.

Last month, ProShares launched the first Bitcoin ETF in the US, with more to follow.

3/ Fantastic!

Once again, ETFs open the markets for retail investors, giving a straightforward way to buy Bitcoin!

Once again, ETFs open the markets for retail investors, giving a straightforward way to buy Bitcoin!

4/ Well, there is one catch.

These ETFs aren't made from fresh Bitcoin - instead, they're just Bitcoin-flavoured funds, made from concentrate.

As such, investors don't receive a direct exposure to BTC but rather through Bitcoin futures.

These ETFs aren't made from fresh Bitcoin - instead, they're just Bitcoin-flavoured funds, made from concentrate.

As such, investors don't receive a direct exposure to BTC but rather through Bitcoin futures.

5/ So what, who cares!? Futures or spot - it's still going to the moon, right?

Sure, why not.

But the ticket to the moon via futures is going to be a little more expensive.

Futures do not track Bitcoin exactly and have additional costs compared to holding Bitcoin spot.

Sure, why not.

But the ticket to the moon via futures is going to be a little more expensive.

Futures do not track Bitcoin exactly and have additional costs compared to holding Bitcoin spot.

6/ And unfortunately, if you're in the US, that's the only route you have for now.

The SEC has been rejecting applications for Bitcoin spot ETFs so far, citing “fraudulent and manipulative acts and practices”.

Hence, a futures-based ETFs is what we have.

The SEC has been rejecting applications for Bitcoin spot ETFs so far, citing “fraudulent and manipulative acts and practices”.

Hence, a futures-based ETFs is what we have.

https://twitter.com/EricBalchunas/status/1459199179293528067

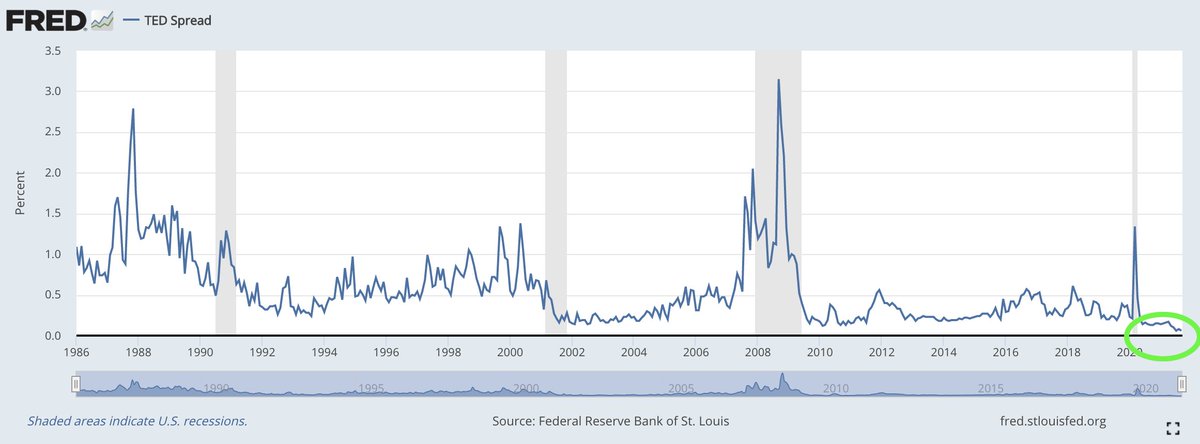

7/ The trouble with futures is that they don't always trade at the same level as spot.

For example, at the time of writing in Nov 2021, Bitcoin was trading at $58,824, whereas the Dec future was priced at $59,615.

This represents a $791 premium or 1.34% over one month.

For example, at the time of writing in Nov 2021, Bitcoin was trading at $58,824, whereas the Dec future was priced at $59,615.

This represents a $791 premium or 1.34% over one month.

8/ The issue is that as time goes by, this premium will eventually evaporate because the futures contract has to converge with spot at expiry:

9/ Therefore, Bitcoin has to appreciate by at least 1.34% for the Dec futures holder just to break even.

Of course, given Bitcoin's volatility, it's not something that can't be done, but it still represents an additional headwind for the holder.

Of course, given Bitcoin's volatility, it's not something that can't be done, but it still represents an additional headwind for the holder.

10/ And maybe it wouldn't have been such a problem if these were perpetual futures.

But CME futures have an expiration date, and you simply cannot HODL it forever.

Once a contract expires, you have to "roll your exposure" and buy a new futures contract.

Also, at a premium.

But CME futures have an expiration date, and you simply cannot HODL it forever.

Once a contract expires, you have to "roll your exposure" and buy a new futures contract.

Also, at a premium.

11/ The further the expiry, the more expensive the contract - a relationship called a contango.

Due to contango, every time we approach the expiry, we have to sell the cheaper futures and buy the more expensive one.

Buy high, sell low.

Due to contango, every time we approach the expiry, we have to sell the cheaper futures and buy the more expensive one.

Buy high, sell low.

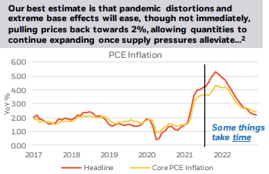

12/ Over time, this adds up to an additional cost, usually termed a "contango bleed".

Using current market data, if we held November contract, it would expire at end of the month.

Selling Nov and buying Dec would cost us 1% on the roll, which is approximately 12% annualized.

Using current market data, if we held November contract, it would expire at end of the month.

Selling Nov and buying Dec would cost us 1% on the roll, which is approximately 12% annualized.

13/ However, this roll cost varies and can be lower or higher, depending on the futures term structure.

Some estimate it can get to as low as 2.5% annually, while others have less optimistic forecasts:

Some estimate it can get to as low as 2.5% annually, while others have less optimistic forecasts:

https://twitter.com/AtlasPulse/status/1450393579617198083

14/ Over time, it can add up to a significant underperformance compared to simply holding Bitcoin.

Don't believe me? Ask the volatility traders.

There is nothing that demonstrates contango bleed better than a VXX fund.

Don't believe me? Ask the volatility traders.

There is nothing that demonstrates contango bleed better than a VXX fund.

15/ VXX uses a similar strategy: it holds VIX futures and rolls them as they expire.

Given that VIX term structure is in contango most of the time, this results in a roll cost.

Adjusting for reverse stock splits, since its launch in 2009, VXX lost 99.94% on contango bleed.

Given that VIX term structure is in contango most of the time, this results in a roll cost.

Adjusting for reverse stock splits, since its launch in 2009, VXX lost 99.94% on contango bleed.

16/ So this leads us to the Bitcoin-linked ETF - BITO.

Despite being SEC-approved, the fund is actually a few levels away from physical (physical?) Bitcoin.

To obtain a consistent Bitcoin exposure for its investors, the BITO fund has to roll the futures and pay the difference.

Despite being SEC-approved, the fund is actually a few levels away from physical (physical?) Bitcoin.

To obtain a consistent Bitcoin exposure for its investors, the BITO fund has to roll the futures and pay the difference.

17/ And even though it's supposed to track Bitcoin, it can't keep up with the cryptocurrency.

Since its inception on 19 October 2021, it has already underperformed Bitcoin spot by around 2%.

Since its inception on 19 October 2021, it has already underperformed Bitcoin spot by around 2%.

18/ At the moment, the fund greatly benefits from the TINA effect and remains one of the few options in the US to gain Bitcoin exposure without a cryptocurrency wallet.

But once Bitcoin spot ETFs become available, it might be difficult for BITO to retain its 1 billion AUM.

But once Bitcoin spot ETFs become available, it might be difficult for BITO to retain its 1 billion AUM.

19/ Thank you so much for taking the time to read this!

I hope you found it valuable.

If you enjoyed this thread, sign up for our newsletter.

It's the #1 FREE finance newsletter on @SubstackInc

gritcapital.substack.com/welcome

I hope you found it valuable.

If you enjoyed this thread, sign up for our newsletter.

It's the #1 FREE finance newsletter on @SubstackInc

gritcapital.substack.com/welcome

20/And follow GRIT AMBASSADOR...

Former Goldman Sachs Quant @perfiliev for more educational threads about stocks, options and other topics within the incredible world of financial markets.

Former Goldman Sachs Quant @perfiliev for more educational threads about stocks, options and other topics within the incredible world of financial markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh