Next is "Raees Ahmed Standard Biryani House" in #Landhi #Karachi which was made to register on a Previous complaint and issued a show cause notice for Penalty so inquired what happened to that notice is it finalised #TaxChoriBandKaru

741/n

741/n

Complaint 16 Nov, Reply 24 Nov

Restaurant was fined for Rs 10,000/= which is abysmally low for the sale and running of it.

And they are still being non compliant to which they know soon again :)

#TaxChoriBandKaru

742/n

Restaurant was fined for Rs 10,000/= which is abysmally low for the sale and running of it.

And they are still being non compliant to which they know soon again :)

#TaxChoriBandKaru

742/n

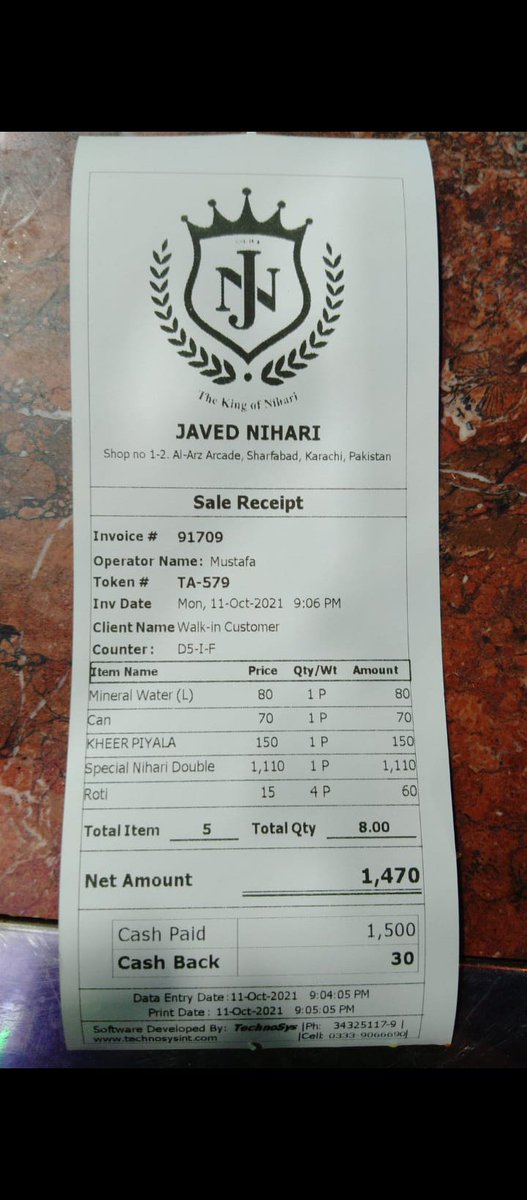

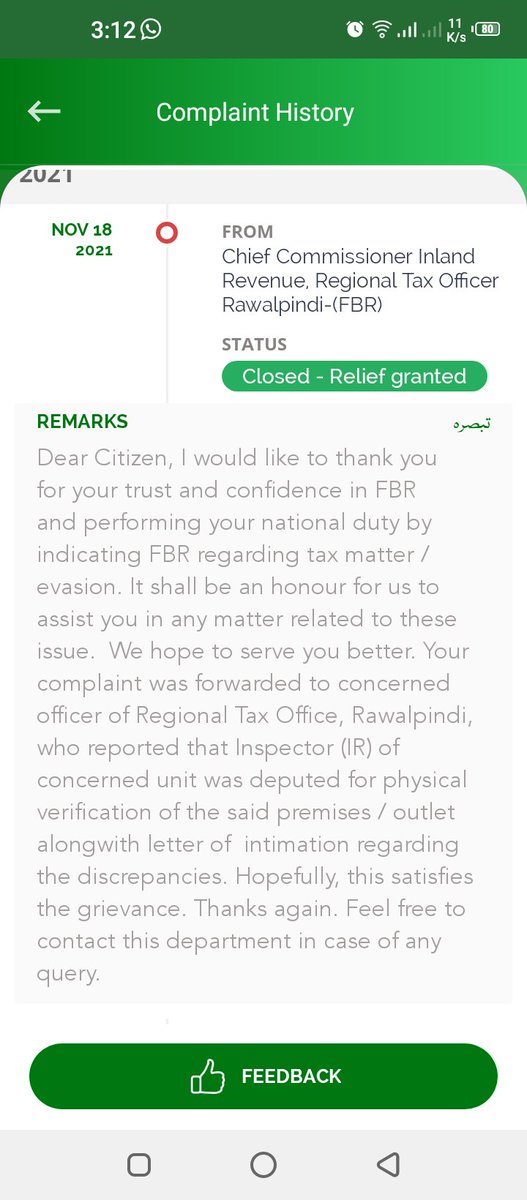

Next "Javed Nihari" #Sharfabad branch in #Karachi issuing non compliant invoice with no SNTN# mentioned #TaxChoriBandKaru

743/n

743/n

Complaint on 16 Nov, Reply 13 Dec.

SRB visited and collect an invoice as per them mostly compliant and as per the Invoice in complaint they said there was some error in POS machine which I dont buy we will see next time

#TaxChoriBandKaru

744/n

SRB visited and collect an invoice as per them mostly compliant and as per the Invoice in complaint they said there was some error in POS machine which I dont buy we will see next time

#TaxChoriBandKaru

744/n

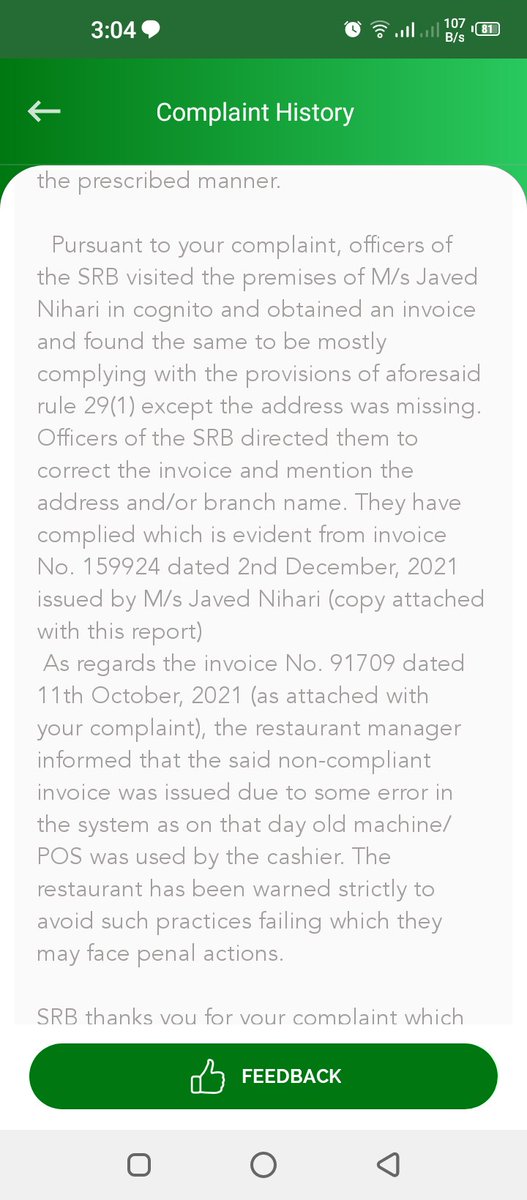

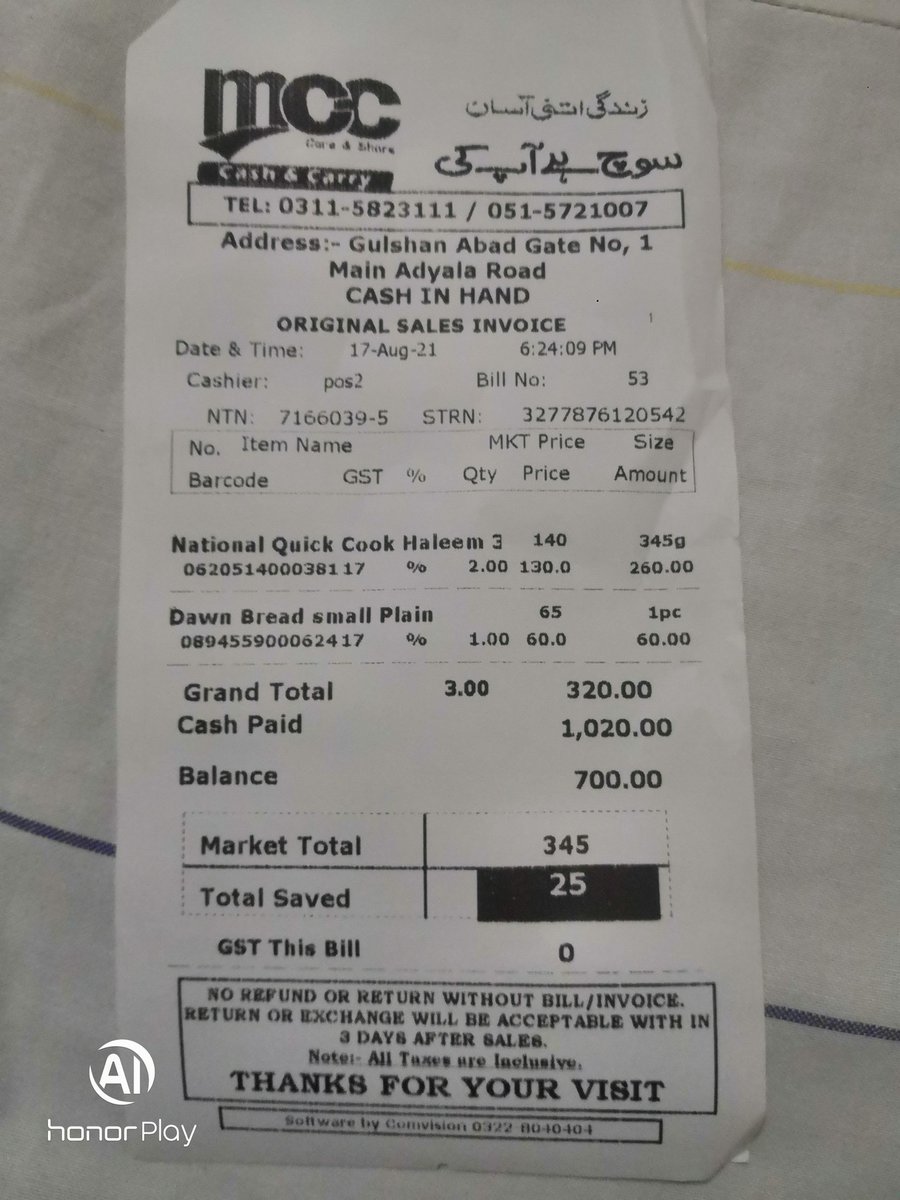

Next "Madina Cash & Carry" in Adyala #Rawalpindi branch issuing invoices which are not linked with #FBRPOS

#TaxChoriBandKaru

745/n

#TaxChoriBandKaru

745/n

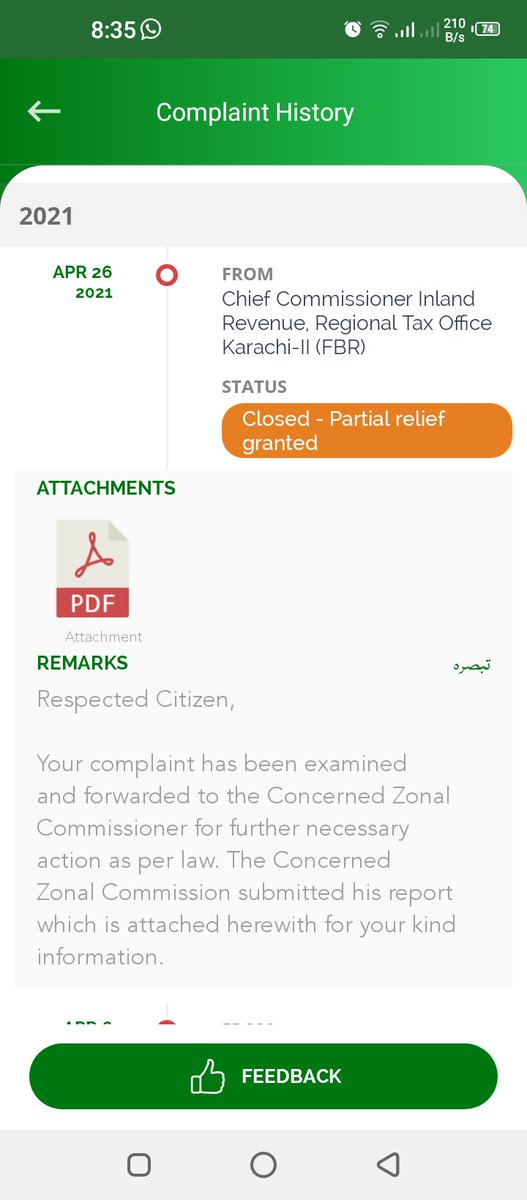

Complaint 19 Aug, Reply 18 Nov

Same old Delaying Tactics of @FBRSpokesperson

A nonsense reply AFTER 3 MONTHS it is send to concerned IR commissionar for Investigation lol what were you doing for 3 months? #TaxChoriBandKaru

@PakistanPMDU

746/n

Same old Delaying Tactics of @FBRSpokesperson

A nonsense reply AFTER 3 MONTHS it is send to concerned IR commissionar for Investigation lol what were you doing for 3 months? #TaxChoriBandKaru

@PakistanPMDU

746/n

Next "Bacha Party" a clothing store chain branch at #Clifton #Karachi issuing invoices which dont have any NTN# nor linked with #FBRPOS

#TaxChoriBandKaru

747/n

#TaxChoriBandKaru

747/n

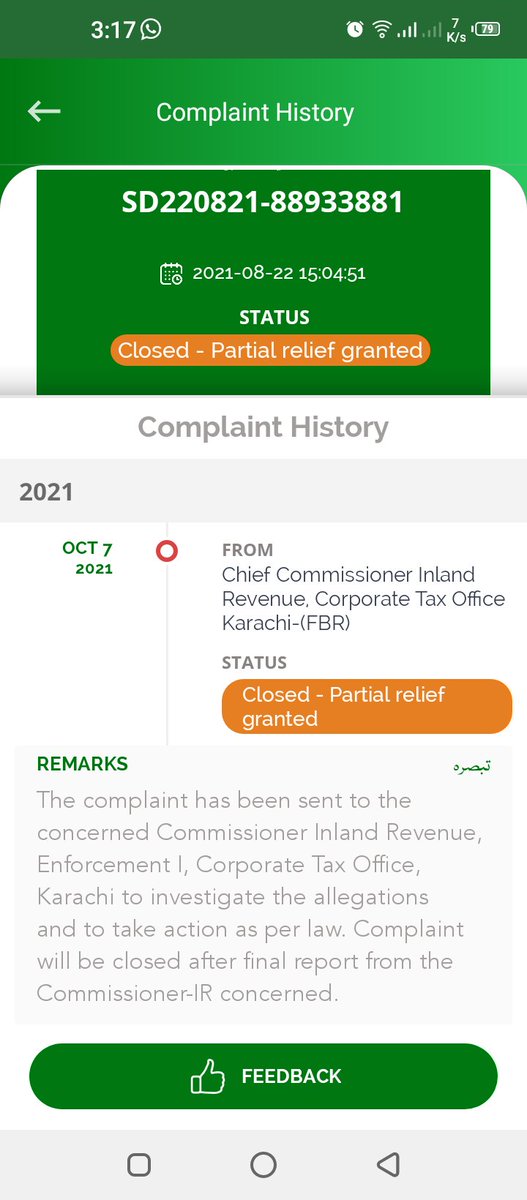

Complaint 22 Aug, Reply 07 Oct

It has been send to concerned commissionar IR to Investigate after 1.5 months @FBRSpokesperson

@PakistanPMDU

#TaxChoriBandKaru

748/n

It has been send to concerned commissionar IR to Investigate after 1.5 months @FBRSpokesperson

@PakistanPMDU

#TaxChoriBandKaru

748/n

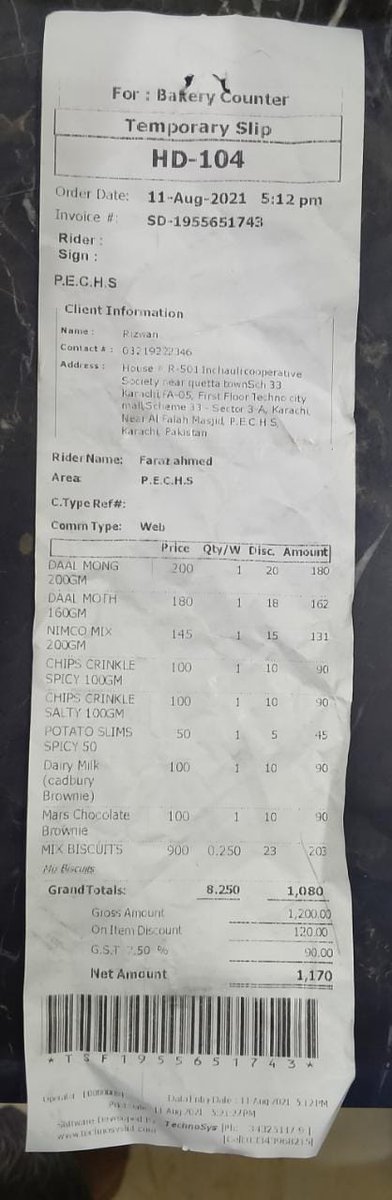

Next "Rizwan Seeets & Bakers" in #Landhi #Karachi which on an earlier complaint was registered and #FBRPOS proceedings started so asked what happened to it has it got integrated as 01 Nov invoice showed its not

#TaxChoriBandKaru

749/n

#TaxChoriBandKaru

749/n

Complaint 06 Nov, Reply 25 Nov

As per #FBR reply it got integrated with #FBRPOS on 22 Nov 2021

We will know how compliant they are soon as we do get Sweets in office often from there 😄 #TaxChoriBandKaru

750/n

As per #FBR reply it got integrated with #FBRPOS on 22 Nov 2021

We will know how compliant they are soon as we do get Sweets in office often from there 😄 #TaxChoriBandKaru

750/n

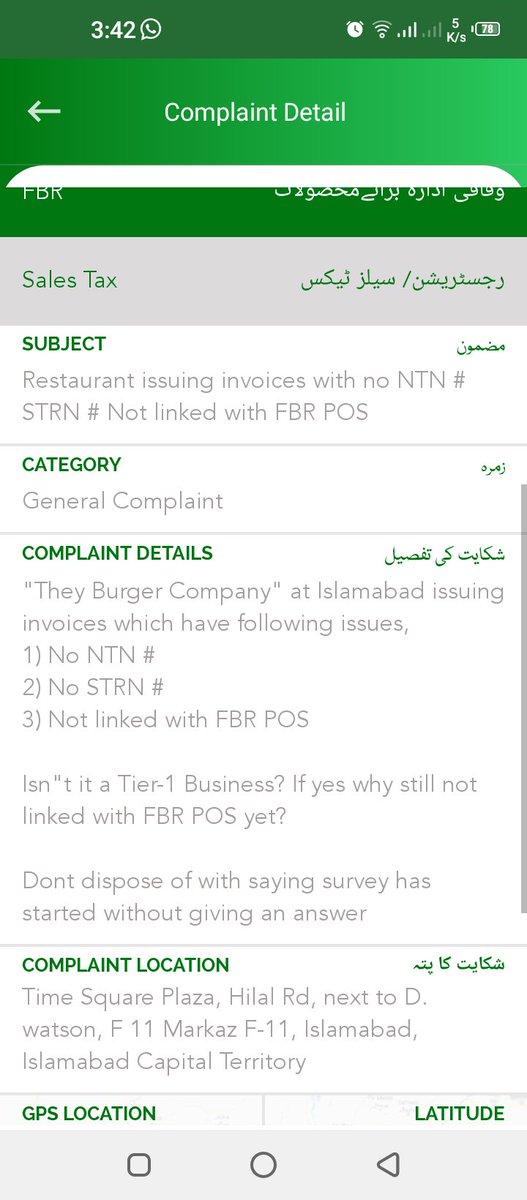

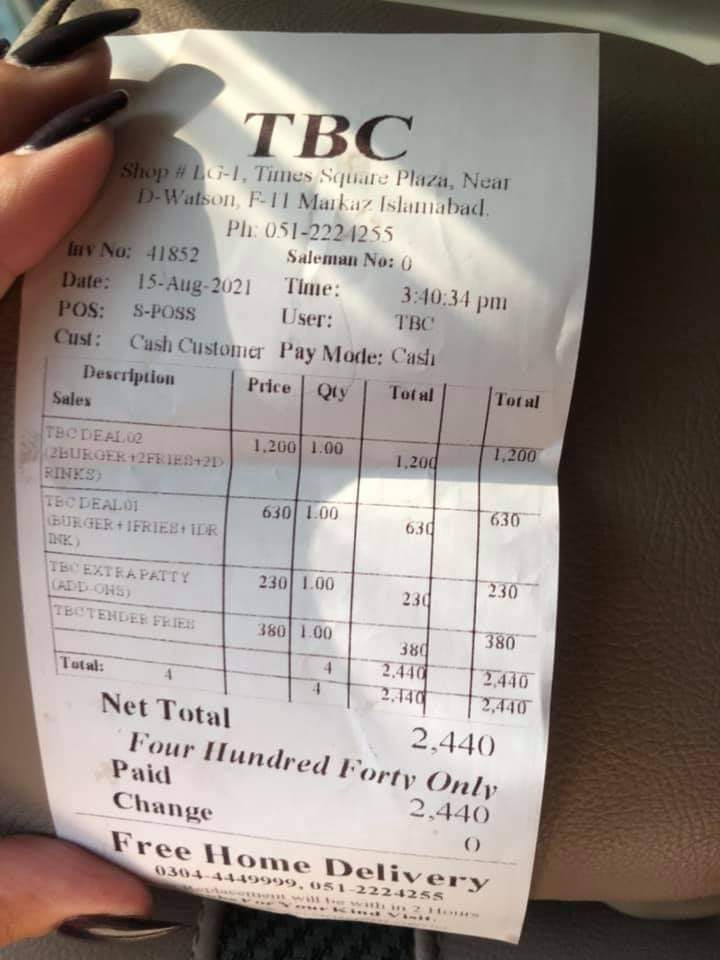

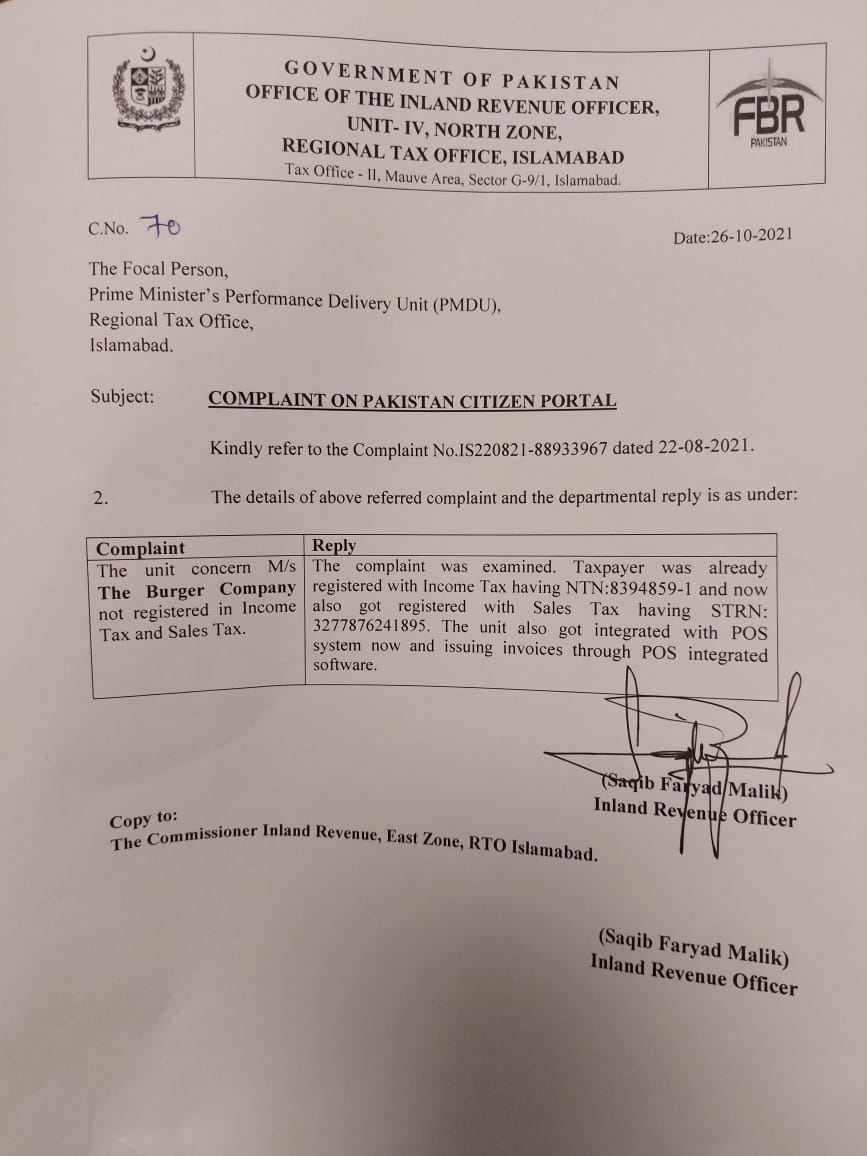

Next "The Burger Company" in #Islamabad issuing invoices with no NTN# STRN# nor linked with #FBRPOS either #TaxChoriBandKaru

751/n

751/n

Complaint 22 Aug, Reply 27 Oct

It was registered for Income Tax and now it also got registered for Sales Tax and #FBRPOS integrated

#TaxChoriBandKaru

752/n

It was registered for Income Tax and now it also got registered for Sales Tax and #FBRPOS integrated

#TaxChoriBandKaru

752/n

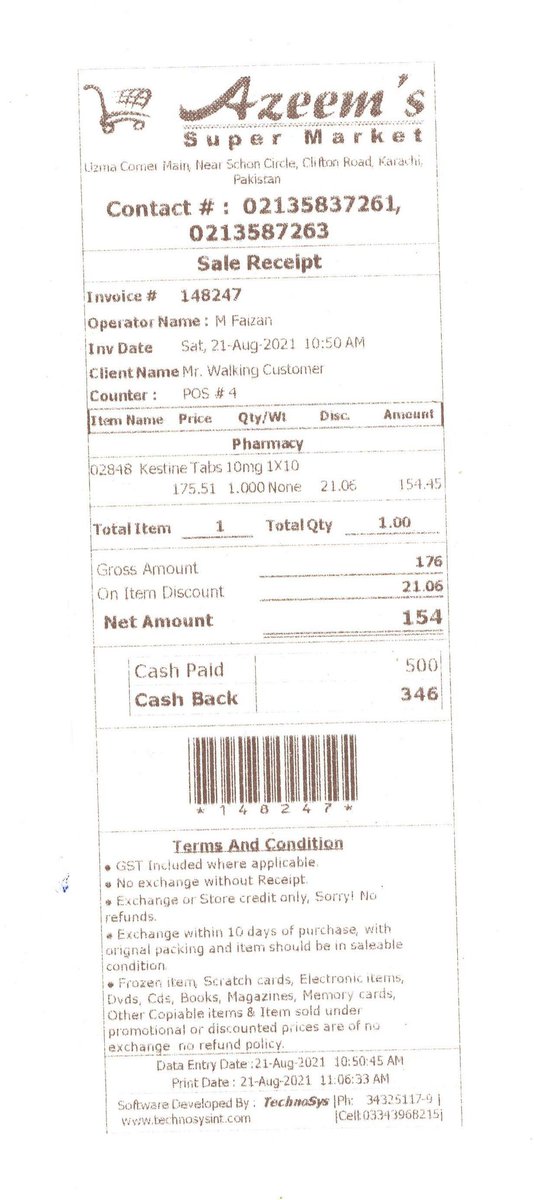

Next "Azeem's Super Market" in #Clifton #Karachi issuing invoices with no NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

753/n

#TaxChoriBandKaru

753/n

Complaint 22 Aug, Reply 24 Sep

Complaint send to concerned commissionar to investigate without reply if its registered for NTN & STRN or not! @FBRSpokesperson

@PakistanPMDU

#TaxChoriBandKaru

754/n

Complaint send to concerned commissionar to investigate without reply if its registered for NTN & STRN or not! @FBRSpokesperson

@PakistanPMDU

#TaxChoriBandKaru

754/n

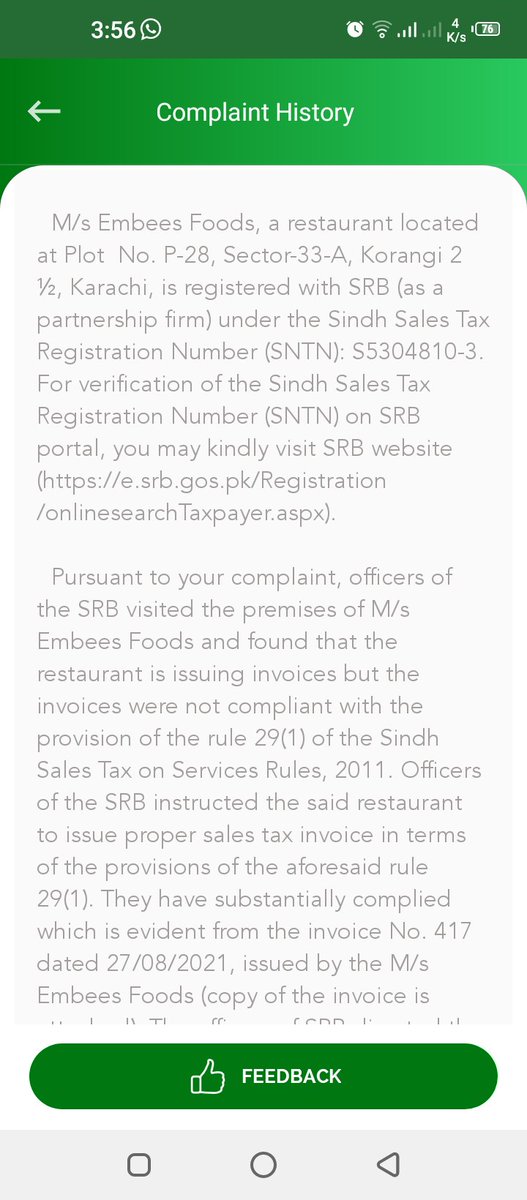

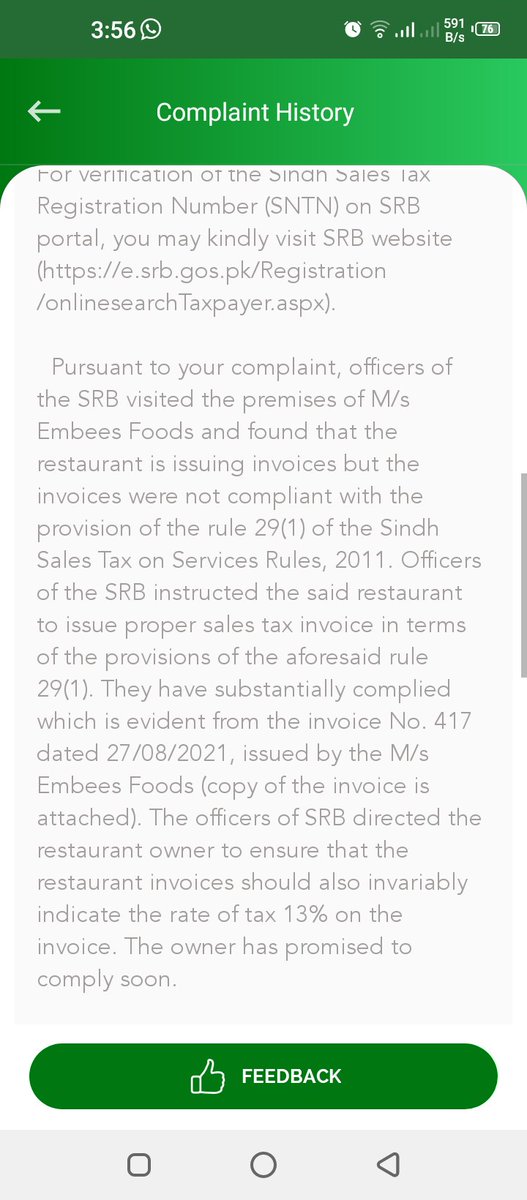

Next "Embesses Foods" in #Landhi #Karachi not issuing invoices so asked if they are registered with SRB or not

#TaxChoriBandKaru

755/n

#TaxChoriBandKaru

755/n

Complaint 22 Aug, Reply 18 Sep

The eatery is registered with SRB but are warned to issue proper Sales Tax Invoices which they have pretty much complied now

#TaxChoriBandKaru

756/n

The eatery is registered with SRB but are warned to issue proper Sales Tax Invoices which they have pretty much complied now

#TaxChoriBandKaru

756/n

Next "The Bistro" in #DHA #Islamabad issuing invoices with no NTN# no STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

757/n

#TaxChoriBandKaru

757/n

Complaint 22 Aug, Reply 29 Sep

It is not registered for Sales Tax however registered for Income Tax and not on #FBRPOS either due to which a Penalty Show Cause notice of Rs 1 Million has been issued

#TaxChoriBandKaru

758/n

It is not registered for Sales Tax however registered for Income Tax and not on #FBRPOS either due to which a Penalty Show Cause notice of Rs 1 Million has been issued

#TaxChoriBandKaru

758/n

Next "Thirsty the Soda Shop" at #Bahadrabad #Karachi issuing invoices without any SNTN# so asked if they are registered with SRB or not?

#TaxChoriBandKaru

759/n

#TaxChoriBandKaru

759/n

Complaint 22 Aug, Reply 25 Sep

It is NOT registered with SRB and on Finding Non Coperation to asked to register they are served with Show Cause notice for Mandatory Registration and imposition of Penalty

#TaxChoriBandKaru

760/n

It is NOT registered with SRB and on Finding Non Coperation to asked to register they are served with Show Cause notice for Mandatory Registration and imposition of Penalty

#TaxChoriBandKaru

760/n

Next "United Bakery" in #Hyderabad issuing invoices with no NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

761/n

#TaxChoriBandKaru

761/n

Complaint 22 Aug, Reply 05 Oct

It is already in process for being integrated and issued a penalty notice of Rs 1 Million and the proceedings are on going

#TaxChoriBandKaru

762/n

It is already in process for being integrated and issued a penalty notice of Rs 1 Million and the proceedings are on going

#TaxChoriBandKaru

762/n

Next "Kababjees Bakers" #PECHS #Karachi branch issuing invoices not linked with #FBRPOS so asked are their all branches integrated on #FBRPOS or not or were they fined for previous complaint or not as still issuing non compliant invoices

763/n

763/n

Complaint 22 Aug, Reply 24 Sep

This is as rediculous reply as can be given by #FBR absolutely NO REPLY was given of questions asked @fbernardeschi

@PakistanPMDU

We can understand why as its a big fish so FBR protecting them we all know why

#TaxChoriBandKaru

764/n

This is as rediculous reply as can be given by #FBR absolutely NO REPLY was given of questions asked @fbernardeschi

@PakistanPMDU

We can understand why as its a big fish so FBR protecting them we all know why

#TaxChoriBandKaru

764/n

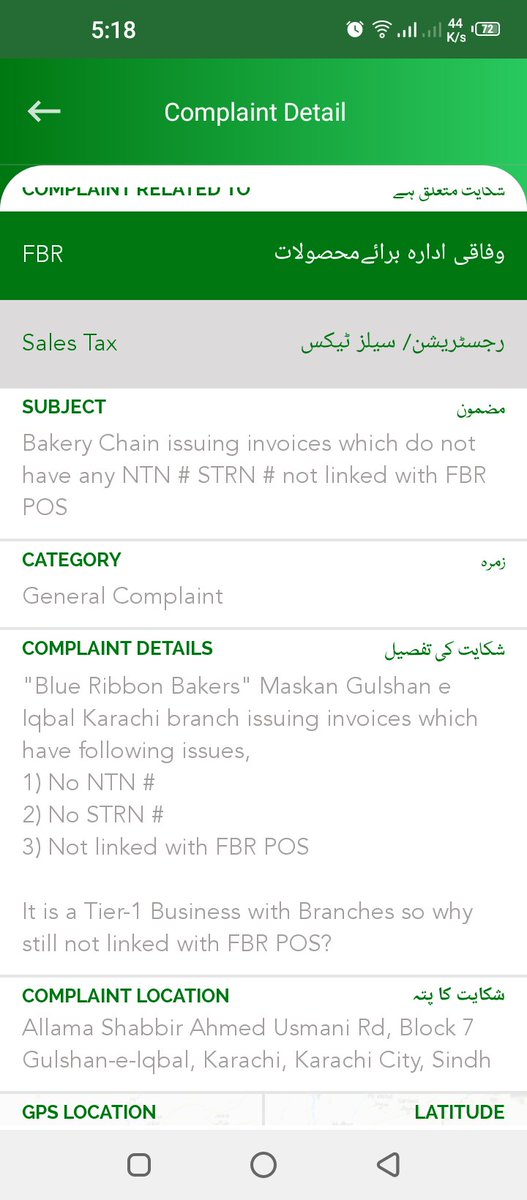

Next "Blue Ribbon Bakers" #Maskan #GulshaneIqbal #Karachi branch issuing invoices manually with no NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

765/n

#TaxChoriBandKaru

765/n

Complaint 22 Aug, Reply 24 Sep

Again NO reply was given by @FBRSpokesperson

for NTN & STRN question and send to concerned commissionar IR for investigation, its a Lolipop of a reply basically by FBR used very often @PakistanPMDU

#TaxChoriBandKaru

766/n

Again NO reply was given by @FBRSpokesperson

for NTN & STRN question and send to concerned commissionar IR for investigation, its a Lolipop of a reply basically by FBR used very often @PakistanPMDU

#TaxChoriBandKaru

766/n

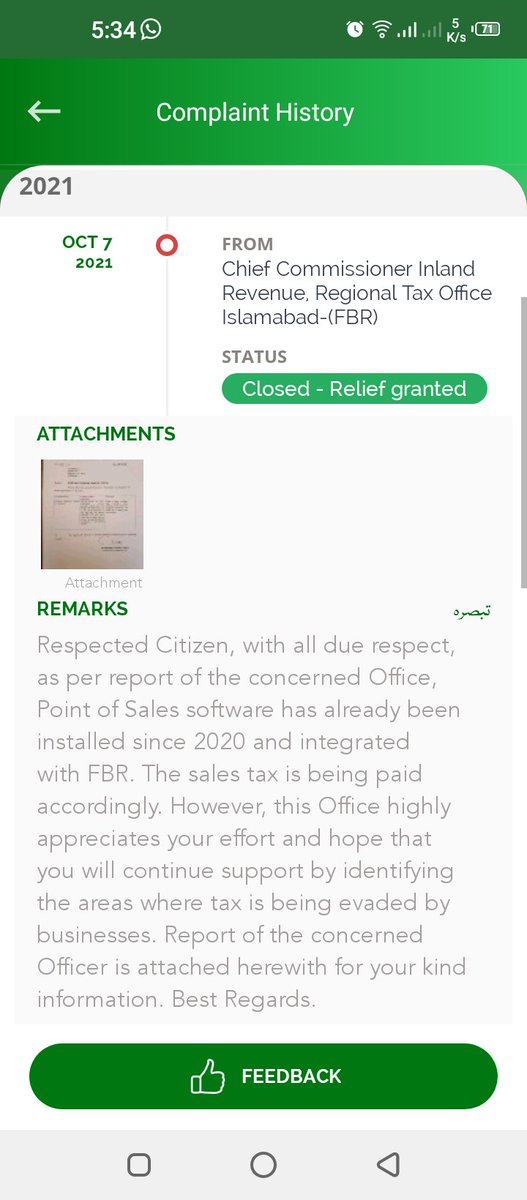

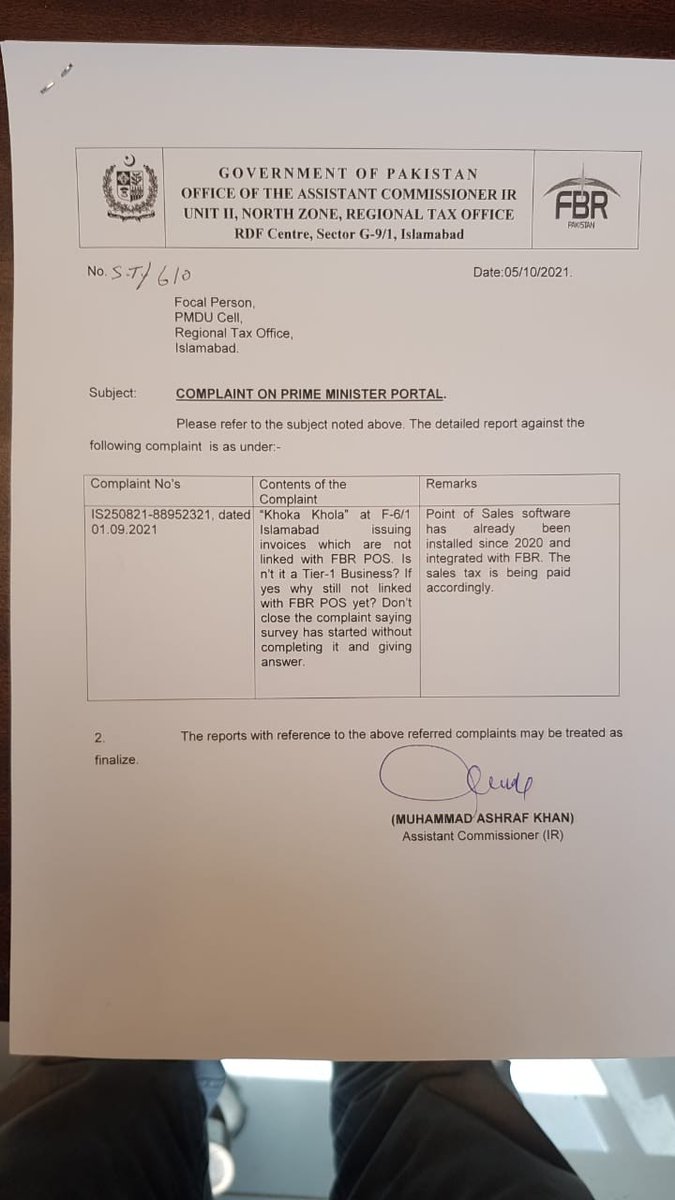

Complaint 25 Aug, Reply 07 Oct

It is integrated with #FBRPOS since 2020 but NO REPLY of @FBRSpokesperson why no penal action taken against them on doing this FRAUD of issuing non #FBRPOS ?

@PakistanPMDU

#TaxChoriBandKaru

768/n

It is integrated with #FBRPOS since 2020 but NO REPLY of @FBRSpokesperson why no penal action taken against them on doing this FRAUD of issuing non #FBRPOS ?

@PakistanPMDU

#TaxChoriBandKaru

768/n

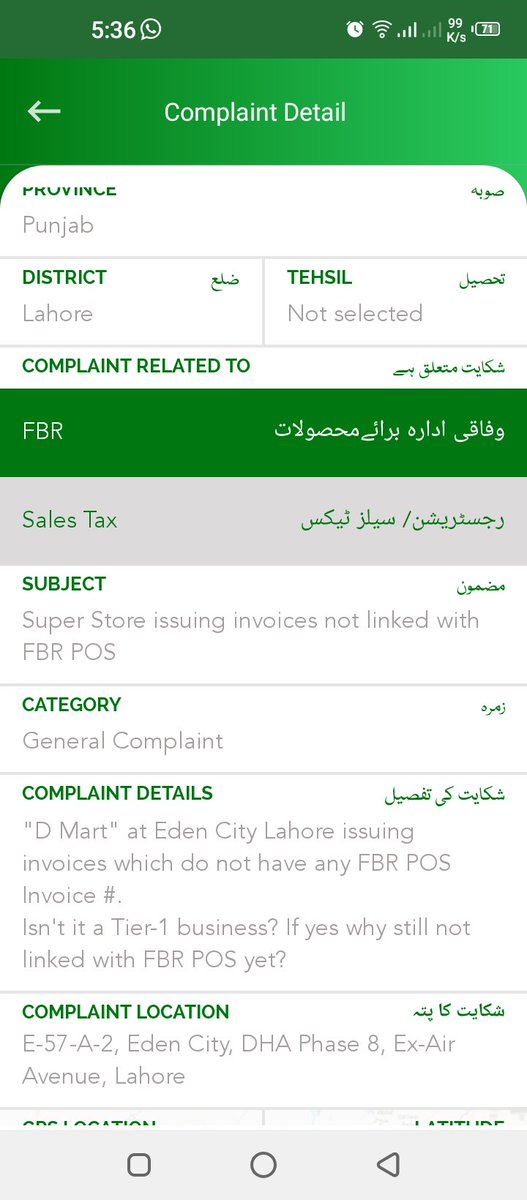

Next "D Mart" #EdenCity #Lahore branch issuing invoices not linked with #FBRPOS

#TaxChoriBandKaru

769/n

#TaxChoriBandKaru

769/n

Complaint 25 Aug, Reply 15 Sep

Investigation started against the said store as Notice issued

#TaxChoriBandKaru

770/n

Investigation started against the said store as Notice issued

#TaxChoriBandKaru

770/n

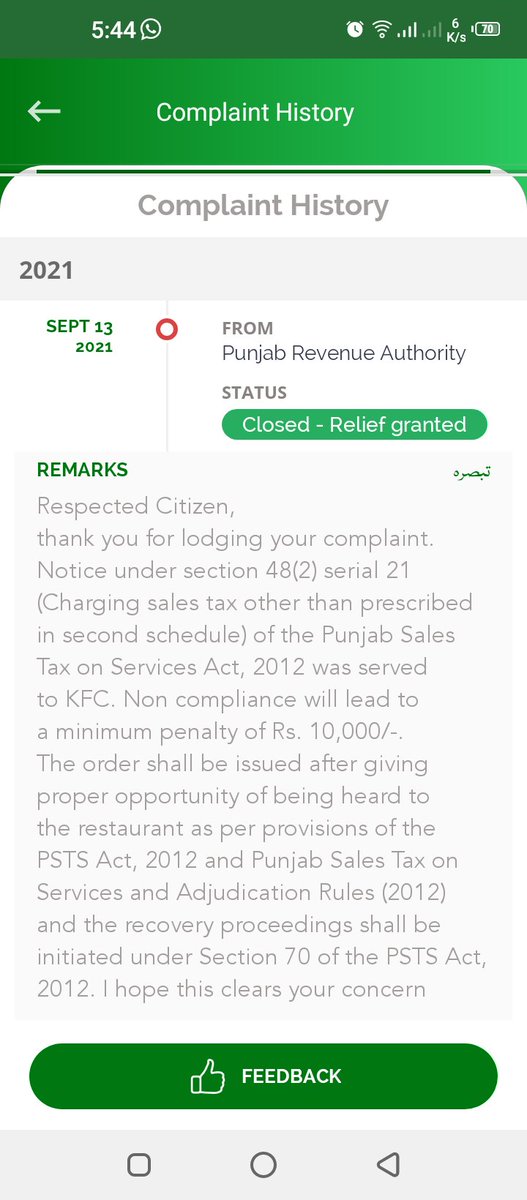

Next is "KFC" #BahriaTown #Lahore branch charging 16% Sales Tax instead of 5% on Card Payments @kfc_pk

#TaxChoriBandKaru

771/n

#TaxChoriBandKaru

771/n

Complaint 25 Aug, Reply 13 Sep

Showcause notice issued to as to why Minimum penalty of Rs 10,000 not be imposed on @kfc_pk for violating Tax Percentages as prescribed by PRA

#TaxChoriBandKaru

772/n

Showcause notice issued to as to why Minimum penalty of Rs 10,000 not be imposed on @kfc_pk for violating Tax Percentages as prescribed by PRA

#TaxChoriBandKaru

772/n

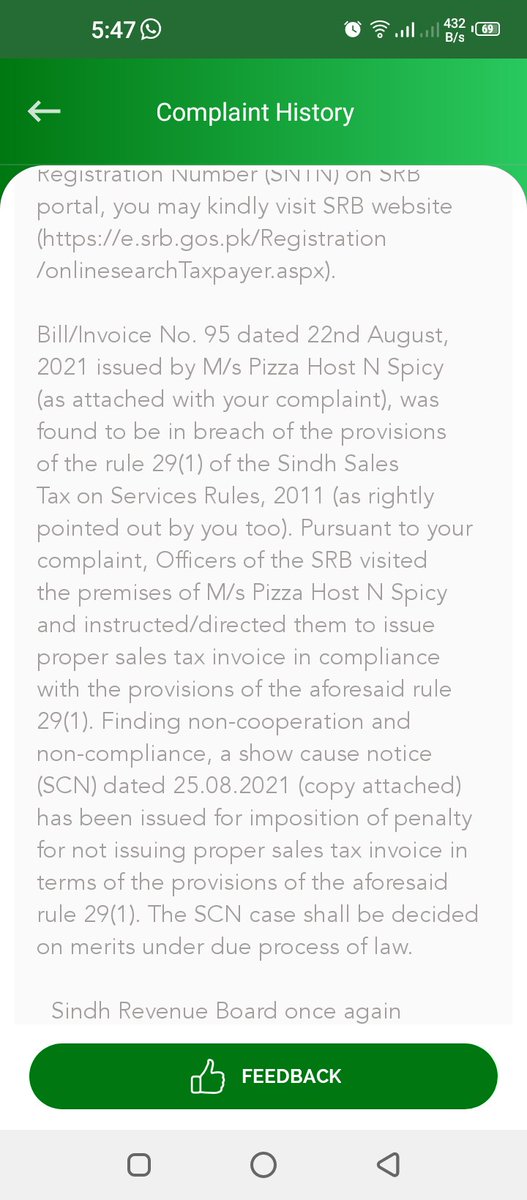

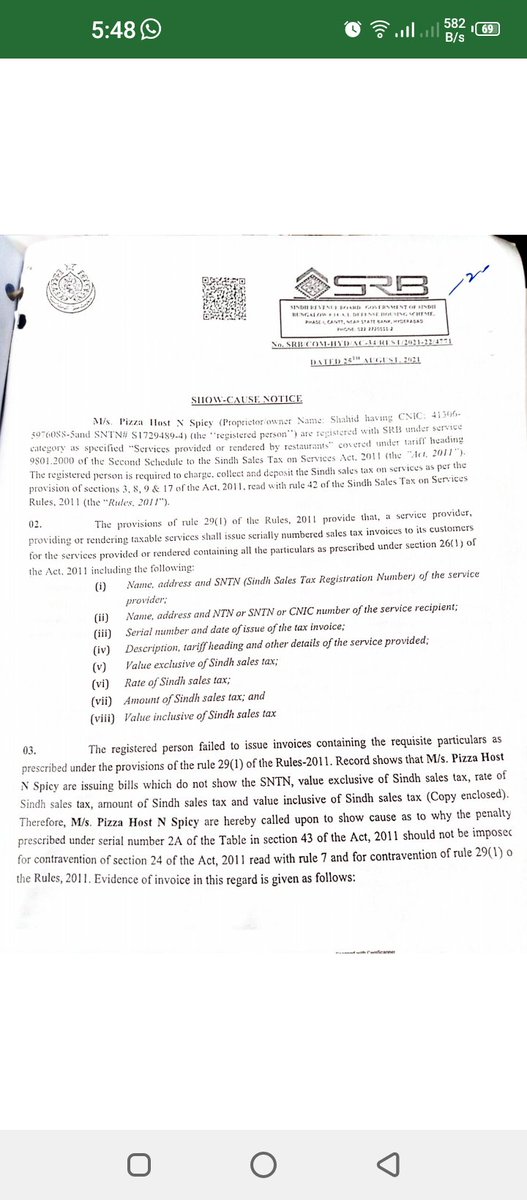

Next "Pizza Host n Spicy" in #Hyderabad issuing invoices without any SNTN# so asked are they registered with SRB or not?

#TaxChoriBandKaru

773/n

#TaxChoriBandKaru

773/n

Complaint 25 Aug, Reply 15 Sep

It is registered with SRB but on finding non compliance and non coperation a show cause notice for imposition of Penalty issued

#TaxChoriBandKaru

774/n

It is registered with SRB but on finding non compliance and non coperation a show cause notice for imposition of Penalty issued

#TaxChoriBandKaru

774/n

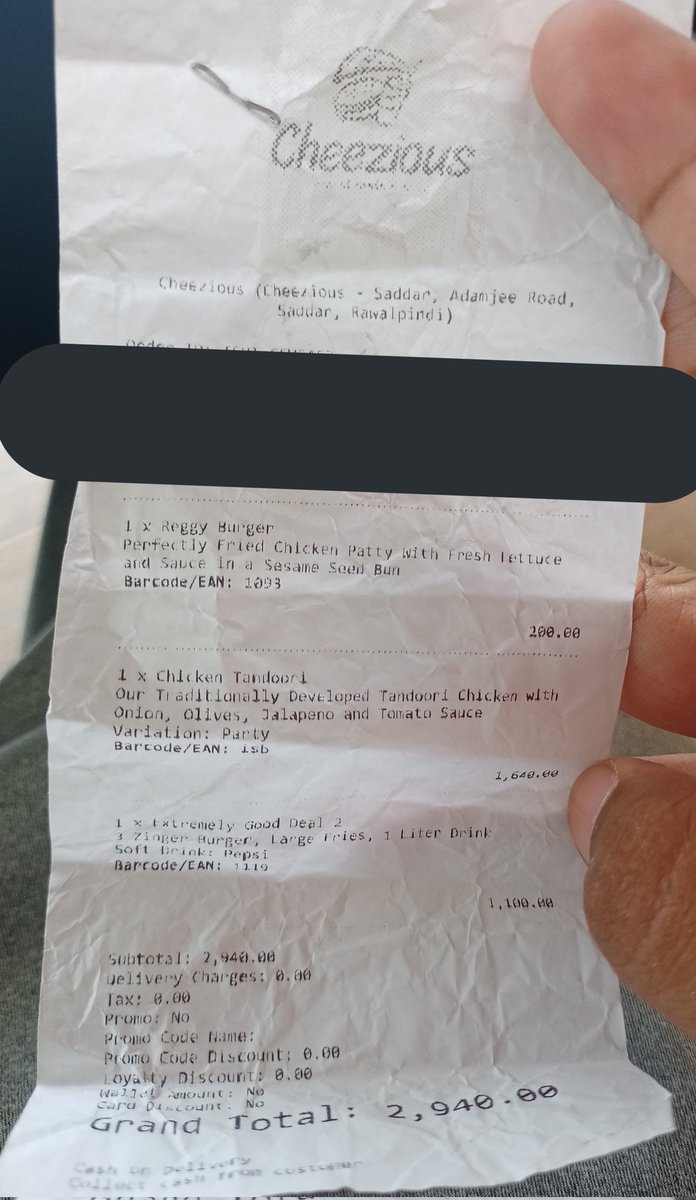

Next is "Cheezious" branch in #Saddar #Rawalpindi issuing invoices without any PNTN# so asked if they are registered with #PRA or not

#TaxChoriBandKaru

775/n

#TaxChoriBandKaru

775/n

Complaint 25 Aug, Reply 13 Sep

It is NOT registered with #PRA and a Registration notice has been send

#TaxChoriBandKaru

776/n

It is NOT registered with #PRA and a Registration notice has been send

#TaxChoriBandKaru

776/n

Next "Cock n Bull" in #Lahore issuing invoices with no Sales Tax amount and a PNTN# showing last sales tax return submitted in Mar-21

#TaxChoriBandKaru

777/n

#TaxChoriBandKaru

777/n

Complaint 25 Aug, Reply 15 Sep

Show cause notice by #PRA and hence legal proceedings for not submitting Sales Tax return already started

#TaxChoriBandKaru

778/n

Show cause notice by #PRA and hence legal proceedings for not submitting Sales Tax return already started

#TaxChoriBandKaru

778/n

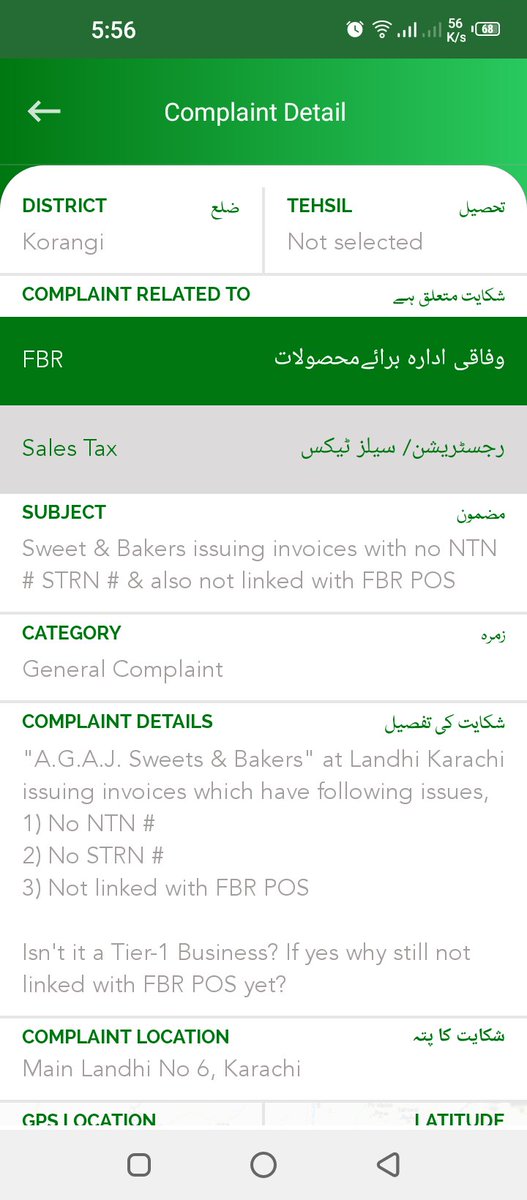

Next "A.G.A.J. Sweets & Bakers" in #Landhi #Karachi issuing invoices with no NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

779/n

#TaxChoriBandKaru

779/n

Complaint 25 Aug, Reply 27 Sep

After Physical verification and Investigation it was observed its a Tier-1 business and #FBRPOS integration is now in process by #FBR however NO REPLY was given on NTN & STRN question @FBRSpokesperson @PakistanPMDU

#TaxChoriBandKaru

780/n

After Physical verification and Investigation it was observed its a Tier-1 business and #FBRPOS integration is now in process by #FBR however NO REPLY was given on NTN & STRN question @FBRSpokesperson @PakistanPMDU

#TaxChoriBandKaru

780/n

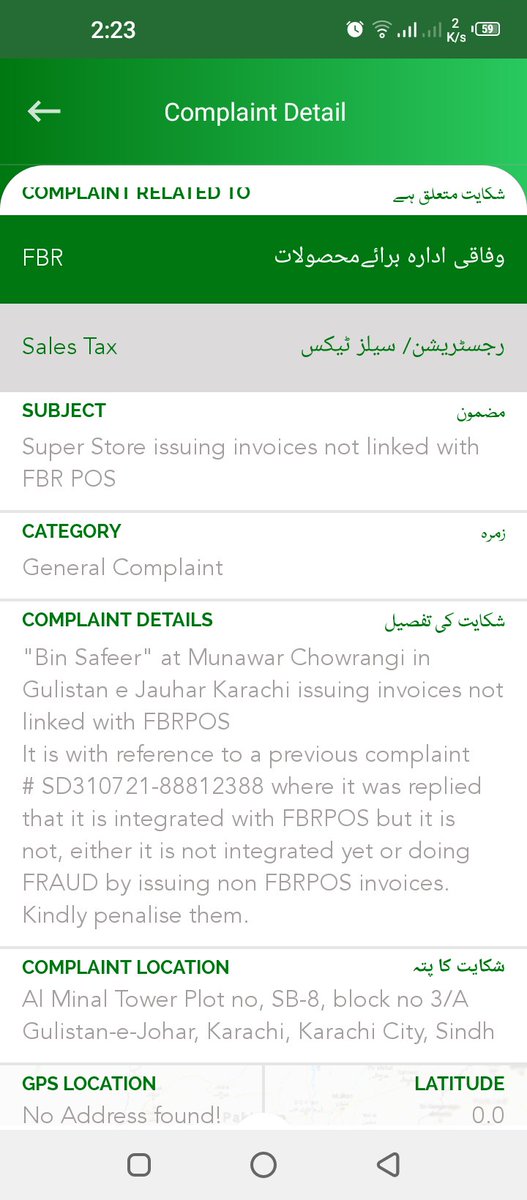

Next "Bin Safeer" super store branch at Munawar Chowrangi which was complained and made to integrate on previous complaint and still giving non compliant invoices without #FBRPOS

#TaxChoriBandKaru

781/n

#TaxChoriBandKaru

781/n

Complaint 27 Nov, Reply 21 Dec

As per #FBR they are integrated and all systems functioning BUT at that time there was some technical fault due to which #FBRPOS invoices could not be printed lol.

As for matter still doing same have put ANOTHER one!

#TaxChoriBandKaru

782/n

As per #FBR they are integrated and all systems functioning BUT at that time there was some technical fault due to which #FBRPOS invoices could not be printed lol.

As for matter still doing same have put ANOTHER one!

#TaxChoriBandKaru

782/n

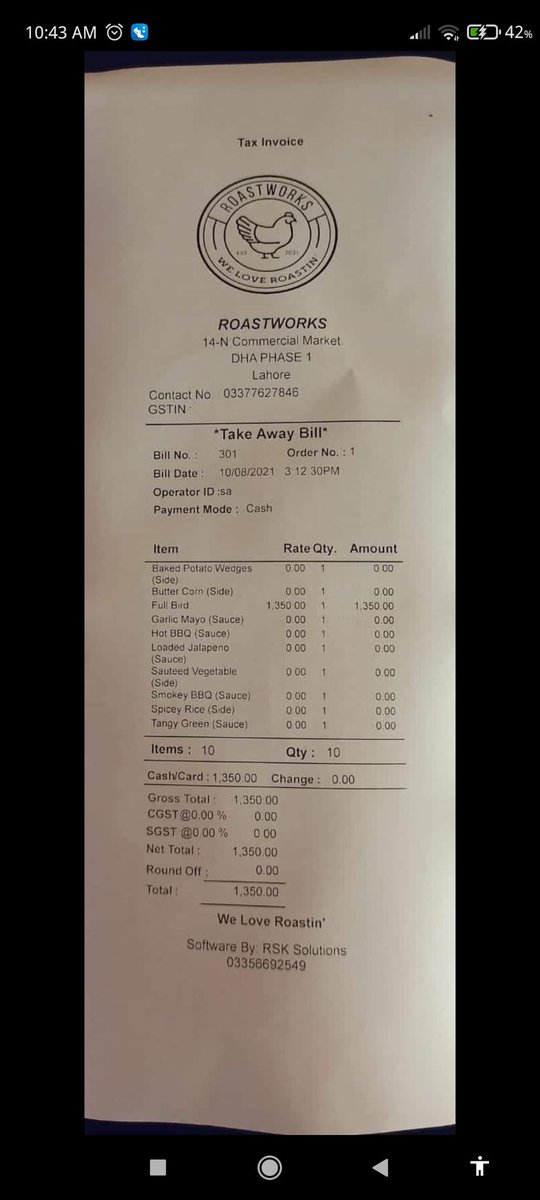

Next "Roastworks" in #DHA #Lahore issuing invoices which do not have any PNTN# on it so asked are they registered with #PRA

#TaxChoriBandKaru

783/n

#TaxChoriBandKaru

783/n

Complaint 25 Aug, Reply 15 Sep

It was NOT REGISTERED so a Registration notice was send by #PRA

#TaxChoriBandKaru

784/n

It was NOT REGISTERED so a Registration notice was send by #PRA

#TaxChoriBandKaru

784/n

Next "Meher Select" at Shell Petrol Pump #Islamabad issuing invoices with no NTN# no STRN# nor on #FBRPOS

#TaxChoriBandKaru

785/n

#TaxChoriBandKaru

785/n

Complaint 25 Aug, Reply 06 Oct

It was NOT REGISTERED for Sales Tax so a mandatory registration notice for Sales Tax issued and #FBRPOS proceedings to be initiated after it.

#TaxChoriBandKaru

786/n

It was NOT REGISTERED for Sales Tax so a mandatory registration notice for Sales Tax issued and #FBRPOS proceedings to be initiated after it.

#TaxChoriBandKaru

786/n

Next "Dandy Designs" at #JauharTown #Lahore issuing invoices with no NTN# no STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

787/n

#TaxChoriBandKaru

787/n

Complaint 25 Aug, Reply 14 Sep

It was NOT REGISTERED for Sales Tax so a registration notice issue by #FBR and further recoery proceedings to follow after it.

#TaxChoriBandKaru

788/n

It was NOT REGISTERED for Sales Tax so a registration notice issue by #FBR and further recoery proceedings to follow after it.

#TaxChoriBandKaru

788/n

Next "Red Onion" in #Rawalpindi issuing invoices which have a PNTN# but its showing nothing on #PRA website so asked about are they register or what

#TaxChoriBandKaru

789/n

#TaxChoriBandKaru

789/n

Complaint 25 Aug, Reply 13 Sep

They are registered with #PRA but printing wrong PNTN# so a notice send by PRA to mentione the correct PNTN# on invoice.

#TaxChoriBandKaru

790/n

They are registered with #PRA but printing wrong PNTN# so a notice send by PRA to mentione the correct PNTN# on invoice.

#TaxChoriBandKaru

790/n

Next "The Butcher's Cafe & Grill" in #Centurus Mall #Islamabad food court issuing invoices with no NTN# no STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

791/n

#TaxChoriBandKaru

791/n

Conplaint 25 Aug, Reply 13 Oct

It is registered with #FBR but issued a Show Cause notice for Penalty of Rs 1 Million for being non compliant and Fraud with #FBR

#TaxChoriBandKaru

792/n

It is registered with #FBR but issued a Show Cause notice for Penalty of Rs 1 Million for being non compliant and Fraud with #FBR

#TaxChoriBandKaru

792/n

Next "New Al Habib Pakwan & Biryani Center" at #KorangiCreek #Karachi issuing invoices with no SNTN# so asked are they registered with #SRB

#TaxChoriBandKaru

793/n

#TaxChoriBandKaru

793/n

Complaint 29 Aug, Reply 24 Sep

It was NOT REGISTERED with #SRB so a Show Cause notice for mandatory registration and imposition of penalty issued by #SRB

#TaxChoriBandKaru

794/n

It was NOT REGISTERED with #SRB so a Show Cause notice for mandatory registration and imposition of penalty issued by #SRB

#TaxChoriBandKaru

794/n

Next "Johny & Jugnu" at #Lahore issuing invoices with no PNTN# so asked are they registered with #PRA

#TaxChoriBandKaru

795/n

#TaxChoriBandKaru

795/n

Complaint 29 Aug, Reply 05 Oct

It was replied by #PRA that its registered with them since 2018 BUT not told was there any show cause notice for Penalty or warning for being non compliant or not!

#TaxChoriBandKaru

796/n

It was replied by #PRA that its registered with them since 2018 BUT not told was there any show cause notice for Penalty or warning for being non compliant or not!

#TaxChoriBandKaru

796/n

Next "Tulip Riverside Hotel & Restaurant" at #Jhelum issuing invoices without any PNTN# so asked are they registered with #PRA

#TaxChoriBandKaru

797/n

#TaxChoriBandKaru

797/n

Complaint 29 Aug, Reply 15 Sep

It is REGISTERED with #PRA since 2012 and so a Warning letter issued by #PRA for being non compliant

#TaxChoriBandKaru

798/n

It is REGISTERED with #PRA since 2012 and so a Warning letter issued by #PRA for being non compliant

#TaxChoriBandKaru

798/n

Next "Ajwa Bakers & Restaurant" at #Kharian issuing invoices without any PNTN# so asked are they registered with #PRA

#TaxChoriBandKaru

799/n

#TaxChoriBandKaru

799/n

Complaint 29 Aug, Reply 15 Sep

It is Registered with #PRA since Jan 2020 and been issued a Warning letter by #PRA for being non compliant

#TaxChoriBandKaru

800/n

It is Registered with #PRA since Jan 2020 and been issued a Warning letter by #PRA for being non compliant

#TaxChoriBandKaru

800/n

Next is "Yumm Biryani & Caterers" at #Landhi #Karachi issuing invoices without any SNTN# so asked if they are even registered with #SRB or not

#TaxChoriBandKaru

801/n

#TaxChoriBandKaru

801/n

Complaint 29 Aug, Reply 18 Sep

As per #SRB it doesnt need to register as its under the threshold and its daily sales is avg Rs 4k.

I don't buy this at all means not even selling 2 Daig Biryani or not even a Single Catering order/day 😂

#Ehsas mein dalo

#TaxChoriBandKaru

802/n

As per #SRB it doesnt need to register as its under the threshold and its daily sales is avg Rs 4k.

I don't buy this at all means not even selling 2 Daig Biryani or not even a Single Catering order/day 😂

#Ehsas mein dalo

#TaxChoriBandKaru

802/n

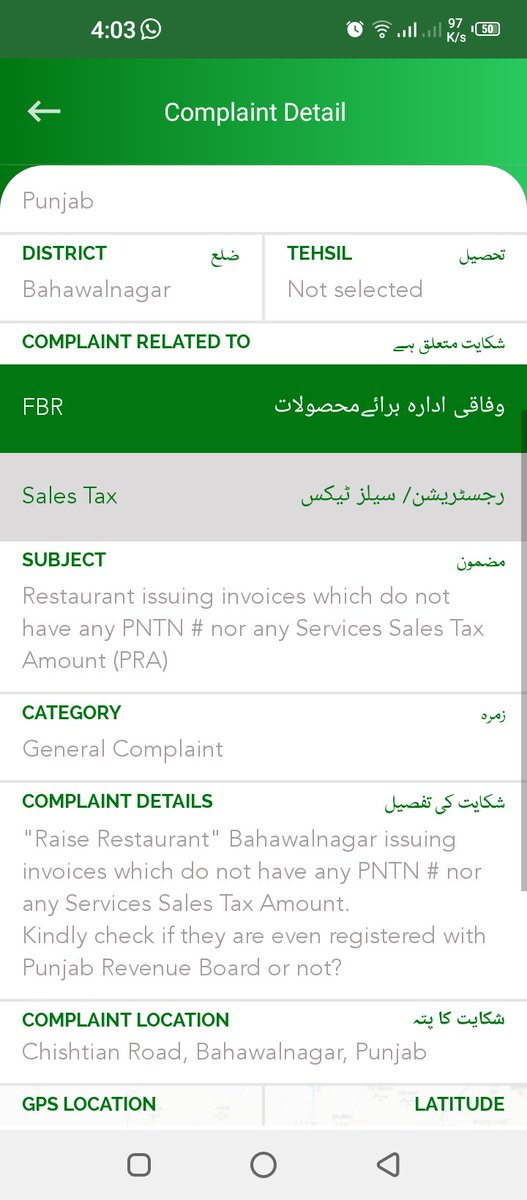

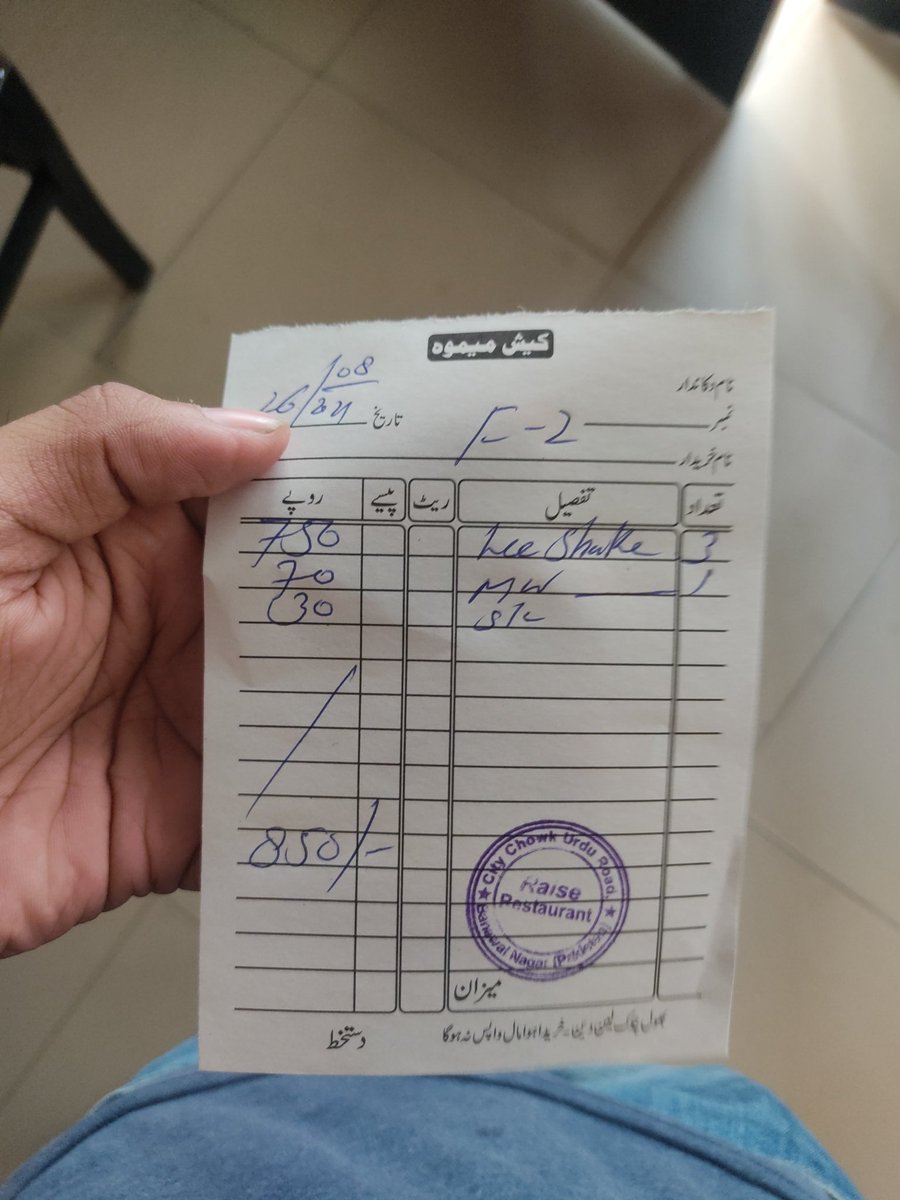

Next "Raise Restaurant" at #Bahawalnagar issuing invoices with no PNTN# so asked if they are registered with #PRA

#TaxChoriBandKaru

803/n

#TaxChoriBandKaru

803/n

Complaint 29 Aug, Reply 13 Sep

It is registered with #PRA but issued a show cause notice for being non compliant

#TaxChoriBandKaru

804/n

It is registered with #PRA but issued a show cause notice for being non compliant

#TaxChoriBandKaru

804/n

Next "Tipu Store" at Cantt #Multan issuing invoices with no NTN# no STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

805/n

#TaxChoriBandKaru

805/n

Complaint 05 Sep, Reply 23 Sep

Another Stereotype robotic reply from @FBRSpokesperson

Where they basically answered NOTHING out of the 3 Questions asked

#TaxChoriBandKaru

806/n

Another Stereotype robotic reply from @FBRSpokesperson

Where they basically answered NOTHING out of the 3 Questions asked

#TaxChoriBandKaru

806/n

Next is "Biryani Center" in #DHA #Karachi issuing invoices with no SNTN# so asked are they registered with #SRB or not

#TaxChoriBandKaru

807/n

#TaxChoriBandKaru

807/n

Complaint 05 Sep, Reply 01 Nov

It is Registered with #SRB but issued a show cause notice for being non compliant for imposition of penalty by #SRB

#TaxChoriBandKaru

808/n

It is Registered with #SRB but issued a show cause notice for being non compliant for imposition of penalty by #SRB

#TaxChoriBandKaru

808/n

Next "Pak Islam Dairy & Ice Cream" at #ShahFaisal #Karachi not issuing any invoices so asked are they registered with #SRB or not

#TaxChoriBandKaru

809/n

#TaxChoriBandKaru

809/n

Complaint 05 Sep, Reply 02 Nov

It was NOT REGISTERED so issued a show cause notice for mandatory registration and imposition of penalty by #SRB

#TaxChoriBandKaru

810/n

It was NOT REGISTERED so issued a show cause notice for mandatory registration and imposition of penalty by #SRB

#TaxChoriBandKaru

810/n

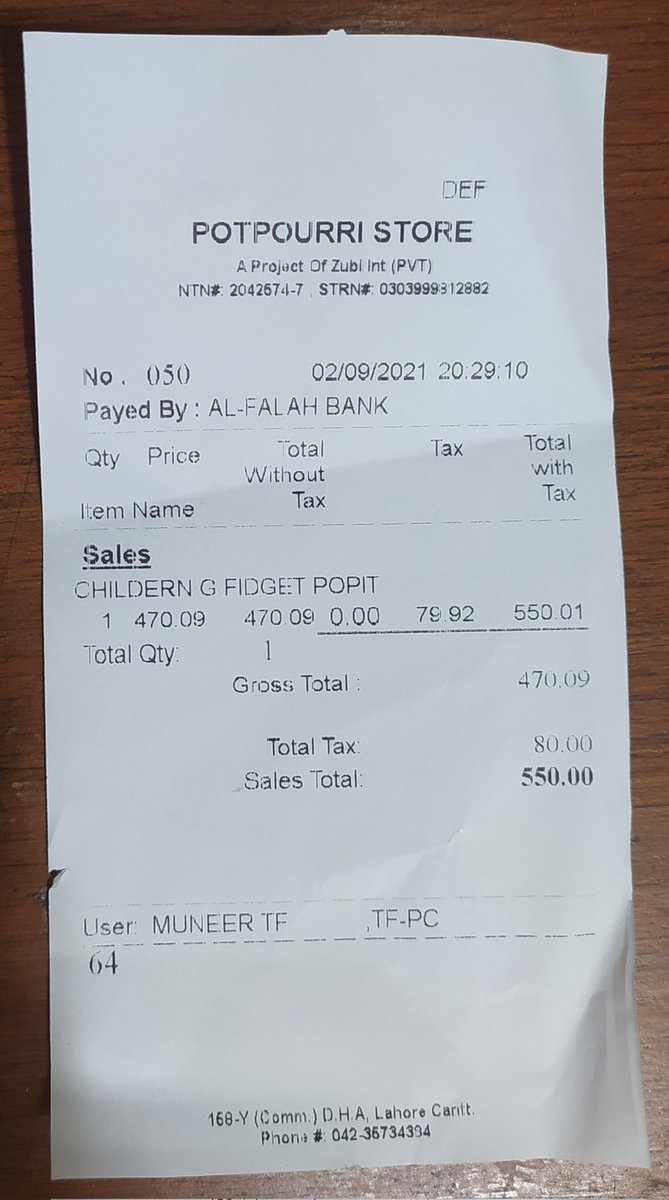

Next "Potpouri Store" in #DHA #Lahore issuing invoices not linked with #FBRPOS

#TaxChoriBandKaru

811/n

#TaxChoriBandKaru

811/n

Complaint 05 Sep, Reply 11 Nov

This is a Weird reply for me I couldnt decipher, It is integrated with #FBRPOS and FBR said the slip was of Bank Confirmation not actual sales so no #FBRPOS particulars on it.

It looks a sale receipt rather than a Bank Slip

#TaxChoriBandKaru

812/n

This is a Weird reply for me I couldnt decipher, It is integrated with #FBRPOS and FBR said the slip was of Bank Confirmation not actual sales so no #FBRPOS particulars on it.

It looks a sale receipt rather than a Bank Slip

#TaxChoriBandKaru

812/n

Next "Noman Foods" in #Korangi #Karachi not issuing invoices so asked are they even registered with #SRB

#TaxChoriBandKaru

813/n

#TaxChoriBandKaru

813/n

Complaint 05 Sep, Reply 01 Nov

It was NOT REGISTERED and made to register on complaint by #SRB and now issuing Sales Tax Invoices.

Actually they are still not and have filed another one against them for Non Compliance after this too 😄

#TaxChoriBandKaru

814/n

It was NOT REGISTERED and made to register on complaint by #SRB and now issuing Sales Tax Invoices.

Actually they are still not and have filed another one against them for Non Compliance after this too 😄

#TaxChoriBandKaru

814/n

Next "Saveway Super Mart" in #GulshaneIqbal #Karachi which was made to integrate on a previous complaint send to Concerned commisionar still issuing invoices with no NTN# STRN# nor linked with #FBRPOS so asked what happened to previous complaint

#TaxChoriBandKaru

815/n

#TaxChoriBandKaru

815/n

Complaint 05 Sep, Reply 01 Nov

@FBRSpokesperson

As always replied HALF the things, that its integrated now with #FBRPOS BUT didn't said a thing on what action taken on FRAUD of issuing NON FBRPOS slips now after being integrated?

#TaxChoriBandKaru

816/n

@FBRSpokesperson

As always replied HALF the things, that its integrated now with #FBRPOS BUT didn't said a thing on what action taken on FRAUD of issuing NON FBRPOS slips now after being integrated?

#TaxChoriBandKaru

816/n

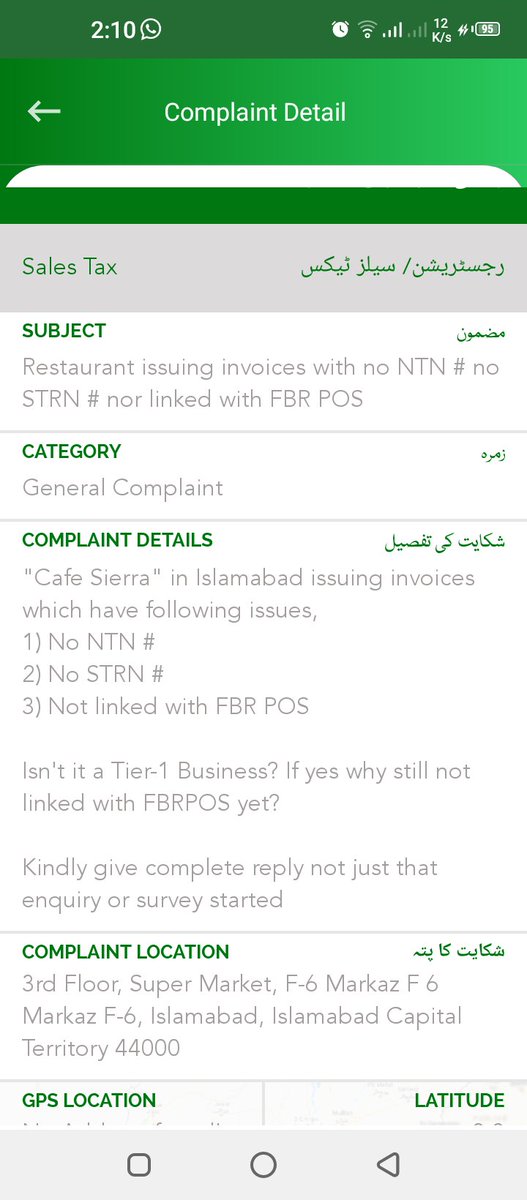

Next "Cafe Sierra" in #Islamabad issuing invoices with no NTN# STRN# nor linked with #FBRPOS

#TaxChoriBandKaru

817/n

#TaxChoriBandKaru

817/n

Complaint 05 Sep, Reply 07 Oct

It was NOT INTEGRATED and issued a show cause notice now for #FBRPOS integration

#TaxChoriBandKaru

818/n

It was NOT INTEGRATED and issued a show cause notice now for #FBRPOS integration

#TaxChoriBandKaru

818/n

Next "Soni Smart Mart" at #Clifton #Karachi issuing invoices without any NTN# STRN# nor linked with #FBRPOS

#TaxChoriBandKaru

819/n

#TaxChoriBandKaru

819/n

Complaint 05 Sep, Reply 11 Oct

Send to concerned commisionar IR for investigation

#TaxChoriBandKaru

820/n

Send to concerned commisionar IR for investigation

#TaxChoriBandKaru

820/n

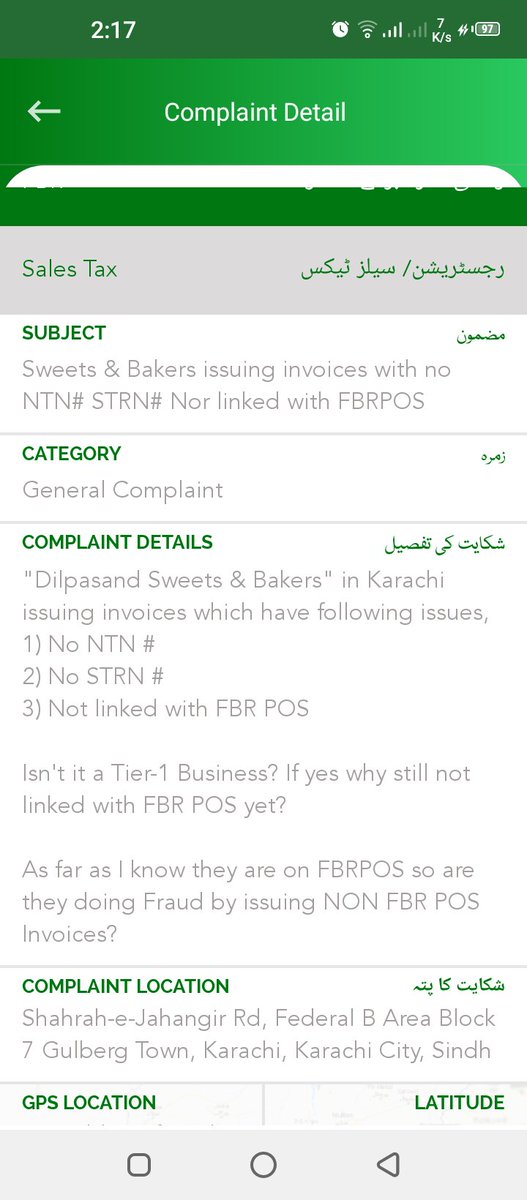

Next "Dilpasand Sweets & Bakers" in #Karachi #AyeshaManzil branch issuing invoices without any NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

821/n

#TaxChoriBandKaru

821/n

Complaint 05 Sep, Reply 10 Nov

@FBRSpokesperson

As most of the time disregarded the evidence provided and said they observed that its compliant in mystery shopping 😄

They are not, have put up another one with new invoices!

#TaxChoriBandKaru

@dilpasand1957

822/n

@FBRSpokesperson

As most of the time disregarded the evidence provided and said they observed that its compliant in mystery shopping 😄

They are not, have put up another one with new invoices!

#TaxChoriBandKaru

@dilpasand1957

822/n

Next "United King" in #Clifton #Karachi issuing invoices without any NTN# STRN# nor linked with #FBRPOS

They were issued a show cause & penalty of Rs 1 Milion in April to integrate with FBRPOS so enquired are they still not integrated?

#TaxChoriBandKaru

823/n

They were issued a show cause & penalty of Rs 1 Milion in April to integrate with FBRPOS so enquired are they still not integrated?

#TaxChoriBandKaru

823/n

Conplaint 05 Sep, Reply 10 Nov

@FBRSpokesperson

Again not replied to most part, said show cause issued alredy, didnt answer is it integrated or not still or are they talking about that one in April or a New one on this!

#TaxChoriBandKaru

824/n

@FBRSpokesperson

Again not replied to most part, said show cause issued alredy, didnt answer is it integrated or not still or are they talking about that one in April or a New one on this!

#TaxChoriBandKaru

824/n

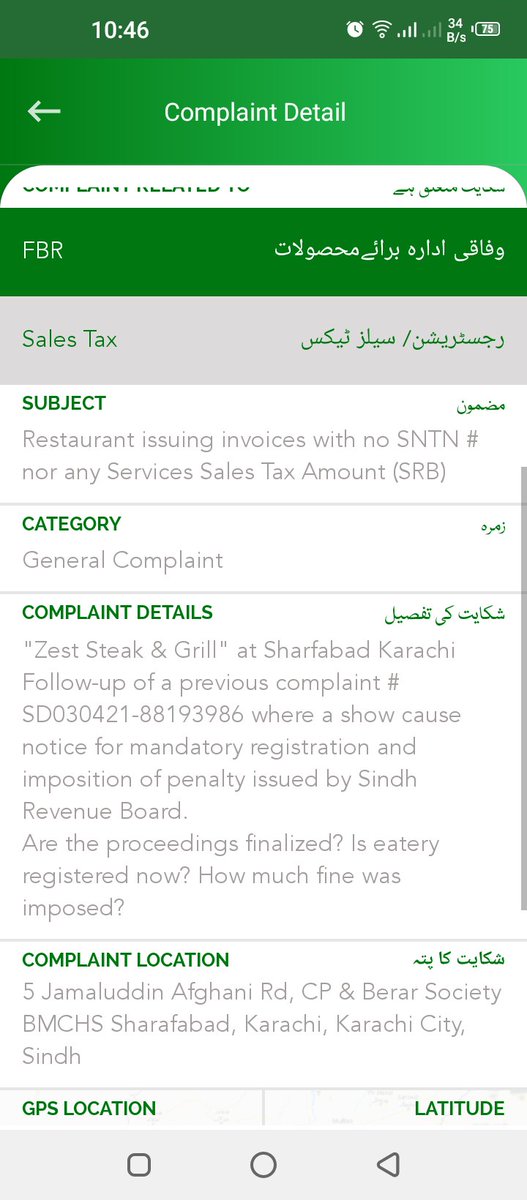

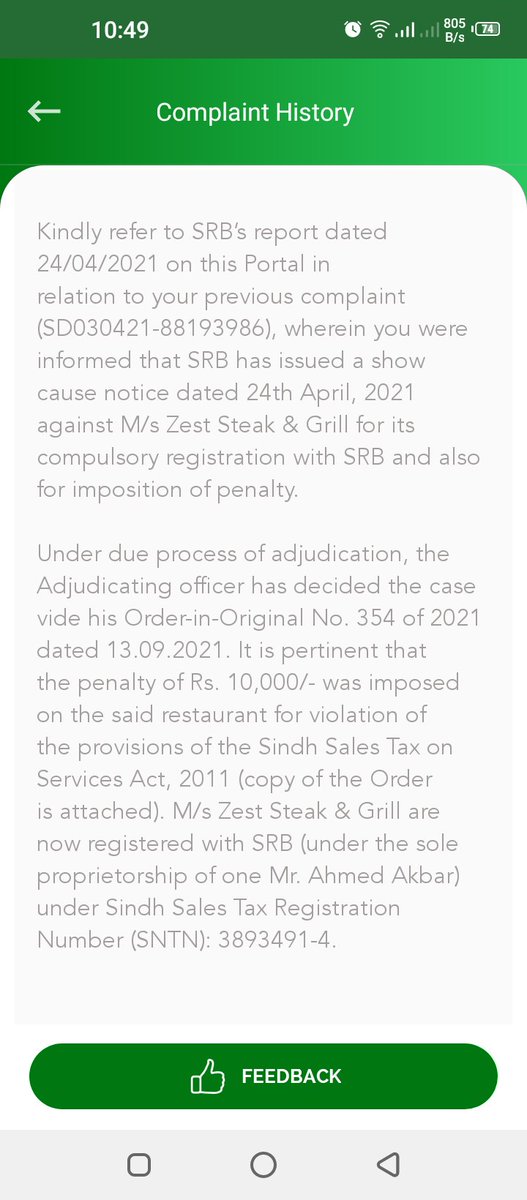

Next "Zest Steak & Grill" at #Sharfabad #Karachi it was a followup of previous complaint where it was issued a show cause notice for mandatory registration & imposition of penalty so asked are the proceedings now completed? #TaxChoriBandKaru

825/n

825/n

Complaint 22 Dec, Reply 04 Jan

It is now registered with Sindh Revenue Board and was fined Rs 10,000/

#TaxChoriBandKaru

826/n

It is now registered with Sindh Revenue Board and was fined Rs 10,000/

#TaxChoriBandKaru

826/n

Next "Al Reef Shawarma" in #Karachi

This was a followup of previous complaint where it was issued a mandatory registration and imposition of penalty notice by #SRB so asked are the proceedings finalized now?

#TaxChoriBandKaru

827/n

This was a followup of previous complaint where it was issued a mandatory registration and imposition of penalty notice by #SRB so asked are the proceedings finalized now?

#TaxChoriBandKaru

827/n

Complaint 23 Dec, Reply 07 Jan

It is now registered with #SRB and was fined Rs 100,000/

#TaxChoriBandKaru

828/n

It is now registered with #SRB and was fined Rs 100,000/

#TaxChoriBandKaru

828/n

Next "Hunger Melts" in #GulistaneJauhar #Karachi

A followup where it was issued a Show cause notice for mandatory registration and imposition of penalty so asked are the proceedings finalized by #SRB

#TaxChoriBandKaru

829/n

A followup where it was issued a Show cause notice for mandatory registration and imposition of penalty so asked are the proceedings finalized by #SRB

#TaxChoriBandKaru

829/n

Complaint 23 Dec, Reply 07 Jan

It is now registered with #SRB and was fined Rs 100,000/

#TaxChoriBandKaru

830/n

It is now registered with #SRB and was fined Rs 100,000/

#TaxChoriBandKaru

830/n

Next "Readings" at #Gulberg #Lahore issuing invoices which do not have any NTN# STRN# nor linked with #FBRPOS

#TaxChoriBandKaru

831/n

#TaxChoriBandKaru

831/n

Complaint 01 Aug, Reply 06 Jan

It was not registered so proceedings started to get it registered & integrated with #FBRPOS

#TaxChoriBandKaru

832/n

It was not registered so proceedings started to get it registered & integrated with #FBRPOS

#TaxChoriBandKaru

832/n

Next "Tehzeeb Restaurant by Tasty" in #Multan issuing with no PNTN# nor any services sales tax amount so asked are they registered with #PRA or not?

#TaxChoriBandKaru

833/n

#TaxChoriBandKaru

833/n

Complaint 05 Sep, Reply 07 Oct

It is registered with #PRA but issued Penalty notice for issuing non compliant receipts

#TaxChoriBandKaru

834/n

It is registered with #PRA but issued Penalty notice for issuing non compliant receipts

#TaxChoriBandKaru

834/n

Next "Mjs Sweet & Bakers" in #Rawalpindi issuing invoices which do not have any NTN# nor STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

835/n

#TaxChoriBandKaru

835/n

Complaint 05 Sep, Reply 15 Nov

This was NOT REGISTERED for Sales Tax so proceedings started to make them register by #FBR

#TaxChoriBandKaru

836/n

This was NOT REGISTERED for Sales Tax so proceedings started to make them register by #FBR

#TaxChoriBandKaru

836/n

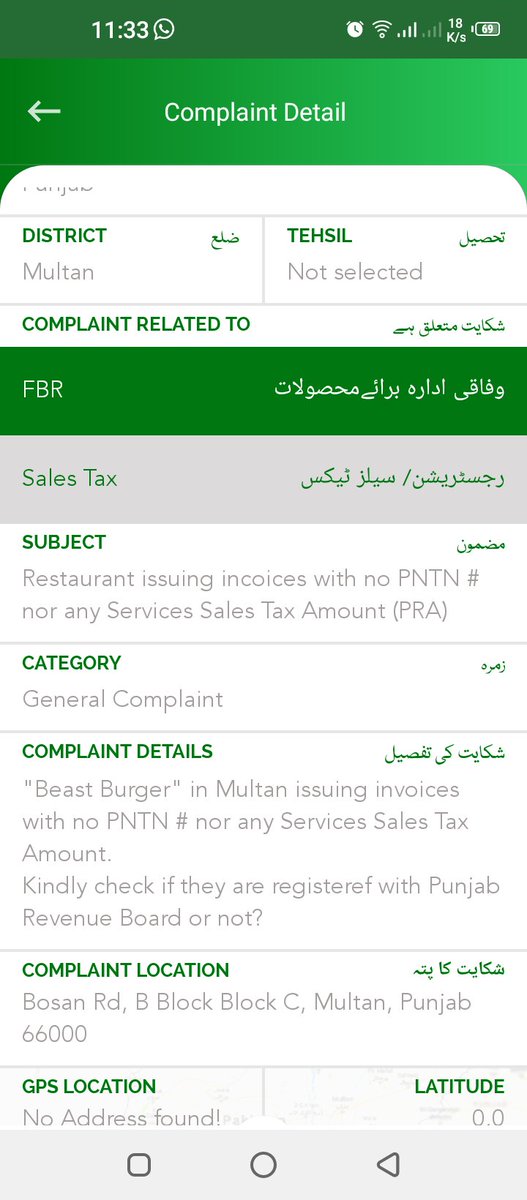

Next "Beast Burger" in #Multan issuing invoices which do not have any PNTN# nor any services sales tax amount so asked is it registered with #PRA or not?

#TaxChoriBandKaru

837/n

#TaxChoriBandKaru

837/n

Complaint 05 Sep, Reply 07 Oct

It was NOT REGISTERED so send registration notice by #PRA

#TaxChoriBandKaru

838/n

It was NOT REGISTERED so send registration notice by #PRA

#TaxChoriBandKaru

838/n

Next "Anarkali" in #Rawalpindi over charging for Mineral Water, Soft Drink & Roti

#TaxChoriBandKaru

839/n

#TaxChoriBandKaru

839/n

Complaint 05 Sep, Reply 05 Oct

This is weird I stopped doing such complaints as MOST commisionars said that Eateries doesnt come under Price Act but on the other hand some commisionars fined such eateries like this which was fined Rs 5,000/

#TaxChoriBandKaru

840/n

This is weird I stopped doing such complaints as MOST commisionars said that Eateries doesnt come under Price Act but on the other hand some commisionars fined such eateries like this which was fined Rs 5,000/

#TaxChoriBandKaru

840/n

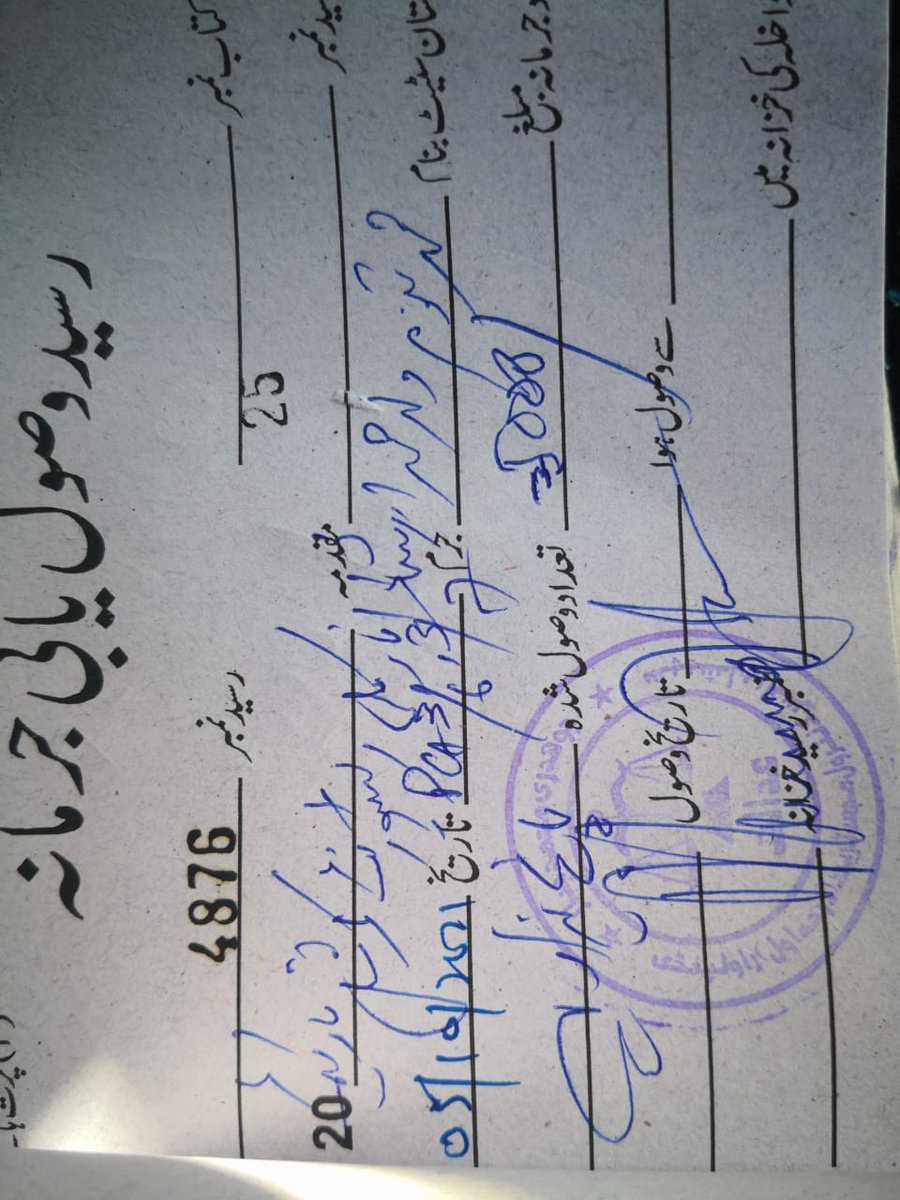

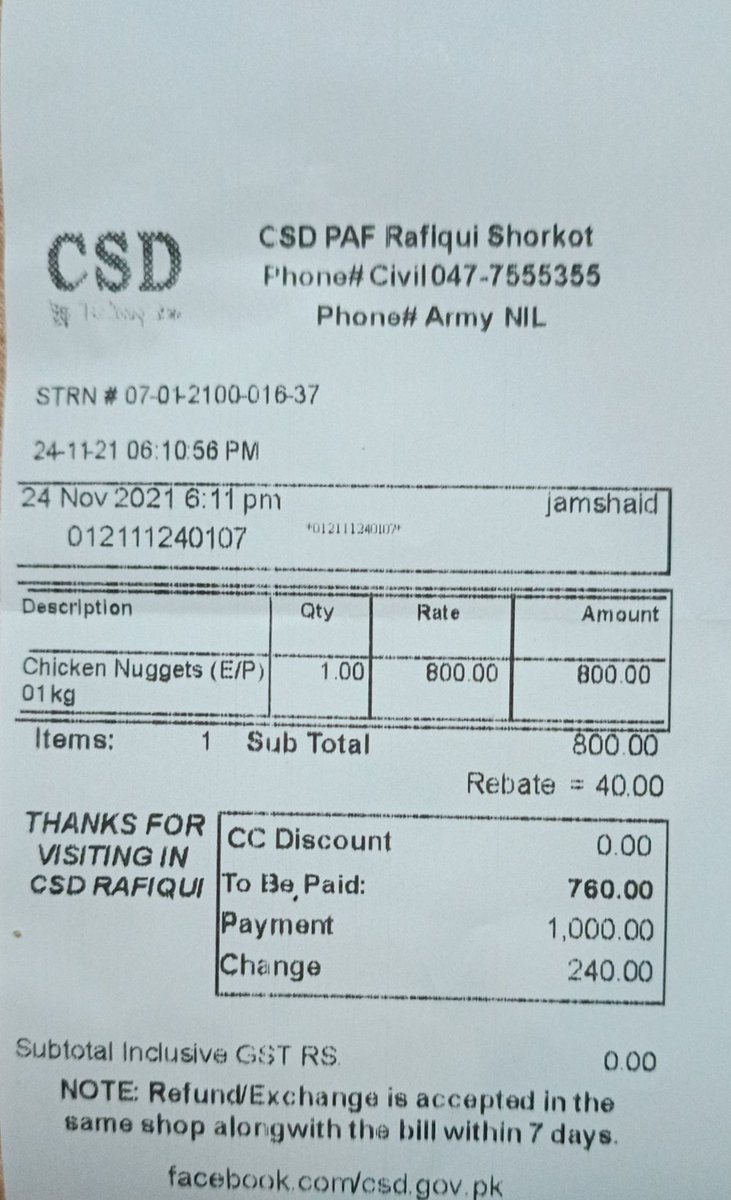

Next "CSD" mart at #PAF Base #Shorkot issuing invoices not having any NTN# nor linked with #FBRPOS

#TaxChoriBandKaru

841/n

#TaxChoriBandKaru

841/n

Complaint 06 Dec, Reply 28 Dec

It was mentioned that 46 Branches are Registered BUT THIS BRANCH is NOT REGISTERED with #FBR so show cause notice issued and legal process for registration and integration started #TaxChoriBandKaru

842/n

It was mentioned that 46 Branches are Registered BUT THIS BRANCH is NOT REGISTERED with #FBR so show cause notice issued and legal process for registration and integration started #TaxChoriBandKaru

842/n

Next "Defence Services Officers Mess" in #Lahore issuing invoices which do not have any PNTN# nor any services sales tax amount, so asked are they registered with #PRA or not

#TaxChoriBandKaru

843/n

#TaxChoriBandKaru

843/n

Complaint 10 Dec, Reply 27 Dec

It was NOT registered and served a Registration show cause notice by #PRA

#TaxChoriBandKaru

844/n

It was NOT registered and served a Registration show cause notice by #PRA

#TaxChoriBandKaru

844/n

Next "Ejaz Food Chatkhara" in #NorthKarachi issuing invoices not having any SNTN# nor any services sales tax amount.

#TaxChoriBandKaru

845/n

#TaxChoriBandKaru

845/n

Complaint 05 Sep, Reply 02 Nov

It was NOT REGISTERED but asked to register by #SRB and they complied now

#TaxChoriBandKaru

846/n

It was NOT REGISTERED but asked to register by #SRB and they complied now

#TaxChoriBandKaru

846/n

Next "B.B.Q. Tonight" in #Islamabad issuing invoices which are not linked with #FBRPOS

#TaxChoriBandKaru

847/n

#TaxChoriBandKaru

847/n

Complaint 05 Sep, Reply 11 Oct

It was ASKED to Integrate before also and a show cause of Rs 1 Million was already imposed on it for Non Integration on which they haven't complied yet.

Such names and have NO SHAME!

#TaxChoriBandKaru

848/n

It was ASKED to Integrate before also and a show cause of Rs 1 Million was already imposed on it for Non Integration on which they haven't complied yet.

Such names and have NO SHAME!

#TaxChoriBandKaru

848/n

Next "Imtiaz Super Store" branch in #Clifton #Karachi issuing invoices not linked with #FBRPOS doing fraud with #FBR

#TaxChoriBandKaru

849/n

#TaxChoriBandKaru

849/n

Complaint 05 Sep, Reply 17 Nov

Statutory action against #Imtiaz initiated after examining and finding complaint to be true.

Usually fines for such are Rs 500,000/ thats what was mentioned in all such cases where #FBR mentioned amount or attached notice

#TaxChoriBandKaru

850/n

Statutory action against #Imtiaz initiated after examining and finding complaint to be true.

Usually fines for such are Rs 500,000/ thats what was mentioned in all such cases where #FBR mentioned amount or attached notice

#TaxChoriBandKaru

850/n

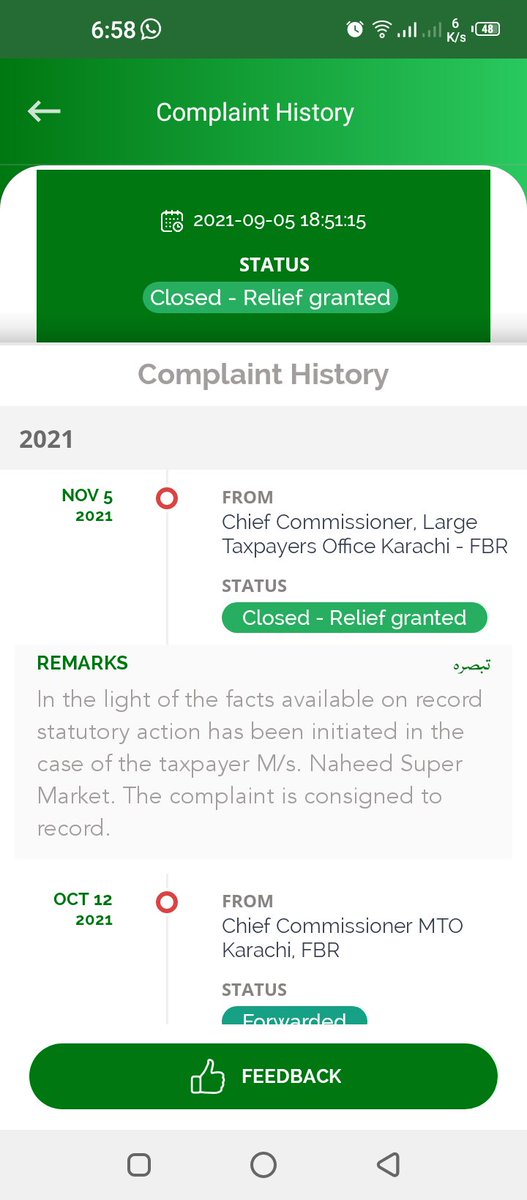

Next "Naheed . pk" their online version when ordering from it they are issuing invoices not linked with #FBRPOS

#TaxChoriBandKaru

851/n

#TaxChoriBandKaru

851/n

Complaint 05 Sep, Reply 05 Nov

Statutory action has been taken in light of Facts.

Whatever that means in #FBR terms

#TaxChoriBandKaru

852/n

Statutory action has been taken in light of Facts.

Whatever that means in #FBR terms

#TaxChoriBandKaru

852/n

Next "Frizzle" at #JauharTown #Lahore issuing invoices not having any PNTN# nor any Services Sales Tax Amount so asked is it registered with #PRA or not

#TaxChoriBandKaru

853/n

#TaxChoriBandKaru

853/n

Complaint 05 Sep, Reply 07 Oct

It is registered with #PRA but a show cause notice for Penalty of Rs 25,000/ is served for being Non Compliant.

#TaxChoriBandKaru

854/n

It is registered with #PRA but a show cause notice for Penalty of Rs 25,000/ is served for being Non Compliant.

#TaxChoriBandKaru

854/n

Next "Kitchen Deli" in #Islamabad issuing invoices without any NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

855/n

#TaxChoriBandKaru

855/n

Complaint 05 Sep, Reply 07 Oct

It was NOT INTEGRATED so issued notice for Integration with #FBRPOS by #FBR

#TaxChoriBandKaru

856/n

It was NOT INTEGRATED so issued notice for Integration with #FBRPOS by #FBR

#TaxChoriBandKaru

856/n

Next "H Mart" at #Hayatabad #Peshawar issuing invoices not having any NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

857/n

#TaxChoriBandKaru

857/n

Complaint 05 Sep, Reply 21 Sep

It is Registered for Income Tax & Sales Tax and #FBRPOS integration already underway

#TaxChoriBandKaru

858/n

It is Registered for Income Tax & Sales Tax and #FBRPOS integration already underway

#TaxChoriBandKaru

858/n

Next "Broadway Pizza" at #IqbalTown #Lahore charging 16% Sales Tax on Card Payments instead of 5% so asked do they have the approval from #PRA for doing this?

#TaxChoriBandKaru

859/n

#TaxChoriBandKaru

859/n

Complaint 05 Sep, Reply 04 Oct

Broadway Pizza didn't have the approval for charging 16% on Card Payments and were fined Rs 10,000/ by #PRA after hearings

#TaxChoriBandKaru

860/n

Broadway Pizza didn't have the approval for charging 16% on Card Payments and were fined Rs 10,000/ by #PRA after hearings

#TaxChoriBandKaru

860/n

Next "Time Out" shop at #Attock Petrol Station in #Islamabad issuing invoices with no NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

861/n

#TaxChoriBandKaru

861/n

Complaint 05 Sep, Reply 13 Oct

It was NOT REGISTERED so verification and registration process started by #FBR

#TaxChoriBandKaru

862/n

It was NOT REGISTERED so verification and registration process started by #FBR

#TaxChoriBandKaru

862/n

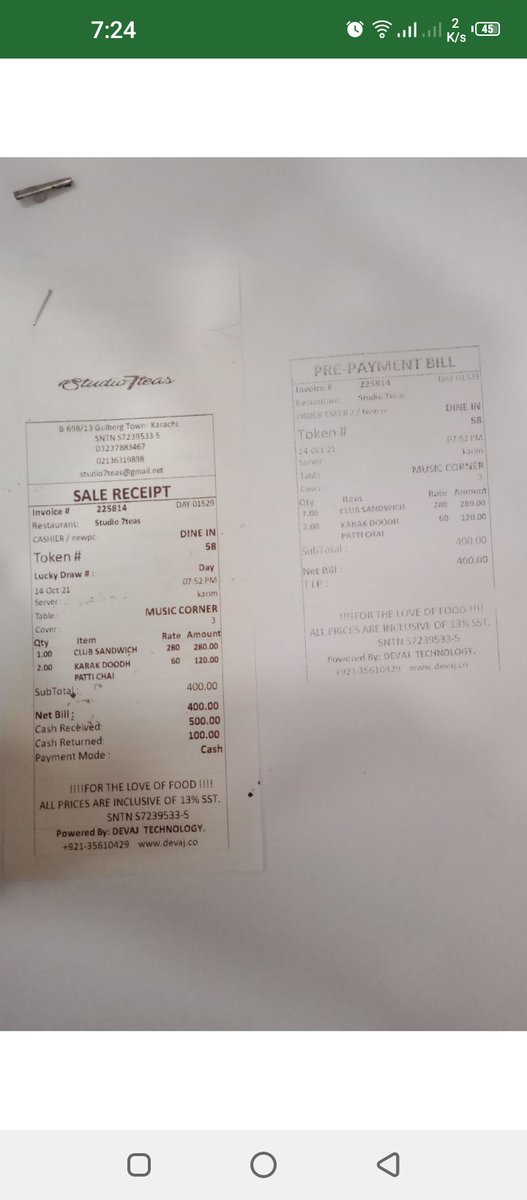

Next "Studio 7Teas" in #Karachi issuing invoices not having any SNTN# nor any Services Sales Tax Amount so asked are they registered with #SRB or not?

#TaxChoriBandKaru

863/n

#TaxChoriBandKaru

863/n

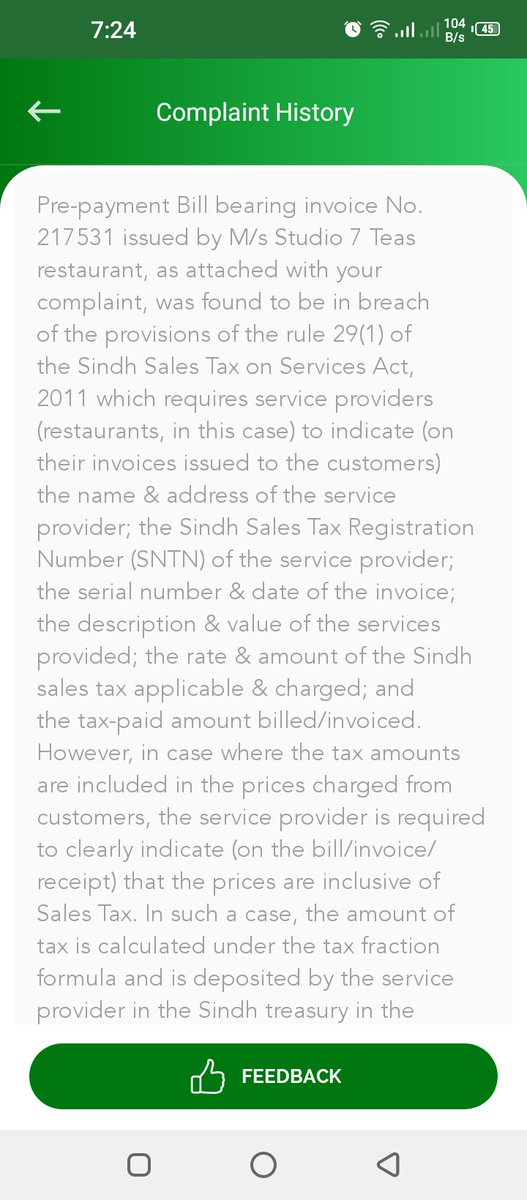

Complaint 05 Sep, Reply 18 Oct

It is Registered and is Warned to issue proper sales tax invoices which they complied

#TaxChoriBandKaru

864/n

It is Registered and is Warned to issue proper sales tax invoices which they complied

#TaxChoriBandKaru

864/n

Next "Paul Bakery & Cafe" in #DHA #Karachi issuing invoices with no SNTN# and are charging services sales tax so asked are they registered with #SRB or not?

#TaxChoriBandKaru

865/n

#TaxChoriBandKaru

865/n

Complaint 05 Sep, Reply 28 Oct

They are Registered with #SRB and are warned by them to issue proper Sales Tax Invoices which they now have complied

#TaxChoriBandKaru

866/n

They are Registered with #SRB and are warned by them to issue proper Sales Tax Invoices which they now have complied

#TaxChoriBandKaru

866/n

Next "The Jammers Cafe" in #Islamabad issuing invoices which do not have any NTN# STRN# nor linked with #FBRPOS either

#TaxChoriBandKaru

867/n

#TaxChoriBandKaru

867/n

Complaint 05 Sep, Reply 21 Sep

It is NOT REGISTERED as No record was found in system, so Verification & Registration proceedings started by #FBR

#TaxChoriBandKaru

868/n

It is NOT REGISTERED as No record was found in system, so Verification & Registration proceedings started by #FBR

#TaxChoriBandKaru

868/n

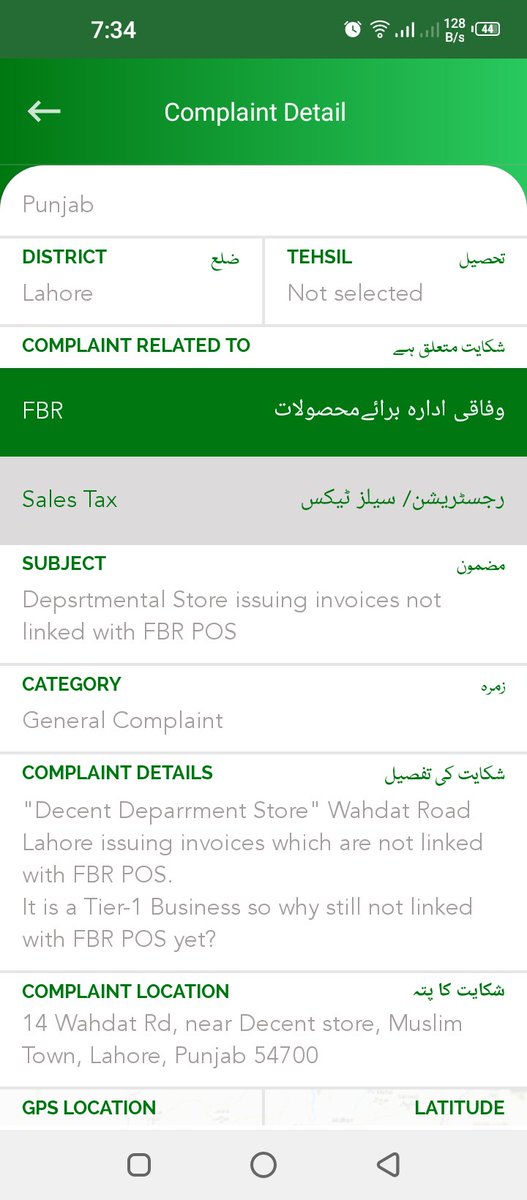

Next "Decent Department Store" #WahdatRoad #Lahore issuing invoices not linked with #FBRPOS

#TaxChoriBandKaru

869/n

#TaxChoriBandKaru

869/n

Complaint 05 Sep, Reply 28 Sep

It is Integrated BUT a weird reply from @FBRSpokesperson

Saying its an #FBRPOS invoice lol I dont see any FBR Invoice # or QR Code on it.

#TaxChoriBandKaru

870/n

It is Integrated BUT a weird reply from @FBRSpokesperson

Saying its an #FBRPOS invoice lol I dont see any FBR Invoice # or QR Code on it.

#TaxChoriBandKaru

870/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh