1/12 Texas C19 Update:

THREAD:

* It is possible positivity rate has already peaked

* new 1-day record for reported cases

* Various Hospital metrics rate of growth continues strong decline

* Severe hospitalization still not at 2020 Winter pace yet, while cases are 5X 2020

1/n

THREAD:

* It is possible positivity rate has already peaked

* new 1-day record for reported cases

* Various Hospital metrics rate of growth continues strong decline

* Severe hospitalization still not at 2020 Winter pace yet, while cases are 5X 2020

1/n

https://twitter.com/therealarod1984/status/1481039028669628420

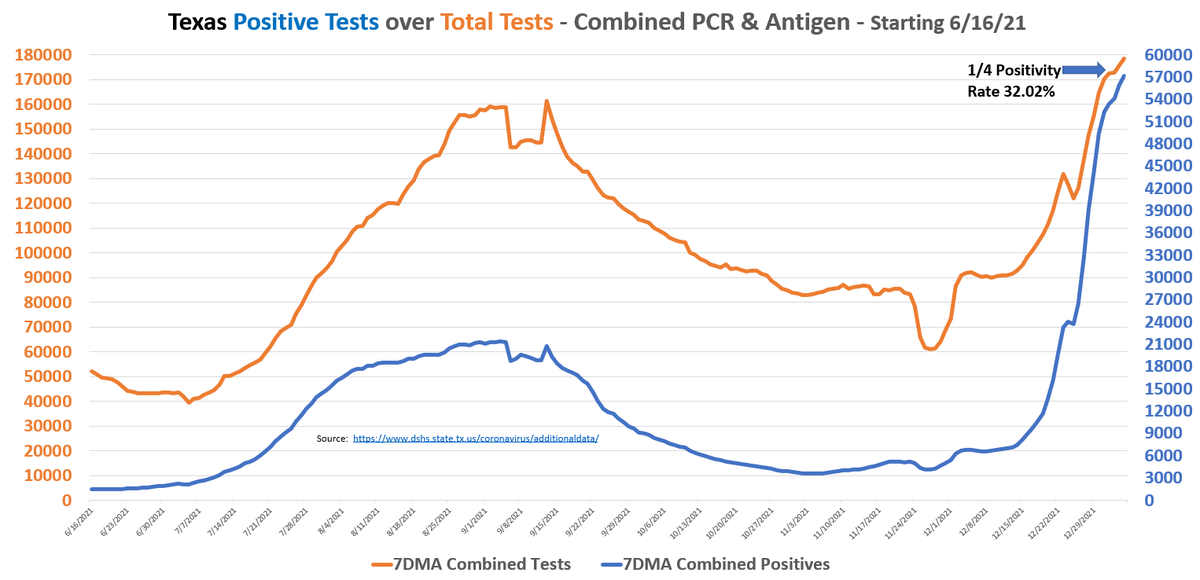

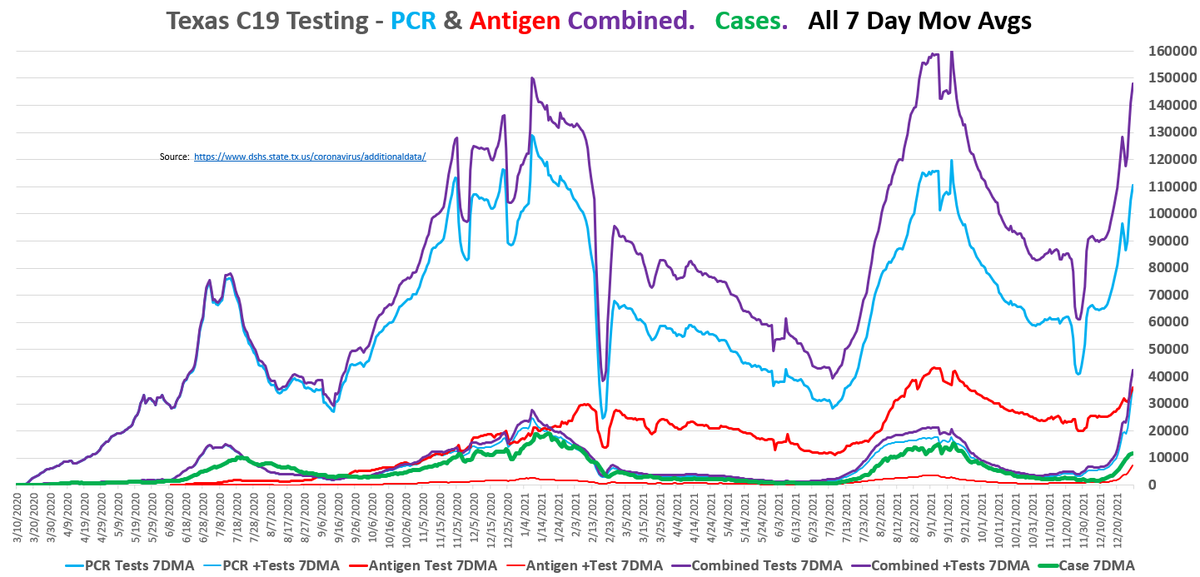

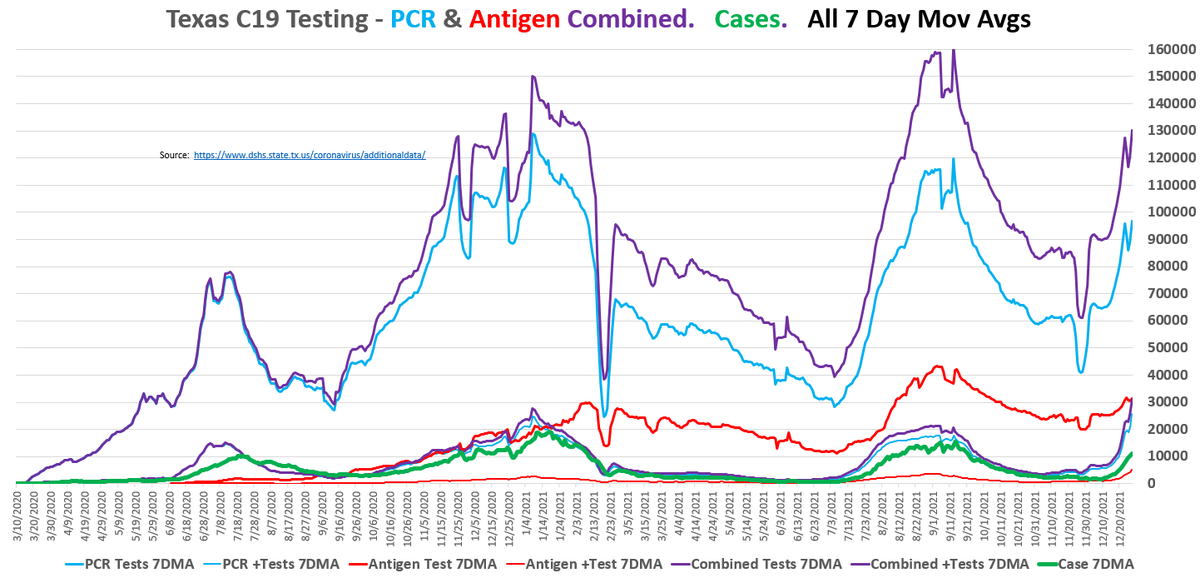

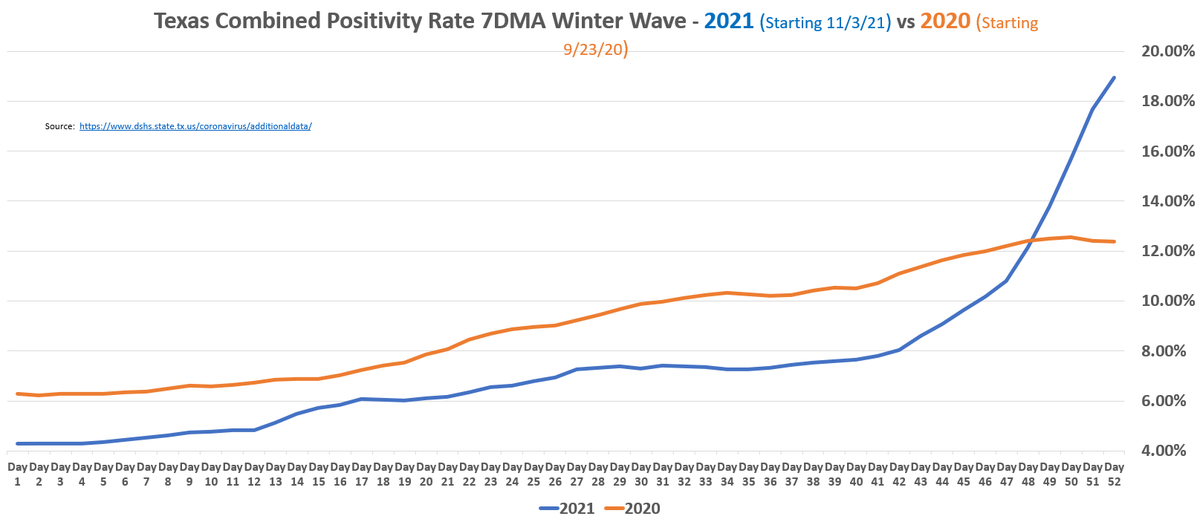

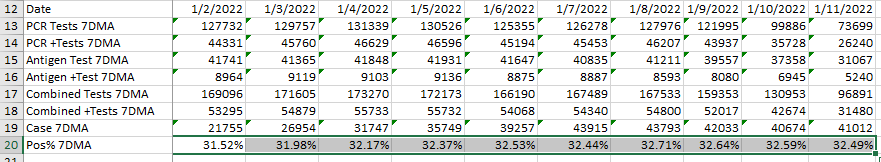

1/12 Testing

Tests filed by date of specimen collection < 8 days old is incomplete

As of 1/2:

* Pos rate 31.52% but really flattening

* Positives @ 53K/day

* Testing @ 169K/day

* Its early but pos rate has formed a peak on 1/8. Could change, but 1st clear peak so far

2/n

.

Tests filed by date of specimen collection < 8 days old is incomplete

As of 1/2:

* Pos rate 31.52% but really flattening

* Positives @ 53K/day

* Testing @ 169K/day

* Its early but pos rate has formed a peak on 1/8. Could change, but 1st clear peak so far

2/n

.

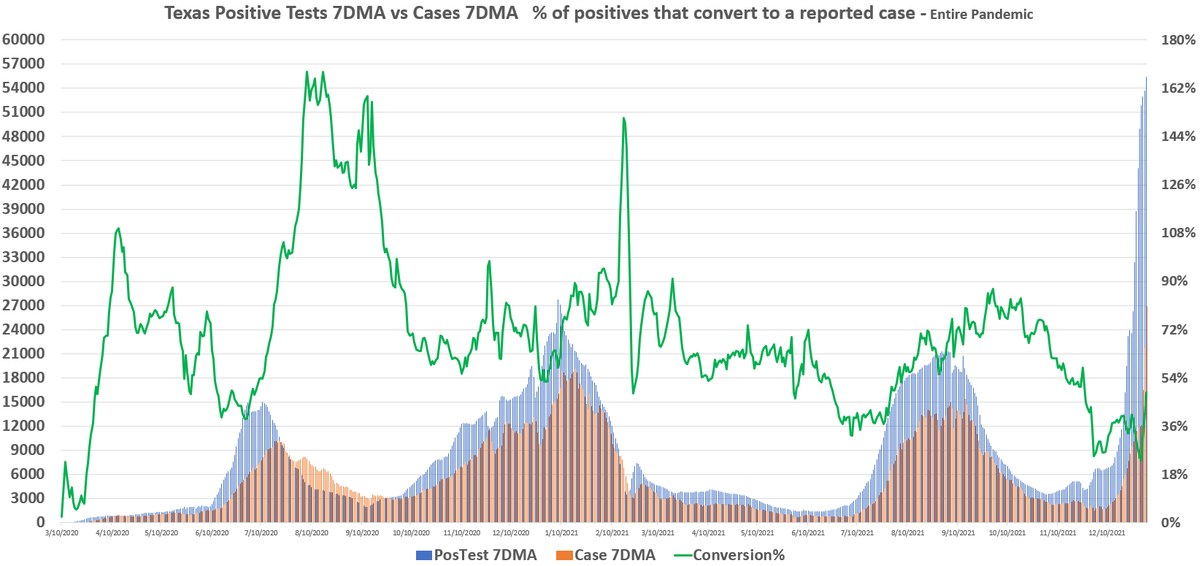

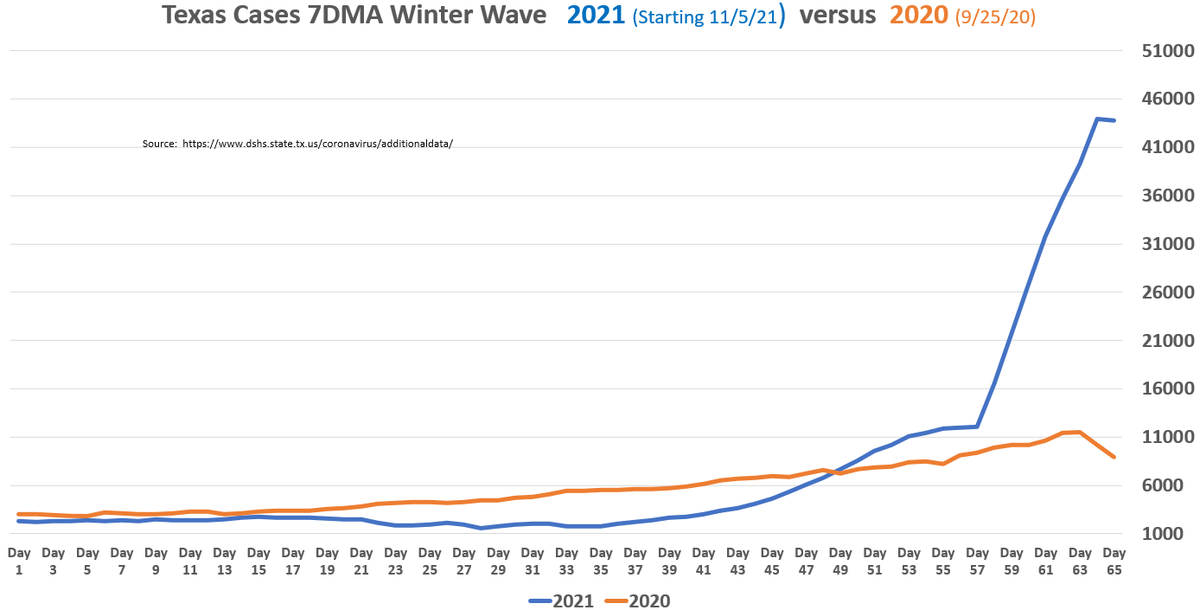

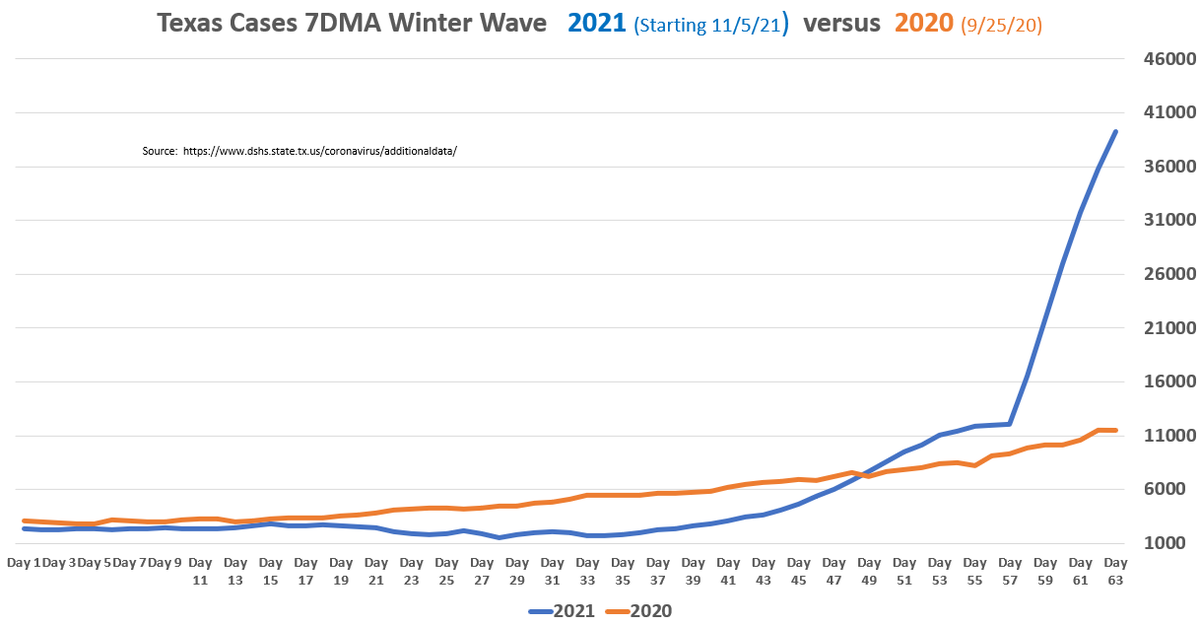

1/12 - Cases

* Cases batched by date received by the county

* Case 7DMA~ 44K, after 60K+ day

* Rate of growth⬇️

* The % of positive test conversion to cases is indicative of position in the wave. As of 1/2, that % is starting a steep climb. Helps confirm pos rate peak

,

3/n

* Cases batched by date received by the county

* Case 7DMA~ 44K, after 60K+ day

* Rate of growth⬇️

* The % of positive test conversion to cases is indicative of position in the wave. As of 1/2, that % is starting a steep climb. Helps confirm pos rate peak

,

3/n

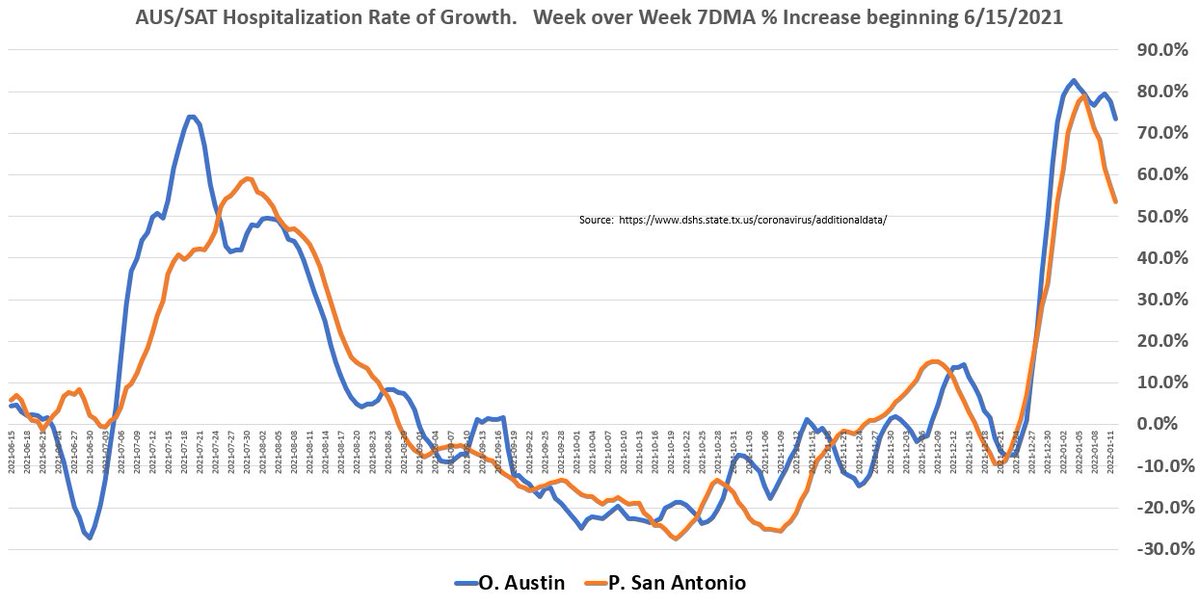

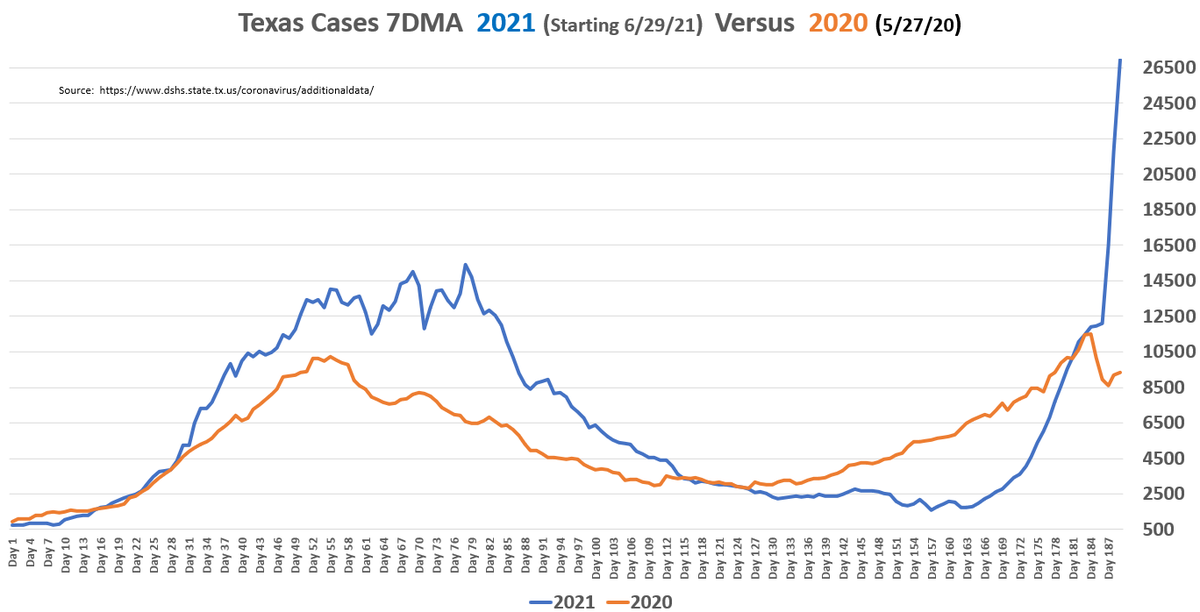

1/12 Hospitalizations - Part 1

* % of beds tagged as Covid & Census up to 18.75% & 11571

* Admits 7DMA - 1847. Past 2 Wednesdays had seen +300 admits day over day. Today only +158. 7DMA growth rate down to 33%

* Hosp growth rate is following suit

* HOU continues to cool

4/n

* % of beds tagged as Covid & Census up to 18.75% & 11571

* Admits 7DMA - 1847. Past 2 Wednesdays had seen +300 admits day over day. Today only +158. 7DMA growth rate down to 33%

* Hosp growth rate is following suit

* HOU continues to cool

4/n

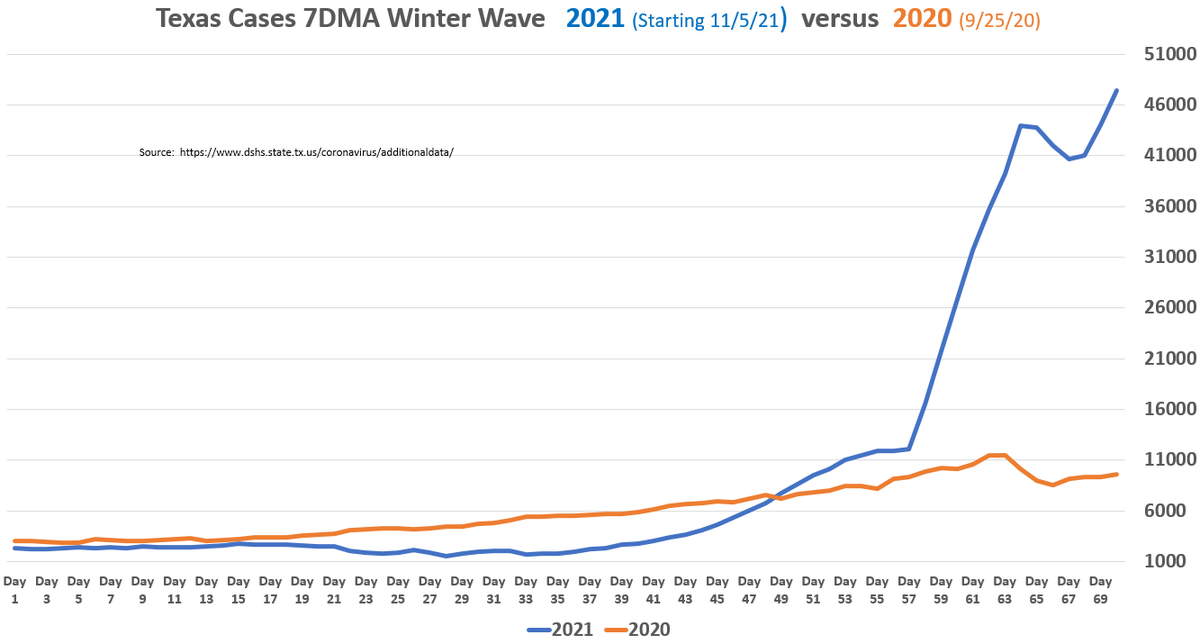

1/12 Hospitalizations - Part 2

* Second chart on Houston, SETRAC Admits 7DMA has already nosed over and 7DMA rate of growth down to 11%

* ICU will catch 2020 pace tomorrow

* Vents likely still 5 days away.

* Remember cases are 500% above 2020 Winter pace. #notsevere

5/n

.

* Second chart on Houston, SETRAC Admits 7DMA has already nosed over and 7DMA rate of growth down to 11%

* ICU will catch 2020 pace tomorrow

* Vents likely still 5 days away.

* Remember cases are 500% above 2020 Winter pace. #notsevere

5/n

.

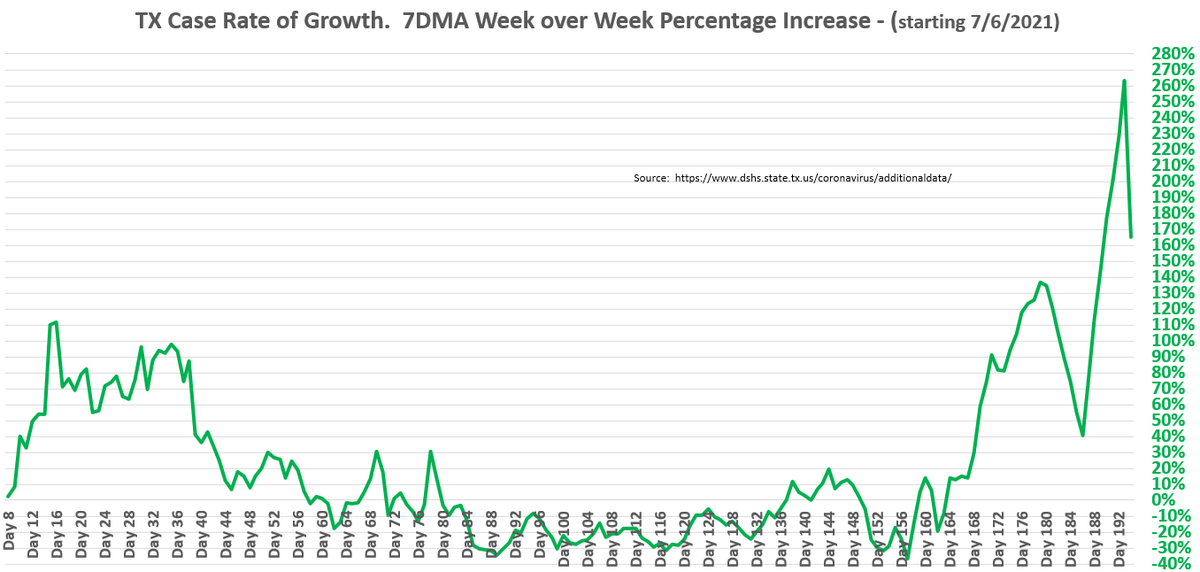

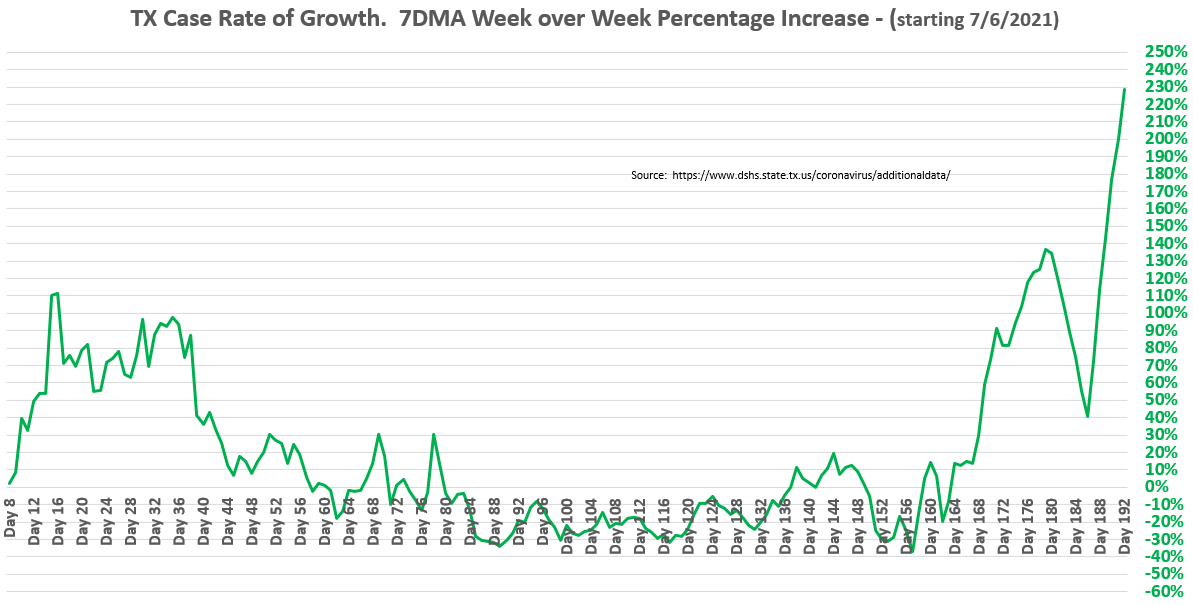

1/12 Conclusion

* Remember, cases are a function of testing

* If pos rate has peaked, its the 1st domino in fall of a wave. This wave is super steep, likely falls steeply too

* Summer '21, Hosps peaked ~21 days after pos rate. Cases 35 days, LOL. Going to be sooner here.

6/end

* Remember, cases are a function of testing

* If pos rate has peaked, its the 1st domino in fall of a wave. This wave is super steep, likely falls steeply too

* Summer '21, Hosps peaked ~21 days after pos rate. Cases 35 days, LOL. Going to be sooner here.

6/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh