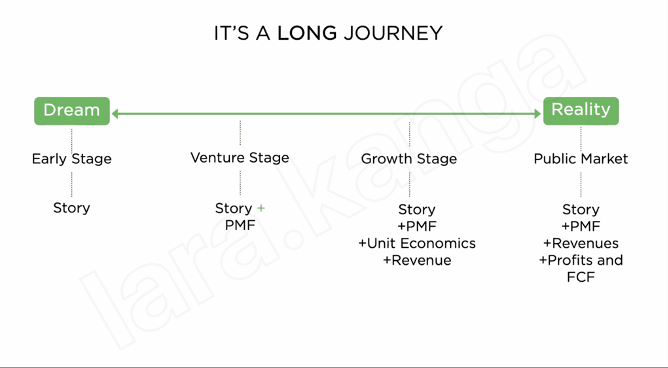

1 of t/ top reasons #startups fail is not having enough capital, or not raising $.

@i_JaspriyaKaur & @Sahiba_Gambhir take #founders through using #Finance as a #moat.

More on bad math vs healthy financial practices & building a strong foundation frm day 1 👇

#TuesdayTalkies 🧵

@i_JaspriyaKaur & @Sahiba_Gambhir take #founders through using #Finance as a #moat.

More on bad math vs healthy financial practices & building a strong foundation frm day 1 👇

#TuesdayTalkies 🧵

2/ Don’t confuse revenue w/terms like GMV, ARR, Bookings etc. Revenue is a key metric which determines business depth and valuations; however it can be easily misinterpreted/misunderstood.

#TuesdayTalkies @i_JaspriyaKaur @Sahiba_Gambhir

#Surge05 #GetReadyToSurge

#TuesdayTalkies @i_JaspriyaKaur @Sahiba_Gambhir

#Surge05 #GetReadyToSurge

3/ Good math is imperative for good Unit Economics. It's important to keep evaluating your biz assumptions as UE are fragile @ initial stages. Certain assumptions made when you hit the market may not pan out as expected. Fix the UE piece first before going all out on growth.

4/ ✅Track the right metrics for the right results.

✅Taxes & reg compliances are critical, an oversight can impact the bottom line.

✅Focus on your balance sheet. The top line could show great momentum but receivables issues could make you run out of cash sooner than expected.

✅Taxes & reg compliances are critical, an oversight can impact the bottom line.

✅Focus on your balance sheet. The top line could show great momentum but receivables issues could make you run out of cash sooner than expected.

• • •

Missing some Tweet in this thread? You can try to

force a refresh