1/

14 DeFi Tokens All Wrapped Into ONE

- The S&P 500 of DeFi 📈

- Strict/transparent token inclusion criteria 🤓

- Redeem underlying tokens any time 💰

- Market-cap weighted 🏋🏼♂️

- Auto-rebalancing ⚖️

- Socialize transaction costs ⛽️

- Diversified #DeFi 😎

$DPI Thread 🧵 👇🏼

14 DeFi Tokens All Wrapped Into ONE

- The S&P 500 of DeFi 📈

- Strict/transparent token inclusion criteria 🤓

- Redeem underlying tokens any time 💰

- Market-cap weighted 🏋🏼♂️

- Auto-rebalancing ⚖️

- Socialize transaction costs ⛽️

- Diversified #DeFi 😎

$DPI Thread 🧵 👇🏼

2/

What is the DeFi Pulse Index token $DPI?

The DeFi Pulse Index is a capitalization-weighted index that tracks the performance of decentralized financial assets across the market.

Cool video by @earth_maze

What is the DeFi Pulse Index token $DPI?

The DeFi Pulse Index is a capitalization-weighted index that tracks the performance of decentralized financial assets across the market.

Cool video by @earth_maze

3/

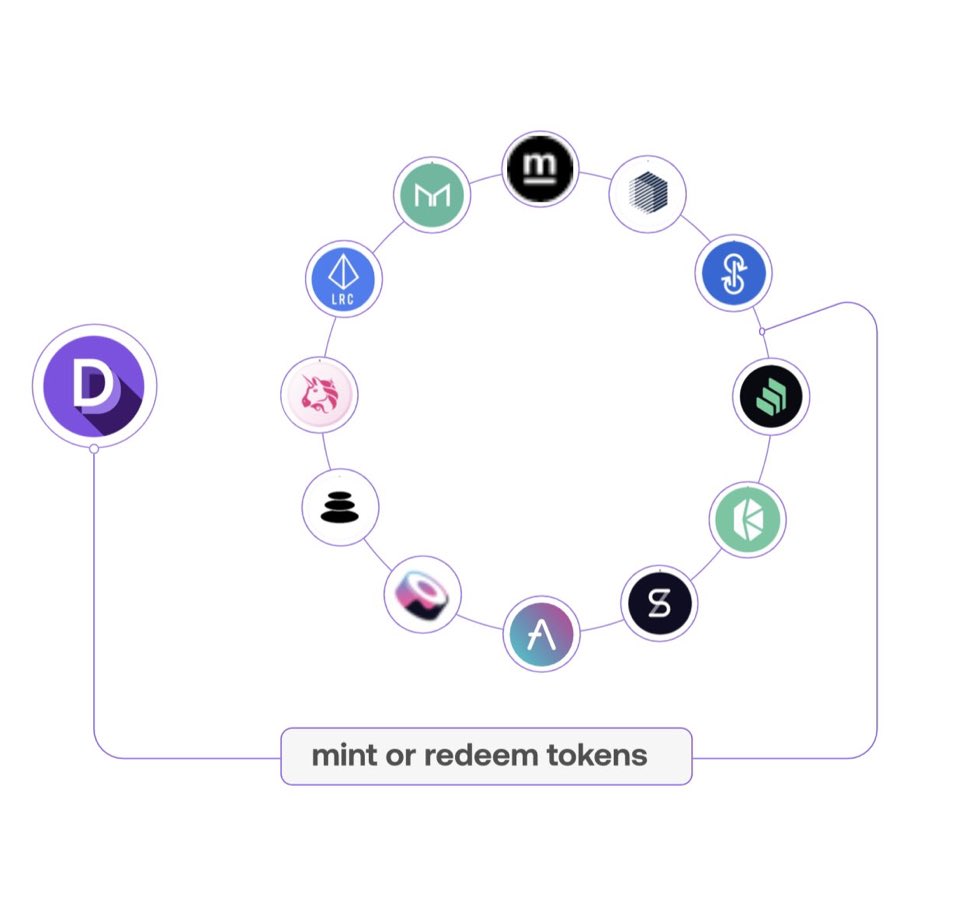

DPI is a crypto index designed to track DeFi’s performance. Market cap-weighted based on circulating supply, DPI tracks projects in #DeFi that show a commitment to ongoing maintenance and development.

@sassal0x explains on @BanklessHQ podcast

DPI is a crypto index designed to track DeFi’s performance. Market cap-weighted based on circulating supply, DPI tracks projects in #DeFi that show a commitment to ongoing maintenance and development.

@sassal0x explains on @BanklessHQ podcast

4/

Allocations as of 7/14:

$UNI $AAVE $MKR $COMP $SNX $SUSHI $YFI $REN $LRC $BAL $KNC $CREAM $FARM $MTA

Future potential inclusions?

Allocations as of 7/14:

$UNI $AAVE $MKR $COMP $SNX $SUSHI $YFI $REN $LRC $BAL $KNC $CREAM $FARM $MTA

Future potential inclusions?

5/

What can I do with $DPI?

LP - @Uniswap, @SushiSwap, @loopringorg

Leveraged LPs - @ImpermaxFinance, @AlphaFinanceLab

Yield Farming - @harvest_finance

Lend & Borrow - @CreamdotFinance

Liquidity Mining - @indexcoop

Collateral Debt Position - @unitprotocol, @SushiSwap

What can I do with $DPI?

LP - @Uniswap, @SushiSwap, @loopringorg

Leveraged LPs - @ImpermaxFinance, @AlphaFinanceLab

Yield Farming - @harvest_finance

Lend & Borrow - @CreamdotFinance

Liquidity Mining - @indexcoop

Collateral Debt Position - @unitprotocol, @SushiSwap

6/

Hoot Hoot 🦉 That’s all!

I’ll see you all at #DeFi Summer in NYC! 🗽

Featuring:

@RebeccaRettig1 of @AaveAave

@dgogel of @dydxprotocol

@lay2000lbs of @PoolTogether_

@mdudas of @TheBlock__

Hoot Hoot 🦉 That’s all!

I’ll see you all at #DeFi Summer in NYC! 🗽

Featuring:

@RebeccaRettig1 of @AaveAave

@dgogel of @dydxprotocol

@lay2000lbs of @PoolTogether_

@mdudas of @TheBlock__

• • •

Missing some Tweet in this thread? You can try to

force a refresh