🦉The DeFi Pulse Index - $DPI 🦉

Seeing a lot of new users in the Discord asking questions about $DPI, so:

- What is the DeFi Pulse Index?

- What is #DeFi?

- How does it work?

- Who manages the index?

- Who controls the assets?

Let's take a look in this thread🧵👇🏽

Seeing a lot of new users in the Discord asking questions about $DPI, so:

- What is the DeFi Pulse Index?

- What is #DeFi?

- How does it work?

- Who manages the index?

- Who controls the assets?

Let's take a look in this thread🧵👇🏽

1a/

What is DeFi? 🤔

Decentralized finance, or #DeFi, is an ecosystem of financial applications built primarily on the #Ethereum blockchain.

The industry has ballooned from $1bn in Q120 to $85bn in Q321.

probably nothing...

What is DeFi? 🤔

Decentralized finance, or #DeFi, is an ecosystem of financial applications built primarily on the #Ethereum blockchain.

The industry has ballooned from $1bn in Q120 to $85bn in Q321.

probably nothing...

1b/

What is DeFi? 🤔

DeFi relies entirely on software protocols, allowing for permissionless and trustless financial activity.

What is DeFi? 🤔

DeFi relies entirely on software protocols, allowing for permissionless and trustless financial activity.

1d/

What is DeFi? 🤔

DeFi eliminates the need for centralized entities to operate as intermediaries (and gatekeepers), which improves access to the financial system.

What is DeFi? 🤔

DeFi eliminates the need for centralized entities to operate as intermediaries (and gatekeepers), which improves access to the financial system.

2a/

DeFi is Vast, Complex, and Growing🚀

DeFi allows for superior composability and interoperability relative to the legacy financial system, which has resulted in explosive growth but also challenges to adding portfolio exposure.

DeFi is Vast, Complex, and Growing🚀

DeFi allows for superior composability and interoperability relative to the legacy financial system, which has resulted in explosive growth but also challenges to adding portfolio exposure.

2b/

DeFi is Vast, Complex, and Growing🚀

Picking winners is difficult.

The time, research, and expertise required to keep pace with the ecosystem’s evolution is onerous.

DeFi is Vast, Complex, and Growing🚀

Picking winners is difficult.

The time, research, and expertise required to keep pace with the ecosystem’s evolution is onerous.

2c/

DeFi is Vast, Complex, and Growing🚀

Active management is costly. Idiosyncratic risk is high.

Managing, rebalancing, and rotating individual DeFi positions can become expensive and tax-inefficient. Individual protocols can be highly volatile.

DeFi is Vast, Complex, and Growing🚀

Active management is costly. Idiosyncratic risk is high.

Managing, rebalancing, and rotating individual DeFi positions can become expensive and tax-inefficient. Individual protocols can be highly volatile.

3a/

Enter the DeFi Pulse Index - $DPI 💰

The DeFi Pulse Index is a market cap-weighted index providing exposure to 15 top decentralized finance protocols.

Enter the DeFi Pulse Index - $DPI 💰

The DeFi Pulse Index is a market cap-weighted index providing exposure to 15 top decentralized finance protocols.

3b/

Enter the DeFi Pulse Index - $DPI 💰

No need to pick winners: DPI provides target diversified exposure to a basket of blue-chip DeFi protocols

Low costs & tax efficient: Passive rebalancing eliminates the need to actively execute multiple expensive on-chain transactions

Enter the DeFi Pulse Index - $DPI 💰

No need to pick winners: DPI provides target diversified exposure to a basket of blue-chip DeFi protocols

Low costs & tax efficient: Passive rebalancing eliminates the need to actively execute multiple expensive on-chain transactions

3c/

Enter the DeFi Pulse Index - $DPI 💰

No impermanent loss: @SetProtocol's audited infrastructure avoids underperformance from the IL experienced with AMM-based solutions.

Strict criteria: Must meet high standards for token quality/supply, project traction, & user safety

Enter the DeFi Pulse Index - $DPI 💰

No impermanent loss: @SetProtocol's audited infrastructure avoids underperformance from the IL experienced with AMM-based solutions.

Strict criteria: Must meet high standards for token quality/supply, project traction, & user safety

4a/

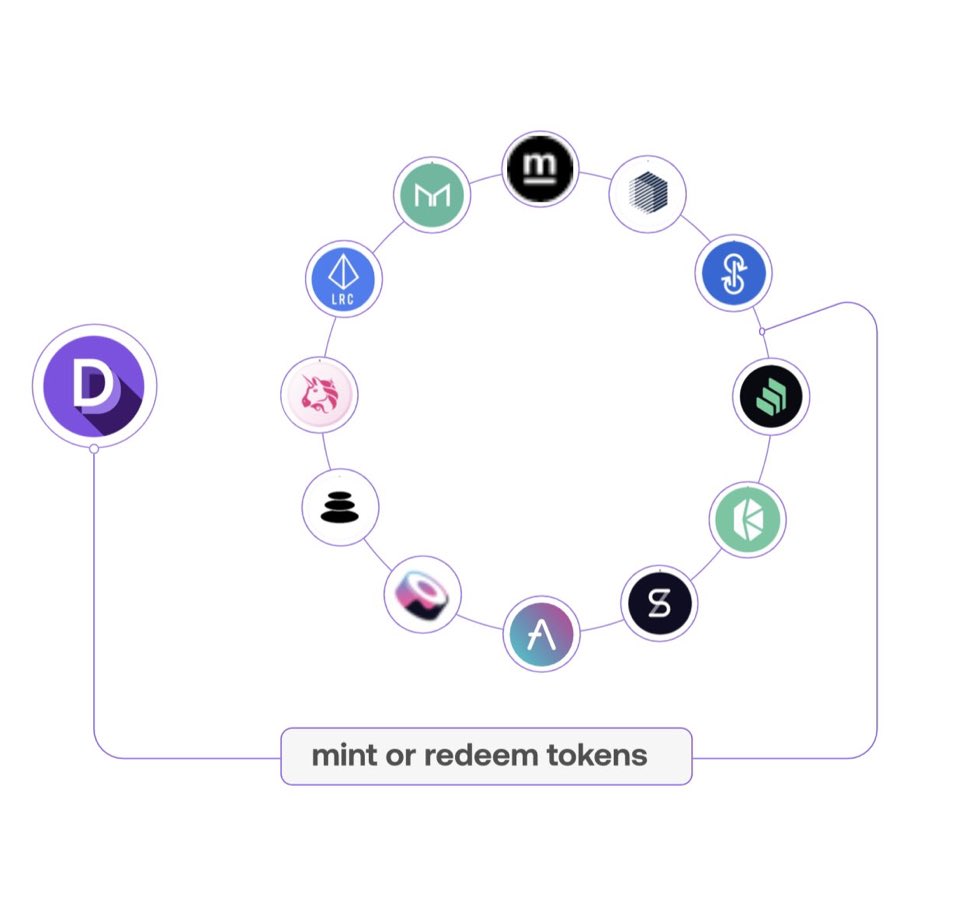

How $DPI Works! 🏗️

Minting & Redemption.

The underlying assets are put into smart contract, as per their weight, to mint $DPI tokens. The holder can redeem all underlying assets at any time.

How $DPI Works! 🏗️

Minting & Redemption.

The underlying assets are put into smart contract, as per their weight, to mint $DPI tokens. The holder can redeem all underlying assets at any time.

4b/

How $DPI Works! 🏗️

Rebalancing.

Occurs on a monthly basis to ensure that $DPI holds tokens that follow its methodology - and with the appropriate market capitalization weight.

How $DPI Works! 🏗️

Rebalancing.

Occurs on a monthly basis to ensure that $DPI holds tokens that follow its methodology - and with the appropriate market capitalization weight.

4c/

How $DPI Works! 🏗️

Custody.

Underlying tokens that back DPI are held inside a @tokensets vault contract, which is not accessible by @tokensets nor @defipulse. Only the individual or institution holding the DPI token has access to the underlying funds in the vault.

How $DPI Works! 🏗️

Custody.

Underlying tokens that back DPI are held inside a @tokensets vault contract, which is not accessible by @tokensets nor @defipulse. Only the individual or institution holding the DPI token has access to the underlying funds in the vault.

5a/

How Tokens are Selected for Inclusion in $DPI 🤓

Descriptive.

- The token must be available on the #Ethereum blockchain and listed on @defipulse.

- The token must not be considered a security.

- The token must be a bearer instrument.

How Tokens are Selected for Inclusion in $DPI 🤓

Descriptive.

- The token must be available on the #Ethereum blockchain and listed on @defipulse.

- The token must not be considered a security.

- The token must be a bearer instrument.

5b/

How Tokens are Selected for Inclusion in $DPI 🤓

Supply.

- It must be possible to reasonably predict the token’s supply over the next five years.

- At least 5% of the five-year supply must be currently circulating.

- Tokenomics must not disadvantage passive holders.

How Tokens are Selected for Inclusion in $DPI 🤓

Supply.

- It must be possible to reasonably predict the token’s supply over the next five years.

- At least 5% of the five-year supply must be currently circulating.

- Tokenomics must not disadvantage passive holders.

5c/

How Tokens are Selected for Inclusion in $DPI 🤓

Traction.

- The project must be widely considered to be building a useful protocol or product.

- The project’s protocol must have significant usage and must have been launched at least 180 days prior.

How Tokens are Selected for Inclusion in $DPI 🤓

Traction.

- The project must be widely considered to be building a useful protocol or product.

- The project’s protocol must have significant usage and must have been launched at least 180 days prior.

5d/

How Tokens are Selected for Inclusion in $DPI 🤓

User Safety.

- Security professionals must have reviewed the protocol for security best practices.

- Alternatively, the protocol must have been operating long enough to create a safety consensus in the #DeFi community.

How Tokens are Selected for Inclusion in $DPI 🤓

User Safety.

- Security professionals must have reviewed the protocol for security best practices.

- Alternatively, the protocol must have been operating long enough to create a safety consensus in the #DeFi community.

6/

How to Purchase $DPI 📈📉

Set Protocol Website - @tokensets

Decentralized Exchanges - @Uniswap, @SushiSwap

Centralized Exchanges - @kucoincom

Over-the-Counter Trading - @wintermute_t

(more to come)

How to Purchase $DPI 📈📉

Set Protocol Website - @tokensets

Decentralized Exchanges - @Uniswap, @SushiSwap

Centralized Exchanges - @kucoincom

Over-the-Counter Trading - @wintermute_t

(more to come)

7/

Similar products to $DPI? 🦉

Metaverse Index $MVI

- focused on gaming, #NFTs, & entertainment occurring in virtual environments

Bankless BED Index $BED

- equal-weighted tracking the top three crypto themes: $BTC, $ETH, $DPI

Data Economy Index $DATA

- Coming soon

Similar products to $DPI? 🦉

Metaverse Index $MVI

- focused on gaming, #NFTs, & entertainment occurring in virtual environments

Bankless BED Index $BED

- equal-weighted tracking the top three crypto themes: $BTC, $ETH, $DPI

Data Economy Index $DATA

- Coming soon

8/

Come build with us! 🧱

Join the @IndexCoop Discord.

We are a community of DeFi experts, technologists, content marketers, & TradFi professionals focused on the creation & adoption of crypto structured products. Mission is to make crypto simple, accessible, and safe for all

Come build with us! 🧱

Join the @IndexCoop Discord.

We are a community of DeFi experts, technologists, content marketers, & TradFi professionals focused on the creation & adoption of crypto structured products. Mission is to make crypto simple, accessible, and safe for all

• • •

Missing some Tweet in this thread? You can try to

force a refresh