Premier League clubs have pushed back against the independent regulator proposed in the recent @tracey_crouch government-led review, raising concerns about the “unintended consequences” of the report’s recommendations. But what is the actual state of English football’s finances?

This analysis looks at how football clubs in the top two divisions have fared in the last 10 years up to 2019/20, the last season when all clubs have published accounts. It therefore excludes 2020/21 when COVID had a big adverse impact as matches were played behind closed doors.

Just looking at revenue, people might think that there are no problems, as the 44 clubs in the Premier League and Championship have generated an impressive £41 bln in the 10 years 2011-20. That said, there is a clear gap between the Big Six, led by #MUFC £4.7 bln, and the rest.

However, a large chunk of this money has simply gone on £28 bln of wages – before clubs pay any other operational expenses, buy players or invest in stadiums, training grounds, etc. Perhaps unsurprisingly, highest wages were paid by #MCFC £2.4 bln, #MUFC £2.3 bln & #CFC £2.2 bln.

This approach has resulted in many unsustainable wages to turnover ratios. Over the last 10 years, 32 of the 44 clubs in Premier League and Championship are above UEFA’s recommended 70% upper limit, including 22 higher than 80%. An incredible 12 clubs are above 100%.

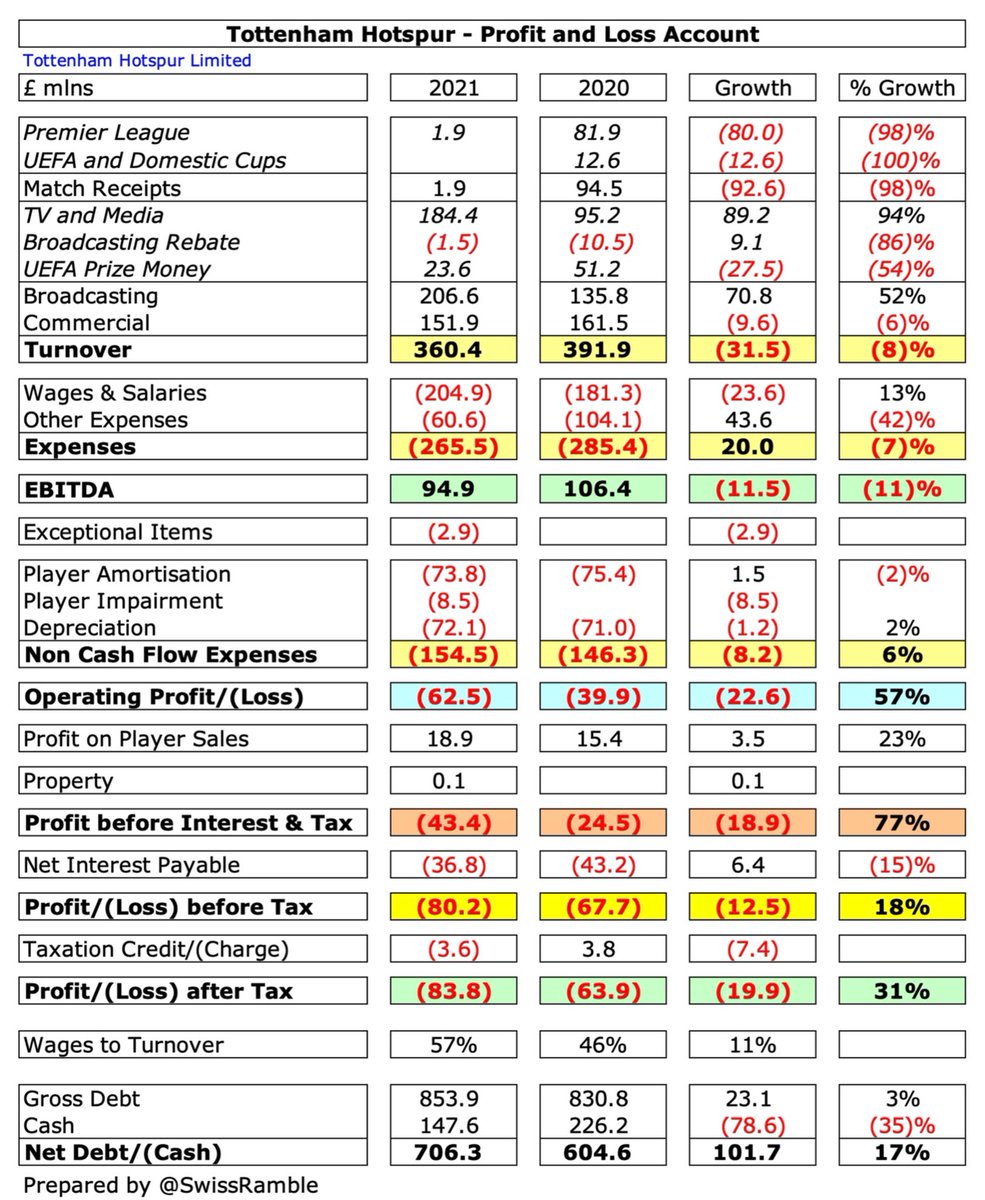

As a result, in the last 10 years the top two English leagues have lost a massive £3.1 bln pre-tax with the largest losses at #AVFC £455m and #MCFC £446m. In this period only 11 out of 44 clubs managed to make money, led by #THFC £338m, #MUFC £191m, #AFC £112m and #NUFC £94m.

These losses would have been even higher without £5.1 bln profit from player sales, led by #CFC £602m, #LFC £359m, #AFC £356m and #THFC £336m. This is a legitimate business model, but these transactions are once-off, so cannot always be relied on to offset operating losses.

Operating losses in the Premier League and Championship in the last 10 years are a staggering £7 bln, with #CFC “leading the way” with £658m, followed by #AVFC £582m, #MCFC £580m & #EFC £408m. Only 3 clubs have produced operating profits: #MUFC £461m, #THFC £137m & Burnley £37m.

These losses have essentially been funded by football club owners putting their hands into their pockets with £6.3 bln financing in the last 10 years (loans £4.2 bln, share capital £2.1 bln). Most generous owners are #MCFC £837m, #CFC £559m, #AVFC £434m and #EFC £348m.

The good news is that relatively little bank debt has been taken out with “only” £693m external financing in the last 10 years. By far the highest is #THFC £746m (new stadium), followed by #LFC £153m (Anfield expansion). In contrast, repayments at #MUFC £249m and #AFC £76m.

However, much of the activity in the transfer market has been “funded” via payments on credit, as transfer debt has increased by £1.4 bln in the last 10 years. The largest increases have come at #AFC £136m, #MUFC £135m, #CFC £111m, #THFC £111m and #WWFC £100m.

These figures are based on the clubs that were competing in the Premier League and Championship in the 2019/20 season, so exclude some clubs relegated to League One, whose financial record is awful, e.g. #SAFC operating losses in last 10 years were over £200m.

In conclusion, there is absolutely nothing wrong with English football – apart from huge losses, unsustainable wages, player purchases on credit and a massive dependency on owner funding. Nothing to see here, please move on, definitely no need for an independent regulator.

• • •

Missing some Tweet in this thread? You can try to

force a refresh