@WhiteWhaleTerra has launched LBP sale of their $WHALE token.

You are probably wondering, what is a good price to buy.

May I help with that?

🧵👇

/1

You are probably wondering, what is a good price to buy.

May I help with that?

🧵👇

/1

https://twitter.com/WhiteWhaleTerra/status/1469895392649224194

LBP is not exactly the only place to get your hands on the $WHALE token - there is another one!

That place is @pylon_protocol Gateway:

gateway.pylon.money/tokens/whale

There are 3 pools available - 6M, 12M and 18M.

Let's take a closer look at them.

/2

That place is @pylon_protocol Gateway:

gateway.pylon.money/tokens/whale

There are 3 pools available - 6M, 12M and 18M.

Let's take a closer look at them.

/2

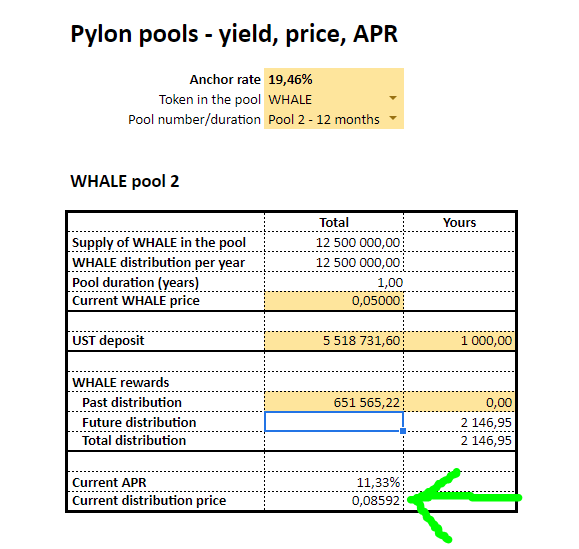

Total $WHALE available in the pools and total $UST deposits are:

18M - 32.5M $WHALE - 5.0M $UST

12M - 12.5M $WHALE - 5.5M $UST

6M - 5.0M $WHALE - 6.75M $UST

Based on that - and assuming Anchor Earn as the opportunity cost - we can calculate the price of $WHALE in Pylon.

/3

18M - 32.5M $WHALE - 5.0M $UST

12M - 12.5M $WHALE - 5.5M $UST

6M - 5.0M $WHALE - 6.75M $UST

Based on that - and assuming Anchor Earn as the opportunity cost - we can calculate the price of $WHALE in Pylon.

/3

Cutting to the chase, the prices are:

18M --- 0,04494 $UST

12M --- 0,08592 $UST

6M --- 0,13136 $UST

/4

18M --- 0,04494 $UST

12M --- 0,08592 $UST

6M --- 0,13136 $UST

/4

I have additionally reverse-engineered the APR calculation of Pylon and figured that the APRs shown assume the base $WHALE price of ~0.05 $UST.

That's another hint beside the one above.

/5

That's another hint beside the one above.

/5

Now, there are 2 things worth remembering:

- LBP is a swap - you get your tokens immediately, your $UST is gone

- Pylon Pools have a lockup period, but you get your $UST back at the pool maturity

Considering this, I predict the market price to be north of $0.13.

- LBP is a swap - you get your tokens immediately, your $UST is gone

- Pylon Pools have a lockup period, but you get your $UST back at the pool maturity

Considering this, I predict the market price to be north of $0.13.

Feel free to check the math and do your own calculations using my "Terra Tools and resources" Google Sheet:

docs.google.com/spreadsheets/d…

Just remember to make a copy for yourself - no way in hell I will give you editing permissions. ;-)

/7-end

docs.google.com/spreadsheets/d…

Just remember to make a copy for yourself - no way in hell I will give you editing permissions. ;-)

/7-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh