Hey! Ever wondered what's it like to be a degenerate options trader?

Do you know how it feels to make those life-changing gains?

Want to learn how to take excessive risks with your money and lose it all on one trade?

Let me take you on this journey.

Do you know how it feels to make those life-changing gains?

Want to learn how to take excessive risks with your money and lose it all on one trade?

Let me take you on this journey.

2/ Let’s go back to the summer of 2021.

The stock of AMC Entertainment almost doubled on 2 June, closing at $62.55.

Reddit was full of various accounts boasting their AMC gains:

The stock of AMC Entertainment almost doubled on 2 June, closing at $62.55.

Reddit was full of various accounts boasting their AMC gains:

3/ Looks good, doesn’t it? Maybe it’s worth getting into AMC ourselves?

Luckily, on 4 June AMC dipped to $47.91/share.

By now we all know what to do with dips, don't we? ;)

Let’s buy some calls, so we can achieve those +5000% gains of an average WallStreetBets anon account.

Luckily, on 4 June AMC dipped to $47.91/share.

By now we all know what to do with dips, don't we? ;)

Let’s buy some calls, so we can achieve those +5000% gains of an average WallStreetBets anon account.

4/ July 50 calls look good - nice and round number with high open interest and good liquidity.

The price is $2,141 for one contract.

If AMC reaches, say $150 in the next month, the option will pay:

($150 - $50) * 100 = $10,000 minus the premium.

The price is $2,141 for one contract.

If AMC reaches, say $150 in the next month, the option will pay:

($150 - $50) * 100 = $10,000 minus the premium.

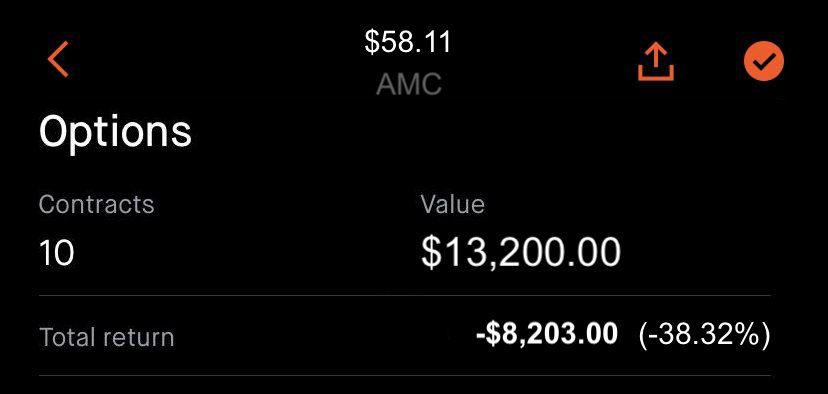

5/ Ok, not bad. With around $25k sitting in the account, we can afford to buy 10 of these bad boys for a total price tag of $21,410.

Potential gains could be $100,000 or more.

It sounds like a perfect YOLO trade!🚀

And it's done! Let's go, baby! #AMCStrong #AMCSqueeze #AMC500k

Potential gains could be $100,000 or more.

It sounds like a perfect YOLO trade!🚀

And it's done! Let's go, baby! #AMCStrong #AMCSqueeze #AMC500k

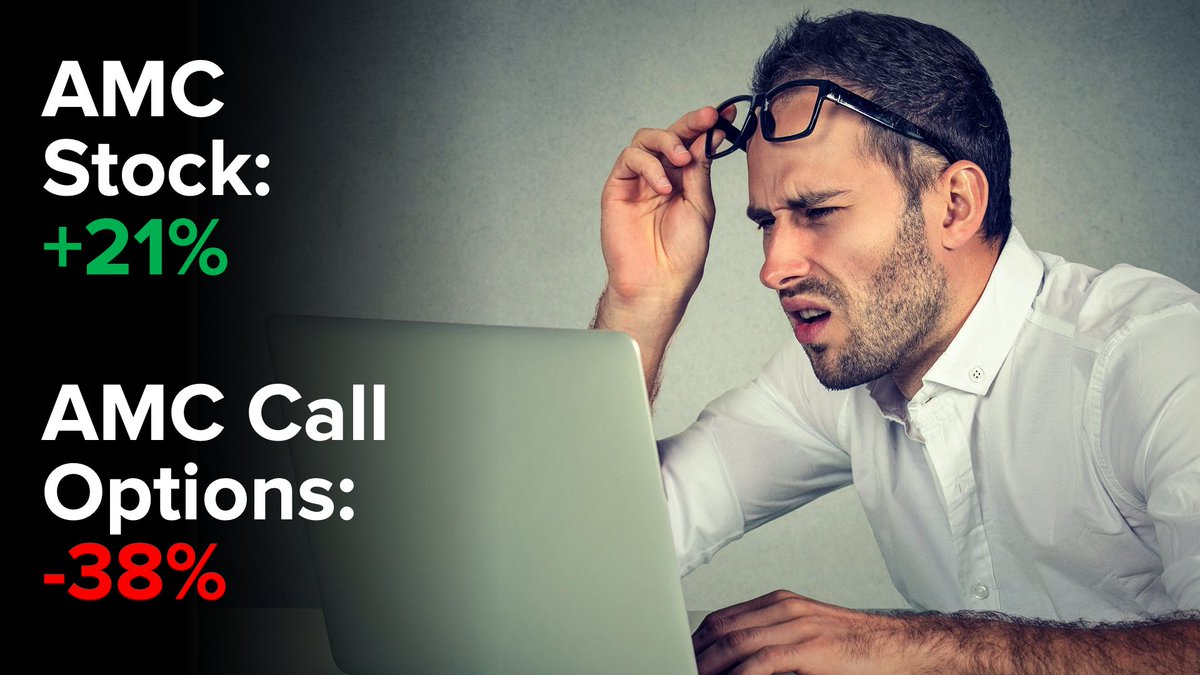

6/ Now, the AMC stock didn't skyrocket but didn’t disappoint either.

It traded above $60 and closed at $58.11 on 28 June.

This is fantastic! Our long calls are in-the-money and probably pumped up our account a bit.

Speaking of which - how much *gainz* did we make? Let's check.

It traded above $60 and closed at $58.11 on 28 June.

This is fantastic! Our long calls are in-the-money and probably pumped up our account a bit.

Speaking of which - how much *gainz* did we make? Let's check.

7/ WHAT?! They lost -38% of the initial value?

How is this even possible when the stock gained +21%?

Did we fat-finger buy puts?

*checks the positions*

No, they're calls. And they're trading at $1,320 each.

Ok, let's cut the losses short and figure out what went wrong.

How is this even possible when the stock gained +21%?

Did we fat-finger buy puts?

*checks the positions*

No, they're calls. And they're trading at $1,320 each.

Ok, let's cut the losses short and figure out what went wrong.

8/ Yes, it’s easy to get swayed by FOMO when the stock shoots for the moon.

However, the aerodynamic properties of your favourite meme-stock is not the only thing to consider when YOLO'ing your hard-earned savings on OTM calls.

However, the aerodynamic properties of your favourite meme-stock is not the only thing to consider when YOLO'ing your hard-earned savings on OTM calls.

9/ Options work in multiple dimensions and are exposed to other factors, in addition to the underlying price.

One of such factors is implied volatility.

Very often, when a meme-stock is headed for the moon, its implied volatility is going the same way.

One of such factors is implied volatility.

Very often, when a meme-stock is headed for the moon, its implied volatility is going the same way.

10/ This represents an additional headwind – it’s more costly to make bets using calls.

For an expensive call option to be profitable - not only the stock needs to rise, but it needs to do so with a LOT of volatility to justify the expensive price tag.

For an expensive call option to be profitable - not only the stock needs to rise, but it needs to do so with a LOT of volatility to justify the expensive price tag.

11/ Unfortunately, this isn’t good news for option holders.

In case the gains from the stock going up (delta) are smaller than the losses from implied volatility falling (vega), then the net position will be a loser.

This is exactly what happened in the AMC example above.

In case the gains from the stock going up (delta) are smaller than the losses from implied volatility falling (vega), then the net position will be a loser.

This is exactly what happened in the AMC example above.

12/ A few days before our trade, AMC closed at $62.55, and its implied volatility spiked to just over 450%.

This is very high, even for the king of memes.

This is very high, even for the king of memes.

13/ When we entered the position on 4 June, the calls we bought traded with an implied vol of 360%.

And by 28 June, volatility further decreased to 180%.

Despite the stock rising +21% over the same period, this was not enough to offset losses from lower implied volatility.

And by 28 June, volatility further decreased to 180%.

Despite the stock rising +21% over the same period, this was not enough to offset losses from lower implied volatility.

14/ In addition to volatility, there is another cost when holding options, known as theta.

Since options are a decaying asset, they lose value as time goes by - with less time, there's less opportunity for the stock price to cross over the option's strike.

Since options are a decaying asset, they lose value as time goes by - with less time, there's less opportunity for the stock price to cross over the option's strike.

15/ When buying out-of-the-money options, the entire option's premium represents the so-called "time-value", which will disappear by expiration date.

Unless changes in underlying price or implied volatility offset this, the option value will decay with each passing day.

Unless changes in underlying price or implied volatility offset this, the option value will decay with each passing day.

16/ This decay is not linear, however, here's what we can do to approximate the cost of holding a near-dated OTM options position.

Time Decay = Option's Premium / Days to Expiration

This number will tell us how much, on average, it costs us to keep a long option position open.

Time Decay = Option's Premium / Days to Expiration

This number will tell us how much, on average, it costs us to keep a long option position open.

17/ In the example, the total cost to purchase 10 OTM calls was $21,410

There were 42 days till expiry. Hence, each day we would expect to lose:

$21,410 / 42 = $510

AMC might be going to the moon, but it has to go there fast for our options to overcome the theta burn of $510.

There were 42 days till expiry. Hence, each day we would expect to lose:

$21,410 / 42 = $510

AMC might be going to the moon, but it has to go there fast for our options to overcome the theta burn of $510.

18/ Any unfavourable moves in stock or implied vol will add to theta losses.

When buying a call, it helps to get a quick sense of how quickly the option will decay.

Is there room for implied vol to rise to compensate for that?

Or will the shares do most of the heavy lifting?

When buying a call, it helps to get a quick sense of how quickly the option will decay.

Is there room for implied vol to rise to compensate for that?

Or will the shares do most of the heavy lifting?

19/ If the implied vol is high - and with meme stocks it usually is - the theta burn will be ruthless.

Even a significant rise in the stock might not be enough to offset the time decay.

And this is something to keep in mind during the next episode of an options-related FOMO...

Even a significant rise in the stock might not be enough to offset the time decay.

And this is something to keep in mind during the next episode of an options-related FOMO...

20/ Thank you so much for taking the time to read this!

I hope you found it valuable.

If you enjoyed this thread, please sign up for our newsletter to make sure you won't miss the next one!

gritcapital.substack.com/welcome

I hope you found it valuable.

If you enjoyed this thread, please sign up for our newsletter to make sure you won't miss the next one!

gritcapital.substack.com/welcome

21/ And follow GRIT AMBASSADOR (and former Goldman Sachs Quant) @perfiliev for more educational threads about stocks, options and other topics within the incredible world of financial markets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh