A number of you have asked about my portfolio holdings, so here it is -

Long - US$ futures, $TLT , US$ cash

Short - $ARKK $ARKF #NQ_F $NET $RIVN

Word of caution - This is not a recommendation and depending on what happens in the markets, this might change quickly.

Long - US$ futures, $TLT , US$ cash

Short - $ARKK $ARKF #NQ_F $NET $RIVN

Word of caution - This is not a recommendation and depending on what happens in the markets, this might change quickly.

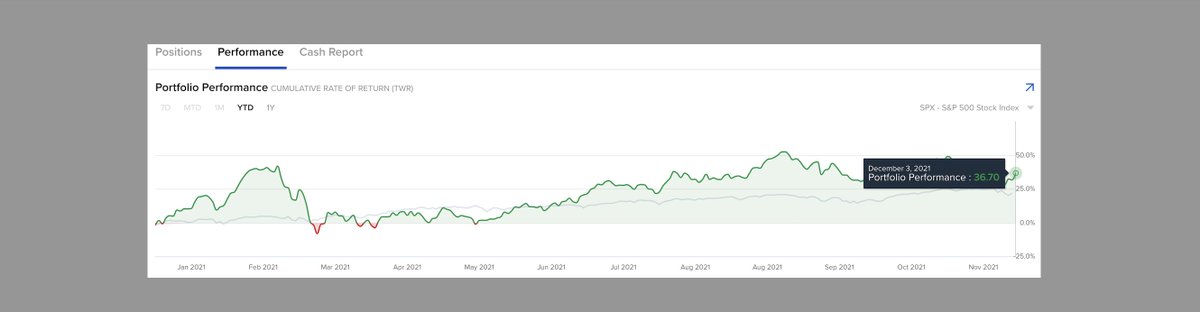

To the trolls who are again chirping and claiming I'm being dishonest about my holdings. Attached is my YTD portfolio performance graph .... +36.7%

This return wouldn't be possible if I was still long growth stocks and faking my holdings.

This return wouldn't be possible if I was still long growth stocks and faking my holdings.

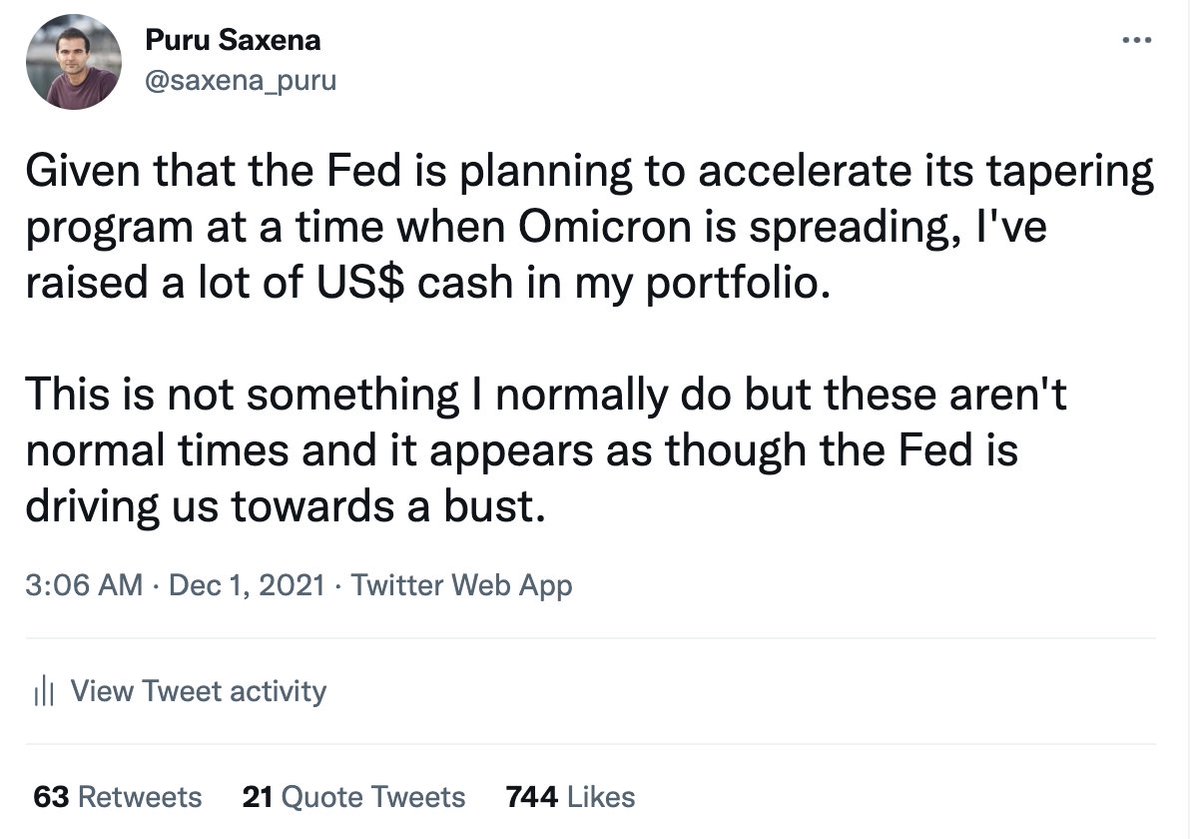

Here is the post from 1 December where I wrote about raising a lot of cash, ended up selling all remaining long positions.

Hope this clarifies this matter.

Hope this clarifies this matter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh