High European gas prices has many reasons but one factor seems to be Gazprom's low storage fill in Europe. Is that really true? Let us look at the facts of @Gazprom's storage situation in Europe. 1/...

#EU #NaturalGas

#EU #NaturalGas

Friendly reminder: The EU imports 33% of its natural gas consumption from Russia, i.e. Gazprom! So if gas is short in Europe, Gazprom does matter. 2/...

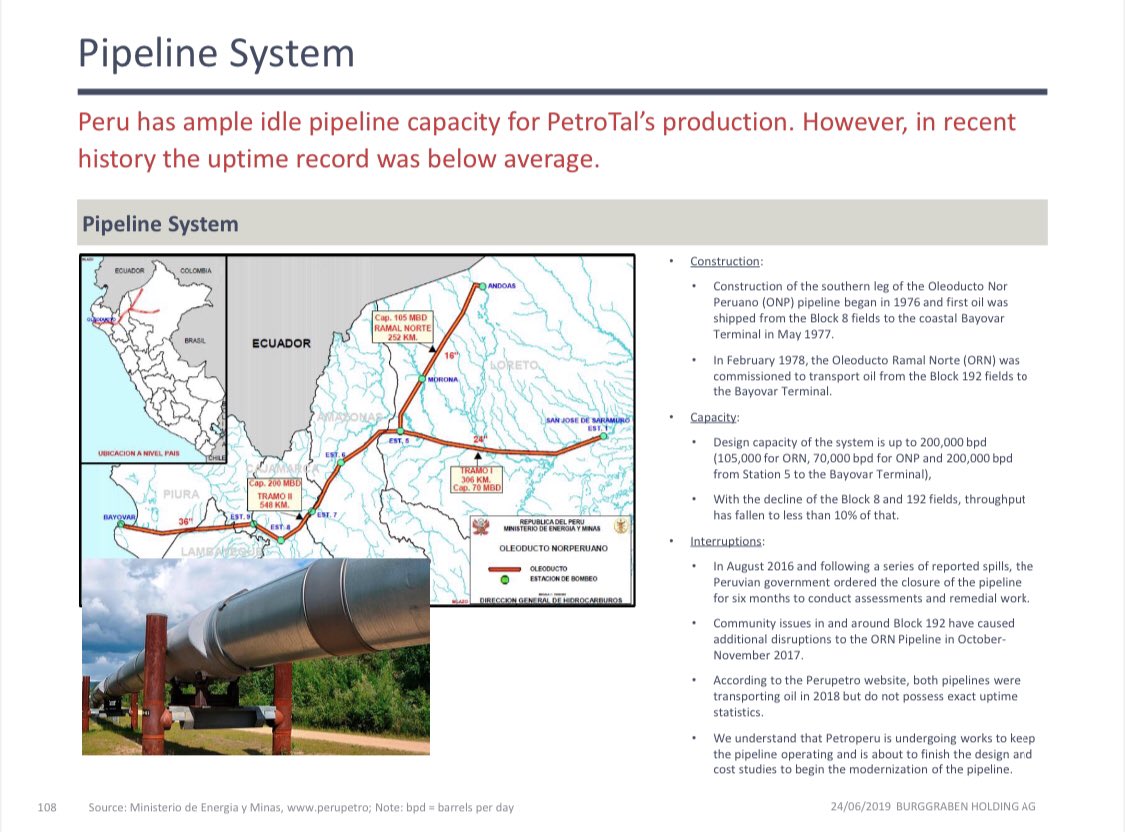

So can we measure the storage percentage fill of Gazprom? Yes, once we identified its locations. Specifically, they are Rehden, Etzel, Jemgum, Katharina in Germany, Haidach in Austria, Bergermeer in NL, Damborice in Czech & Banatski Dvor in Serbia. 3/..

Source: Gazprom

Source: Gazprom

The result: Gazprom storage in Western Europe is 24.6% filled as of 5/11/2021. As they say: thanks for nothing!

Note: we do not have data for Serbia & Czech. But it is irrelavant. The big 3 - Rehden, Haidach & Bergermeer matter. 4/...

Note: we do not have data for Serbia & Czech. But it is irrelavant. The big 3 - Rehden, Haidach & Bergermeer matter. 4/...

Haiden (Austria): 2%

Pro Memoria: Austria is the gas hub of Central & Eastern Europe - 80 million people.

6/...

Pro Memoria: Austria is the gas hub of Central & Eastern Europe - 80 million people.

6/...

Bergermeer (Netherlands): 30%

Pro Memoria: The Netherlands are the gas hub of Western Europe (TTF = Title Transfer Facility) = (Henry Hub role in US). Think: what happened when Cushing wasn't able to clear last spring etc.

7/..

Pro Memoria: The Netherlands are the gas hub of Western Europe (TTF = Title Transfer Facility) = (Henry Hub role in US). Think: what happened when Cushing wasn't able to clear last spring etc.

7/..

Which leads me to Groningen which produes at constrained 8.5bcm in 2021; capable of 20bcm? Size of EU gas market: 470bcm in 2019, ie 4.2%? This SWING producer (like Ghawar) must continue geopolitically. Period.

8/

@billpowers1970 @markrutte @vonderleyen

8/

@billpowers1970 @markrutte @vonderleyen

https://twitter.com/BurggrabenH/status/1441428365584502785?s=20

Counting on more LNG imports? Well, LNG is highly sought after globally. As the global link of local markets, it accelerates gas price convergence. LNG is already 50% of global gas trade & will continue to grow as long as China tries to replace its coal input.

9/...

9/...

Having doubts on price convergence? Since January 2020, Asian LNG prices (quotes as JKM or Japan-Korea Cargo Swaps) have basically converged with EU TTF prices. The link? LNG imports. 10/..

Source: Burggraben analysis; Bloomberg

Source: Burggraben analysis; Bloomberg

Of course, other factors mattered too. For instance EU regulators. They pushed to abandon Oil-Gas Linked contracts during times of high oil prices (pre-2014) to protect consumers. Result: Gazprom trades 80% GOG - Gas to Gas Price today (i.e. by d/s market forces). 11/...

End of thread. Please share. Thx

• • •

Missing some Tweet in this thread? You can try to

force a refresh