Investing in crypto is about understanding narratives: time the narratives, ride the trade, and benefit from the momentum of an inefficient market discovering value.

Here are the narratives that will shape crypto and mint millionaires in 2022:

(THREAD)👇

Here are the narratives that will shape crypto and mint millionaires in 2022:

(THREAD)👇

1. The L1 Trade Continues

The explosive growth of non-eth L1s is not a fad, $ETH dominance is not a given.

Devs and users continue to embrace new chains in the hopes of being early.

@TaschaLabs outlines the dilemma of just rotating back to $ETH below:

The explosive growth of non-eth L1s is not a fad, $ETH dominance is not a given.

Devs and users continue to embrace new chains in the hopes of being early.

@TaschaLabs outlines the dilemma of just rotating back to $ETH below:

https://twitter.com/TaschaLabs/status/1475640136130043914?s=20

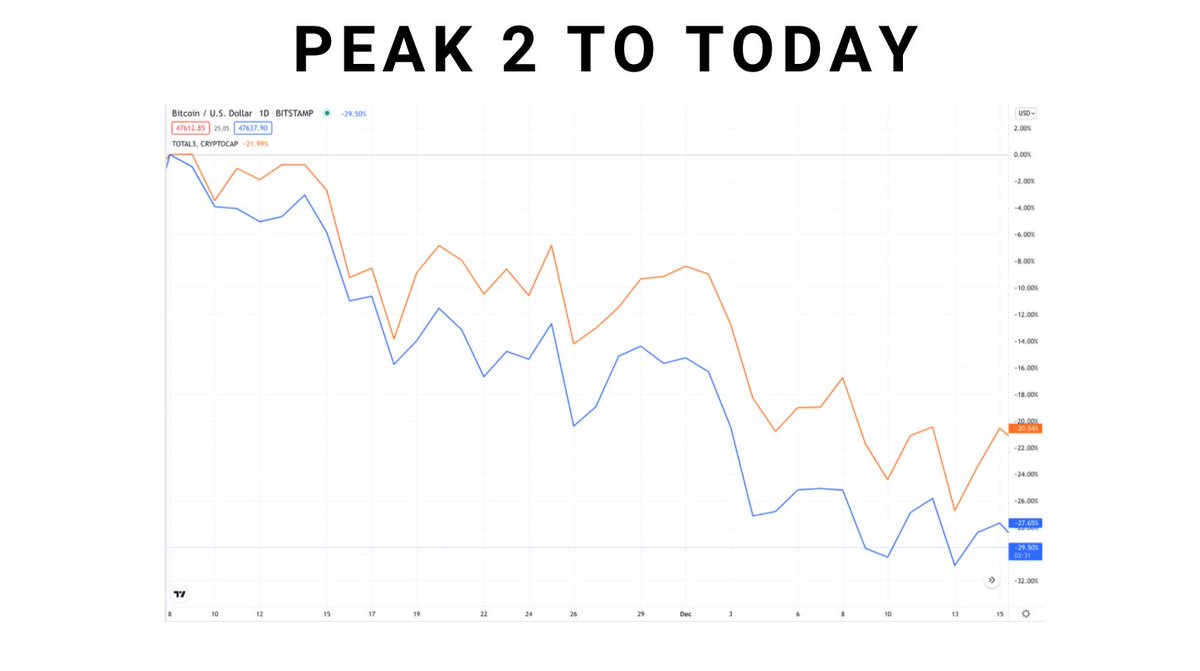

We've already seen the second phase of this trade begin: check out this chart of L1 performance since the $BTC peak in November.

Most L1s tracking $BTC, $ETH flat, but tokens like $NEAR, $LUNA, and $AVAX pumping.

Understanding these rotations and riding them will be vital.

Most L1s tracking $BTC, $ETH flat, but tokens like $NEAR, $LUNA, and $AVAX pumping.

Understanding these rotations and riding them will be vital.

Most chains track $BTC / $ETH while a few pump.

With limited new capital coming to the space, the 'rotator' meme will become dominant.

An L1 will pump, people pile in, it will top, then the next L1 pump will happen.

Communities and 'fundamental value' will determine winners.

With limited new capital coming to the space, the 'rotator' meme will become dominant.

An L1 will pump, people pile in, it will top, then the next L1 pump will happen.

Communities and 'fundamental value' will determine winners.

2. The L2 Trade Begins

L2s are beginning to come to market and launch tokens: Loopring ( $LRC ) and Polygon ( $MATIC ) have both shipped early and outperformed $ETH since the Nov 8 ATH.

L2s are beginning to come to market and launch tokens: Loopring ( $LRC ) and Polygon ( $MATIC ) have both shipped early and outperformed $ETH since the Nov 8 ATH.

Many $ETH adopters have missed the alt-L1 trade, and these L2 rollups present a great opportunity to get back into smaller, high-potential projects.

Value will flow away from ETH and into rollups: ZkSync, Optimism, Arbitrum will lead the charge as they airdrop tokens in 2022.

Value will flow away from ETH and into rollups: ZkSync, Optimism, Arbitrum will lead the charge as they airdrop tokens in 2022.

3. The DeFi Revival

The other option for capital rotation into 'fundamental value' is into the protocols that accrue and distribute cash flows: $CRV and $CVX lead the way.

Also look at things like $SPELL, $MKR, $YFI, and older DeFi coins to pump relative to $ETH.

The other option for capital rotation into 'fundamental value' is into the protocols that accrue and distribute cash flows: $CRV and $CVX lead the way.

Also look at things like $SPELL, $MKR, $YFI, and older DeFi coins to pump relative to $ETH.

This trade might also happen on other L1s: $LUNA, $AVAX, and $SOL early adopters will take capital into DeFi ecosystems that have steadily bleed against the L1 token.

Is DeFi 2.0 winter coming?

Is DeFi 2.0 winter coming?

There are some other narratives fighting for traction as well that might turn into tradeable trends:

• Metaverse tokens

• GameFi

• NFT revival

The slow-bleed-to-zero and @zhusu supercycle are also investable memes, but they can be applied to the whole crypto market.

• Metaverse tokens

• GameFi

• NFT revival

The slow-bleed-to-zero and @zhusu supercycle are also investable memes, but they can be applied to the whole crypto market.

In scrappy, sideways markets, it's vital to keep your ear to the ground. Getting good alpha will be important.

Investing becomes more of a zero-sum game. Investors that primarily use buy-and-hold strategies (like me) will have to be more patient until we see a sentiment change.

Investing becomes more of a zero-sum game. Investors that primarily use buy-and-hold strategies (like me) will have to be more patient until we see a sentiment change.

Like the thread? Please help me out with a few favors:

1. Give me a follow! @jackniewold, I tweet about altcoins

2. Give the thread a fav/RT, it helps it get out to more people:

1. Give me a follow! @jackniewold, I tweet about altcoins

2. Give the thread a fav/RT, it helps it get out to more people:

https://twitter.com/JackNiewold/status/1475911658451185665?s=20

Last thing: if you'd like to read more about altcoins and fundamental/market analysis, check out my newsletter below:

cryptopragmatist.com/sign-up-twitte…

cryptopragmatist.com/sign-up-twitte…

• • •

Missing some Tweet in this thread? You can try to

force a refresh