I asked 47 different Web3 founders, investors, thought leaders, builders, and developers one question:

"What do you believe that a majority of people in crypto disagree with you on?"

Here is what they said 👇

"What do you believe that a majority of people in crypto disagree with you on?"

Here is what they said 👇

1/ @Cooopahtroopa

Leading the Creator Economy @fwbtweets @variantfund @audiusproject + many more 🔮

🔗 alias.co/coopahtroopa

Leading the Creator Economy @fwbtweets @variantfund @audiusproject + many more 🔮

🔗 alias.co/coopahtroopa

2/ @el33th4xor

Founder and CEO @avalabsofficial

Ex-prof @Cornell

Ex-co-director @initc3org

🔗 hackingdistributed.com

Founder and CEO @avalabsofficial

Ex-prof @Cornell

Ex-co-director @initc3org

🔗 hackingdistributed.com

5/ @ianDAOs

Co-Founder @SyndicateDAO ✺

Venture Partner + Co-Founder @IDEOVC + @IDEO

Ex Head of Crypto @CitiVentures + @Citi

Designer. Solidity dev.

Co-Founder @SyndicateDAO ✺

Venture Partner + Co-Founder @IDEOVC + @IDEO

Ex Head of Crypto @CitiVentures + @Citi

Designer. Solidity dev.

7/ @nanexcool

Angel investor and advisor to Ethereum, Defi and NFT projects. House #Ethereum

🔗 nanexcool.com

Angel investor and advisor to Ethereum, Defi and NFT projects. House #Ethereum

🔗 nanexcool.com

8/ @Nicholas_Merten

Founder & CEO of @digifox_finance 🦊

Creator of DataDash, one of the largest YouTube channels for cryptocurrencies.

🔗 youtube.com/c/DataDash

Founder & CEO of @digifox_finance 🦊

Creator of DataDash, one of the largest YouTube channels for cryptocurrencies.

🔗 youtube.com/c/DataDash

9/ @gregisenberg

I talk about web3 communities and community-based products.

CEO: @latecheckoutplz

Advisor: @reddit

🔗 latecheckout.substack.com

I talk about web3 communities and community-based products.

CEO: @latecheckoutplz

Advisor: @reddit

🔗 latecheckout.substack.com

10/ @hudsonjameson

I enjoy cats, my spouse, ice cream, tabletop RPGs, and analog to digital media conversion.

Ops @ Flashbots & @EthCatHerders

co-founder. He/Him. 🏳️🌈

I enjoy cats, my spouse, ice cream, tabletop RPGs, and analog to digital media conversion.

Ops @ Flashbots & @EthCatHerders

co-founder. He/Him. 🏳️🌈

11/ @ViktorBunin

Protocol Specialist at Bison Trails (acquired by Coinbase). Tweetsman. Actually helpful angel, specializing in protocols: layer 1, 2, interop, bridges, and defi.

Protocol Specialist at Bison Trails (acquired by Coinbase). Tweetsman. Actually helpful angel, specializing in protocols: layer 1, 2, interop, bridges, and defi.

12/ @sawinyh

Proud father, husband, and corgi-owner. I'm into product, crypto, UI/UX, and digital marketing (strange mix I know).

Building @defiprime and @dexguru

🔗 dex.guru

Proud father, husband, and corgi-owner. I'm into product, crypto, UI/UX, and digital marketing (strange mix I know).

Building @defiprime and @dexguru

🔗 dex.guru

13/ @tbr90

Web3 investor, builder, and advisor • Prev: @Google Payments • CEO/Fndr TrinityMN (acq) • @CERN • @MorganStanley • @Yale

🔗 hackalert.io

Web3 investor, builder, and advisor • Prev: @Google Payments • CEO/Fndr TrinityMN (acq) • @CERN • @MorganStanley • @Yale

🔗 hackalert.io

14/ @jamie247

CEO @OVioHQ | Accelerating The Open Metaverse at intersection of Tech, Finance & Culture whilst collecting weird JPEGS. Host: Metaverse Podcast 🎙

🔗 outlierventures.io/links/

CEO @OVioHQ | Accelerating The Open Metaverse at intersection of Tech, Finance & Culture whilst collecting weird JPEGS. Host: Metaverse Podcast 🎙

🔗 outlierventures.io/links/

15/ @mattysino

CEO, Sino Global Capital @sinoglobalcap. Digital Assets, China, India, Blockchain. Atmanirbhar Bharat. I will eat your hot pot and samosa.

🔗 sinoglobalcapital.com

CEO, Sino Global Capital @sinoglobalcap. Digital Assets, China, India, Blockchain. Atmanirbhar Bharat. I will eat your hot pot and samosa.

🔗 sinoglobalcapital.com

17/ @evan_van_ness

Investing in the future of web3 @StarbloomVent

Founder of @WeekInEthNews

Web3 maximalist, memecoin minimalist

🔗 evanvanness.com

Investing in the future of web3 @StarbloomVent

Founder of @WeekInEthNews

Web3 maximalist, memecoin minimalist

🔗 evanvanness.com

18/ @scupytrooples

Tech and Futurism enthusiast.

Web3 Dev.

Etherean.

DeFi 2.0 Maximalist.

@AlchemixFi

@egirl_capital

錬金術師

meow/meow's

Tech and Futurism enthusiast.

Web3 Dev.

Etherean.

DeFi 2.0 Maximalist.

@AlchemixFi

@egirl_capital

錬金術師

meow/meow's

19/ @0xFintech

BizDev and advisor in #DeFi

Companies I support @warpfinance @digifox_finance @opium_network

BizDev and advisor in #DeFi

Companies I support @warpfinance @digifox_finance @opium_network

20/ @Darrenlautf

Shitposter: Not3Lau | Founder: The Daily Ape | Author: How To DeFi

🔗 thedailyape.com

Shitposter: Not3Lau | Founder: The Daily Ape | Author: How To DeFi

🔗 thedailyape.com

21/ @jayks17

VP of Marketing @AvaLabsOfficial building @AvalancheAVAX | Former @Fluidityio @AirSwap @Ogilvy @IUBloomington | Photographer: jayks.me | Investor

🔗 linkedin.com/in/jayksofue/

VP of Marketing @AvaLabsOfficial building @AvalancheAVAX | Former @Fluidityio @AirSwap @Ogilvy @IUBloomington | Photographer: jayks.me | Investor

🔗 linkedin.com/in/jayksofue/

22/ @tayvano_

lethal founder. part-time wizard. ceo. @mycrypto is my baby. my 3 y/o is my boss. dont come @ me less you're ready to battle | tay.eth

🔗 mycrypto.com

lethal founder. part-time wizard. ceo. @mycrypto is my baby. my 3 y/o is my boss. dont come @ me less you're ready to battle | tay.eth

🔗 mycrypto.com

24/ @jaimeschmidt

Had my big win, now helping others get theirs. Bootstrapped exit. Investor in consumer & Web3

@ColorCapital

Author: supermaker.com/book

🔗 jaimeschmidt.info

Had my big win, now helping others get theirs. Bootstrapped exit. Investor in consumer & Web3

@ColorCapital

Author: supermaker.com/book

🔗 jaimeschmidt.info

25/ @harshrajat

Creator of epns.io (@epnsproject). #BUIDLing world's first decentralized notification protocol for Web 3.0

🔗 epns.io

Creator of epns.io (@epnsproject). #BUIDLing world's first decentralized notification protocol for Web 3.0

🔗 epns.io

26/ @mrjasonchoi

GP crypto fund @TheSpartanGroup, host @TheBlockcrunch, angel investing in early crypto founders since ‘17. Ex @ContraryCapital @Wharton

🔗 jasonchoi.substack.com

GP crypto fund @TheSpartanGroup, host @TheBlockcrunch, angel investing in early crypto founders since ‘17. Ex @ContraryCapital @Wharton

🔗 jasonchoi.substack.com

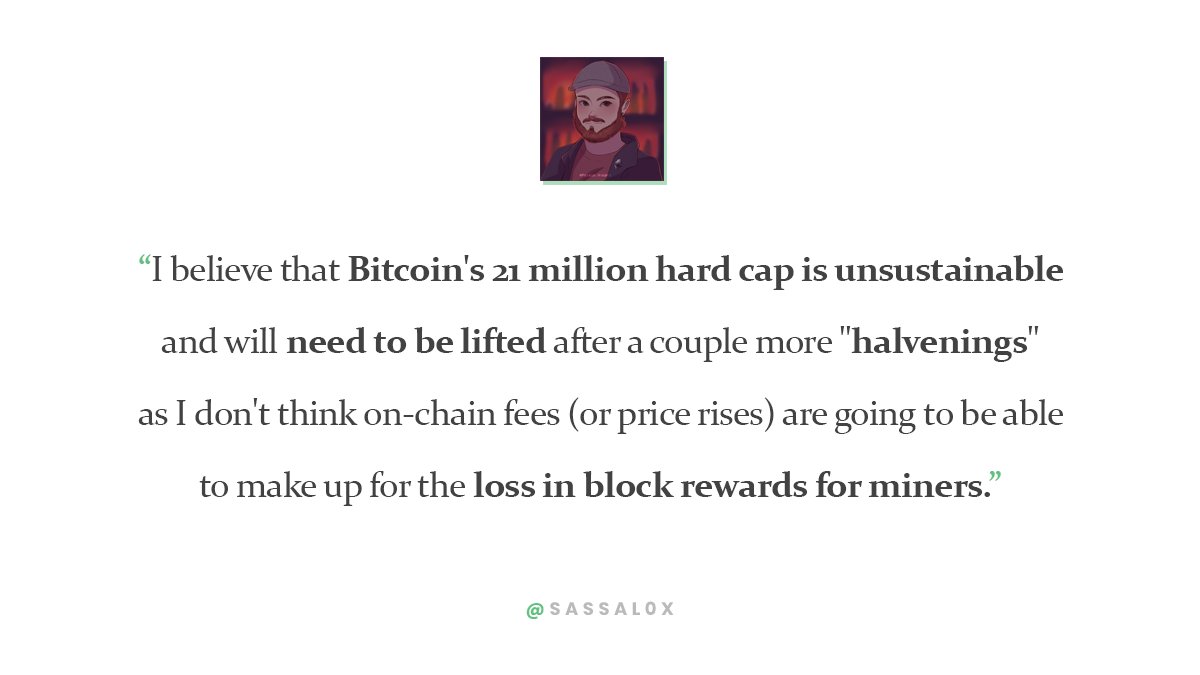

27/ @sassal0x

Independent Ethereum educator, angel investor and advisor.

Founder @thedailygwei ⛽

Co-Founder @ethhub_io ⟠

🔗 youtube.com/c/TheDailyGwei

Independent Ethereum educator, angel investor and advisor.

Founder @thedailygwei ⛽

Co-Founder @ethhub_io ⟠

🔗 youtube.com/c/TheDailyGwei

29/ @hosseeb

Managing partner @dragonfly_cap. Formerly Metastable, @Airbnb, @earndotcom. Effective Altruist. Writer. Former poker pro. One always finds one's burden again.

🔗 haseebq.com

Managing partner @dragonfly_cap. Formerly Metastable, @Airbnb, @earndotcom. Effective Altruist. Writer. Former poker pro. One always finds one's burden again.

🔗 haseebq.com

30/ @IamSuperMassive

Head of Video & Multimedia at thedefiant.io, award-winning filmmaker, occasional crypto artist.

Part-time lobster. Full-time Gremlin.

🔗 youtube.com/c/thedefiant

Head of Video & Multimedia at thedefiant.io, award-winning filmmaker, occasional crypto artist.

Part-time lobster. Full-time Gremlin.

🔗 youtube.com/c/thedefiant

31/ @amytongwu

Partner @LightspeedVP | Crypto, gaming, consumer investor | @EpicGames, @MiniNations, @FTX_Official, @Arbitrum, @WebullGlobal, @AlchemyPlatform, @parallelFi++

🔗 linkedin.com/in/amytongwu

Partner @LightspeedVP | Crypto, gaming, consumer investor | @EpicGames, @MiniNations, @FTX_Official, @Arbitrum, @WebullGlobal, @AlchemyPlatform, @parallelFi++

🔗 linkedin.com/in/amytongwu

33/ @gaby_goldberg

Investing early in web3 @tcg_crypto. Alum @Stanford. Writing about curation, culture, identity, and ownership at gaby.mirror.xyz

🔗 bit.ly/web3readinglist

Investing early in web3 @tcg_crypto. Alum @Stanford. Writing about curation, culture, identity, and ownership at gaby.mirror.xyz

🔗 bit.ly/web3readinglist

36/ @dazuck

Obsessed with scaling coordination, the technologies that enable it, and the challenges that confound it.

Building sovereign data @ceramicnetwork, @3boxlabs

🔗 dazuck.com

Obsessed with scaling coordination, the technologies that enable it, and the challenges that confound it.

Building sovereign data @ceramicnetwork, @3boxlabs

🔗 dazuck.com

37/ @hsinjuchuang

Co-Founder of @DystopiaLabs. Venture Partner at Hack.VC. Former Head of Growth at @StellarOrg @Solana

🔗 dystopialabs.com

Co-Founder of @DystopiaLabs. Venture Partner at Hack.VC. Former Head of Growth at @StellarOrg @Solana

🔗 dystopialabs.com

38/ @sgoldfed

Co-founder @OffchainLabs building @arbitrum. Postdoc @cornell_tech/@initc3org. PhD @PrincetonCS.

🔗 stevengoldfeder.com

Co-founder @OffchainLabs building @arbitrum. Postdoc @cornell_tech/@initc3org. PhD @PrincetonCS.

🔗 stevengoldfeder.com

40/ @harmonylion1

Building a curiosity engine @ideamarket_io • bio: mikeelias.com • ex-atheist • kernel B3 • #WOP7

🔗 ideamarket.io

Building a curiosity engine @ideamarket_io • bio: mikeelias.com • ex-atheist • kernel B3 • #WOP7

🔗 ideamarket.io

41/ @divine_economy

2x founder write on web3: davidphelps.substack.com

invest in web3: cowfund.co

contributor: @ecodao_

🔗 davidphelps.substack.com

2x founder write on web3: davidphelps.substack.com

invest in web3: cowfund.co

contributor: @ecodao_

🔗 davidphelps.substack.com

44/ @DawsonBotsford

Founder of earni.fi. Helping you find airdrops and stay safe in DeFi. Web3/Ethereum Programmer. "Dawson" IRL

🔗 earni.fi

Founder of earni.fi. Helping you find airdrops and stay safe in DeFi. Web3/Ethereum Programmer. "Dawson" IRL

🔗 earni.fi

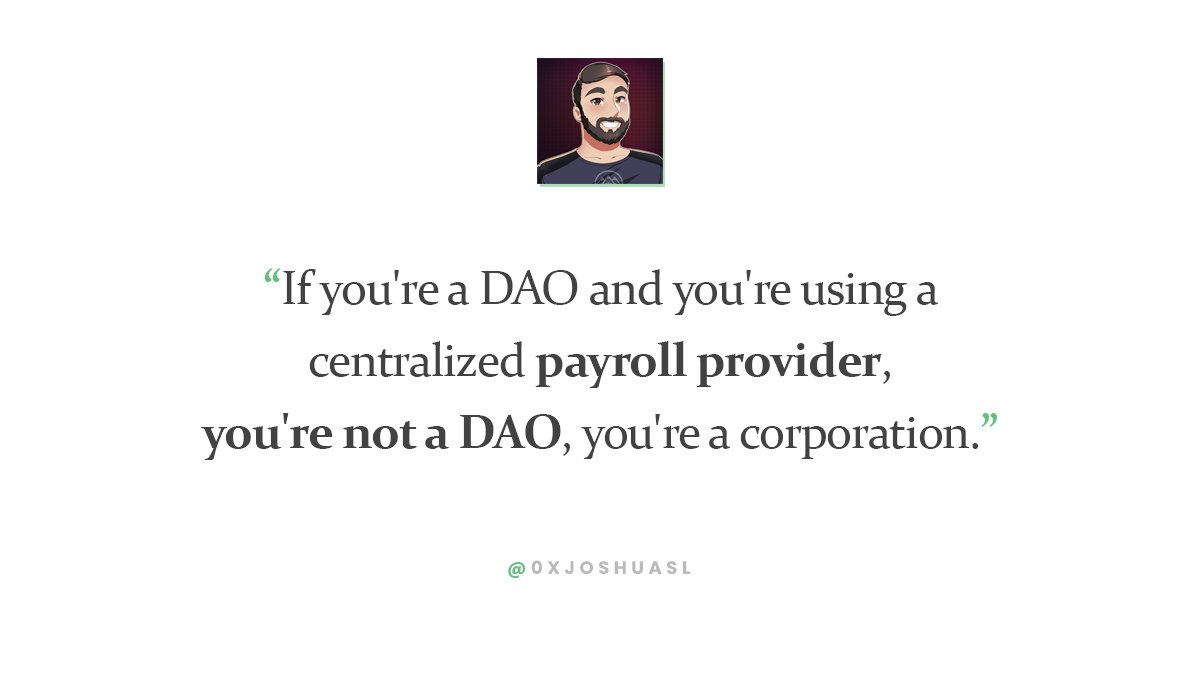

45/ @0xJoshuaSL

Executive Community Steward @Opolis @EthereumDenver | #SporkDAO Steward Founder @Rainbow_Rolls 🌈🧻 @TheRugNews Editor 🏴

@Meta_Cartel 🌶 @Rigor_Hq #BeTheBufficorn

🔗 calendly.com/0xJoshua

Executive Community Steward @Opolis @EthereumDenver | #SporkDAO Steward Founder @Rainbow_Rolls 🌈🧻 @TheRugNews Editor 🏴

@Meta_Cartel 🌶 @Rigor_Hq #BeTheBufficorn

🔗 calendly.com/0xJoshua

47/ @mdudas

web3 is built different // investing @6thmanventures // founder @linksdao @TheBlock__ @button // @paxosglobal @venmo @google @disney

web3 is built different // investing @6thmanventures // founder @linksdao @TheBlock__ @button // @paxosglobal @venmo @google @disney

48/ @iamDCinvestor

investor, advisor & crypto-philosopher. fan of #web3, #ethereum, #defi & #nft art.

🔗 gallery.so/dcinvestor

investor, advisor & crypto-philosopher. fan of #web3, #ethereum, #defi & #nft art.

🔗 gallery.so/dcinvestor

• • •

Missing some Tweet in this thread? You can try to

force a refresh