Dad, husband, organic farmer, forestry, trader, home brewer. DYOR.

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/capnek123/status/1522987870184775681-> Broad market is in a downtrend and the expectation is that rallies will be sold

The indicator measures relative strength in two optional ways.

The indicator measures relative strength in two optional ways.https://twitter.com/tepuuma/status/1522209167510888451Just few weeks back the thinness of the names that made new 52w highs was troubling me. That coupled with broad market looking bad, and extensions being quite high made me to reduce my participation. It was a good call.

2/

2/

Usually when I have a hunch of volatility, I suppress the timeframe of my trading. I go from week positions to day swings to intraday. My core positions are locked, Im not touching those here, why? Because I think its too late already. My way is to sell on strength, not weakness.

Usually when I have a hunch of volatility, I suppress the timeframe of my trading. I go from week positions to day swings to intraday. My core positions are locked, Im not touching those here, why? Because I think its too late already. My way is to sell on strength, not weakness.

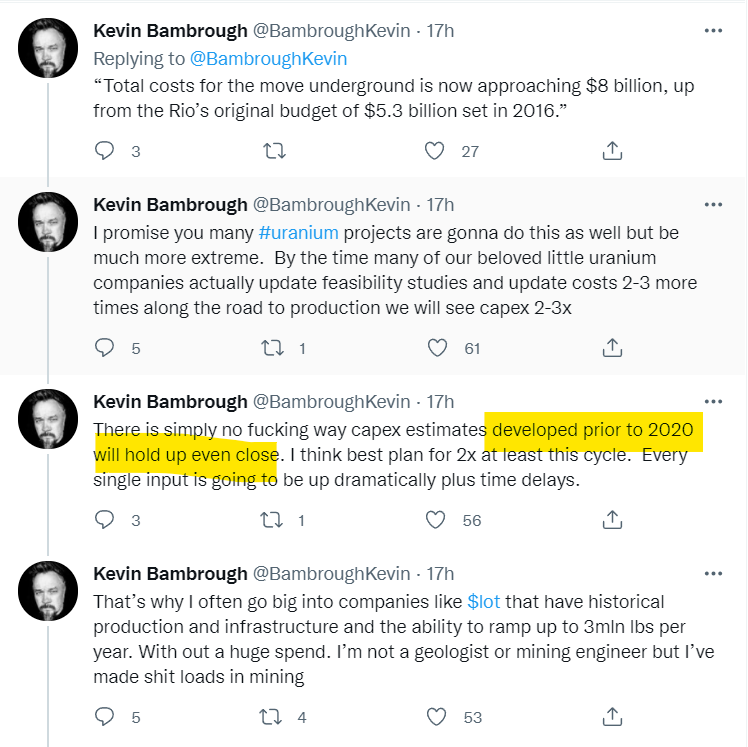

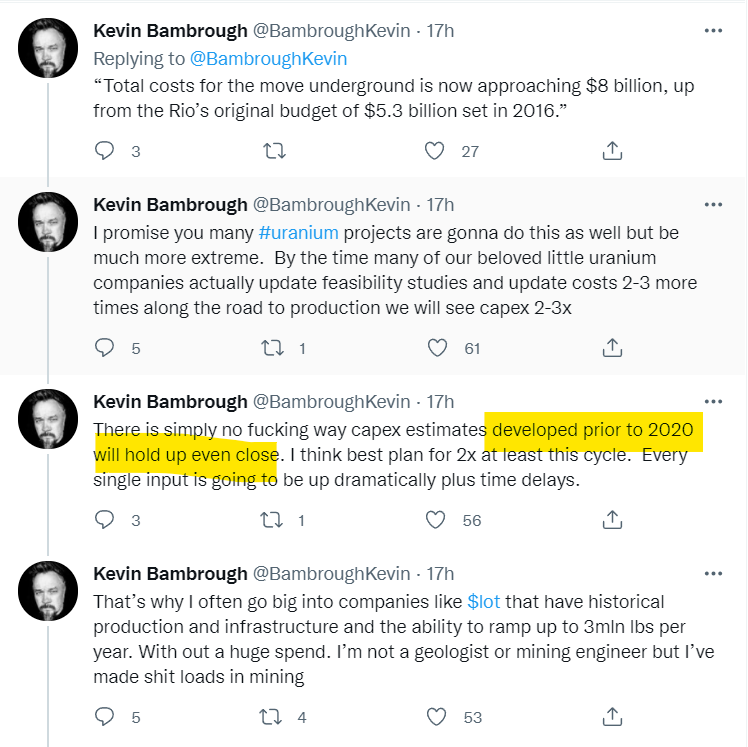

https://twitter.com/BambroughKevin/status/1448998238481174531

2/

2/