1/

Zooming out to bigger picture for #uranium follows.

Ok, so we got a 30% correction at hand in $URNM, 28% $URA. Many of the underlying equities are starting to see 40-50%+ corrections.

Few basic causes ->

Zooming out to bigger picture for #uranium follows.

Ok, so we got a 30% correction at hand in $URNM, 28% $URA. Many of the underlying equities are starting to see 40-50%+ corrections.

Few basic causes ->

2/

#SPUT has been unable to buy enough physical from spot market to lift price, not because of Sprott, but because us market participants who control the share price through supply and demand, havent agreed on pushing and keeping the price in high enough premium.

#SPUT has been unable to buy enough physical from spot market to lift price, not because of Sprott, but because us market participants who control the share price through supply and demand, havent agreed on pushing and keeping the price in high enough premium.

3/

Broad market was looking very thin on top. Breadth was and still is thin and almost nonexistent. Only few of the leaders are keeping indices afloat.

Broad market was looking very thin on top. Breadth was and still is thin and almost nonexistent. Only few of the leaders are keeping indices afloat.

4/

When market momentum turns, it means that the market flywheels that fed the strength in rally, start feeding the downhill. Remember, in volatile tiny sector like uranium, these flywheels turn faster than in broad market, which I think havent yet turned.

When market momentum turns, it means that the market flywheels that fed the strength in rally, start feeding the downhill. Remember, in volatile tiny sector like uranium, these flywheels turn faster than in broad market, which I think havent yet turned.

5/

I'm staying in my "path of least resistance", that we will test recent lows, give or take, and after a "what now?" period, broad market will start a rally to new spectacular ATHs.

I'm staying in my "path of least resistance", that we will test recent lows, give or take, and after a "what now?" period, broad market will start a rally to new spectacular ATHs.

6/

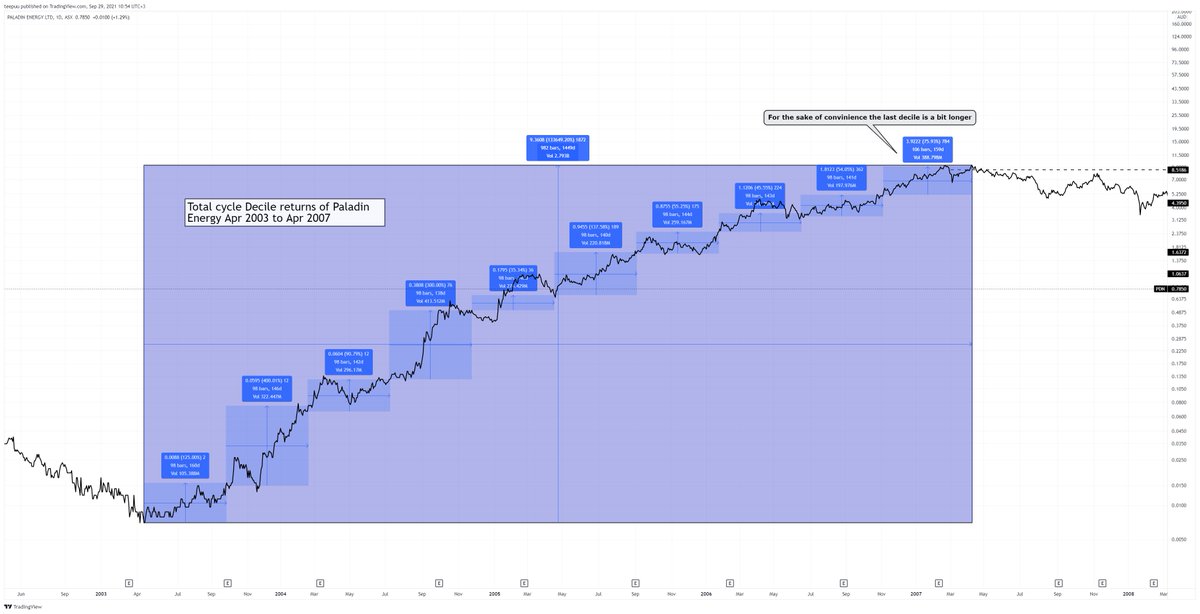

Technically there was, at recent highs in uranium equities, a significant statistical probability that a mean reversion was imminent. Prices were stretched far above the mean prices, anticipating higher commodity pricing.

Technically there was, at recent highs in uranium equities, a significant statistical probability that a mean reversion was imminent. Prices were stretched far above the mean prices, anticipating higher commodity pricing.

7/

A range of stock prices are looking a lot more attractive now at 40%-50% discount to recent highs. That means the expectation of return has doubled since there, and risk has been severely decreased. R/R is turning from symmetric to asymmetric. Numerator & denominator.

A range of stock prices are looking a lot more attractive now at 40%-50% discount to recent highs. That means the expectation of return has doubled since there, and risk has been severely decreased. R/R is turning from symmetric to asymmetric. Numerator & denominator.

8/

As anyone can understand, a blip of -10% doesnt change risk/reward a bit. If one wants to thrive in value investing, one needs to understand that it will be realized by buying reward asymmetry.

As anyone can understand, a blip of -10% doesnt change risk/reward a bit. If one wants to thrive in value investing, one needs to understand that it will be realized by buying reward asymmetry.

9/

Write down what you feel at given times of volatility and come back to your notes every now and then. Then plot them over a urnm price chart. Where did you feel greedy, when fearful or angry. It can be game changer.

Write down what you feel at given times of volatility and come back to your notes every now and then. Then plot them over a urnm price chart. Where did you feel greedy, when fearful or angry. It can be game changer.

10/

When you take a random "trade", it basically has a 50/50 chance of going up or down. Still, our emotional behaviour, which is a evolutionary part of us, ditches those chances. 90% of traders fail, they say. Investing is trading, with longer time horizon and different setup.

When you take a random "trade", it basically has a 50/50 chance of going up or down. Still, our emotional behaviour, which is a evolutionary part of us, ditches those chances. 90% of traders fail, they say. Investing is trading, with longer time horizon and different setup.

• • •

Missing some Tweet in this thread? You can try to

force a refresh