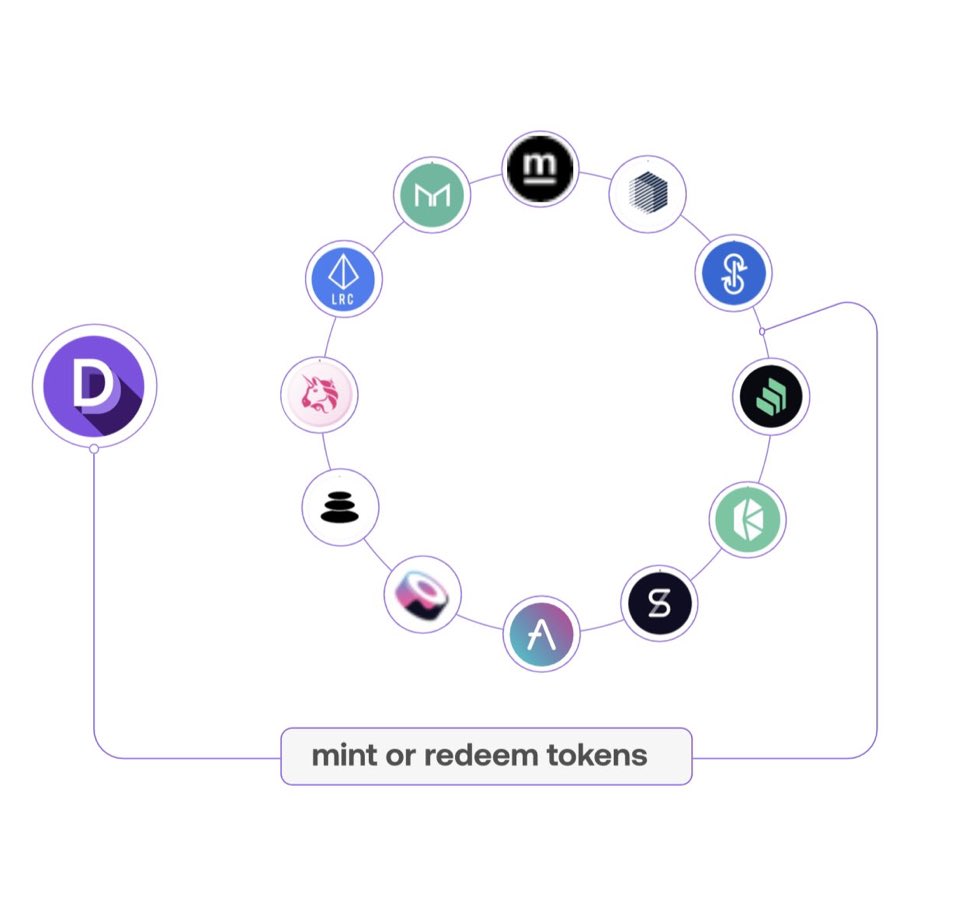

Want to invest in multi-chain and L2 #DeFi projects?

DeFi Pulse Index - $DPI might be your answer.

13 of the 17 asset held in $DPI have deployed on multiple L1s, sidechains, and L2s.

Let's see who they are🧵This is some really interesting information!

1/⤵️

DeFi Pulse Index - $DPI might be your answer.

13 of the 17 asset held in $DPI have deployed on multiple L1s, sidechains, and L2s.

Let's see who they are🧵This is some really interesting information!

1/⤵️

First, where are $DPI protocols deployed?

@Ethereum - 17

@0xPolygon - 10

@Arbitrum - 7

@BinanceChain - 6

@AvalancheAVAX - 6

@FantomFDN - 5

@OptimismPBC - 2

@solana - 1

@CeloOrg - 1

@HECO_Chain - 1

@xDaiChain - 1

@PalmNFT - 1

@HarmonyProtocol- 1

@MoonriverNW- 1

@OKEx - 1

2/⤵️

@Ethereum - 17

@0xPolygon - 10

@Arbitrum - 7

@BinanceChain - 6

@AvalancheAVAX - 6

@FantomFDN - 5

@OptimismPBC - 2

@solana - 1

@CeloOrg - 1

@HECO_Chain - 1

@xDaiChain - 1

@PalmNFT - 1

@HarmonyProtocol- 1

@MoonriverNW- 1

@OKEx - 1

2/⤵️

4 $DPI assets are only on the #Ethereum mainnet:

- @CompoundFinance - $COMP

- @MakerDAO - $MKR

- @VesperFi - $VSP

- @LoopringOrg* - $LRC*

*Loopring is actually its own L2 DEX protocol built with zkRollups for Ethereum. So, we'll say that it's on 1.5 chains.

3/⤵️

- @CompoundFinance - $COMP

- @MakerDAO - $MKR

- @VesperFi - $VSP

- @LoopringOrg* - $LRC*

*Loopring is actually its own L2 DEX protocol built with zkRollups for Ethereum. So, we'll say that it's on 1.5 chains.

3/⤵️

3 of the $DPI assets are on 2 different chains (including #Ethereum):

- @iearnfinance - $YFI - @FantomFDN

- @mStable_ - $MTA - @0xPolygon

- @Synthetix_io - $SNX - @OptimismPBC

Interesting how they are all different here.

4/ ⤵️

- @iearnfinance - $YFI - @FantomFDN

- @mStable_ - $MTA - @0xPolygon

- @Synthetix_io - $SNX - @OptimismPBC

Interesting how they are all different here.

4/ ⤵️

4 of the $DPI assets are on 3 different chains (including #Ethereum):

- $AAVE - @0xPolygon, @AvalancheAVAX

- $BAL - @0xPolygon, @Arbitrum

- $FARM - @0xPolygon, @BinanceChain

- $UNI - @Arbitruim, @OptimismPBC

@Uniswap - not a Polygon fan apparently?

5/⤵️

- $AAVE - @0xPolygon, @AvalancheAVAX

- $BAL - @0xPolygon, @Arbitrum

- $FARM - @0xPolygon, @BinanceChain

- $UNI - @Arbitruim, @OptimismPBC

@Uniswap - not a Polygon fan apparently?

5/⤵️

2 of the $DPI assets are on 4 different chains (including #Ethereum):

- $BADGER - @0xPolygon, @Arbitruim, @BinanceChain

- $INST - @0xPolygon, @Arbitruim, @AvalancheAVAX

Only difference here is #BSC vs #AVAX

6/⤵️

- $BADGER - @0xPolygon, @Arbitruim, @BinanceChain

- $INST - @0xPolygon, @Arbitruim, @AvalancheAVAX

Only difference here is #BSC vs #AVAX

6/⤵️

1 of the $DPI assets is on 5 different chains (including #Ethereum):

- @KyberNetwork - $KNC - @0xPolygon, @BinanceChain, @AvalancheAVAX, @FantomFDN

Interesting how we don't see any L2s here from Kyber.

7/⤵️

- @KyberNetwork - $KNC - @0xPolygon, @BinanceChain, @AvalancheAVAX, @FantomFDN

Interesting how we don't see any L2s here from Kyber.

7/⤵️

1 of the $DPI assets is on 6 different chains (including #Ethereum):

- @CreamdotFinance - $CREAM - @0xPolygon, @Arbitrum, @BinanceChain, @AvalancheAVAX, @FantomFDN

$CREAM, built for apes, by apes 🐵

8/⤵️

- @CreamdotFinance - $CREAM - @0xPolygon, @Arbitrum, @BinanceChain, @AvalancheAVAX, @FantomFDN

$CREAM, built for apes, by apes 🐵

8/⤵️

1 of the $DPI assets is on 7 different chains (including #Ethereum):

- @RenProtocol - $REN - @0xPolygon, @Arbitrum, @BinanceChain, @AvalancheAVAX, @FantomFDN, @Solana

Only difference here between $REN and $CREAM is @Solana

9/⤵️

- @RenProtocol - $REN - @0xPolygon, @Arbitrum, @BinanceChain, @AvalancheAVAX, @FantomFDN, @Solana

Only difference here between $REN and $CREAM is @Solana

9/⤵️

@SushiSwap is deployed on 13 different protocols 🤯

Which means:

@Ethereum

@0xPolygon

@Arbitrum

@BinanceChain

@AvalancheAVAX

@FantomFDN

@Solana

@HECO_Chain

@xDaiChain

@PalmNFT

@HarmonyProtocol

@MoonriverNW

@OKEx

The only one it's not deployed on is @OptimismPBC

wow.

10/⤵️

Which means:

@Ethereum

@0xPolygon

@Arbitrum

@BinanceChain

@AvalancheAVAX

@FantomFDN

@Solana

@HECO_Chain

@xDaiChain

@PalmNFT

@HarmonyProtocol

@MoonriverNW

@OKEx

The only one it's not deployed on is @OptimismPBC

wow.

10/⤵️

That's 17 #DeFi protocols spread across 14 different L2s, L1s, and Sidechains.

Diverse DeFi Exposure

Socialized Gas Cost

Diverse Multi-Chain Exposure

Automatic Rebalancing

17 tokens on 14 chains with ONE CLICK

$DPI

11/🛑

Diverse DeFi Exposure

Socialized Gas Cost

Diverse Multi-Chain Exposure

Automatic Rebalancing

17 tokens on 14 chains with ONE CLICK

$DPI

11/🛑

• • •

Missing some Tweet in this thread? You can try to

force a refresh