1/

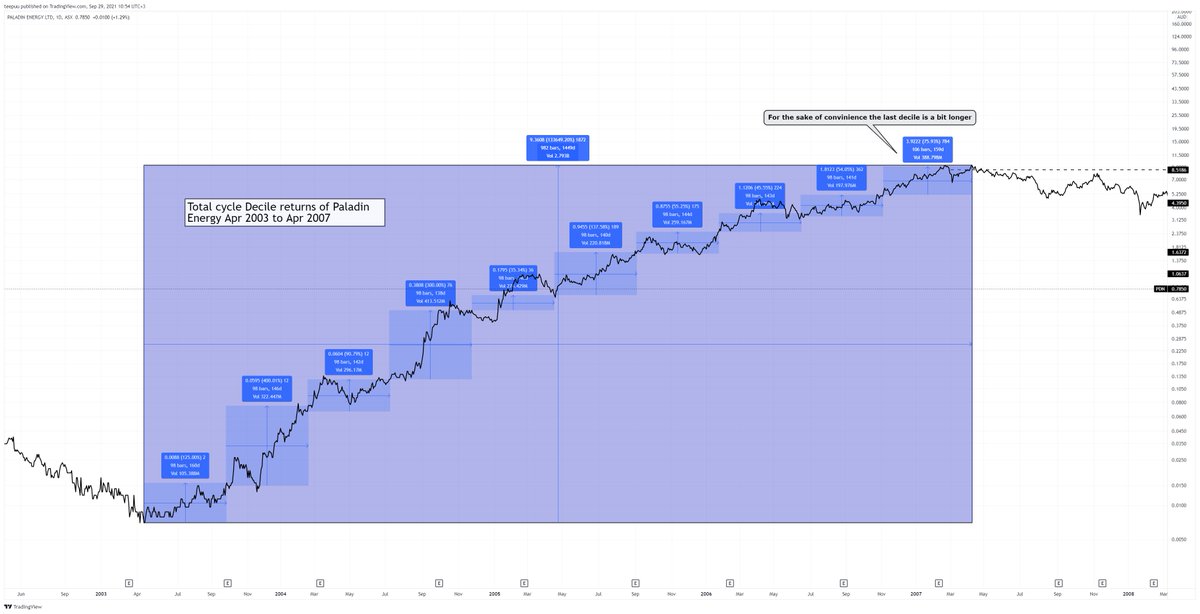

When the last great #uranium bull cycle ignited back in 2003-2004, broad market was starting to recover from the dotcom bubble.

Today we are in quite a different market environment where broad market is relatively a lot more expensive than it was back then.

When the last great #uranium bull cycle ignited back in 2003-2004, broad market was starting to recover from the dotcom bubble.

Today we are in quite a different market environment where broad market is relatively a lot more expensive than it was back then.

2/

On $PDN for example, a 10% discount to 50 dEMA was a gift to add to. Many others gave 20-40% discounts to 50dEMA.

On $PDN for example, a 10% discount to 50 dEMA was a gift to add to. Many others gave 20-40% discounts to 50dEMA.

3/

Stocks dont go up or down in a straight line. They step up and down in multiple time frames. Hourly, daily and weekly.

Stocks dont go up or down in a straight line. They step up and down in multiple time frames. Hourly, daily and weekly.

4/

Market leaders in #uranium are still very strong in longer timeframe charts, even though daily structures are getting broke in multiple equities.

As long as they stay so, this can turn up fast again. If they break, you wish you had more cash.

Market leaders in #uranium are still very strong in longer timeframe charts, even though daily structures are getting broke in multiple equities.

As long as they stay so, this can turn up fast again. If they break, you wish you had more cash.

5/

If the weakness continues and broad market doesnt resolve how to value current situation, I think odds are high to see a flush in #uranium, #gold, #silver, #pot and many other sectors aswell. These four I'm watching the most.

If the weakness continues and broad market doesnt resolve how to value current situation, I think odds are high to see a flush in #uranium, #gold, #silver, #pot and many other sectors aswell. These four I'm watching the most.

7/

At which price levels I will be a net buyer in #uranium equities and add to my long term positions?

Multiple examples of market leaders suggest that I'd want them 25-30% cheaper, ie. H1 2021 price levels.

At which price levels I will be a net buyer in #uranium equities and add to my long term positions?

Multiple examples of market leaders suggest that I'd want them 25-30% cheaper, ie. H1 2021 price levels.

8/

I will be a buyer before this of course, but I will treat my positions more as a trade positions than long term positions.

I will be a buyer before this of course, but I will treat my positions more as a trade positions than long term positions.

9/

For trades, Im looking setups for:

- anticipation and consolidation breakouts

- exaggerated flush sell reversals

- momentum divergence reversals

For trades, Im looking setups for:

- anticipation and consolidation breakouts

- exaggerated flush sell reversals

- momentum divergence reversals

10/

My pf has outperformed $urnm on most days last few weeks, due to good size temporary position in $u.un and highish cash position. Also some nice catches on $tsla short and #vix derivative trades helped a lot.

Nevertheless, my pf is down also.

My pf has outperformed $urnm on most days last few weeks, due to good size temporary position in $u.un and highish cash position. Also some nice catches on $tsla short and #vix derivative trades helped a lot.

Nevertheless, my pf is down also.

7.2/

This doesnt have to happen for me to go back 100%+ invested. I'll just treat those buys as trades.

This doesnt have to happen for me to go back 100%+ invested. I'll just treat those buys as trades.

3.2/

On monthly and quarterly we start to see the real long term trend that is prevailing.

On monthly and quarterly we start to see the real long term trend that is prevailing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh