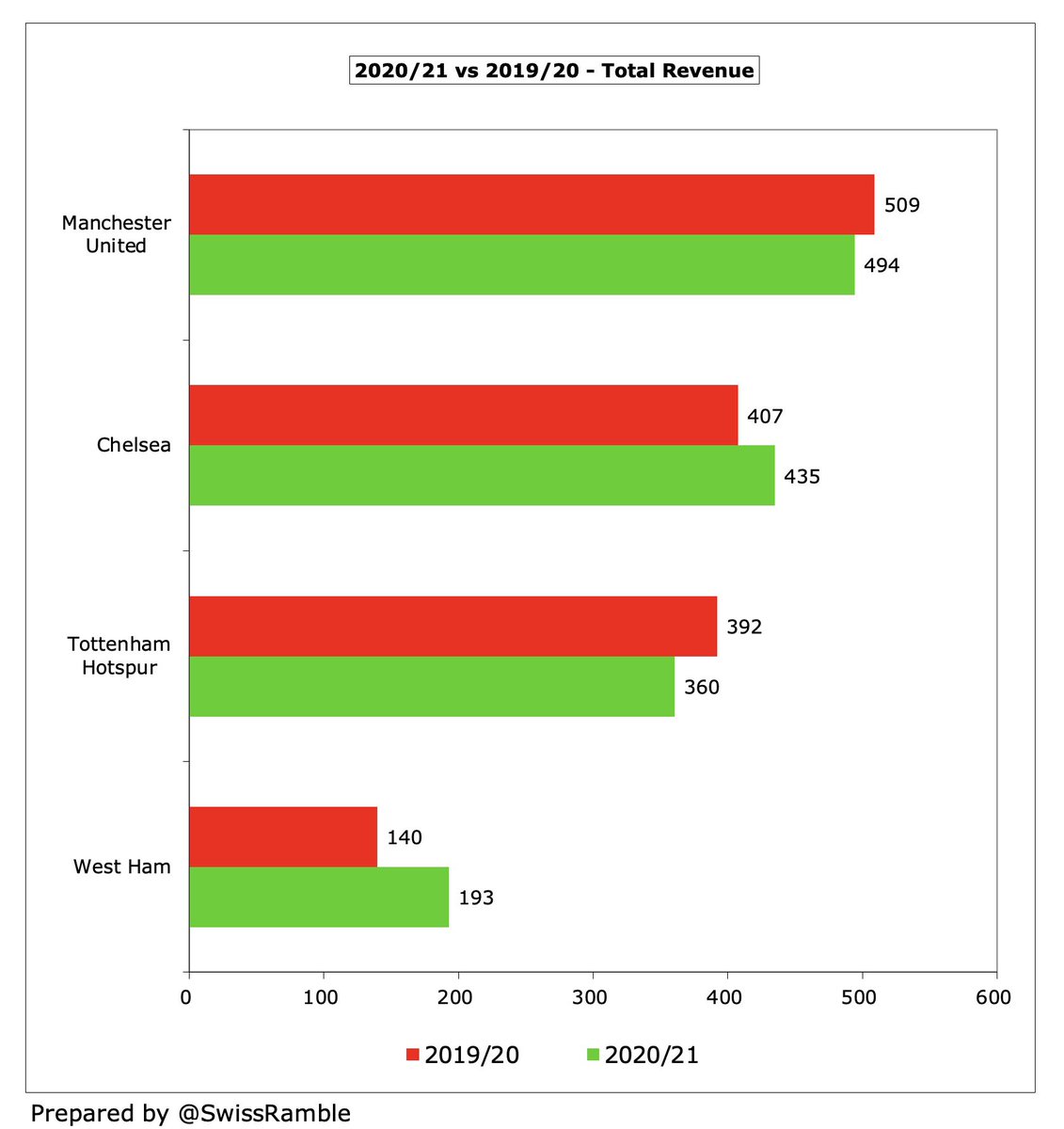

Four Premier League clubs have now published their accounts for the 2020/21 season and it may surprise to many fans that two of them managed to increase their revenue in a season so badly impacted by the pandemic. This thread will explain the reasons, which are mainly technical.

West Ham reported significant (38%) revenue growth from £140m to £193m, while Chelsea also increased revenue by 7% from £407m to £435m. The other clubs saw relatively small revenue falls: Manchester United from £509m to £494m (3%) and Tottenham Hotspur from £392m to £360m (8%).

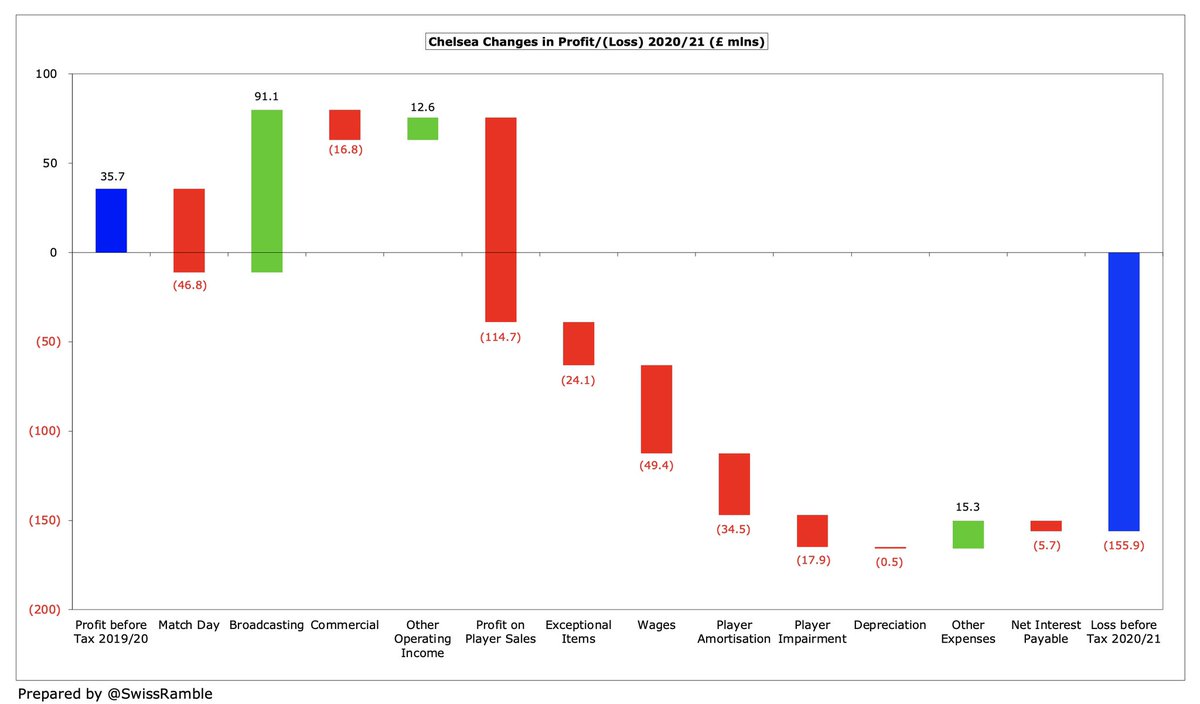

As almost all games were played behind closed doors without fans in 2020/21, match day income took a real pasting, with substantial reductions across the board: #THFC down from £95m to £2m, #MUFC from £90m to £7m, #CFC from £54m to £8m and #WHUFC from £23m to £1m.

Similarly, lockdowns have meant lower commercial revenue with the largest decrease of £47m (17%) at #MUFC (£279m to £232m), though the other clubs all saw reductions: #CFC down £16m (10%) to £154m, #THFC down £10m (6%) to £152m and #WHUFC down £5m (16%) to £29m.

In contrast, broadcasting revenue surged in 2020/21 with all clubs reporting significant year-on-year increases. #WHUFC doubled from £83m to £163m, #MUFC rose 80% from £140m to £255m, while #CFC and #THFC were up by around 50%, from £183m to £274m and £136m to £207m respectively.

This is mainly due to a technical reason, arising from Project Restart, which means that revenue from games played after the clubs’ accounting close could not be booked in 2019/20 accounts, but instead was deferred and so has been included in the accounts for the 2020/21 season.

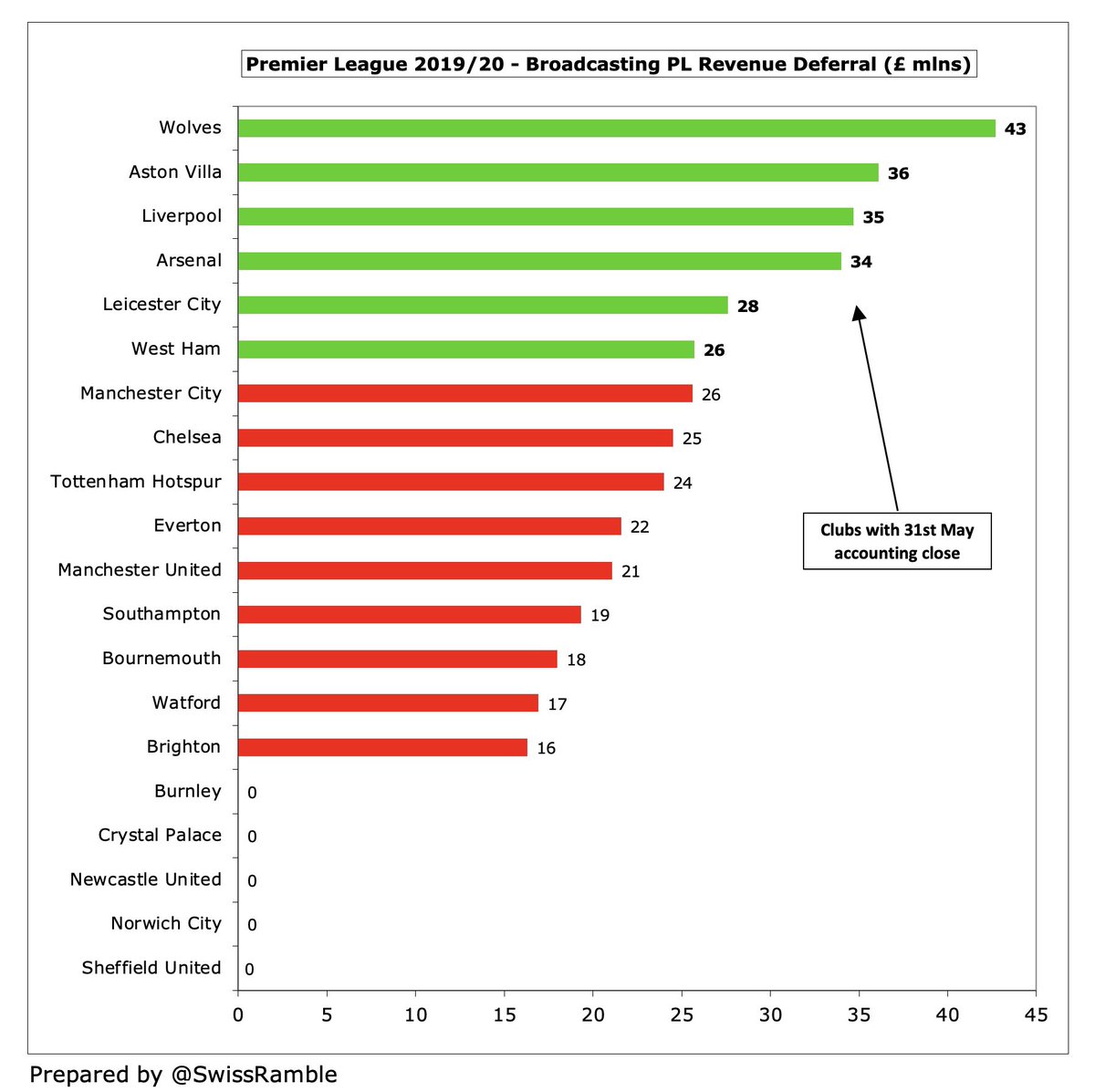

Importantly, not all clubs have the same accounting close, so the revenue impact of this deferral will be different. Clubs whose accounts closed on 31st May had the largest revenue deferrals to 2020/21, while those with 31st July year-end could include all revenue in 2019/20.

#WHUFC had a significant benefit in 2020/21, as their accounts close on 31st May, so they deferred £26m broadcasting revenue (as per their accounts). Amounts deferred were lower for #CFC £25m, #THFC £24m & #MUFC £21m, due to 30th June close (partially offset by higher TV base).

Of course, deferring revenue from 2019/20 to 2020/21 is somewhat of a “double whammy”, as the reduction in the first year and increase in the second year effectively doubles the year-on-year growth, e.g. #WHUFC £26m deferred revenue results in £52m growth.

The impact of deferred revenue means we should see significant revenue growth for some clubs when they publish 2020/21 accounts, especially those with 31st May year-end: #WWFC £43m, #AVFC £36m, #LFC £35m, #AFC £34m and #LCFC £28m. Note: the year-on-year increase is twice as much.

Those clubs with a 30th June close will also see decent growth in broadcasting income: #MCFC £26m, #EFC £22m, #SaintsFC £19m, #AFCB £18m, #WatfordFC £17m and #BHAFC £16m. Again, these amounts need to be doubled to calculate the year-on-year increase.

However, clubs with a 31st July accounting close could include revenue from all games played in the extended 2019/20 season in their accounts for that year, so they will not benefit from any deferred broadcasting revenue in 2002/21 (#BurnleyFC, #CPFC, NUFC, #NCFC and #SUFC).

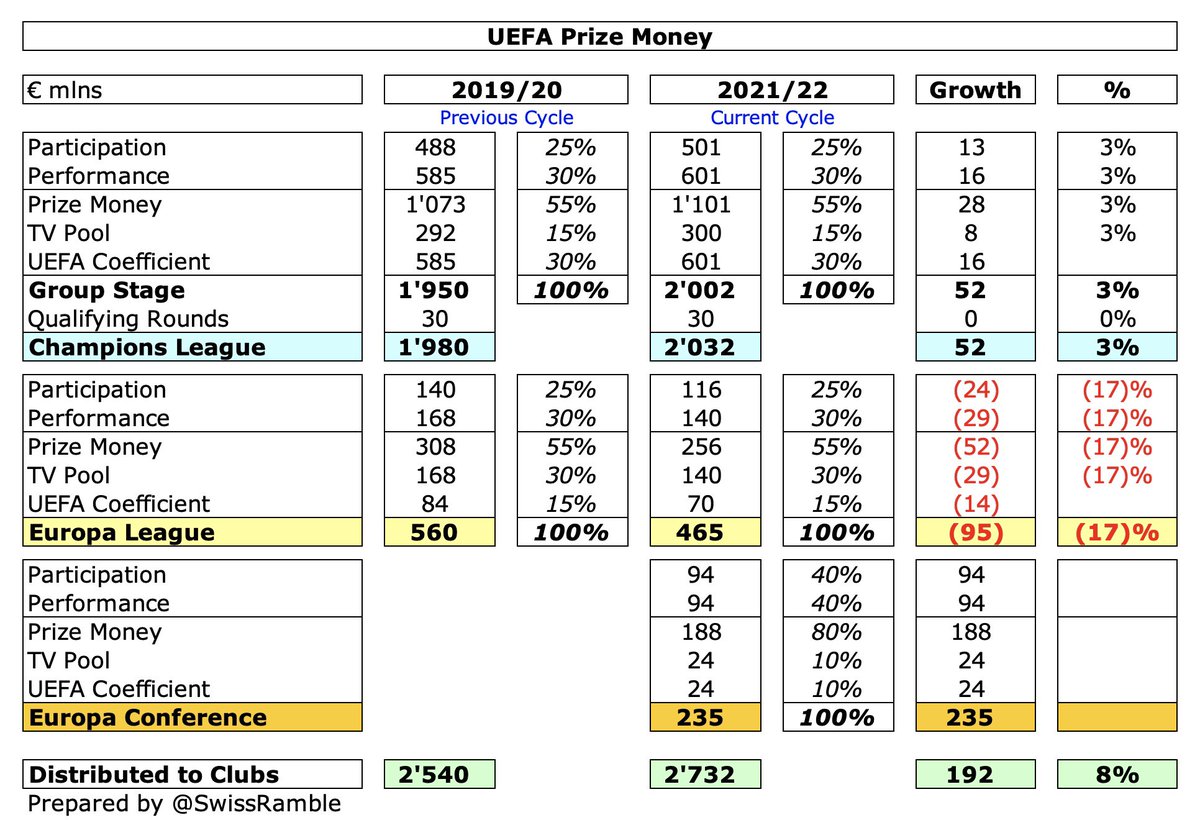

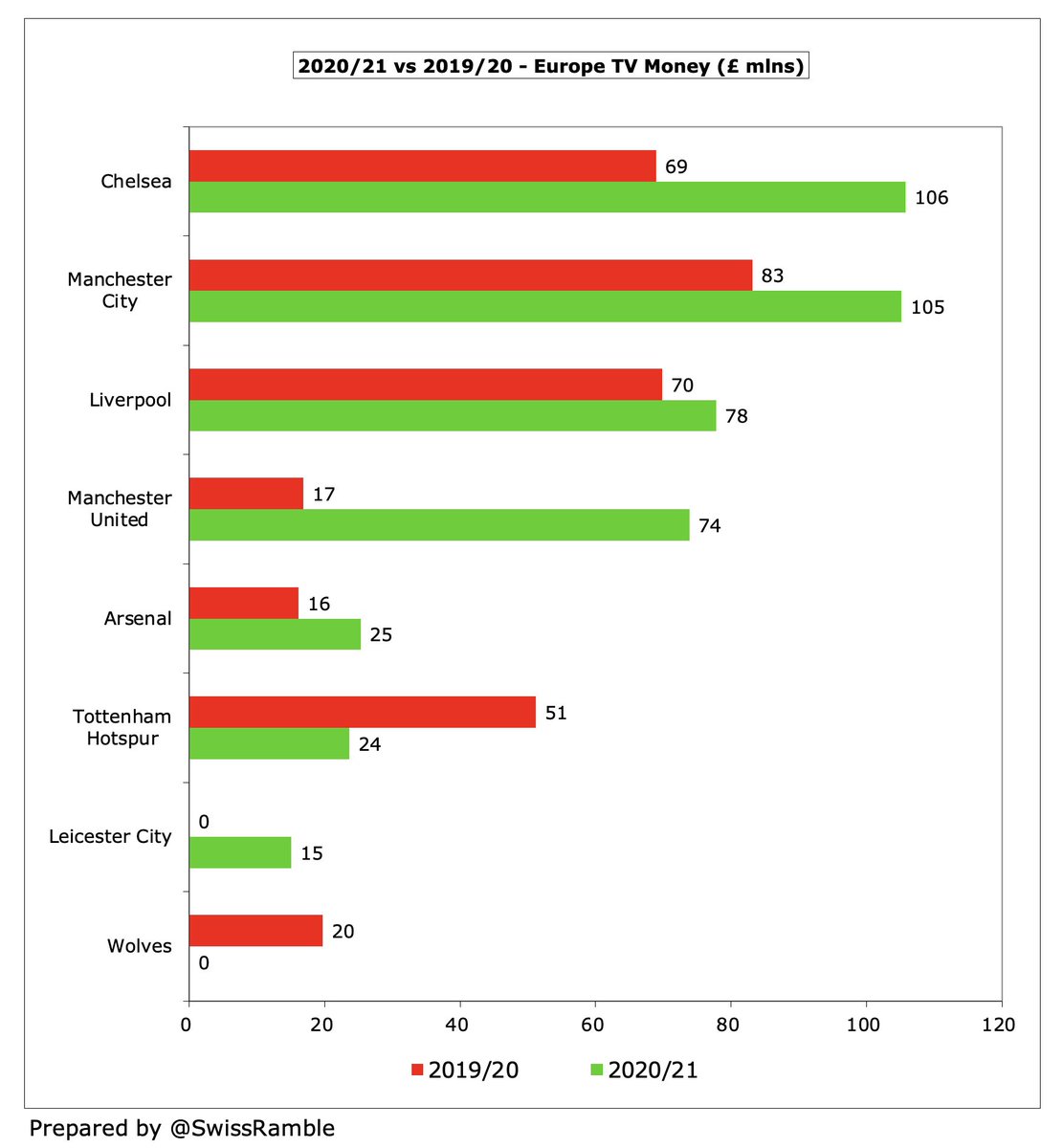

The impact of games played after accounting close in 2019/20 also applies to TV money earned in Europe, though to a far lesser extent. Only #MCFC will see a meaningful uplift in 2020/21 of £9m for Champions League quarter-final (possibly more if last 16 2nd leg also deferred).

In fact, #MCFC will also benefit from the fact that their UEFA revenue was reduced in 2019/20 by a £9m (€10m) Financial Fair Play fine, which will not be repeated in 2020/21, so effectively means a year-on-year increase in their broadcasting income.

There is yet another technical factor that will produce a year-on-year revenue increase, as the Premier League agreed a rebate to broadcasters for delayed matches, which was largely booked in 2019/20 accounts: #MUFC £14m, #CFC £12 m, #THFC £10m and #WHUFC £6m.

Good, old-fashioned success on the pitch can still produce revenue growth, as seen with #WHUFC who improved their league position from 16th to 6th in 2020/21. Based on an estimated £1.8m per place, this resulted in an £18m improvement in their Premier League merit payment.

Similarly, European TV money has also driven year-on-year broadcasting income movements, especially #MUFC who earned £74m in 2020/21 (CL group stage, EL finalists) compared to only £17m in 2019/20 (EL semi-final). Also significant growth for CL finalists, #CFC and #MCFC.

While some clubs have provided details of deferred revenue in their accounts, it is worth emphasising that many of the numbers in this analysis have been estimated (based on broadcasting revenue and games played after accounting close), but the impact is clear (and significant).

As always, when reviewing a football club’s finances, it’s worth looking beyond the headlines, as the devil is often in the detail, particularly this year when revenue figures (and rankings) can be a bit misleading. As the great Elvis Costello once advised, “Watch Your Step.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh