Milan’s 2020/21 accounts cover a season when they finished 2nd in Serie A under Stefano Pioli, thus qualifying for the Champions League, and reached the last 16 of the Europa League and quarter-finals of the Coppa Italia. Some thoughts in the following thread #Milan

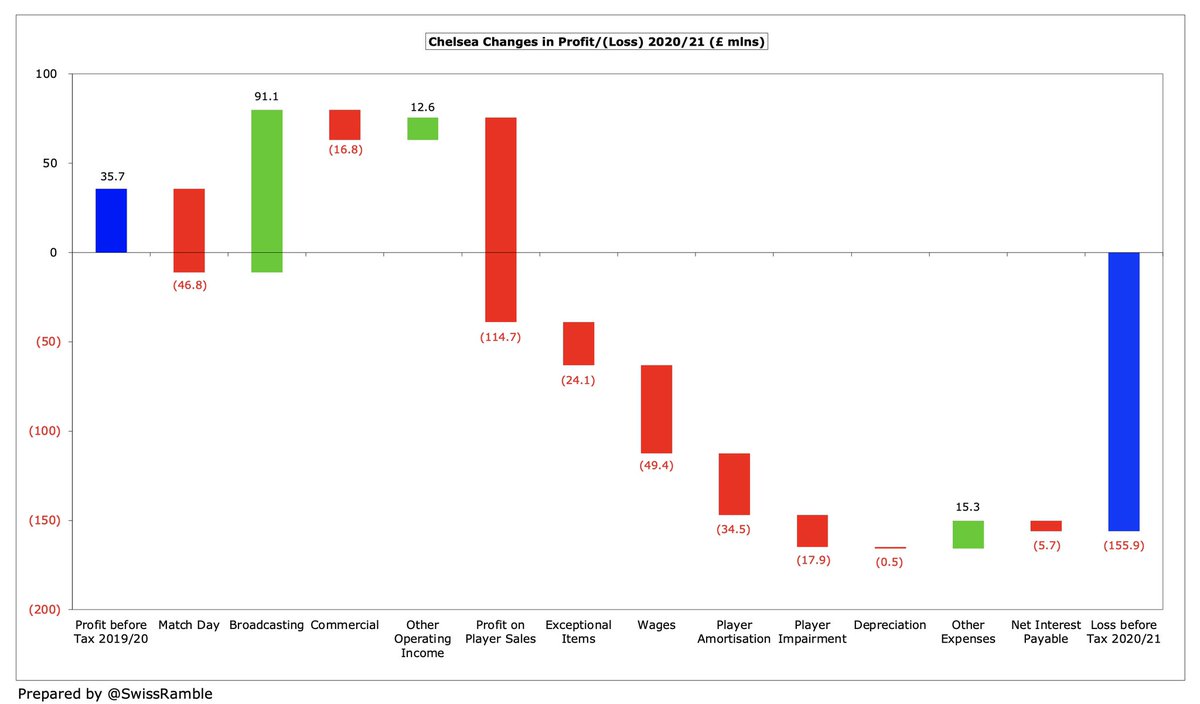

#Milan pre-tax loss more than halved from €192m to €92m, thus improving by €100m, as revenue increased €69m (40%) from €172m to €241m. Profit on player sales rose €3m to €18m, while operating expenses fell €30m (8%). The loss after tax was €96m.

#Milan broadcasting income rose €75m (118%) from €63m to €138m, including revenue deferred from 2019/20 accounts plus return to Europa League, and commercial increased €17m (22%) from €77m to €94m. This compensated for COVID driven reduction in match day, down €24m to zero

As a technical aside, this “international” definition of #Milan €241m revenue is different to the one used in the club’s accounts, which also includes €20m gain on player sales plus €0.2m increase in asset value, giving revenue of €261m, up €69m (36%) from prior year €192m.

#Milan wage bill grew €9m (5%) to €170m, while other expenses were up €8m (10%) to €86m. Player amortisation fell €29m (31%) to €66m, while player write-downs decreased €18m from €20m to €2m. Depreciation rose €2m (22%) to €14m, but net interest dropped €1m to €5m.

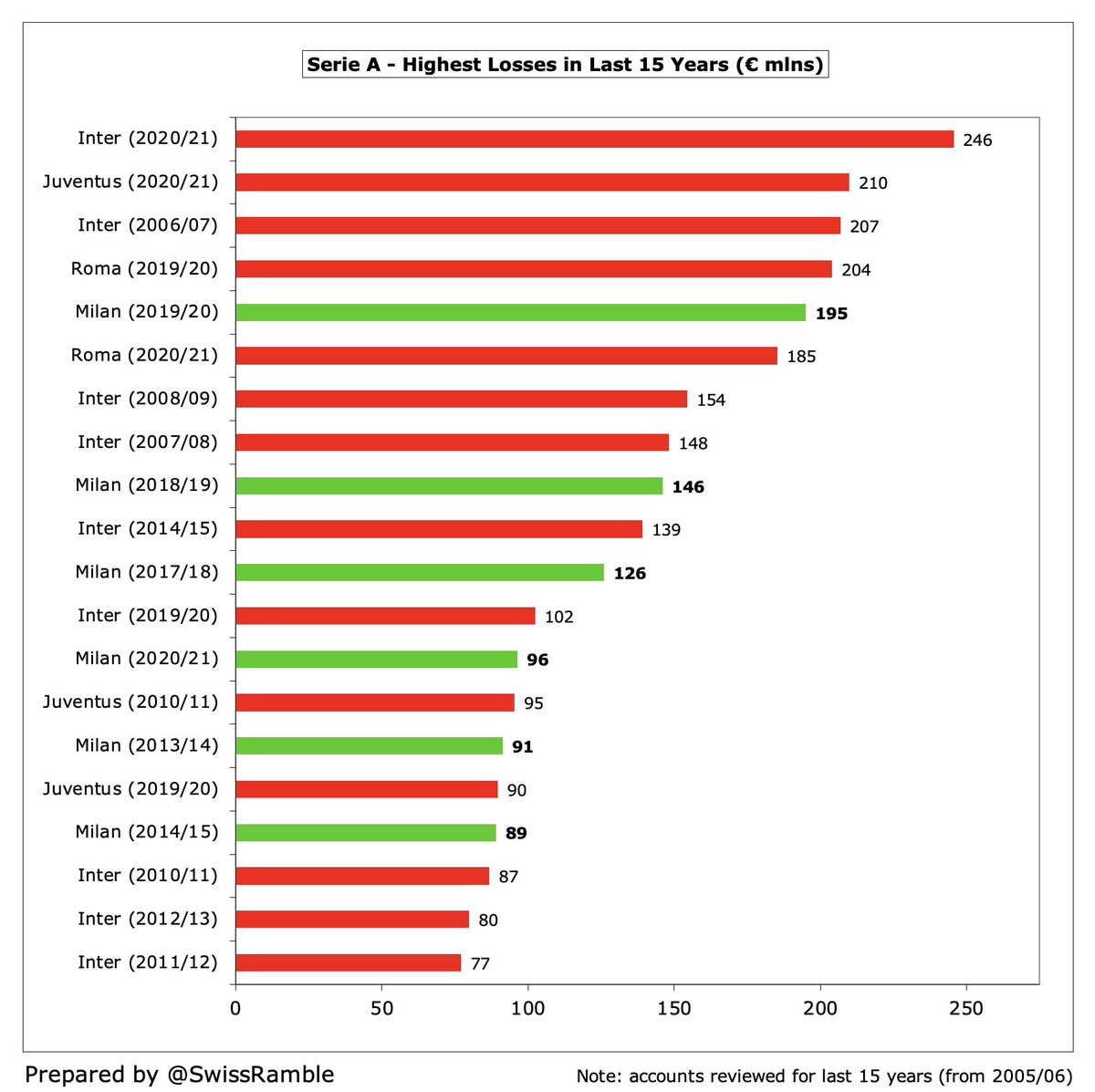

#Milan €96m post-tax loss is nowhere near the highest in Italy in 2020/21, as it is comfortably surpassed by Inter €246m, Juventus €210m and Roma €185m. Atalanta €53m profit is impressive, though their December year-end does not reflect a full year of the pandemic.

COVID has exacerbated underlying financial issues in Italy, so the two highest losses ever were registered in 2020/21. It is worth noting that #Milan are responsible for six of the 20 worst losses in Serie A, but for some perspective Barcelona posted a €481m loss last season.

In fact, the big four Italian clubs have lost a staggering €1.3 bln in the last two seasons (€591m in 2019/20 and €737m in 2020/21), though #Milan were the least bad with their €291m deficit being the smallest, behind Roma €389m, Inter €348m and Juventus €300m.

I estimate total #Milan COVID revenue loss as €74m (€27m in 2020 and €47m in 2021), split between match day €47m, broadcasting €16m and commercial €11m. However, 2021 figures benefit from €20m revenue deferred from 2020 for 10 games played after 30 June accounting close.

#Milan profit on player sales rose €3m to €18m, mainly Suso to Sevilla €20m, offset by €2m loss on Musacchio to Lazio. The transfer market has crashed due to COVID, but this is still a relatively small gain, e.g. much lower in 2020/21 than Atalanta €68m & Sassuolo €39m.

#Milan have lost an amazing €827m in last 8 years (pre-tax), though president Paolo Scaroni said, “The trend is positive. We’ll see about breaking even further on, but it depends on many factors, including whether we are in the Champions League. We hope to improve our results.”

It is worth noting the impact of exceptional costs, which have increased #Milan losses by €157m since 2014. The 2020/21 accounts included €8m provisions (partly for a possible FFP fine) and €2m player write-downs. This season will feature €20m gain on sale of Casa Milan.

Unlike many leading clubs, #Milan have made very little from player sales, only averaging €12m profit a year since 2014, including actually losing money in two of those years. Same story this season with small profits earned from sales of Laxalt, Olzer and possibly Hauge.

#Milan’s poor player trading is one reason they have struggled financially. In 5 years up to 2020, they only made €72m profit here, which is miles below Juventus €563m, Roma €372m and Napoli €325m. In fact, only sold one player for a profit higher than €20m in last 4 years.

#Milan EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, improved from €(66)m to €(15)m, though still one of the worst in Italy.

Similarly, #Milan operating loss (excluding profit from player sales & interest payable) narrowed from €202m to €104m, though this has declined from €27m only 4 years ago. That said, better than the other big Italian clubs: Juventus €228m, Roma €157m and Inter €133m.

#Milan revenue has increased €12m (5%) from pre-pandemic €228m to €241m, despite zero from match day, thanks to commercial improvement and particularly broadcasting (mainly deferred Serie income). By club’s definition, revenue is up €20m (8%) from €241m to €261m.

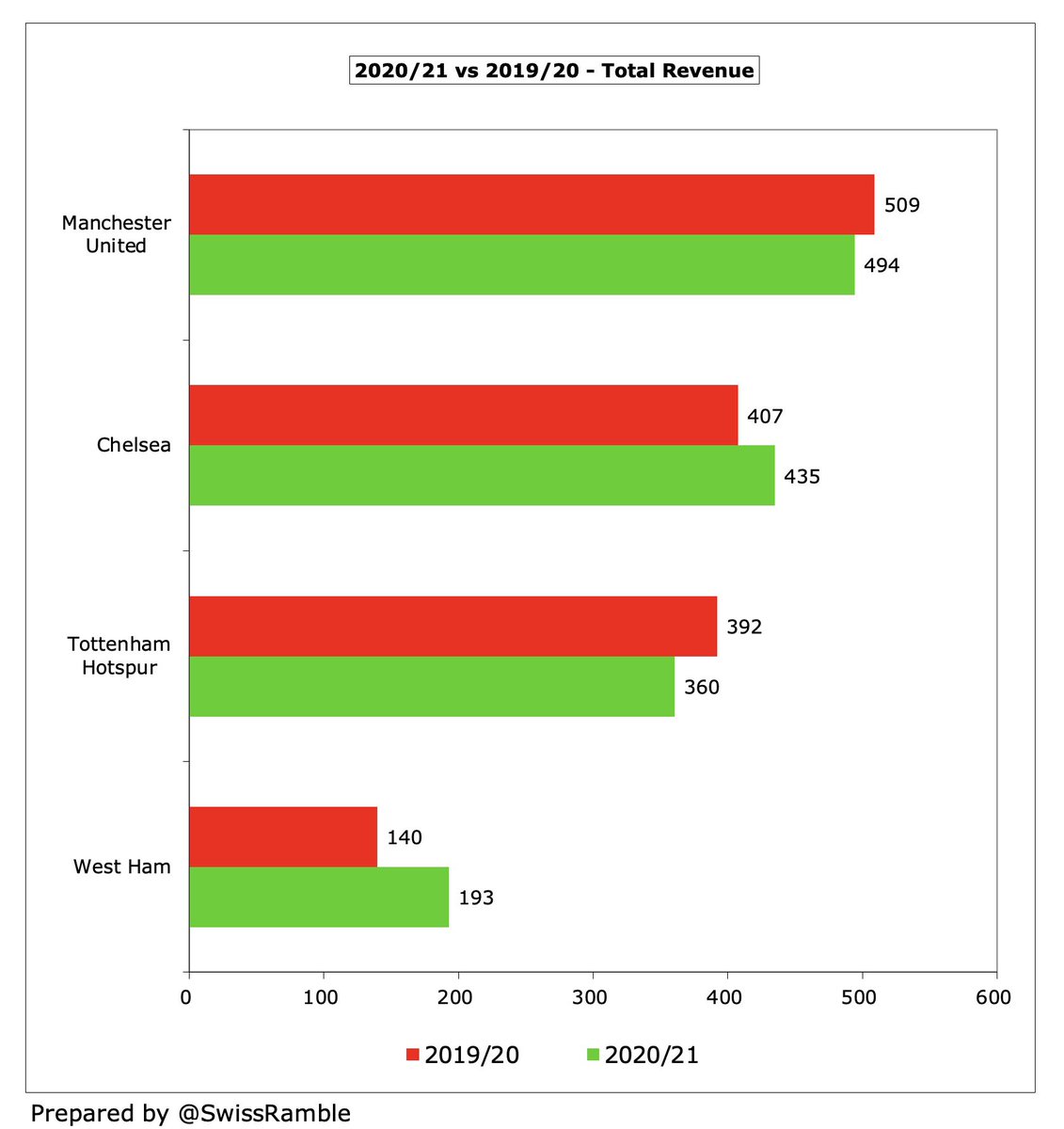

Following the increase, #Milan €241m revenue is 3rd highest in Italy, though still only around half of Juventus’ €450m and a fair way below Inter (€302m in 2019/20). On the other hand, the Rossoneri are in turn well above Roma €197m.

Based on 2019/20 accounts, #Milan fell 9 places from 21st to 30th in the Deloitte Money League, which ranks clubs worldwide by revenue. In 2004 it was a different story, when they were ranked 3rd, generating €83m more revenue than the 10th placed club, but are now €249m lower.

Money League comparisons are a bit misleading though, due to different responses to COVID, e.g. Bundesliga managed to complete its season by end-June, so could recognise a full season’s revenue in 2019/20, while Premier League, Serie A and La Liga extended to July and August.

#Milan broadcasting revenue shot up €75m (118%) from €63m to €138m, benefiting from money deferred from 2019/20 for games played after end-June accounting close plus return to Europe. Behind Juventus, Lazio & Inter (2020/21 accounts), as rivals played in the Champions League.

Per my model #Milan received €77m TV money from Serie A in 2020/21: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); 20% media profile (8% TV audience, 12% fans). Also have to add income deferred from 2019/20 for games played in July & August.

It is imperative that #Milan do well in Europe to boost broadcasting income, as TV rights in Serie A are relatively low. England €3.6 bln and Spain €2.0 bln saw big increases in 2019, while Italy was unchanged at €1.3 bln. In fact, the new 2021-24 deal will be lower.

Based on my estimate, #Milan earned €17m for reaching Europa League last 16 after the UEFA FFP one-year ban meant they could not participate in 2019/20. Much lower than Champions League representatives: Juventus €83m, Lazio €54m, Atalanta €51m and Inter €50m.

#Milan have only received €46m from Europe in the last 5 years, miles behind Juventus €454m, Napoli €243m and Roma €209m. However, they have earned around €45m from this season’s Champions League, even though they were eliminated at the group stage.

#Milan match day income dropped from €24m to zero, as all home games were played behind closed doors. This revenue stream had been as high as €35m pre-COVID, though this was still only around half of Juventus (thanks to their new stadium).

#Milan had the second highest attendance in Italy of around 50,000 pre-COVID, so they will be happy that fans have returned to Italian stadiums this season. Capacity had been increased to 75%, but rising COVID cases has meant a reduction recently.

The #Milan and Inter joint project to build a new stadium has been approved. President Scaroni said, “We cannot become protagonists again unless we have a modern stadium. Without this, it is very challenging to bridge the gap with top European clubs”, as seen by match day income.

#Milan commercial revenue rose €17m (22%) to €94m, due to increases in sponsorship and advertising. This is third highest in Italy, but a full €100m below Juventus €194m. The highest growth in Italy in last 3 years, though they actually had the most commercial income in 2016.

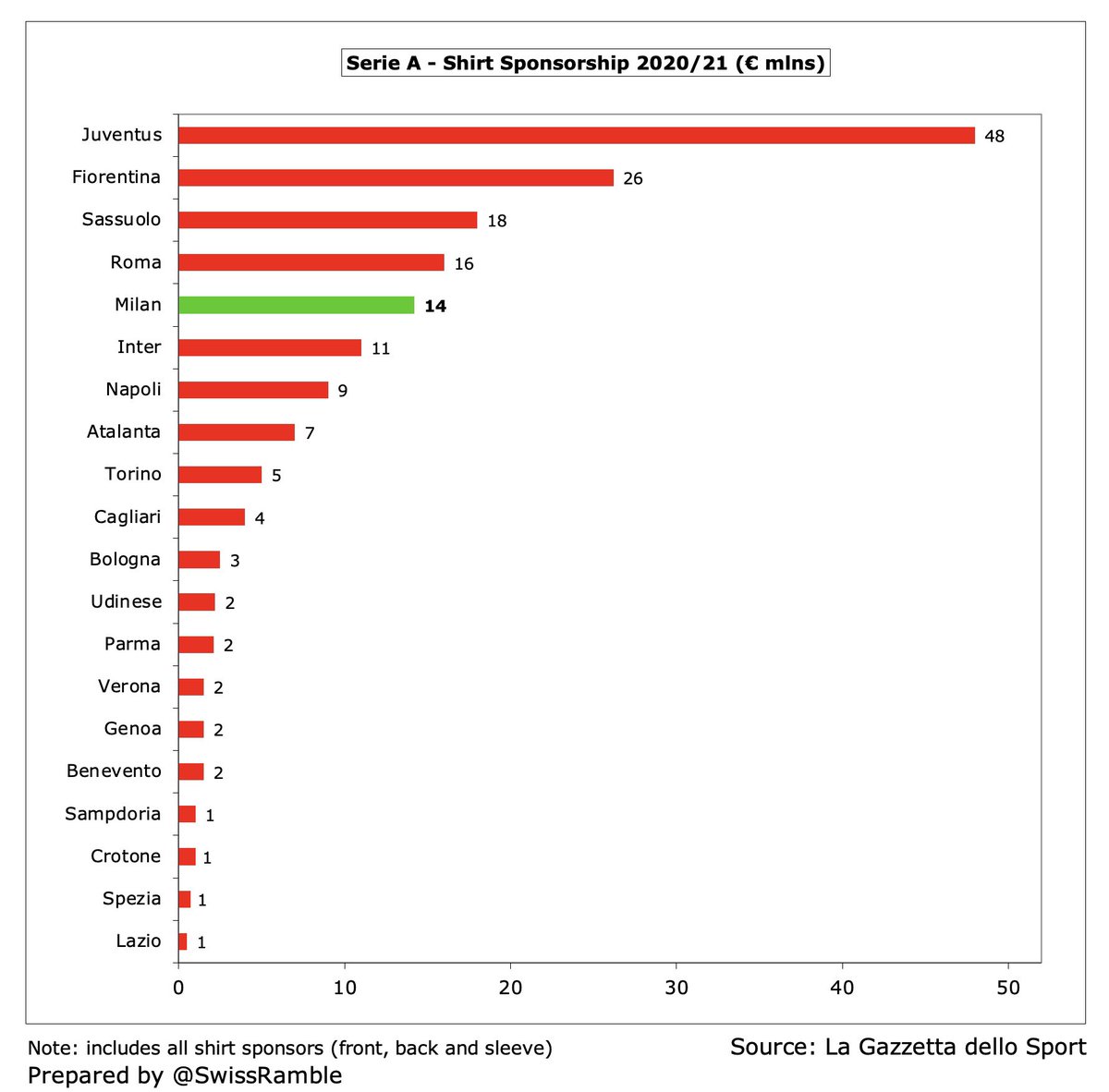

#Milan Emirates shirt sponsor generated €14m, while the Puma kit deal was worth £13m. That’s not bad, but is still far below Juventus (Jeep €45m, Adidas €51m). The shirt sponsorship is also less than Fiorentina (Mediacom) and Sassuolo (Mapei).

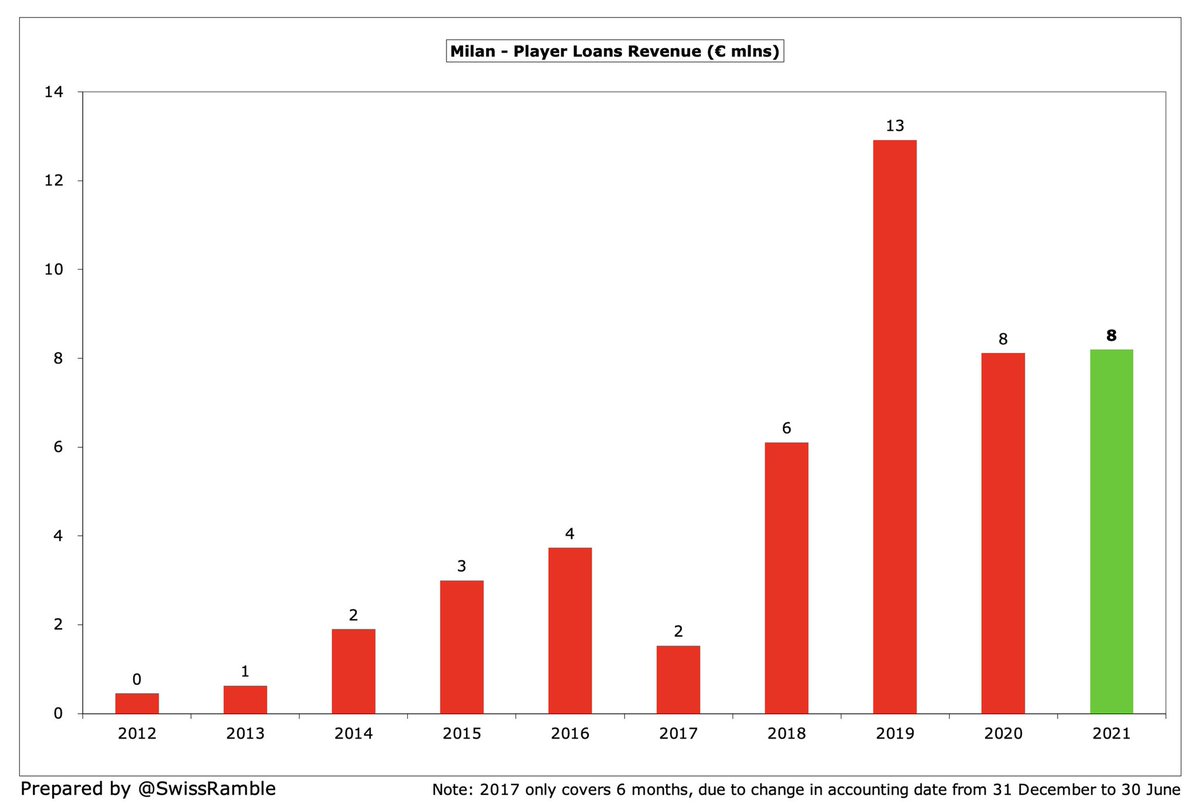

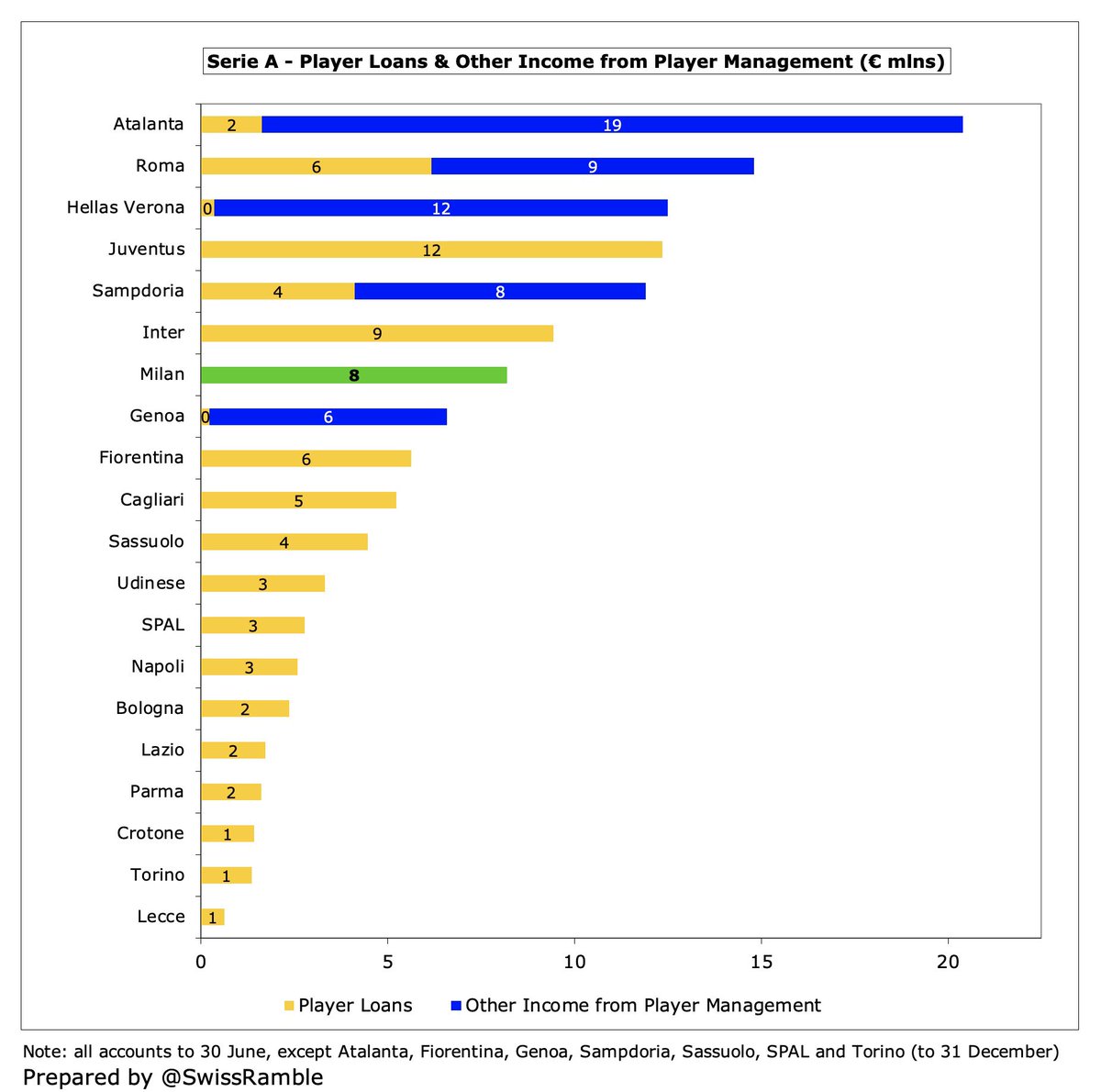

#Milan income from player loans was unchanged at €8m, mainly €5m for the Sandro Tonali agreement with Brescia (plus €10m in costs, so net cost to Milan was €5m). This can be an important revenue stream for some Italian clubs, including other income from player management.

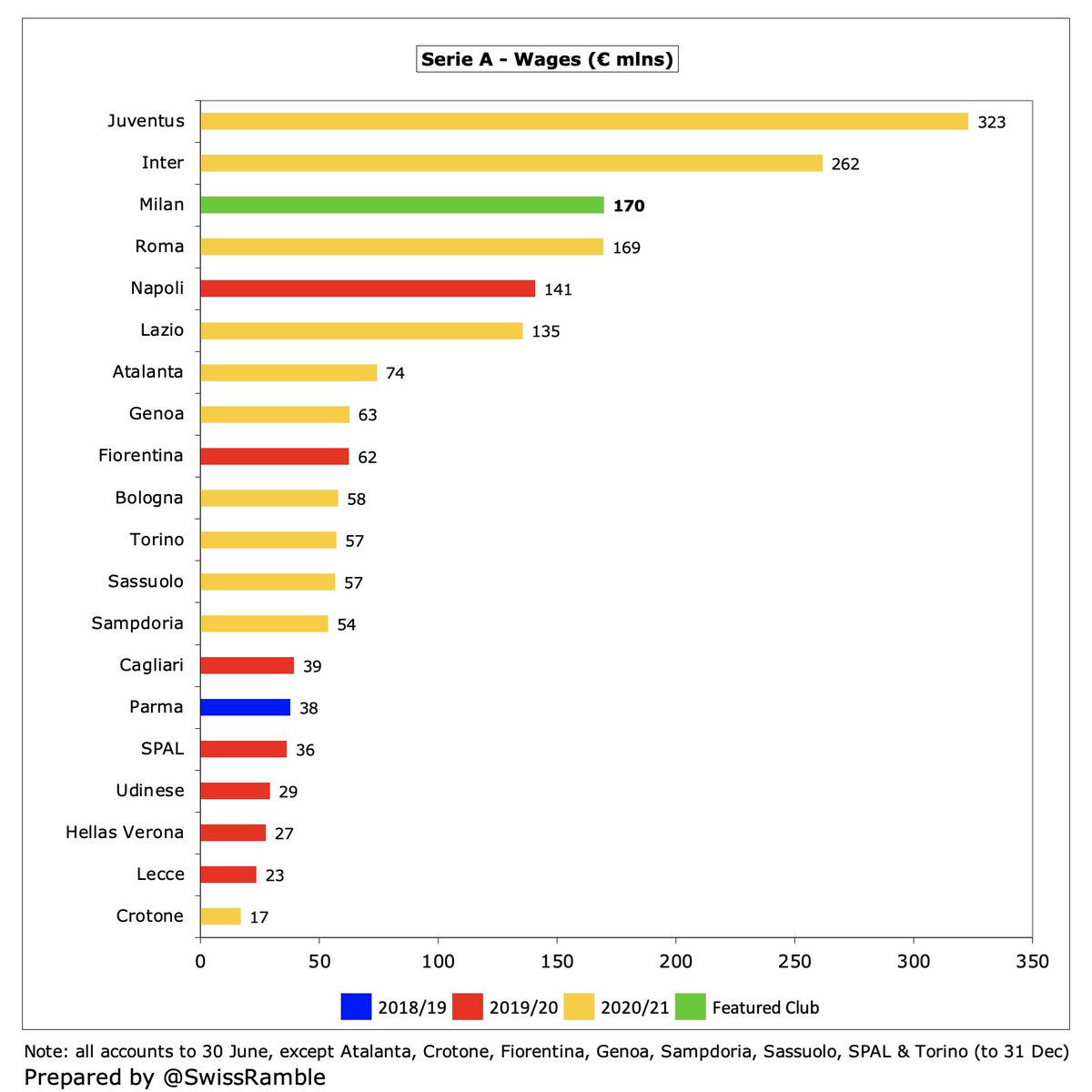

#Milan wage bill rose €9m (5%) from €161m to €170m, mainly due to higher bonuses for Champions League qualification and no April 2020 salary (COVID). Wages only up €12m (8%) in last 5 years, while others’ growth is significantly more, e.g. Inter €137m & Juventus €101m.

Nevertheless, #Milan €170m wage bill is 3rd highest in Italy, just ahead of Roma €169m, but far below Juventus €323m & Inter €262m. Only other Italian clubs above €100m are Napoli €141m (2020) & Lazio €135m, followed by Atalanta €74m (punching well above their weight).

#Milan wages to turnover ratio fell (improved) from 93% to 70%, much more in line with the club’s target. This is now mid-table in Serie A, around the same level as Juventus 72% and Inter 66% (2020), but significantly better than Roma 86%.

Excluding exceptional items, #Milan other expenses increased by €8m (10%) from €78m to €86m, mainly due to the €10m loan fee paid to Brescia for Sandro Tonali. The net cost of this operation was €5m, after considering €5m reported in revenue.

#Milan player amortisation, the annual cost of writing-off transfer fees, fell by around a third (€29m) from €95m to €66m, while player write-downs also dropped €18m to €2m. Now only 5th highest in Italy, far below Juventus €177m, Inter €120m, Napoli €118m and Roma €89m.

On the one hand, #Milan have ramped up expenditure in the transfer market with €583m gross spend in the last 5 years being around twice as much as €295m in preceding 5-year period, on the other hand, they have put the brakes on recently, so now fallen 2 years in a row to €69m.

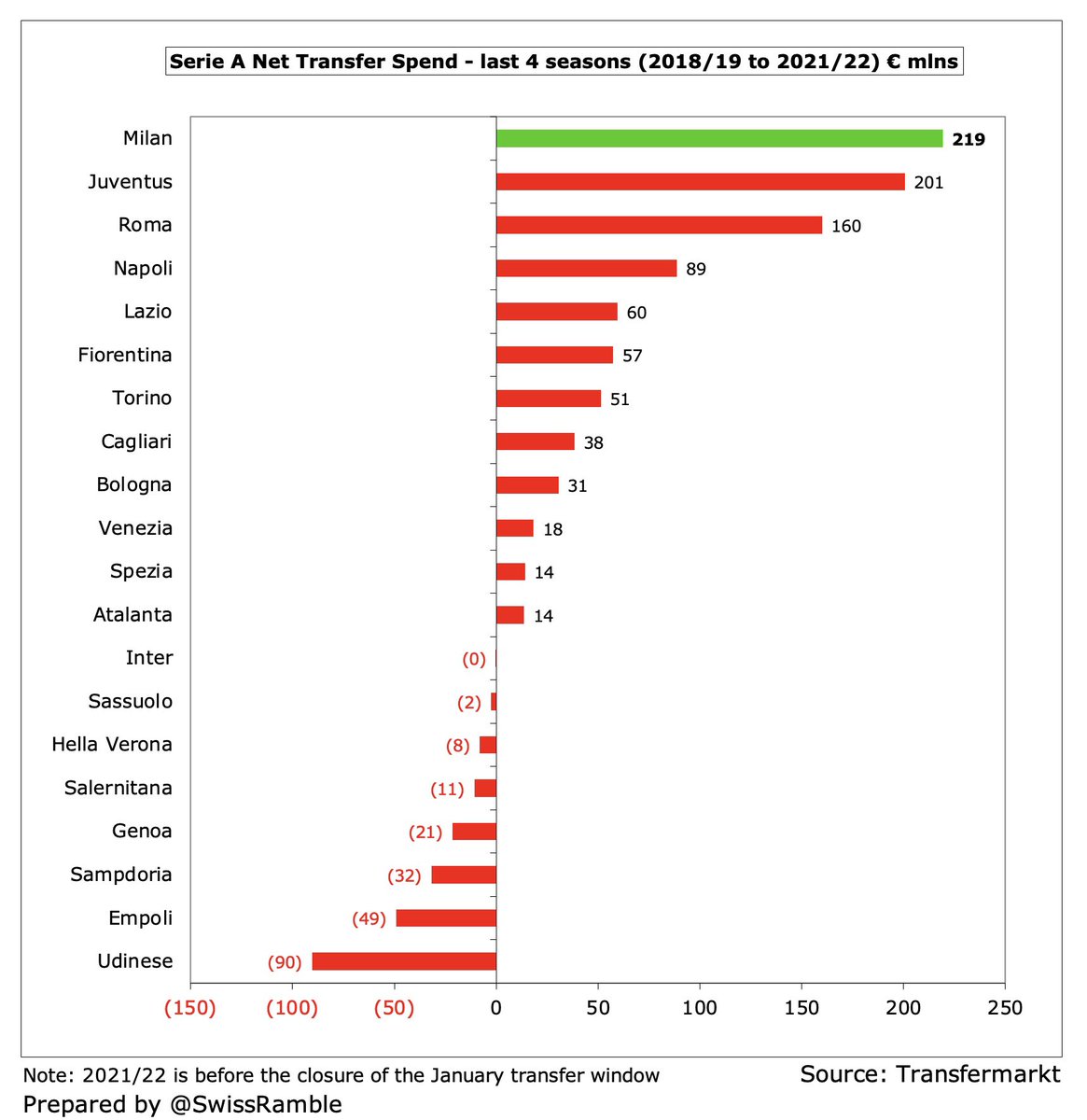

That said, over the last 4 seasons up to 2021/22, #Milan had the highest net transfer spend in Serie A, though they were only fourth highest in terms of gross spend. In 2021/22 the largest player purchases were Fikayo Tomori from #CFC €28m and Mike Maignan from Lille €14m.

#Milan gross debt rose €10m from €115m to €125m, as €41m bank loans to fund the purchase of Casa Milan property offset €31m reduction in factoring payables from €115m to €84m. Elliott repaid the bonds and shareholder loans from the previous Chinese ownership 3 years ago.

#Milan €125m gross financial debt is the fourth highest in Italy, but significantly below Inter €411m (Goldman Sachs financing), Juventus €400m (mainly for new stadium) and Roma €335m (bond issue). Milan’s debt had been as high as €260m in 2013.

Thanks to Elliott’s early repayment of the bonds, #Milan net interest payable is down to €5m (from prior year’s €6m), which is a lot better than Roma €36m, Inter €26m and Juventus €11m. The Rossoneri have reduced this expense from €23m in 2018, which is a major positive.

#Milan have also reduced their gross transfer debt in last 3 years from €172m to €59m, falling from €119m to just €1m on a net basis, i.e. considering amounts owed by other clubs. Gross payables much lower than Juventus €265m, Inter €255m, Napoli €143m and Roma €139m.

#Milan have been very reliant on increases in capital from their owners, including €130m from Elliott in 2020/21 alone, which makes €540m from the Americans in the last 3 years. Since 2011 various owners have put in just over €1 billion to cover the club’s substantial losses.

#Milan have had problems meeting Financial Fair Play regulations, initially resulting in UEFA banning them for 2 years from European competitions. This was overturned by CAS, but the club eventually agreed a 1-year ban, so missed out on the 2019/20 Europa League.

Despite UEFA relaxing their FFP rules, e.g. adjusting for COVID losses and combining 2019/20 and 2020/21 seasons, the club still anticipates some form of future sanction. My calculations suggest that #Milan are miles off meeting the target. Their case will be reviewed early 2022.

CEO Ivan Gazidis said, “We want to get #Milan back where it belongs, both performing well on the pitch and achieving financial sustainability.” While it is no mean feat to halve the deficit and the team is doing well in the league, the fact is they still made a huge loss.

#Milan president Scaroni concluded, “The results of this latest financial report clearly demonstrate progress in terms of solidifying and relaunching the club”, but added, “It is not an easy path and there is still a long way to go – due in no small part to the current crisis.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh