Our investing focus lies on two factors that we see prominent for the #India #markets.

#Momentum & #LowVolatility

Lets see why #LowVolatility.

A 🧵

1/n

#Investing #Volatility #portfolios

#Momentum & #LowVolatility

Lets see why #LowVolatility.

A 🧵

1/n

#Investing #Volatility #portfolios

First up is straight out returns performance.

#LowVolatility portfolios have out-performed their market cap-weighted benchmarks.

2/n

#LowVolatility portfolios have out-performed their market cap-weighted benchmarks.

2/n

The #LowVolatility #portfolio outperformance is persistent and shows prevalence over a long period of historical data.

#investing #volatility #LowVol

3/n

#investing #volatility #LowVol

3/n

The #LowVol #portfolio effect or anomaly as it is also called also spans geographies.

Data across developed and emerging markets shows a consistent risk-reduction and outperformance.

#investing #volatility #LowVol

4/n

Data across developed and emerging markets shows a consistent risk-reduction and outperformance.

#investing #volatility #LowVol

4/n

Long term risk reduction in #LowVol portfolios comes from

a) lower correlation to broad indices during bear and sideways markets

b) internal diversification benefits as the constituents have lower correlation to each other compared to #momentum portfolios

#investing

5/n

a) lower correlation to broad indices during bear and sideways markets

b) internal diversification benefits as the constituents have lower correlation to each other compared to #momentum portfolios

#investing

5/n

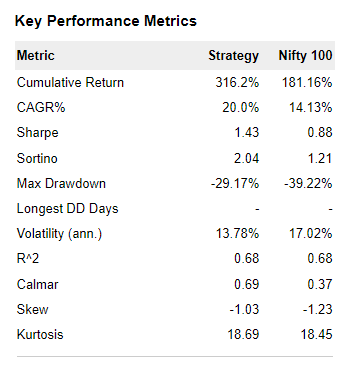

Our #LowVol #portfolio is built using the #Nifty100 as a universe with the 20 lowest #volatility stocks.

We call it the #LV20 Low Volatility Portfolio.

Here's how it performs vs the #Nifty100.

Always invested, always ON wealth building!

6/n

#investing #factor #volatility

We call it the #LV20 Low Volatility Portfolio.

Here's how it performs vs the #Nifty100.

Always invested, always ON wealth building!

6/n

#investing #factor #volatility

#Performance #Metrics across the backtested period show a significant reduction in portfolio #volatility and superior #Sharpe ratio of #LV20 vs #Nifty100.

7/n

#investing #lowvol #factor

7/n

#investing #lowvol #factor

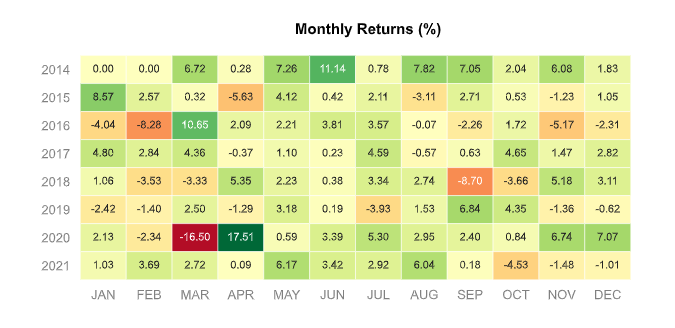

#LV20 portfolio drawdowns are far lower than #Nifty100 in periods of stress like #Covid in March 2020.

The portfolio does not go to cash but internal correlations and the stock selection enables this outperformance.

#MaxDrawdown #Performance

8/n

#factor #investing #lowvol

The portfolio does not go to cash but internal correlations and the stock selection enables this outperformance.

#MaxDrawdown #Performance

8/n

#factor #investing #lowvol

#Lowvol portfolios will underperform in strong bull markets but the strong outperformance in bear and sideways markets results in the #LV20 beating the benchmark in most long term metrics.

9/n

#factor #investing #volatility

9/n

#factor #investing #volatility

• • •

Missing some Tweet in this thread? You can try to

force a refresh