🚀 2x $ETH Leverage with NO Liquidation🚀

@IndexCoop is excited to announce the @TokenSets Polygon deployment of...

ETH 2x Flexible Leverage Index (FLI) ON POLYGON!

Another great example of composability utilizing the @AaveAave Leverage Module.

ZERO LIQUIDATION?🧵

1/⤵️

@IndexCoop is excited to announce the @TokenSets Polygon deployment of...

ETH 2x Flexible Leverage Index (FLI) ON POLYGON!

Another great example of composability utilizing the @AaveAave Leverage Module.

ZERO LIQUIDATION?🧵

1/⤵️

#ETH2xFLIP is an ERC20 token that enables traders to automate leverage to $ETH in a decentralized way using the Aave Leverage Module.

Polygon means investors and Asset Managers, like @IndexCoop, can take advantage of cheaper and faster transactions.

Aave Leverage Module?

2/⤵️

Polygon means investors and Asset Managers, like @IndexCoop, can take advantage of cheaper and faster transactions.

Aave Leverage Module?

2/⤵️

Aave Leverage Module (ALM) - the @TokenSets smart contract, on Polygon & Ethereum, enables leveraged trading

Uses a Debt Issuance Module that calls functions on the ALM to maintain the interest & liquidation state (auto leverage rebalancing)

How does @IndexCoop use ALM?

3/⤵️

Uses a Debt Issuance Module that calls functions on the ALM to maintain the interest & liquidation state (auto leverage rebalancing)

How does @IndexCoop use ALM?

3/⤵️

The @IndexCoop uses the ALM to power the $FLI Flexible Leverage Index product series.

This automatically levers and delevers the product depending on specific thresholds and parameters.

This ultimately ensures zero liquidation and fully manages the product for investors.

4/⤵️

This automatically levers and delevers the product depending on specific thresholds and parameters.

This ultimately ensures zero liquidation and fully manages the product for investors.

4/⤵️

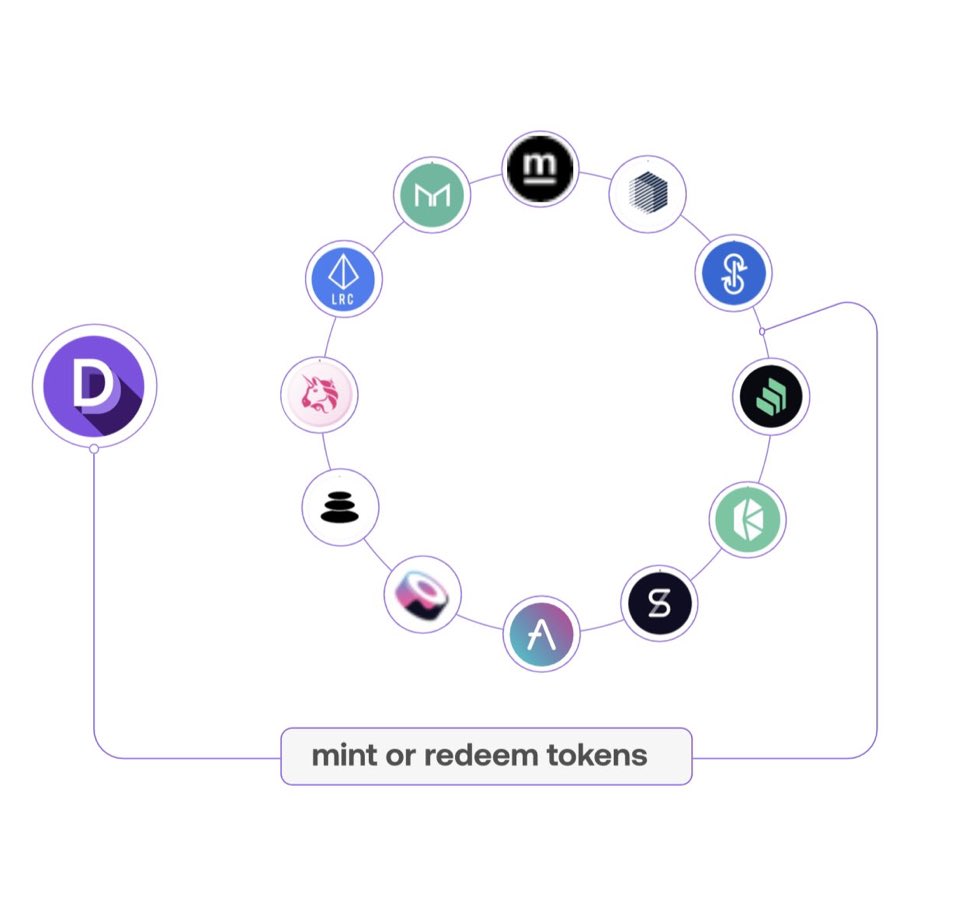

With @TokenSet's infrastructure and the ALM, users unlock the full composability of their assets.

Enabling integration into the broader ecosystem and services to more use-cases.

@IndexCoop🤝 @TokenSets🤝@DeFiPulse🤝@AaveAave🤝@0xPolygon

Bullish on $INDEX yet, anon?

5/🛑

Enabling integration into the broader ecosystem and services to more use-cases.

@IndexCoop🤝 @TokenSets🤝@DeFiPulse🤝@AaveAave🤝@0xPolygon

Bullish on $INDEX yet, anon?

5/🛑

• • •

Missing some Tweet in this thread? You can try to

force a refresh