So after Oxford @nanopore's #NCM21 tech dev presentation, where does this leave ONT technology in comparison of Illumina? (thread)

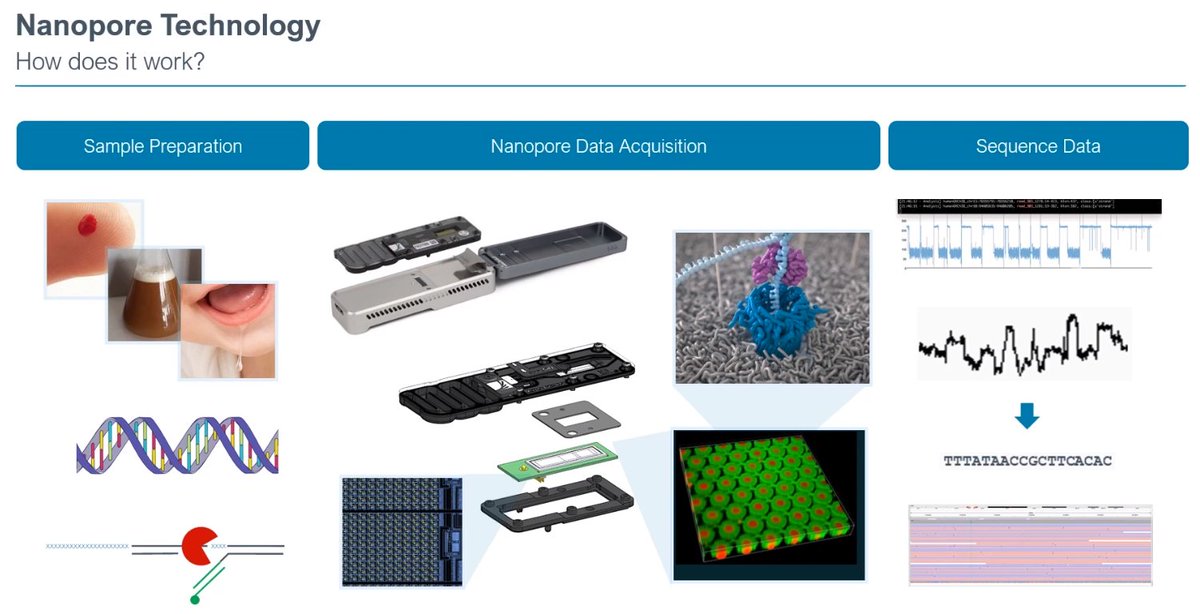

The ONT technology offers a lower barrier to entry with the MinION, and this results in a competitive advantage over turn-around time sensitive applications (Point of Care settings).

ONT showed their competitiveness in both long-read and short-read applications yesterday, a limitation for Illumina which tried to overcome with their failed attempt to acquire PacBio.

Overall, all applications benefit from longer reads, except Liquid Biopsy cfDNA, where the fragments are of an average 166bp. So a long-read technology gives better completeness and haplotypic information in a native form.

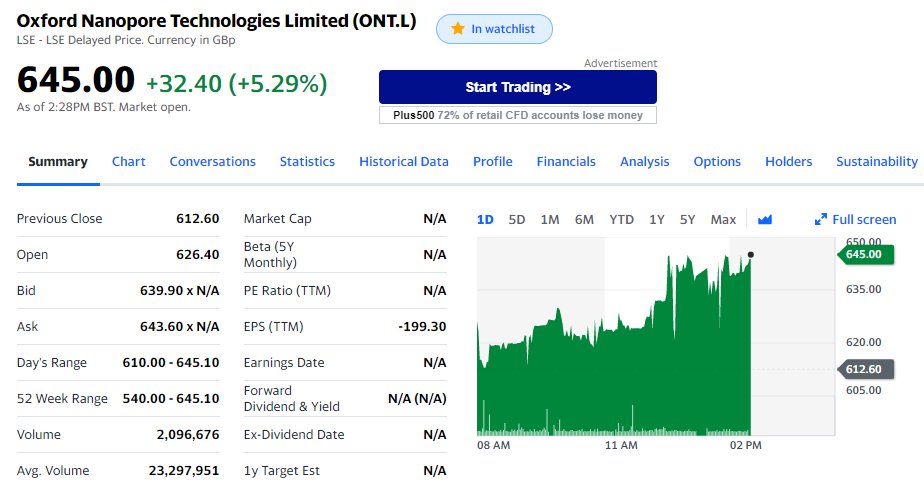

In terms of pricing, ONT announced their PromethION flowcell can now achieve a $1000 genome, including their P2 kits. There is a range here, as depending on the sample type and volume, we can probably talk of around $3500-500 range. Illumina is in a similar range but ...

... has more experience in delivering short-read $600 genomes in their NovaSeq platform. The NextSeq 2000 is probably closer to $1200 and anything smaller is in the $2000-5000 range.

The NCM21 presentation by ONT gives us a current state-of-the-art timepoint in terms of accuracy: Q20+ for simplex reads, and near Q30 for duplex, with a current efficiency of around 30-40% (to be released in 2022). Illumina has been in the 80-85% of reads at Q30+ for a while.

In some applications, the inflection point is already at Q20 level: the improvements of ONT's kit12 demonstrate that there isn't much more left to achieve for SNP and Indel calling. Same for consensus assembly of microbial genomes, now at QV50 for 20x coverage.

For other applications, until most of the reads are at Q30, Illumina will still have an advantage. ONT showed their "adaptive sampling + adaptive accuracy" concept, which could be in commercial shape in a year or two (?), which would in my opinion close the gap almost completely.

Final open question: do you think Oxford Nanopore will overtake Illumina in terms of sequencing market share, revenue, etc. in the next ten years? Difficult to say, in my opinion, but there is definitely a path for Illumina to move into Diagnostics (Grail Bio, NIPT) and ...

... with that, give up a significant chunk of their market share of their current instrument+reagents market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh